In the age of digital, in which screens are the norm it's no wonder that the appeal of tangible printed items hasn't gone away. It doesn't matter if it's for educational reasons as well as creative projects or simply adding a personal touch to your area, Married Income Tax Deduction are a great resource. Through this post, we'll dive into the world "Married Income Tax Deduction," exploring the benefits of them, where to locate them, and how they can add value to various aspects of your life.

Get Latest Married Income Tax Deduction Below

Married Income Tax Deduction

Married Income Tax Deduction -

Married individuals filing jointly get double that allowance with a standard deduction of 27 700 in 2023 and 29 200 in 2024 Similarly singles are taxed at the lowest marginal tax rate of 10

00 00 00 00 Subscribe Apple Podcasts Spotify iHeartRadio Key Takeaways Double the Deductions Married and filing jointly typically can net you a bigger Standard Deduction reducing your taxable income 27 700 for most couples under age 65 in 2023 jumping up to 29 200 in 2024

Married Income Tax Deduction cover a large range of printable, free materials that are accessible online for free cost. They are available in a variety of types, like worksheets, templates, coloring pages, and many more. The appealingness of Married Income Tax Deduction is in their versatility and accessibility.

More of Married Income Tax Deduction

Married Tax Brackets 2021 Westassets

Married Tax Brackets 2021 Westassets

Marriage and taxes Marriage tax penalty or marriage bonus What is your filing status Click to expand Key Takeaways To reduce the so called marriage penalty Congress made the thresholds for six of the seven tax brackets for married couples filing joint returns exactly double those available to single filers

Key Takeaways Married filing separately is a tax status used by married couples who choose to record their incomes exemptions and deductions on separate tax

The Married Income Tax Deduction have gained huge popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Flexible: They can make printables to fit your particular needs whether you're designing invitations planning your schedule or even decorating your home.

-

Educational Value: Free educational printables offer a wide range of educational content for learners of all ages, which makes them a vital aid for parents as well as educators.

-

An easy way to access HTML0: Fast access an array of designs and templates will save you time and effort.

Where to Find more Married Income Tax Deduction

IRS 2021 Tax Tables Deductions Exemptions Purposeful finance

IRS 2021 Tax Tables Deductions Exemptions Purposeful finance

How Do You File Jointly Filing your taxes jointly isn t that different from filing as single or head of household You and your spouse still have to report your income and list deductions and credits The biggest difference is that you ll choose married filing jointly as your filing status instead of the others

February 6 2024 When you tie the knot your relationship is not the only thing that changes your tax situation does too This article is essential for every married couple or those planning to get married as it uncovers the various tax benefits breaks and advantages of marriage

If we've already piqued your curiosity about Married Income Tax Deduction and other printables, let's discover where you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection and Married Income Tax Deduction for a variety needs.

- Explore categories such as design, home decor, craft, and organization.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing as well as flashcards and other learning tools.

- Great for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for free.

- These blogs cover a broad spectrum of interests, everything from DIY projects to party planning.

Maximizing Married Income Tax Deduction

Here are some new ways of making the most of printables for free:

1. Home Decor

- Print and frame beautiful art, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Use printable worksheets from the internet to enhance your learning at home or in the classroom.

3. Event Planning

- Designs invitations, banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Get organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Married Income Tax Deduction are a treasure trove with useful and creative ideas that cater to various needs and passions. Their accessibility and versatility make them a great addition to each day life. Explore the world of printables for free today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really for free?

- Yes you can! You can download and print these tools for free.

-

Does it allow me to use free printables for commercial purposes?

- It's based on the conditions of use. Always verify the guidelines provided by the creator before using any printables on commercial projects.

-

Do you have any copyright violations with printables that are free?

- Some printables may come with restrictions regarding usage. Check the terms and condition of use as provided by the creator.

-

How do I print printables for free?

- Print them at home using an printer, or go to the local print shop for higher quality prints.

-

What software do I need to run printables for free?

- The majority of printed documents are in the PDF format, and can be opened with free software such as Adobe Reader.

