In the digital age, where screens have become the dominant feature of our lives however, the attraction of tangible, printed materials hasn't diminished. Be it for educational use or creative projects, or simply adding the personal touch to your home, printables for free can be an excellent resource. In this article, we'll take a dive to the depths of "Maximum Ppf Deduction Under Section 80c," exploring the different types of printables, where to get them, as well as how they can enrich various aspects of your life.

Get Latest Maximum Ppf Deduction Under Section 80c Below

Maximum Ppf Deduction Under Section 80c

Maximum Ppf Deduction Under Section 80c -

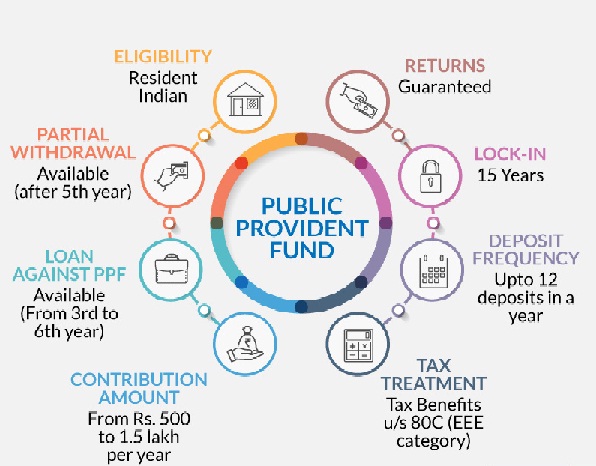

Deduction under Section 80C is capped at Rs 1 5 lakh By doing so you can reduce your income tax liability depending on the tax bracket that you fall under For instance taxpayers with net income over Rs 10 lakh and in the

A maximum deduction allowed is Rs 1 5 lakh under 80C Hence if you fall in the 30 tax bracket then you can save taxes upto Rs 46800 including cess 31 2 on Rs 1 5 lakh Accordingly if you belong in the 20 tax bracket

Maximum Ppf Deduction Under Section 80c offer a wide range of downloadable, printable documents that can be downloaded online at no cost. The resources are offered in a variety forms, like worksheets templates, coloring pages and many more. The value of Maximum Ppf Deduction Under Section 80c is their flexibility and accessibility.

More of Maximum Ppf Deduction Under Section 80c

Section 80C Deductions List To Save Income Tax FinCalC Blog

Section 80C Deductions List To Save Income Tax FinCalC Blog

Investments up to 1 5 lakh are eligible for tax deductions under Section 80C And since the maximum amount you can deposit in a PPF is 1 5 lakh per annum it simply means that the entire amount can tax deductible

The maximum limit for deduction under section 80C including the subsections is INR 1 50 000 except for NPS tier I investment under section 80CCD 1B INDEX Investments Eligible for Section 80C Deduction

Maximum Ppf Deduction Under Section 80c have garnered immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Personalization We can customize designs to suit your personal needs be it designing invitations planning your schedule or even decorating your house.

-

Educational Value: Education-related printables at no charge provide for students from all ages, making the perfect tool for teachers and parents.

-

The convenience of Instant access to numerous designs and templates, which saves time as well as effort.

Where to Find more Maximum Ppf Deduction Under Section 80c

Section 80C Deduction Under Section 80C In India Paisabazaar

Section 80C Deduction Under Section 80C In India Paisabazaar

You can claim tax deductions under Section 80C up to a maximum of INR 1 5 lakh per year for your own PPF contribution your spouse s PPF contribution and contributions to minor children s PPF accounts

Does PPF comes under 80C Yes investment in PPF is allowable as deduction under section 80C of the Income Tax Act Maximum contribution limit under PPF is INR 1 50 000

Now that we've piqued your interest in Maximum Ppf Deduction Under Section 80c We'll take a look around to see where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of printables that are free for a variety of applications.

- Explore categories like the home, decor, the arts, and more.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing with flashcards and other teaching tools.

- Ideal for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers offer their unique designs with templates and designs for free.

- The blogs covered cover a wide range of interests, from DIY projects to planning a party.

Maximizing Maximum Ppf Deduction Under Section 80c

Here are some fresh ways ensure you get the very most of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or decorations for the holidays to beautify your living areas.

2. Education

- Use these printable worksheets free of charge to reinforce learning at home as well as in the class.

3. Event Planning

- Design invitations and banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Keep track of your schedule with printable calendars along with lists of tasks, and meal planners.

Conclusion

Maximum Ppf Deduction Under Section 80c are a treasure trove of innovative and useful resources that cater to various needs and interests. Their accessibility and versatility make these printables a useful addition to both professional and personal lives. Explore the vast world of Maximum Ppf Deduction Under Section 80c right now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free absolutely free?

- Yes you can! You can print and download these documents for free.

-

Does it allow me to use free printables for commercial purposes?

- It is contingent on the specific conditions of use. Always read the guidelines of the creator prior to using the printables in commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Some printables may contain restrictions in use. Always read the terms and regulations provided by the author.

-

How can I print Maximum Ppf Deduction Under Section 80c?

- Print them at home using any printer or head to any local print store for higher quality prints.

-

What program do I need to run printables free of charge?

- The majority of printed documents are in PDF format. They can be opened with free software such as Adobe Reader.

