In this age of electronic devices, with screens dominating our lives and our lives are dominated by screens, the appeal of tangible printed materials hasn't faded away. In the case of educational materials, creative projects, or just adding an individual touch to the space, Maximum Tax Rebate Under 80d are now an essential resource. The following article is a take a dive in the world of "Maximum Tax Rebate Under 80d," exploring the benefits of them, where they can be found, and how they can be used to enhance different aspects of your daily life.

Get Latest Maximum Tax Rebate Under 80d Below

Maximum Tax Rebate Under 80d

Maximum Tax Rebate Under 80d -

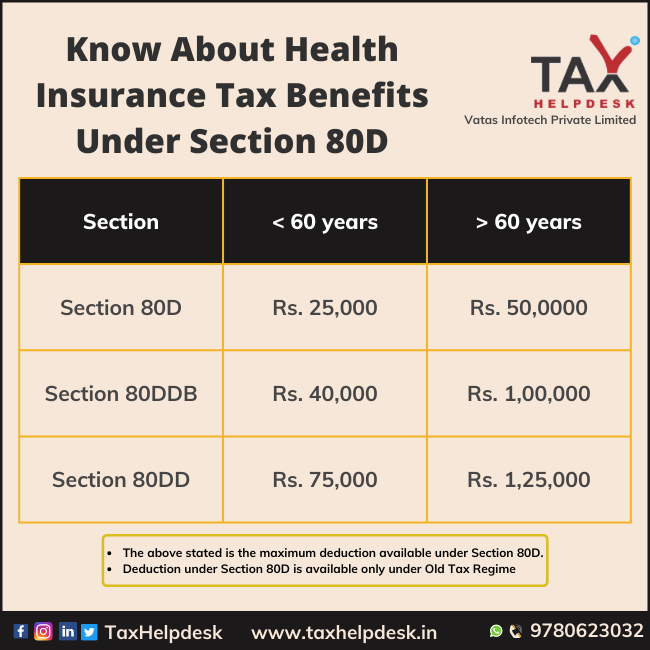

Verkko 21 marrask 2023 nbsp 0183 32 Keep them in a safe and easily accessible place Do Understand Deduction Limits Understand the deduction limits under Section 80D As of 2023 for individuals below 60 years of age the maximum deduction allowed is 25 000 for self spouse and children with an additional 25 000 for parents 50 000 if parents are

Verkko 15 helmik 2023 nbsp 0183 32 Maximum deduction that can be claimed Section 80D Age of the insured Maximum deduction allowed under Section 80D Both individual and parents are below 60 years of age Rs 50 000 Individual below 60 years and parents are senior citizens Rs 75 000 Both individual and parents are senior citizens Rs 1 00 000

Maximum Tax Rebate Under 80d include a broad array of printable items that are available online at no cost. The resources are offered in a variety styles, from worksheets to templates, coloring pages and more. The value of Maximum Tax Rebate Under 80d is their flexibility and accessibility.

More of Maximum Tax Rebate Under 80d

Know About Health Insurance Tax Benefits Under Section 80D

Know About Health Insurance Tax Benefits Under Section 80D

Verkko An employee can claim a maximum deduction of 10 of his salary for workers or 20 of his total income for self employed taxpayers or Rs1 5 lakhs whichever is less under this clause Sections 80C 80CCC and 80 CCD 1 each allow a

Verkko Yes under Section 80D taxpayers can avail of tax deduction up to INR 25 000 per year for medical premium paid for self family and dependent who are under 60 years of age

Maximum Tax Rebate Under 80d have risen to immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

The ability to customize: This allows you to modify printed materials to meet your requirements, whether it's designing invitations making your schedule, or even decorating your house.

-

Educational Impact: Printables for education that are free can be used by students of all ages, which makes them a vital tool for teachers and parents.

-

It's easy: Access to many designs and templates will save you time and effort.

Where to Find more Maximum Tax Rebate Under 80d

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Verkko 11 huhtik 2022 nbsp 0183 32 N 228 ill 228 tiedoilla vuonna 2022 verot olisivat verottajan laskurin mukaan Ei j 228 senen verot vuodessa 8 514 97 YTK n j 228 senen verot vuodessa 8 463 76 Edellisist 228 voi laskea ett 228 esimerkkitilanteessa YTK n j 228 senmaksu v 228 hent 228 228 maksettavia veroja 51 21 J 228 senyyden kokonaiskustannus j 228 senmaksu verov 228 hennys on siten

Verkko Section 80D provides for tax deduction from the total taxable income for the payment by any mode other than cash of medical insurance premium paid by an Individual or a HUF This tax deduction is available over and above the deduction of

Since we've got your curiosity about Maximum Tax Rebate Under 80d Let's find out where you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of printables that are free for a variety of objectives.

