In the digital age, where screens rule our lives and the appeal of physical, printed materials hasn't diminished. In the case of educational materials such as creative projects or simply to add the personal touch to your space, Maximum Tax Benefit On Home Loan have become a valuable source. In this article, we'll dive to the depths of "Maximum Tax Benefit On Home Loan," exploring the different types of printables, where to locate them, and how they can be used to enhance different aspects of your life.

Get Latest Maximum Tax Benefit On Home Loan Below

Maximum Tax Benefit On Home Loan

Maximum Tax Benefit On Home Loan -

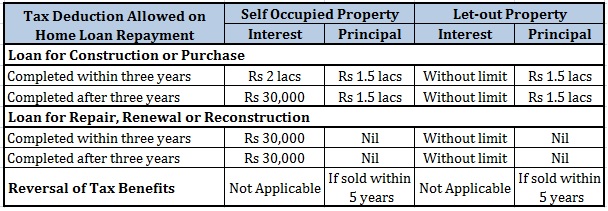

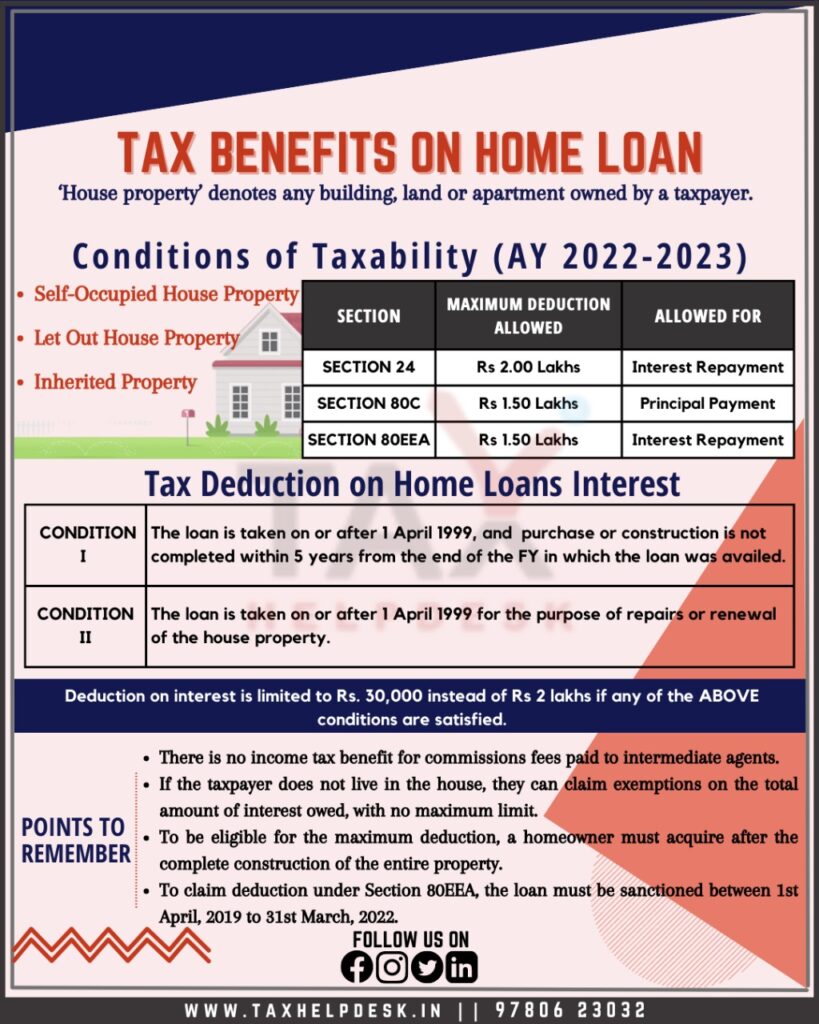

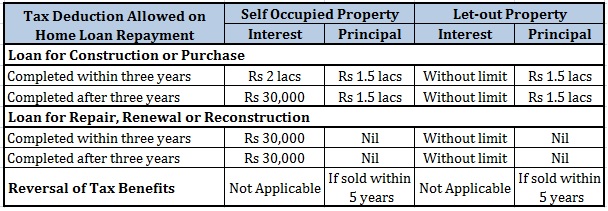

Home Loan Tax Benefits under Section 24 Under Section 24 b of the Income Tax Act you can avail of home loan tax benefits on the interest paid on your home loan The maximum rebate that can be availed for a self occupied house is Rs 2 lakh from your gross income annually

The tax benefit for a home loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section 24 b for self occupied home Up to Rs 1 5 lakh under Section 80C

Maximum Tax Benefit On Home Loan include a broad range of printable, free materials available online at no cost. They are available in a variety of types, such as worksheets templates, coloring pages, and many more. The appealingness of Maximum Tax Benefit On Home Loan is in their variety and accessibility.