Deduction From Gross Total Income Section 80C To 80U Graphical Table

Section 80C Deductions Save Up To 1 5 Lakhs On Taxes

Check more sample of Maximum Ppf Deduction Under Section 80c below

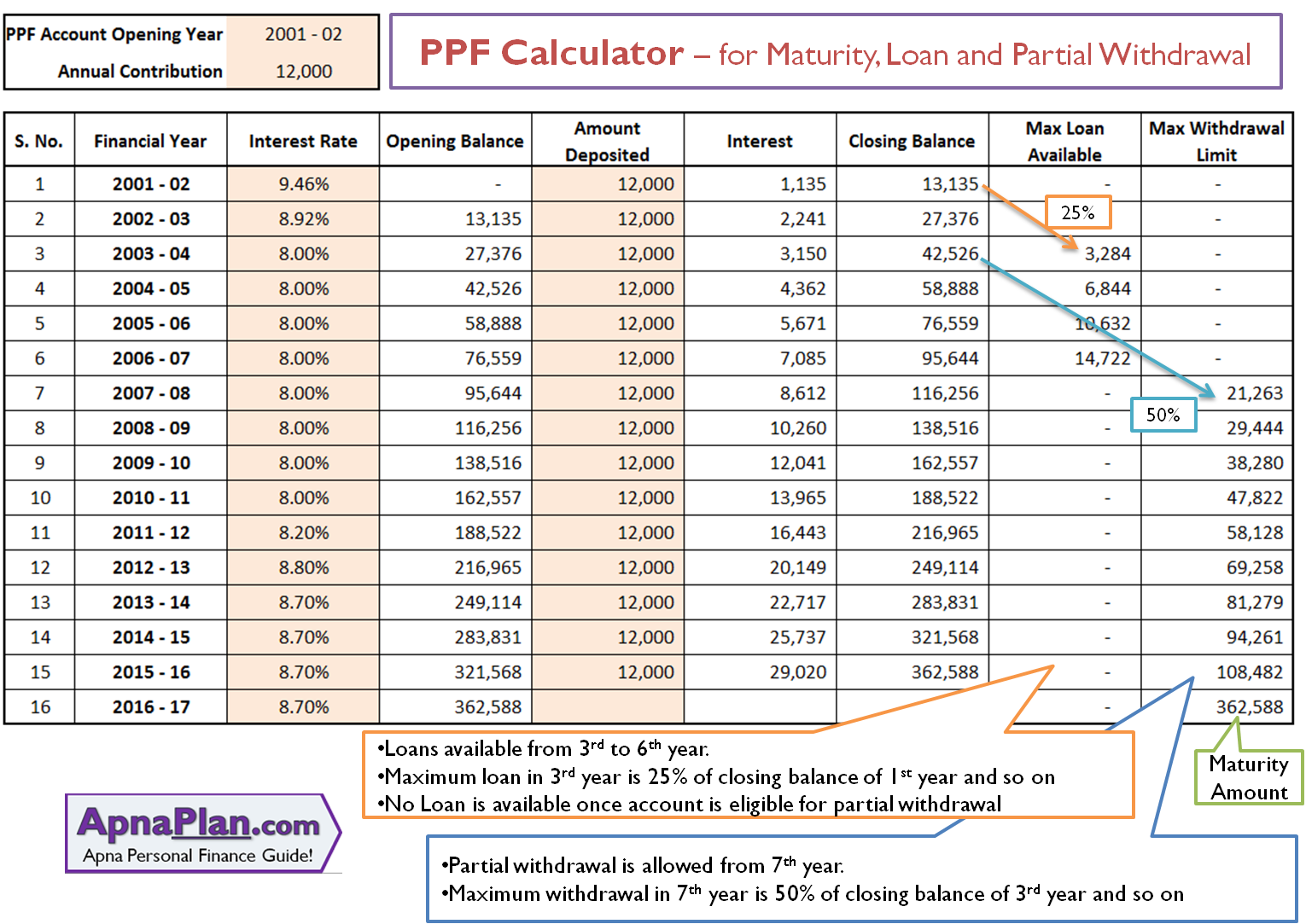

PPF Calculator Excel 2020 Cal Maturity Loan Withdrawal

Section 80C Deduction For School College Education Fees

Income Tax Deduction Under Section 80C To 80U FY 2022 23

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Section 80c Everything You Should Know Deduction Under 80c Tax

Section 80C Deduction For Tax Saving Investments Learn By Quicko

https://cleartax.in

A maximum deduction allowed is Rs 1 5 lakh under 80C Hence if you fall in the 30 tax bracket then you can save taxes upto Rs 46800 including cess 31 2 on Rs 1 5 lakh Accordingly if you belong in the 20 tax bracket

https://cleartax.in

The maximum deduction under Section 80C 80CCC and 80CCD 1 put together is Rs 1 5 lakhs However you may claim an additional deduction of Rs 50 000 allowed u s 80CCD 1B for contributions made to

A maximum deduction allowed is Rs 1 5 lakh under 80C Hence if you fall in the 30 tax bracket then you can save taxes upto Rs 46800 including cess 31 2 on Rs 1 5 lakh Accordingly if you belong in the 20 tax bracket

The maximum deduction under Section 80C 80CCC and 80CCD 1 put together is Rs 1 5 lakhs However you may claim an additional deduction of Rs 50 000 allowed u s 80CCD 1B for contributions made to

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Section 80C Deduction For School College Education Fees

Section 80c Everything You Should Know Deduction Under 80c Tax

Section 80C Deduction For Tax Saving Investments Learn By Quicko

Deduction Under Section 80C To 80U YouTube

Section 80C Of Income Tax Act Tax Deduction AY 2023 24

Section 80C Of Income Tax Act Tax Deduction AY 2023 24

Income Tax Deduction PPF U s 80C With Auto Fills Income Tax Form 16