- Explore categories such as home decor, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free, flashcards, and learning tools.

- Perfect for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers post their original designs or templates for download.

- These blogs cover a wide range of interests, all the way from DIY projects to planning a party.

Maximizing Maximum Tax Rebate Under 80d

Here are some ideas how you could make the most of printables that are free:

1. Home Decor

- Print and frame beautiful images, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Use free printable worksheets for teaching at-home for the classroom.

3. Event Planning

- Designs invitations, banners and decorations for special events like weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Maximum Tax Rebate Under 80d are a treasure trove with useful and creative ideas that meet a variety of needs and passions. Their availability and versatility make these printables a useful addition to any professional or personal life. Explore the world of printables for free today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Maximum Tax Rebate Under 80d truly are they free?

- Yes you can! You can print and download these items for free.

-

Can I use the free printables to make commercial products?

- It is contingent on the specific usage guidelines. Always verify the guidelines of the creator prior to using the printables in commercial projects.

-

Are there any copyright violations with printables that are free?

- Certain printables might have limitations on use. Always read the terms and conditions offered by the author.

-

How can I print Maximum Tax Rebate Under 80d?

- You can print them at home using the printer, or go to any local print store for more high-quality prints.

-

What program do I require to view printables at no cost?

- The majority of printed documents are in the PDF format, and is open with no cost software, such as Adobe Reader.

Section 80D How To Get Double Benefits Of Tax Rebate And Medical

Section 80D Deduction In Respect Of Health Or Medical Insurance

Check more sample of Maximum Tax Rebate Under 80d below

IndiaNivesh Section 80 Deductions Income Tax Deductions Under

Tax Rebate Under 80C 80D Mob 9896270548 Ambala Cantt tax lic

Epf Contribution Table For Age Above 60 2019 Frank Lyman

What Is Income Tax Limit For Property Tax And Insurance

Tips And Tricks Follow THESE 5 Techniques To SAVE Income Tax News

Section 80d Of Income Tax Act Ay 2020 21 Worthen Althiche

https://economictimes.indiatimes.com/wealth/tax/you-can-claim-maximum...

Verkko 15 helmik 2023 nbsp 0183 32 Maximum deduction that can be claimed Section 80D Age of the insured Maximum deduction allowed under Section 80D Both individual and parents are below 60 years of age Rs 50 000 Individual below 60 years and parents are senior citizens Rs 75 000 Both individual and parents are senior citizens Rs 1 00 000

https://invested.in/tax-benefit-can-be-claimed-under-section-80d

Verkko 2 marrask 2023 nbsp 0183 32 In section 80C you can save up to 1 5 lakhs whereas in section 80D you can save up to 1 lakhs only Also saving but Section 80C which is implemented in 1961 is for all investments At the same time section 80D is only for the health insurance policy for self spouse children and parents

Verkko 15 helmik 2023 nbsp 0183 32 Maximum deduction that can be claimed Section 80D Age of the insured Maximum deduction allowed under Section 80D Both individual and parents are below 60 years of age Rs 50 000 Individual below 60 years and parents are senior citizens Rs 75 000 Both individual and parents are senior citizens Rs 1 00 000

Verkko 2 marrask 2023 nbsp 0183 32 In section 80C you can save up to 1 5 lakhs whereas in section 80D you can save up to 1 lakhs only Also saving but Section 80C which is implemented in 1961 is for all investments At the same time section 80D is only for the health insurance policy for self spouse children and parents

What Is Income Tax Limit For Property Tax And Insurance

Tax Rebate Under 80C 80D Mob 9896270548 Ambala Cantt tax lic

Tips And Tricks Follow THESE 5 Techniques To SAVE Income Tax News

Section 80d Of Income Tax Act Ay 2020 21 Worthen Althiche

Tax Rebate Under Section 87A Claim Income Tax Rebate For FY 2018 19

All You Need To Know About Section 80D Of Income Tax Act Ebizfiling

All You Need To Know About Section 80D Of Income Tax Act Ebizfiling

Save Income Tax Under 80C 80D 80DD 80CCD 1B 80DDB 80GG 80EE 80E