In this digital age, when screens dominate our lives and the appeal of physical printed objects hasn't waned. For educational purposes in creative or artistic projects, or just adding the personal touch to your area, Maryland Homestead Exemption Application are a great source. In this article, we'll dive into the world "Maryland Homestead Exemption Application," exploring what they are, where they are, and ways they can help you improve many aspects of your daily life.

Get Latest Maryland Homestead Exemption Application Below

Maryland Homestead Exemption Application

Maryland Homestead Exemption Application -

The quickest and easiest way to determine eligibility for these credits and submit an application is by accessing the department s innovative online tax credit application system The deadline to file for both tax credits is October 1 2024

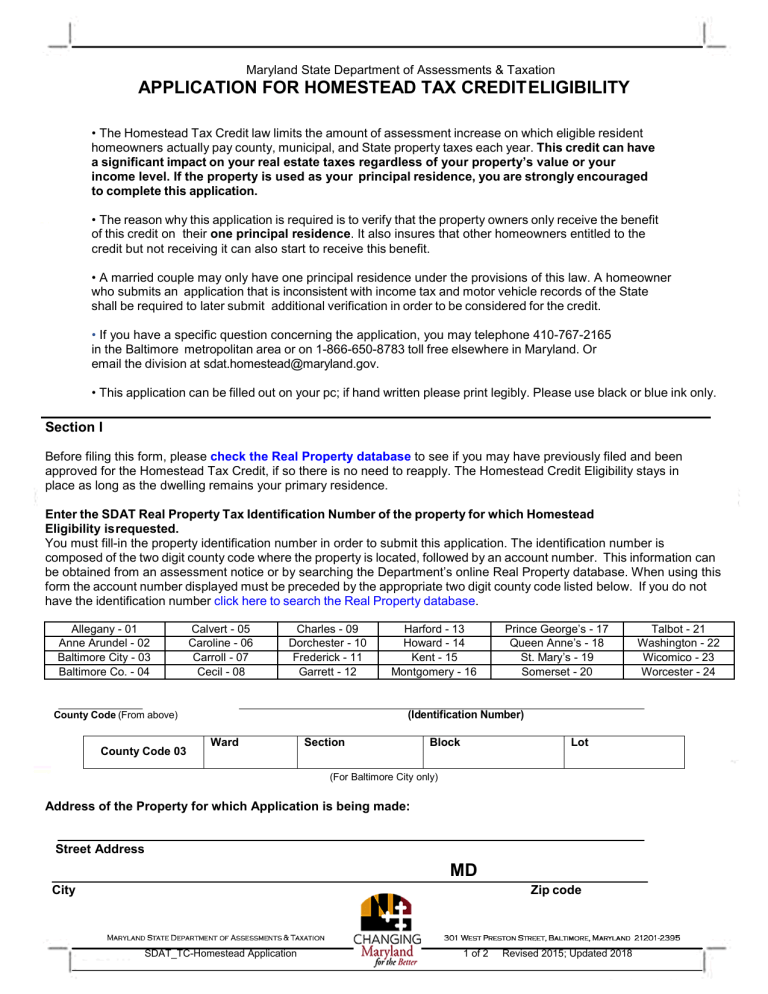

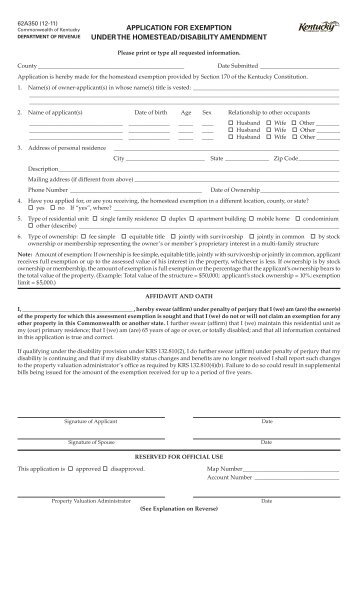

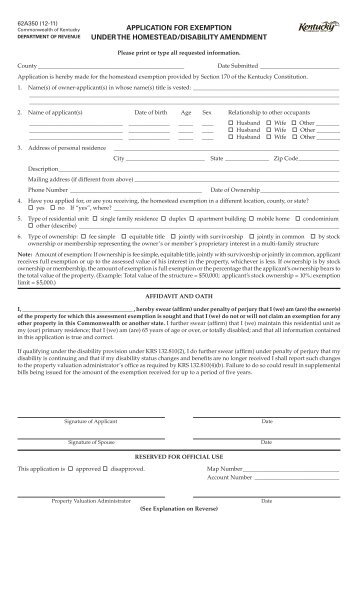

You may file this application online at onestop md gov recommended If you have any questions please email sdat homestead maryland gov or call 410 767 2165 toll free 1 866 650 8783 This application can be filled out on your PC if hand written please print legibly Please use black or blue ink only Section I

Maryland Homestead Exemption Application offer a wide selection of printable and downloadable material that is available online at no cost. These materials come in a variety of forms, like worksheets coloring pages, templates and much more. The attraction of printables that are free is in their versatility and accessibility.

More of Maryland Homestead Exemption Application

York County Sc Residential Tax Forms Homestead Exemption CountyForms

York County Sc Residential Tax Forms Homestead Exemption CountyForms