More of Maximum Tax Benefit On Home Loan

Home Loan Tax Benefit saving In 2019 20 In Hindi tax Benefit saving On

Home Loan Tax Benefit saving In 2019 20 In Hindi tax Benefit saving On

The interest portion of the EMI paid for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh

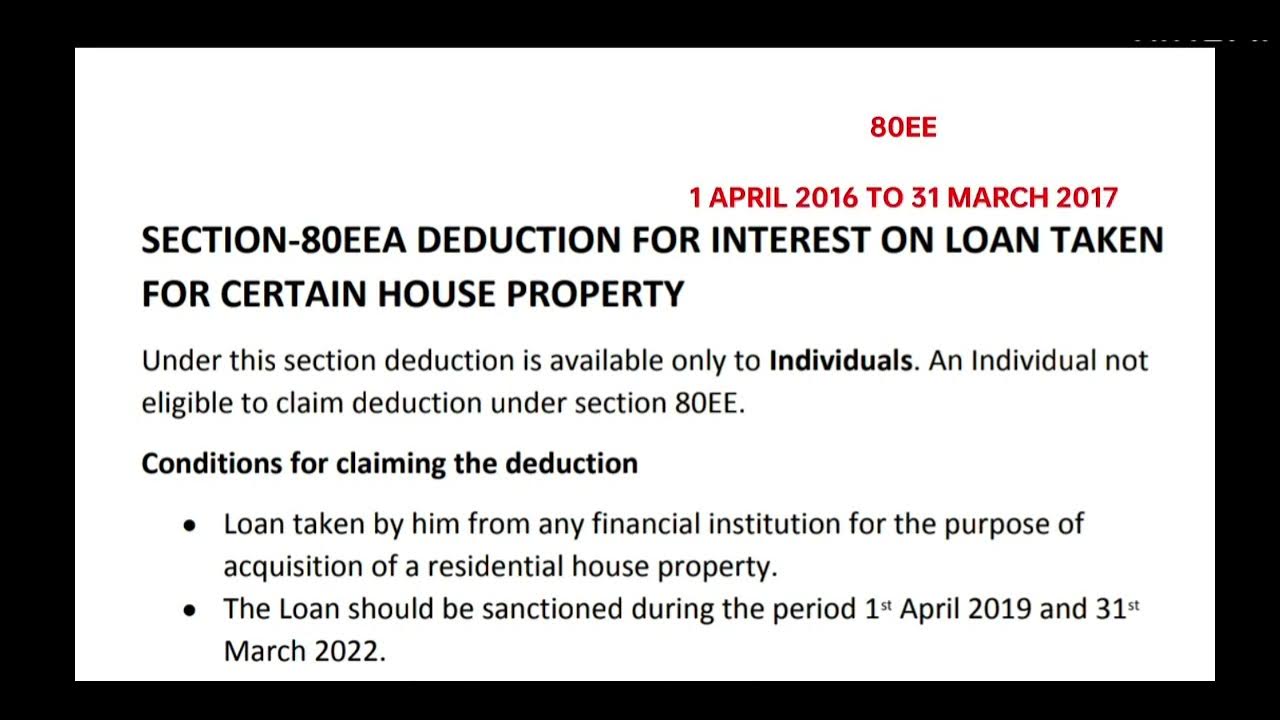

Tax Benefits under Section 80EE Allows you to avail tax benefits of up to Rs 1 5 lakh on the interest component paid on a home loan The benefit can be availed over and above the existing exemption of Rs 2 lakh under Section 24 b The value of property must be less than Rs 45 lakh

Printables that are free have gained enormous recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Customization: It is possible to tailor print-ready templates to your specific requirements be it designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational Benefits: These Maximum Tax Benefit On Home Loan cater to learners from all ages, making them a useful tool for parents and teachers.

