In this day and age where screens have become the dominant feature of our lives and the appeal of physical printed objects isn't diminished. Be it for educational use project ideas, artistic or simply adding an element of personalization to your home, printables for free can be an excellent resource. In this article, we'll dive deep into the realm of "Married Couple Tax Deduction," exploring the benefits of them, where to get them, as well as what they can do to improve different aspects of your life.

Get Latest Married Couple Tax Deduction Below

Married Couple Tax Deduction

Married Couple Tax Deduction -

For the 2024 tax year single people pay a rate of 37 on taxable income over 609 350 For married couples filing jointly that threshold is just 731 200 far from double that available to single taxpayers That s a significant marriage penalty for high income couples In some cases married couples actually get a marriage bonus

The 2023 standard deduction for married couples filing jointly is 27 700 This applies to taxes filed by April 15 2024 or by Oct 15 2024 with an extension

Married Couple Tax Deduction offer a wide range of printable, free items that are available online at no cost. These resources come in various types, such as worksheets coloring pages, templates and much more. The beauty of Married Couple Tax Deduction is in their variety and accessibility.

More of Married Couple Tax Deduction

Treasury Grants Equal Tax Benefits To Married Gay Couples Al Jazeera

Treasury Grants Equal Tax Benefits To Married Gay Couples Al Jazeera

For 2024 they ll get the regular standard deduction of 29 200 for a married couple filing jointly They also both get an additional standard deduction amount of 1 550 per person for being

Single filers are taxed at the lowest marginal tax rate of 10 on their first 11 600 in income in the 2024 tax year Married couples filing jointly are taxed at the 10 rate on their first

Printables that are free have gained enormous popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Modifications: This allows you to modify printed materials to meet your requirements for invitations, whether that's creating them for your guests, organizing your schedule or even decorating your home.

-

Educational Benefits: These Married Couple Tax Deduction provide for students from all ages, making them an essential resource for educators and parents.

-

Convenience: Quick access to numerous designs and templates saves time and effort.