The tax credit is based upon the amount by which the property taxes exceed a percentage of your income according to the following formula 0 of the first 8 000 of the combined household income 4 of the next 4 000 of income 6 5 of the next 4 000 of income and 9 of all income above 16 000 The chart below is printed in 1 000

Charitable Religious and Educational Real Property Exemptions To receive an exemption for the taxable year the property must be owned by the organization prior to the beginning of the tax year July 1 for which the exemption is sought The organization owning the property prior to the taxable year may apply for the exemption by September 1

Maryland Homestead Exemption Application have gained a lot of appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

customization: You can tailor the design to meet your needs when it comes to designing invitations for your guests, organizing your schedule or decorating your home.

-

Educational Value Printables for education that are free are designed to appeal to students of all ages, which makes the perfect aid for parents as well as educators.

-

It's easy: Quick access to a plethora of designs and templates can save you time and energy.

Where to Find more Maryland Homestead Exemption Application

Important Information About The Maryland Homestead Tax Credit YouTube

Important Information About The Maryland Homestead Tax Credit YouTube

Maryland Property Tax Credit Programs MarylandDepartment of Assessments and Taxation SDAT s Tax Credit Public Service Counter is moving 301 West Preston Street Suite 900 Baltimore 21201 will close on April 12th at 3PM In person services will resume at 8 30AM on April 15th at SDAT s new location 123 Market Place Baltimore MD 21202