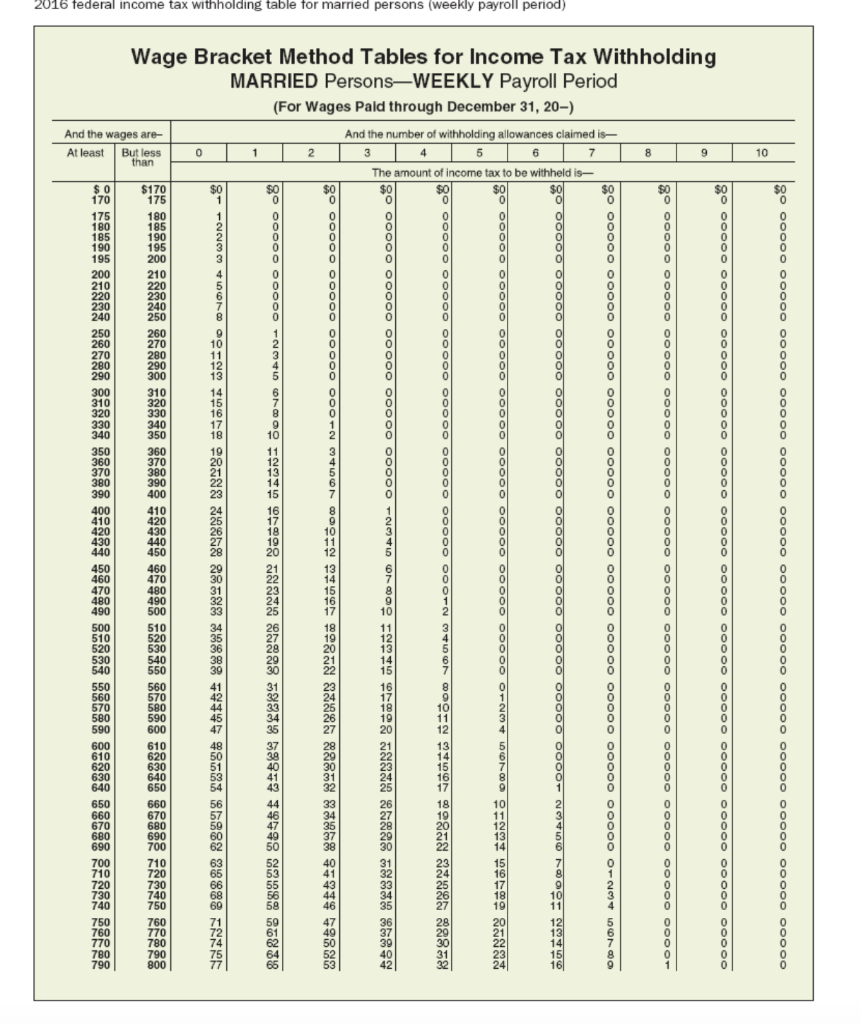

Solved 2016 Federal Income Tax Withholding Table For Married Chegg

IRS Inflation Adjustments Taxed Right

Check more sample of Married Income Tax Deduction below

2022 Federal Tax Brackets And Standard Deduction Printable Form

IRS Releases Key 2021 Tax Information standarddeduction2021

2022 Tax Brackets Married Filing Jointly Irs Printable Form

14 Best Images Of Federal Itemized Deductions Worksheet Federal

2022 Tax Tables Married Filing Jointly Printable Form Templates And

2022 Tax Brackets Irs Married Filing Jointly Unblocked 2022

https://turbotax.intuit.com/tax-tips/marriage/...

00 00 00 00 Subscribe Apple Podcasts Spotify iHeartRadio Key Takeaways Double the Deductions Married and filing jointly typically can net you a bigger Standard Deduction reducing your taxable income 27 700 for most couples under age 65 in 2023 jumping up to 29 200 in 2024

https://www.forbes.com/advisor/taxes/standard-deduction

Here s what that means If you earned 75 000 in 2023 and file as a single taxpayer taking the standard deduction of 13 850 will reduce your taxable income to 61 150 Standard

00 00 00 00 Subscribe Apple Podcasts Spotify iHeartRadio Key Takeaways Double the Deductions Married and filing jointly typically can net you a bigger Standard Deduction reducing your taxable income 27 700 for most couples under age 65 in 2023 jumping up to 29 200 in 2024

Here s what that means If you earned 75 000 in 2023 and file as a single taxpayer taking the standard deduction of 13 850 will reduce your taxable income to 61 150 Standard

14 Best Images Of Federal Itemized Deductions Worksheet Federal

IRS Releases Key 2021 Tax Information standarddeduction2021

2022 Tax Tables Married Filing Jointly Printable Form Templates And

2022 Tax Brackets Irs Married Filing Jointly Unblocked 2022

2022 Federal Tax Brackets And Standard Deduction Printable Form

IRS Announces 2022 Tax Rates Standard Deduction

IRS Announces 2022 Tax Rates Standard Deduction

2022 Federal Tax Brackets Married Filing Jointly