-

Simple: Fast access a plethora of designs and templates is time-saving and saves effort.

Where to Find more Maximum Tax Benefit On Home Loan

Tax Benefits How To Use Home Loan Interest To Benefit Of Tax

Tax Benefits How To Use Home Loan Interest To Benefit Of Tax

Section 24b of the Income Tax Act states that home loan borrowers who have availed of a home loan and are repaying it can claim tax benefit on the interest component of their home loan up to a maximum of Rs 2 Lakh

A maximum of Rs 1 5 lakh can be deducted under section 80EEA in a fiscal year It is allowed for a maximum of Rs 2 lakh in addition to the deduction under section 24 A tax payer can thus claim a deduction of up to Rs 3 5 lakh in a fiscal year in the case that they purchase a reasonably priced home

We've now piqued your interest in Maximum Tax Benefit On Home Loan, let's explore where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection and Maximum Tax Benefit On Home Loan for a variety motives.

- Explore categories such as decoration for your home, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free along with flashcards, as well as other learning materials.

- Ideal for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates free of charge.

- These blogs cover a broad spectrum of interests, including DIY projects to party planning.

Maximizing Maximum Tax Benefit On Home Loan

Here are some fresh ways for you to get the best use of Maximum Tax Benefit On Home Loan:

1. Home Decor

- Print and frame beautiful artwork, quotes or seasonal decorations to adorn your living spaces.

2. Education

- Use printable worksheets for free to enhance learning at home, or even in the classroom.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Maximum Tax Benefit On Home Loan are an abundance of practical and innovative resources designed to meet a range of needs and desires. Their availability and versatility make them a fantastic addition to both personal and professional life. Explore the endless world of Maximum Tax Benefit On Home Loan right now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really free?

- Yes they are! You can print and download these resources at no cost.

-

Can I utilize free printing templates for commercial purposes?

- It's dependent on the particular conditions of use. Always consult the author's guidelines before using printables for commercial projects.

-

Do you have any copyright violations with printables that are free?

- Some printables could have limitations on usage. Make sure to read the conditions and terms of use provided by the creator.

-

How do I print Maximum Tax Benefit On Home Loan?

- You can print them at home with either a printer or go to a print shop in your area for the highest quality prints.

-

What program do I need in order to open printables that are free?

- The majority of printed documents are in PDF format. They can be opened using free software such as Adobe Reader.

How To Claim Tax Benefits On Home Loan Bleu Finance

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

Check more sample of Maximum Tax Benefit On Home Loan below

SECTION 80EEA ADDITIONAL BENEFIT ON HOME LOAN RBGCONSULTANTS

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

Home Loan Tax Benefits As Per Union Budget 2020

Homebuyers Can t Avail Tax Benefit On Home Loan From April 1 The Live

Tax Benefit On Home Loan And HRA Both

20151209 Tax Benefits On A Home Loan Personal Finance Plan

https://cleartax.in/s/home-loan-tax-benefits

The tax benefit for a home loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section 24 b for self occupied home Up to Rs 1 5 lakh under Section 80C

https://housing.com/news/home-loans-guide-claiming-tax-benefits

How much tax benefit can I get on home loan Tax deduction on the principal component is limited to Rs 1 50 lakhs per annum under Section 80C while rebate towards interest is capped at Rs 2 lakhs Additional tax benefits are also offered to first time home buyers under Section 80EE and Section 80EEA

The tax benefit for a home loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section 24 b for self occupied home Up to Rs 1 5 lakh under Section 80C

How much tax benefit can I get on home loan Tax deduction on the principal component is limited to Rs 1 50 lakhs per annum under Section 80C while rebate towards interest is capped at Rs 2 lakhs Additional tax benefits are also offered to first time home buyers under Section 80EE and Section 80EEA

Homebuyers Can t Avail Tax Benefit On Home Loan From April 1 The Live

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

Tax Benefit On Home Loan And HRA Both

20151209 Tax Benefits On A Home Loan Personal Finance Plan

When To Claim Tax Benefit On Home Loan And HRA Both BusinessToday

Indiabulls Home Loans Tax Benefit On Home Loan Top Up

Indiabulls Home Loans Tax Benefit On Home Loan Top Up

Income Tax Benefits On Home Loan Mothish Kumar Property Coach YouTube