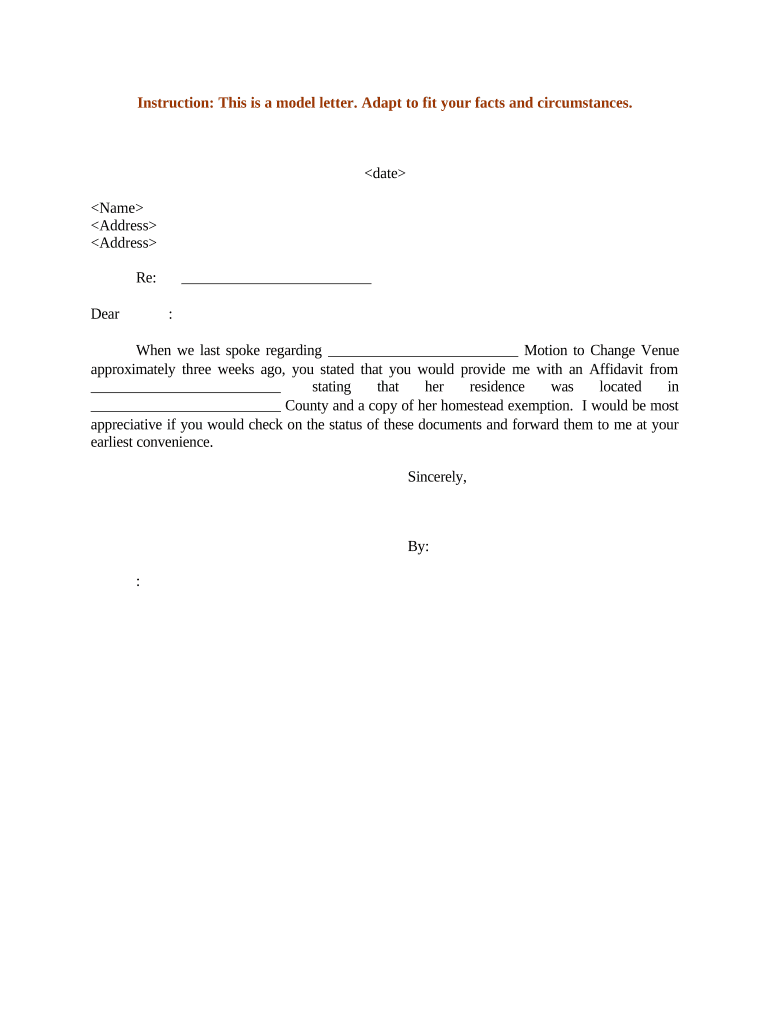

If you have a specific question concerning the application you may telephone 410 767 2165 in the Baltimore metropolitan area or on 1 866 650 8783 toll free elsewhere in Maryland Or email the division at sdat homestead maryland gov This application can be filled out on your pc if hand written please print legibly

Now that we've piqued your interest in printables for free Let's look into where you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of printables that are free for a variety of motives.

- Explore categories such as furniture, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets or flashcards as well as learning materials.

- It is ideal for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates free of charge.

- The blogs are a vast spectrum of interests, that includes DIY projects to party planning.

Maximizing Maryland Homestead Exemption Application

Here are some ideas how you could make the most of Maryland Homestead Exemption Application:

1. Home Decor

- Print and frame stunning artwork, quotes or other seasonal decorations to fill your living spaces.

2. Education

- Print free worksheets to enhance learning at home also in the classes.

3. Event Planning

- Design invitations, banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Be organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Maryland Homestead Exemption Application are a treasure trove of practical and imaginative resources that satisfy a wide range of requirements and interests. Their access and versatility makes them an invaluable addition to both professional and personal lives. Explore the wide world of Maryland Homestead Exemption Application today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Maryland Homestead Exemption Application truly free?

- Yes, they are! You can download and print these documents for free.

-

Are there any free printables for commercial purposes?

- It's dependent on the particular terms of use. Always review the terms of use for the creator before using printables for commercial projects.

-

Are there any copyright violations with printables that are free?

- Some printables could have limitations concerning their use. Make sure to read the terms and regulations provided by the author.

-

How do I print printables for free?

- You can print them at home with a printer or visit the local print shops for top quality prints.

-

What program will I need to access Maryland Homestead Exemption Application?

- The majority of printables are as PDF files, which can be opened using free programs like Adobe Reader.

