In this day and age in which screens are the norm and the appeal of physical printed materials isn't diminishing. Whatever the reason, whether for education for creative projects, simply to add an extra personal touch to your space, Low Income Tax Credit have become an invaluable resource. Here, we'll dive into the world "Low Income Tax Credit," exploring the different types of printables, where they can be found, and how they can improve various aspects of your daily life.

Get Latest Low Income Tax Credit Below

Low Income Tax Credit

Low Income Tax Credit -

The earned income tax credit EITC is a tax break available to low and moderate income wage earners It is a refundable tax credit that reduces the amount of taxes owed on a

A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund

Low Income Tax Credit offer a wide selection of printable and downloadable materials available online at no cost. These resources come in many styles, from worksheets to coloring pages, templates and many more. The appeal of printables for free is their versatility and accessibility.

More of Low Income Tax Credit

Ontario Introducing A Low income Tax Credit Starting In 2019 News

Ontario Introducing A Low income Tax Credit Starting In 2019 News

Prepare accurate tax returns for people who claim certain tax credits such as the Earned Income Tax Credit EITC Helps low to moderate income workers and families get a tax break Child Tax Credit Credit for Other Dependents CTC ODC Provides a tax benefit for families with a qualifying dependent child and families with dependents

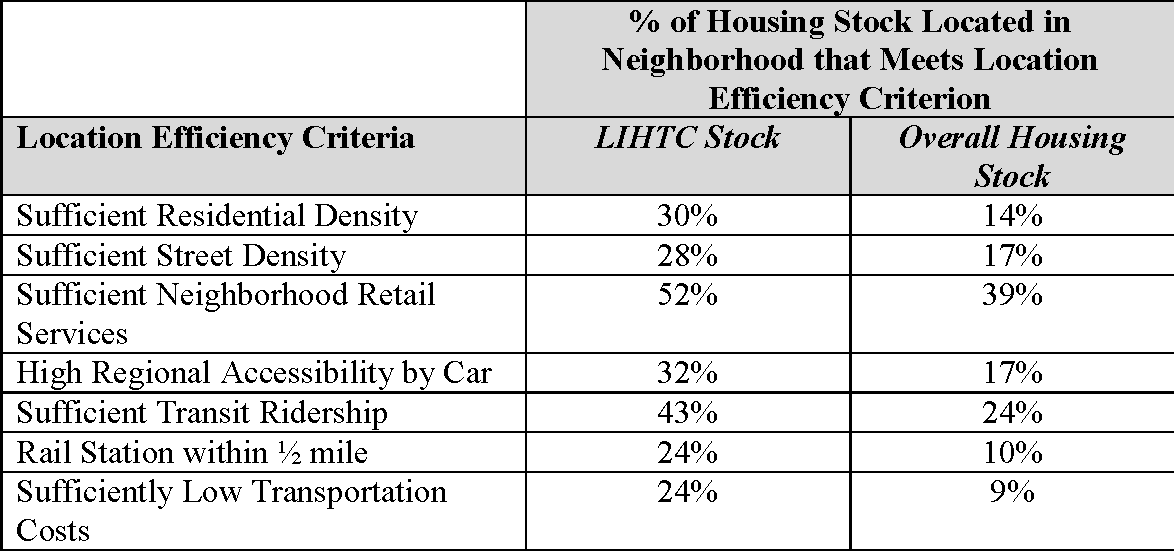

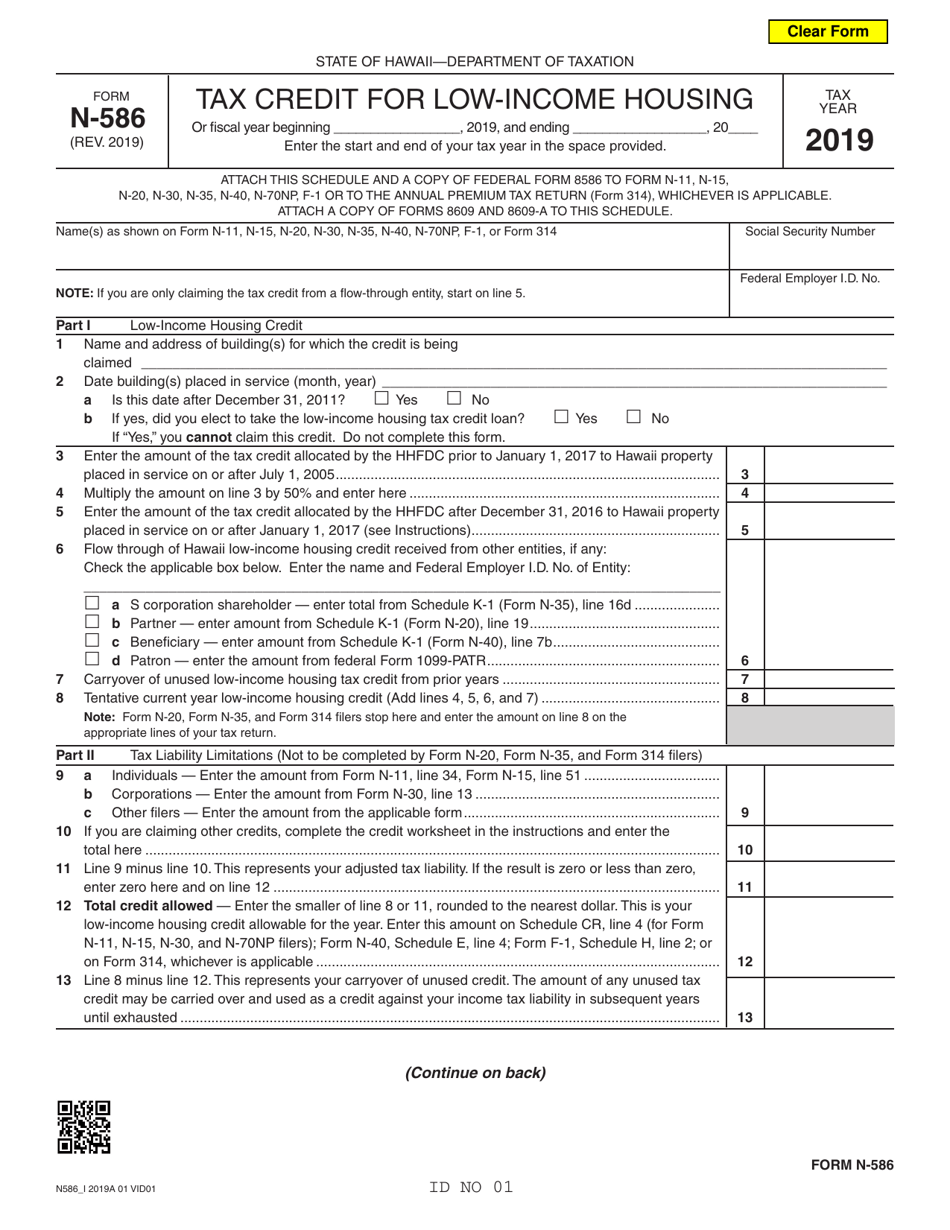