Where to Find more Married Couple Tax Deduction

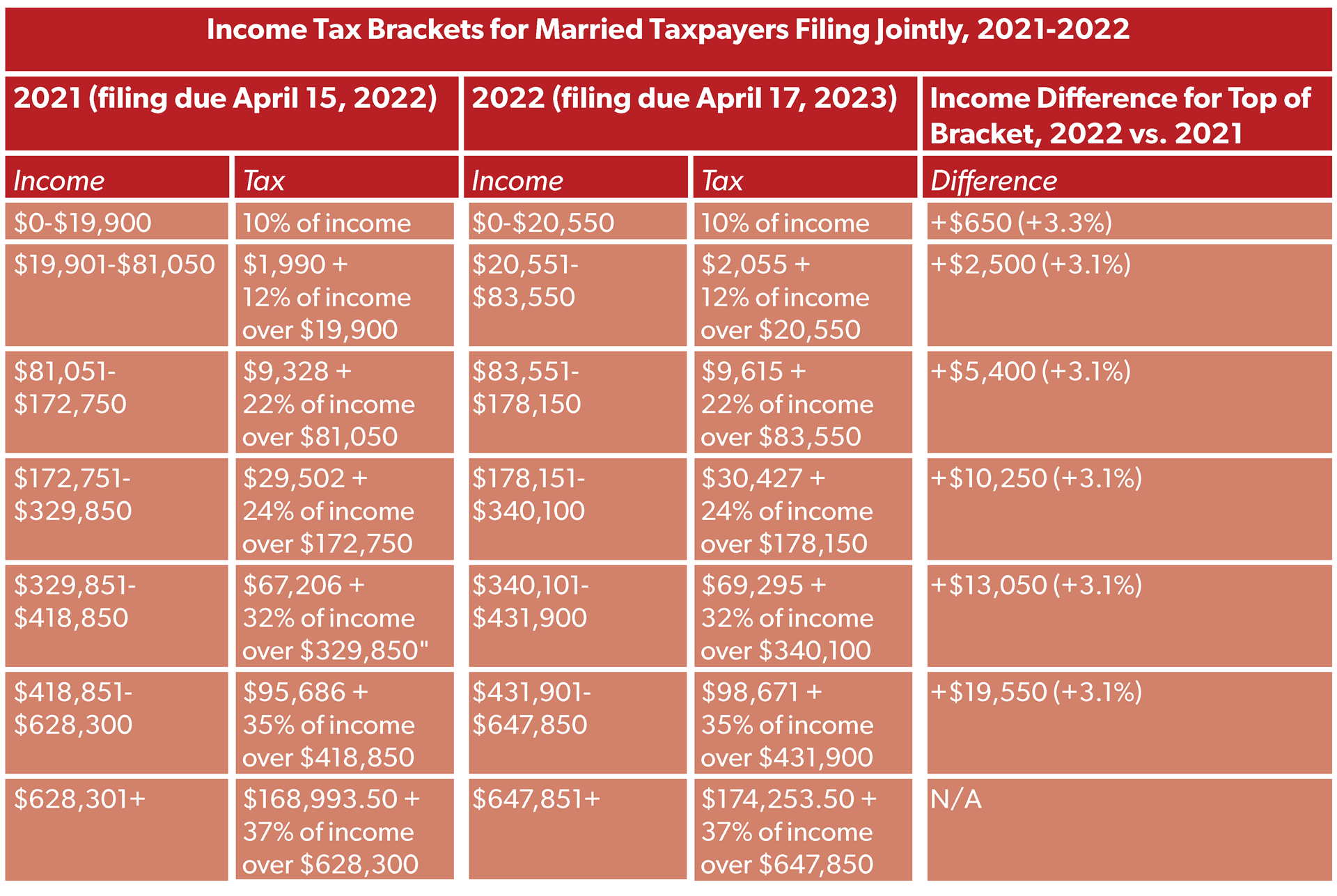

Married Tax Brackets 2021 Westassets

Married Tax Brackets 2021 Westassets

The standard deduction for married couples filing jointly for tax year 2022 rises to 25 900 up 800 from the prior year For single taxpayers and married individuals filing separately the standard deduction rises to 12 950 for 2022 up 400 and for heads of households the standard deduction will be 19 400 for tax year 2022 up 600

Marriage can affect your taxes often for the better The Tax Cuts and Jobs Act largely eliminated the marriage penalty for many married income tax filers who file jointly Couples with disparate incomes may find that their jointly filed tax return can lead to bigger tax savings than they saw as 2 single filers

Now that we've ignited your interest in Married Couple Tax Deduction Let's look into where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of Married Couple Tax Deduction designed for a variety goals.

- Explore categories like interior decor, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free, flashcards, and learning tools.

- The perfect resource for parents, teachers or students in search of additional sources.

3. Creative Blogs

- Many bloggers post their original designs and templates for free.

- These blogs cover a wide selection of subjects, starting from DIY projects to planning a party.

Maximizing Married Couple Tax Deduction

Here are some creative ways of making the most use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes or seasonal decorations that will adorn your living areas.

2. Education

- Utilize free printable worksheets to reinforce learning at home or in the classroom.

3. Event Planning

- Design invitations, banners, and decorations for special events such as weddings and birthdays.

4. Organization

- Be organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Married Couple Tax Deduction are a treasure trove of useful and creative resources designed to meet a range of needs and pursuits. Their availability and versatility make them a valuable addition to your professional and personal life. Explore the vast array of Married Couple Tax Deduction to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Married Couple Tax Deduction really gratis?

- Yes, they are! You can print and download these free resources for no cost.

-

Are there any free printables for commercial uses?

- It's contingent upon the specific conditions of use. Always verify the guidelines provided by the creator before using their printables for commercial projects.

-

Do you have any copyright issues when you download Married Couple Tax Deduction?

- Some printables may have restrictions regarding their use. Be sure to review the terms of service and conditions provided by the author.

-

How do I print printables for free?

- You can print them at home using either a printer or go to a print shop in your area for the highest quality prints.

-

What program do I need to open printables that are free?

- Most PDF-based printables are available with PDF formats, which is open with no cost software, such as Adobe Reader.