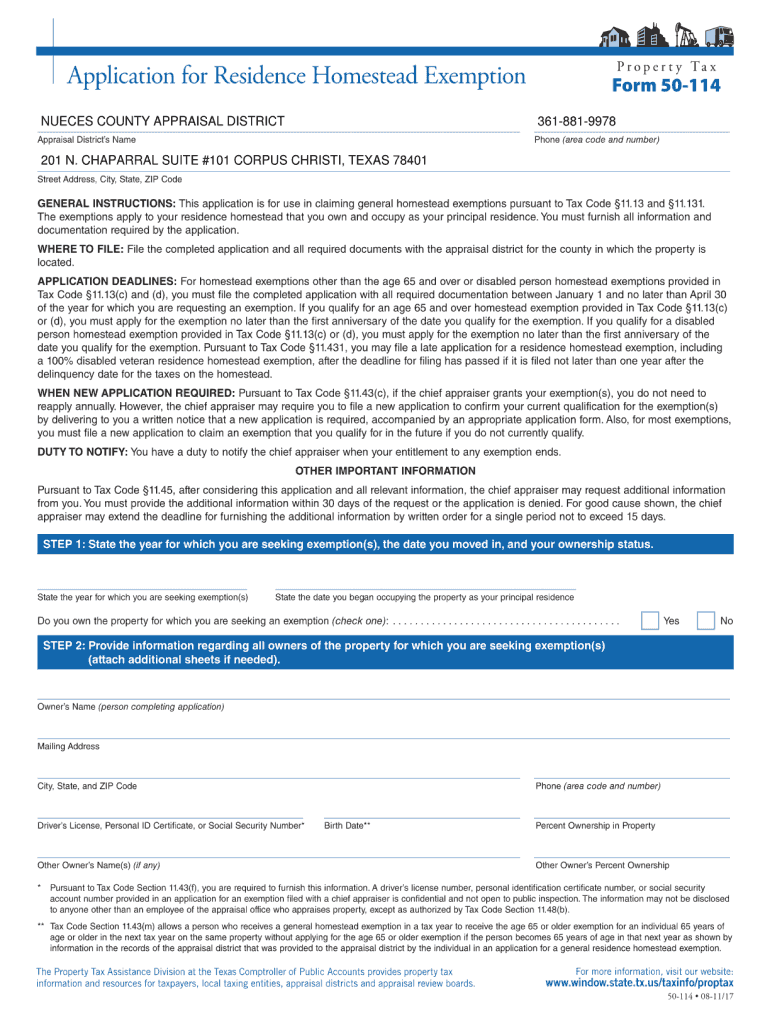

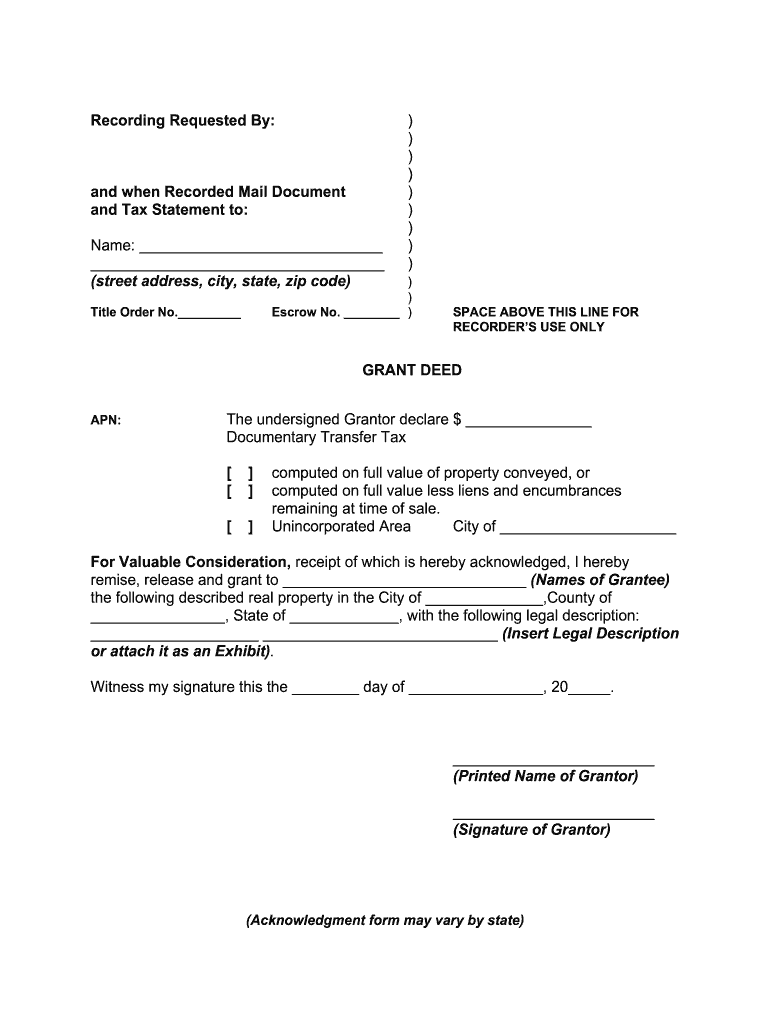

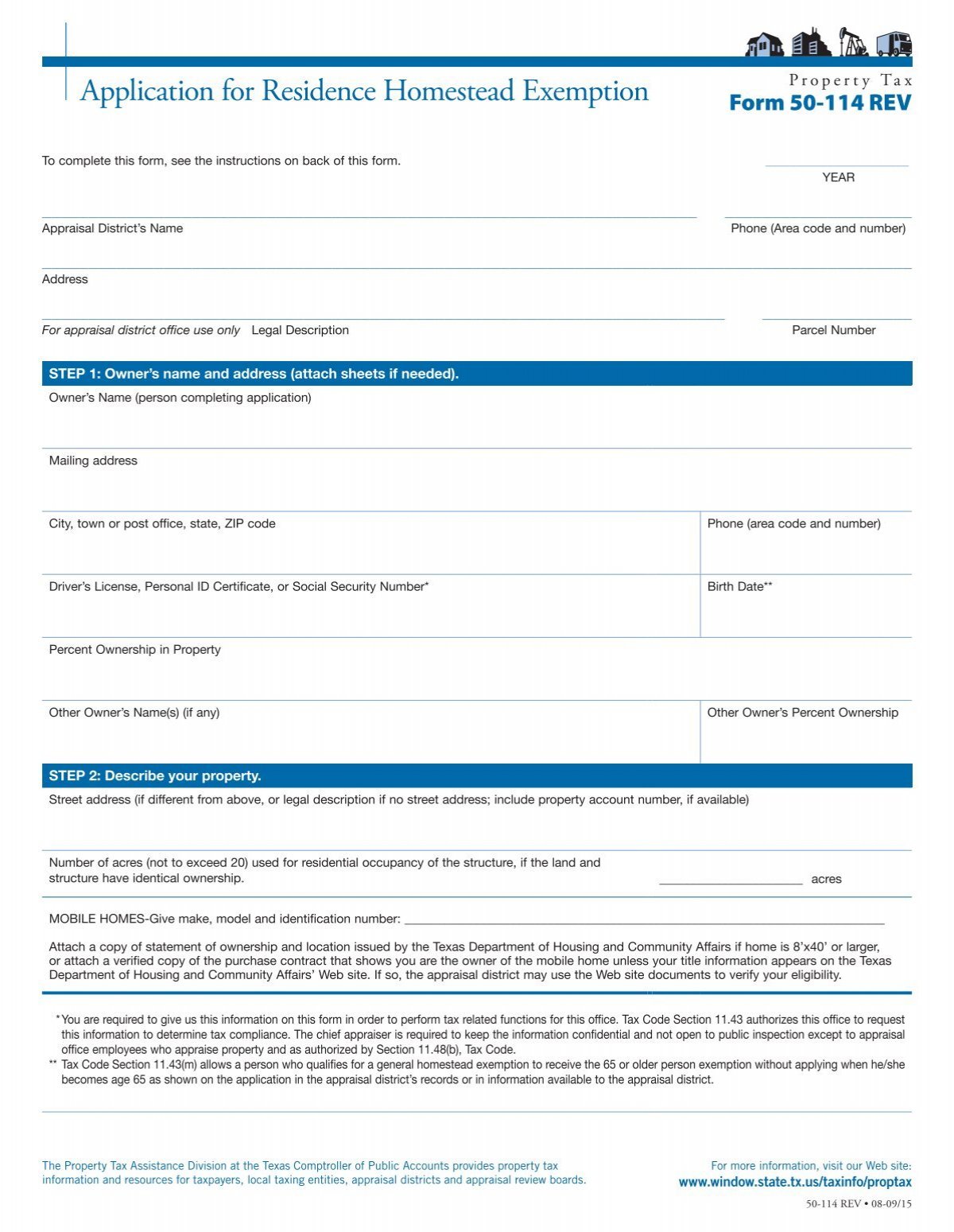

Application For Residence Homestead Exemption Harris County Appraisal

Maryland Homestead Application

Check more sample of Maryland Homestead Exemption Application below