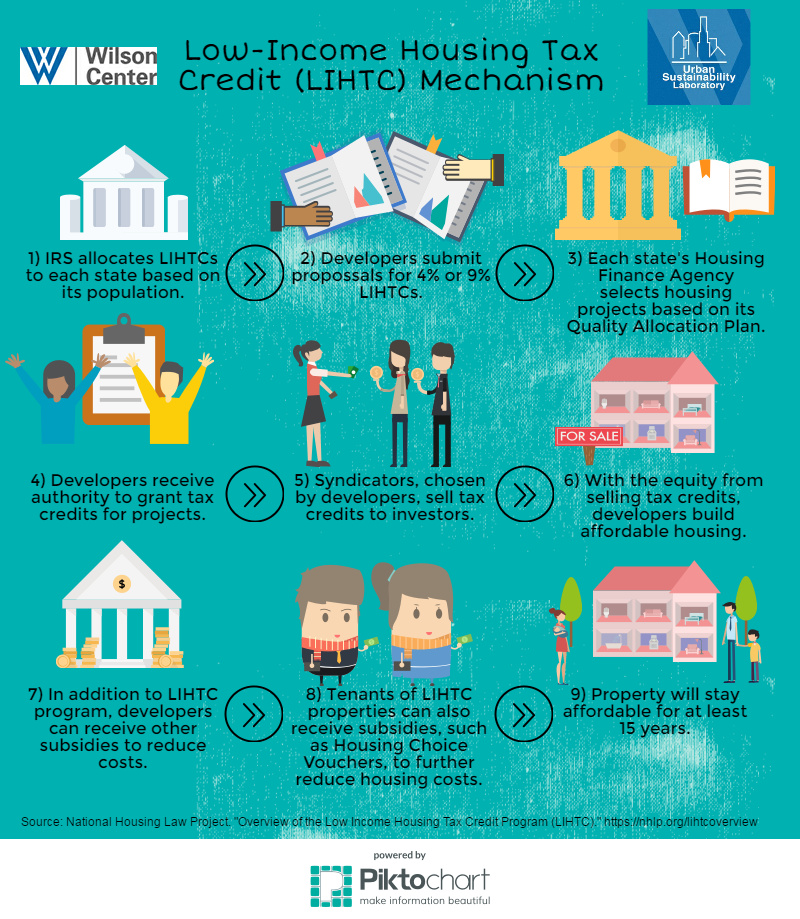

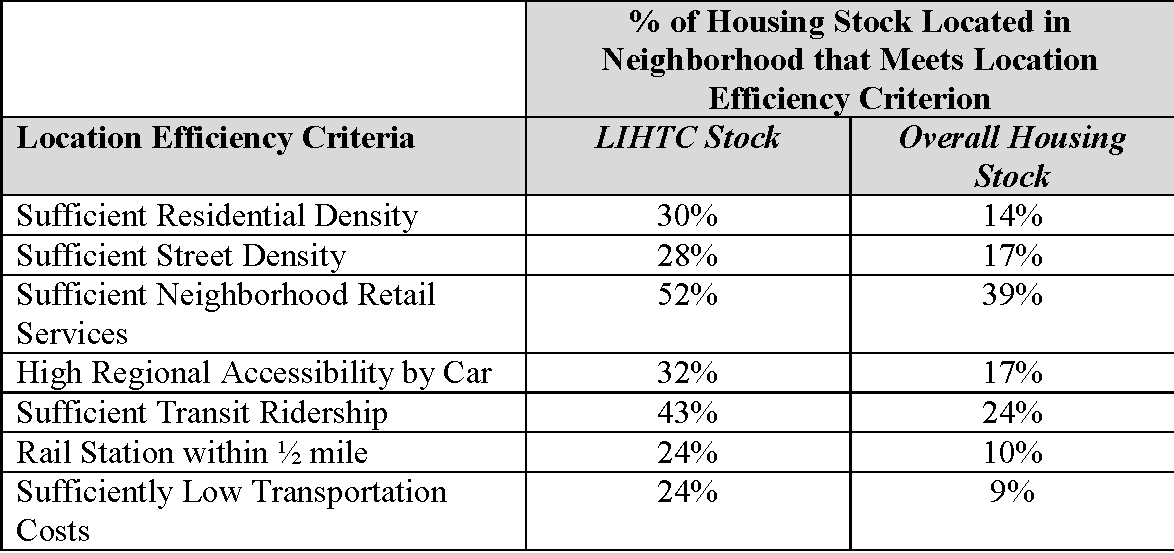

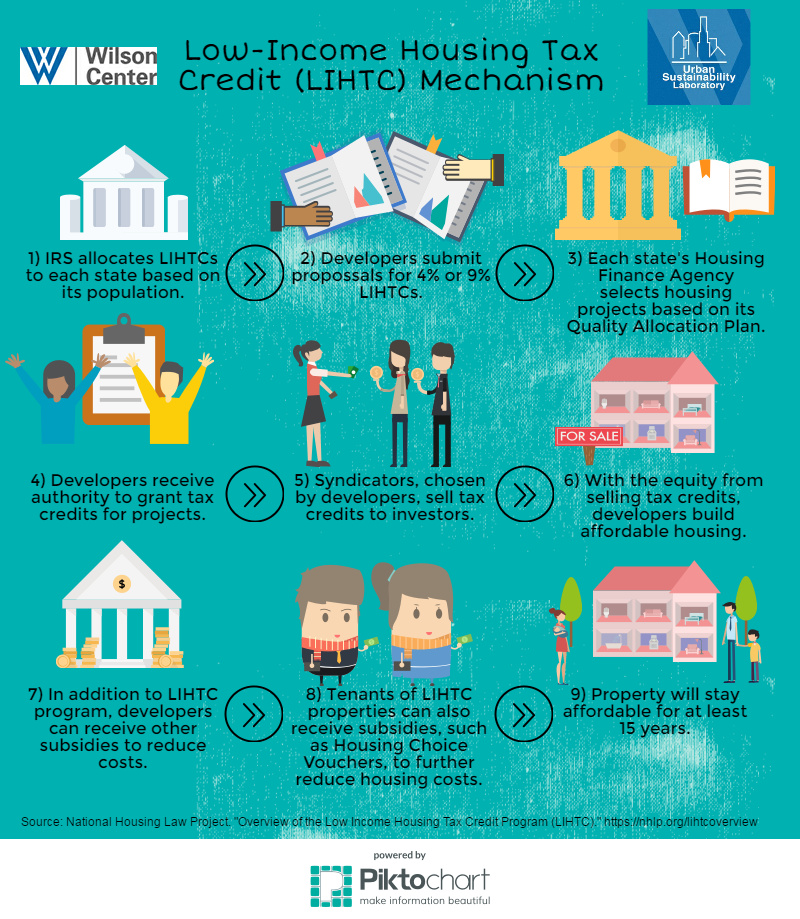

The Low Income Housing Tax Credit LIHTC is a tax incentive for housing developers to construct purchase or renovate rental housing for low income individuals and families The LIHTC was

Low Income Tax Credit have garnered immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

customization: We can customize printed materials to meet your requirements whether you're designing invitations, organizing your schedule, or even decorating your home.

-

Educational Benefits: Downloads of educational content for free offer a wide range of educational content for learners of all ages, which makes them a useful instrument for parents and teachers.

-

It's easy: Quick access to a plethora of designs and templates helps save time and effort.

Where to Find more Low Income Tax Credit

Turtle Hill Townhomes Low Income Tax Credit 538 Ann Ave Kansas City

Turtle Hill Townhomes Low Income Tax Credit 538 Ann Ave Kansas City

For the tax year that just ended low income workers without kids can receive a credit worth up to 1 500 nearly triple what the credit was worth in 2020

Earned Income Tax Credit EITC Assistant The Earned Income Tax Credit EITC helps low to moderate income workers and families get a tax break Answer some questions to see if you qualify

Now that we've ignited your interest in printables for free we'll explore the places you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety with Low Income Tax Credit for all purposes.

- Explore categories such as home decor, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free as well as flashcards and other learning materials.