Federal Income Tax Deduction Chart My XXX Hot Girl

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

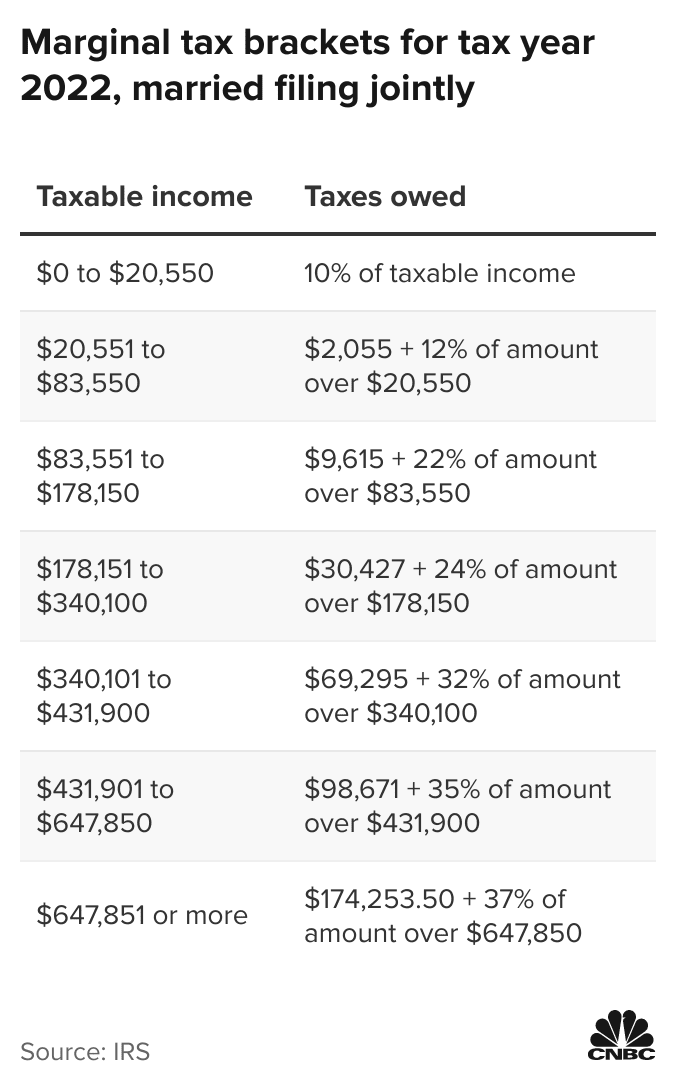

2022 Tax Brackets Married Filing Jointly Irs Printable Form

Check more sample of Married Couple Tax Deduction below

2022 Tax Brackets Married Filing Jointly Irs Printable Form

Tax Return Guide For Married Couples Income Tax Professionals

Tax Return For Married Couples Perth Mobile Tax

2022 Us Tax Brackets Irs

Married Couples Tax Break Tax Banana

QBI Rules Is Determining The QBI Deduction Which Depends On A Taxpayer

https://www.nerdwallet.com/article/taxes/married...

The 2023 standard deduction for married couples filing jointly is 27 700 This applies to taxes filed by April 15 2024 or by Oct 15 2024 with an extension

https://money.usnews.com/money/personal-finance/...

For tax year 2023 the standard deduction is 27 700 for married couples filing jointly and 13 850 for single taxpayers and married individuals filing separately

The 2023 standard deduction for married couples filing jointly is 27 700 This applies to taxes filed by April 15 2024 or by Oct 15 2024 with an extension

For tax year 2023 the standard deduction is 27 700 for married couples filing jointly and 13 850 for single taxpayers and married individuals filing separately

2022 Us Tax Brackets Irs

Tax Return Guide For Married Couples Income Tax Professionals

Married Couples Tax Break Tax Banana

QBI Rules Is Determining The QBI Deduction Which Depends On A Taxpayer

2022 Tax Brackets Irs Married Filing Jointly Dfackldu

NEW INCOME TAX RATES Married Couple Filing Jointly EXISTING RATES NEW

NEW INCOME TAX RATES Married Couple Filing Jointly EXISTING RATES NEW

2022 Federal Tax Brackets Married Filing Jointly