Application For Nueces Residence Homestead Exemption Fill Online

The Fund 2019 Florida Homestead Exemption

Homestead Tax Credit

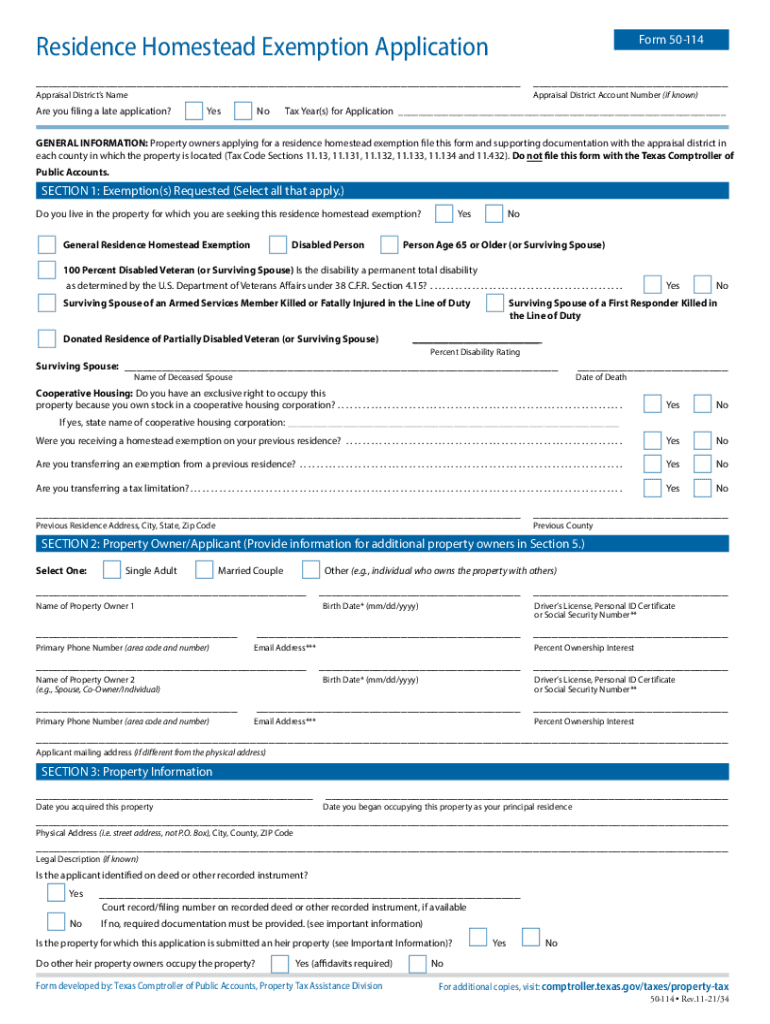

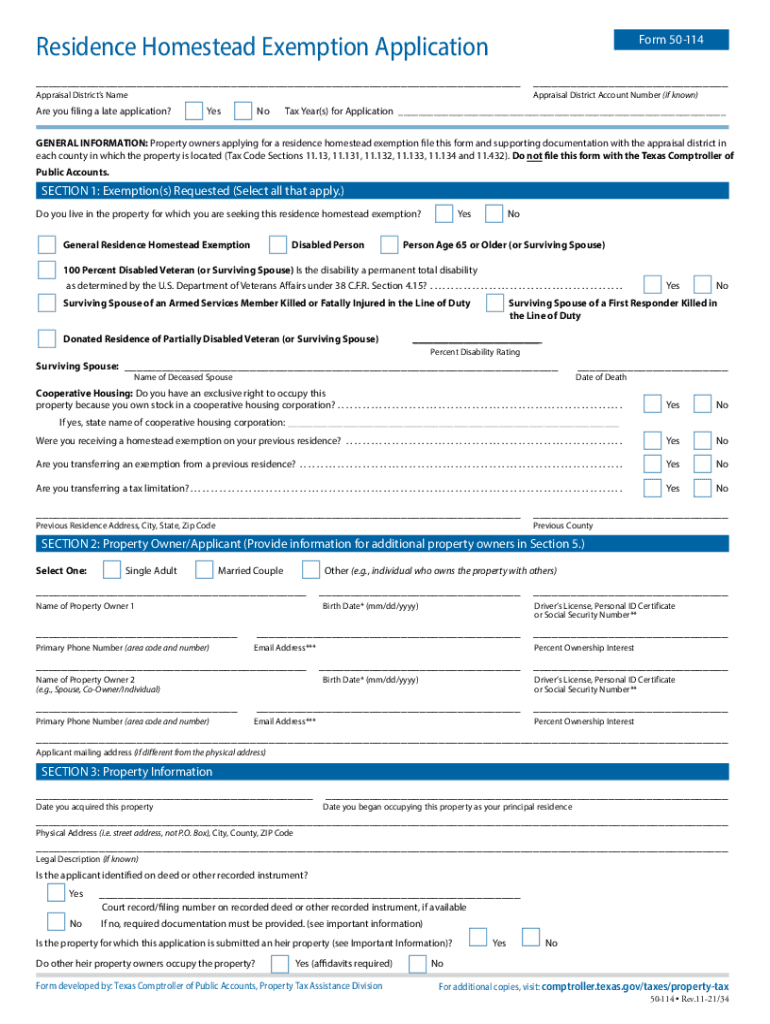

Texas Residence Homestead Exemption Form Fill Out And Sign Printable