- Ideal for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers provide their inventive designs or templates for download.

- The blogs are a vast selection of subjects, that includes DIY projects to planning a party.

Maximizing Low Income Tax Credit

Here are some ways create the maximum value of Low Income Tax Credit:

1. Home Decor

- Print and frame stunning art, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Utilize free printable worksheets for teaching at-home for the classroom.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Make sure you are organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Low Income Tax Credit are an abundance of fun and practical tools that cater to various needs and pursuits. Their access and versatility makes them a fantastic addition to your professional and personal life. Explore the vast array of Low Income Tax Credit today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really available for download?

- Yes you can! You can download and print these free resources for no cost.

-

Are there any free templates for commercial use?

- It is contingent on the specific conditions of use. Always read the guidelines of the creator before using printables for commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Certain printables might have limitations on use. Make sure you read these terms and conditions as set out by the author.

-

How do I print Low Income Tax Credit?

- Print them at home using a printer or visit a local print shop to purchase higher quality prints.

-

What program do I require to open printables at no cost?

- The majority of PDF documents are provided in PDF format. They can be opened with free software, such as Adobe Reader.

Low Income Tax Credit Housing KS IA NE Rural Housing Odimo

Form N 586 Download Fillable PDF Or Fill Online Tax Credit For Low

Check more sample of Low Income Tax Credit below

WVHDF IMPACT Low Income Housing Tax Credit Program YouTube

Low income Tax Credit Now Available In Washington Publications

Georgia Low Income Tax Credit IncomeProTalk

Dallas Low Income Tax Credit Apartments Pay 30 In Rent Each Month

How To Apply For The Housing Tax Credit Permissioncommission

Low Income Housing Tax Credits Why They Matter How They Work And How

https://www.irs.gov/newsroom/tax-credits-for...

A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund

https://money.usnews.com/money/personal-finance/...

The earned income tax credit has been around since 1975 designed to help low and moderate income households It s a work credit so you have to be employed to get it and it may

A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund

The earned income tax credit has been around since 1975 designed to help low and moderate income households It s a work credit so you have to be employed to get it and it may

Dallas Low Income Tax Credit Apartments Pay 30 In Rent Each Month

Low income Tax Credit Now Available In Washington Publications

How To Apply For The Housing Tax Credit Permissioncommission

Low Income Housing Tax Credits Why They Matter How They Work And How

2019 Georgia Low Income Housing Tax Credits SK Collaborative

Low income Housing Tax Credit In Arizona

Low income Housing Tax Credit In Arizona

Washington Legislature Approves Expansion Of Low income Tax Credit