Maryland Homestead Property Tax Credit Program

Residence Homestead Exemption Application Coleman County CAD Fill Out

https:// dat.maryland.gov /SDAT Forms/Homestead...

You may file this application online at onestop md gov recommended If you have any questions please email sdat homestead maryland gov or call 410 767 2165 toll free 1 866 650 8783 This application can be filled out on your PC if hand written please print legibly Please use black or blue ink only Section I

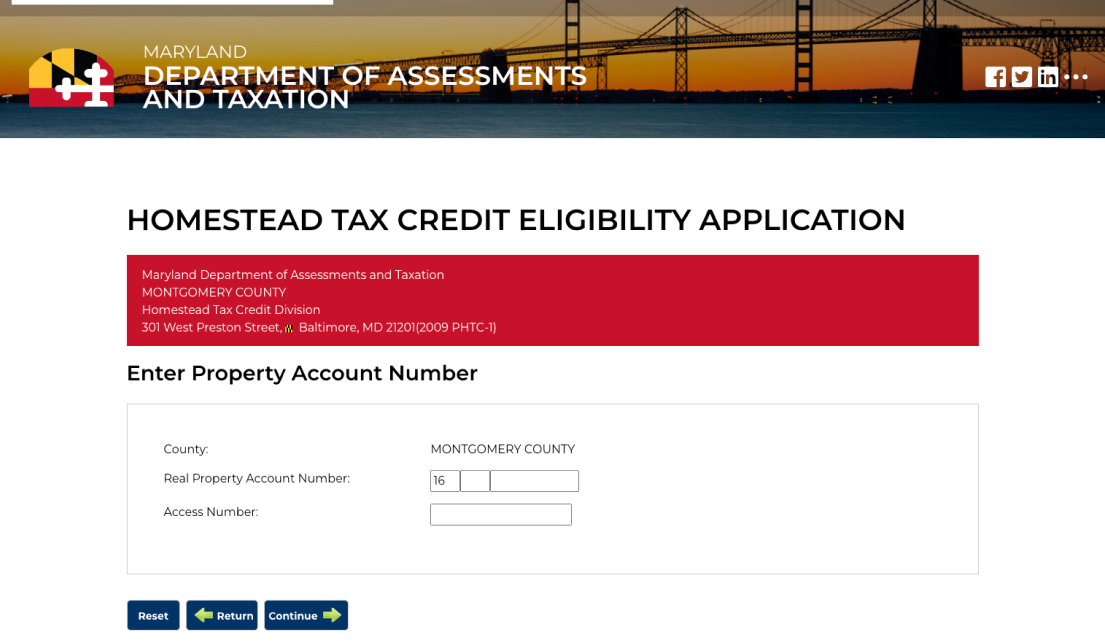

https:// onestop.md.gov /forms/homestead-tax-credit...

The Homestead Tax Credit Eligibility Application is needed to ensure that homeowners receive the Homestead credit only on their principal residence You can find out if you have already filed an application by looking up your property in our Real Property database Show more Apply or Register Ready to apply Online Application

You may file this application online at onestop md gov recommended If you have any questions please email sdat homestead maryland gov or call 410 767 2165 toll free 1 866 650 8783 This application can be filled out on your PC if hand written please print legibly Please use black or blue ink only Section I

The Homestead Tax Credit Eligibility Application is needed to ensure that homeowners receive the Homestead credit only on their principal residence You can find out if you have already filed an application by looking up your property in our Real Property database Show more Apply or Register Ready to apply Online Application

Texas Residence Homestead Exemption Form Fill Out And Sign Printable

The Fund 2019 Florida Homestead Exemption

Maryland Homestead Property Tax Credit Program

Residence Homestead Exemption Application Coleman County CAD Fill Out

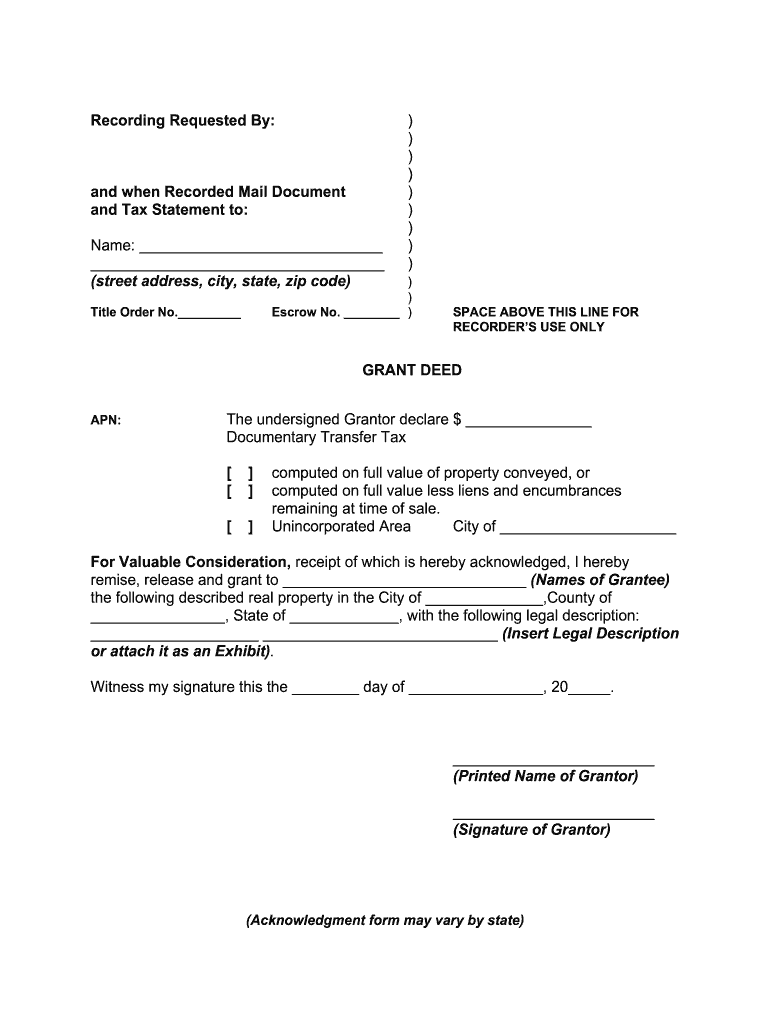

Homestead Exemption Form Fill Out And Sign Printable PDF Template

Nebraska Homestead Exemption Application Or Certification Of Status

Nebraska Homestead Exemption Application Or Certification Of Status

Application For Residence Homestead Exemption