In this age of electronic devices, where screens rule our lives and our lives are dominated by screens, the appeal of tangible printed materials hasn't faded away. Be it for educational use and creative work, or just adding personal touches to your home, printables for free can be an excellent source. Here, we'll take a dive into the world of "Meaning Of Tax Deduction At Source," exploring the benefits of them, where they are available, and the ways that they can benefit different aspects of your daily life.

Get Latest Meaning Of Tax Deduction At Source Below

Meaning Of Tax Deduction At Source

Meaning Of Tax Deduction At Source -

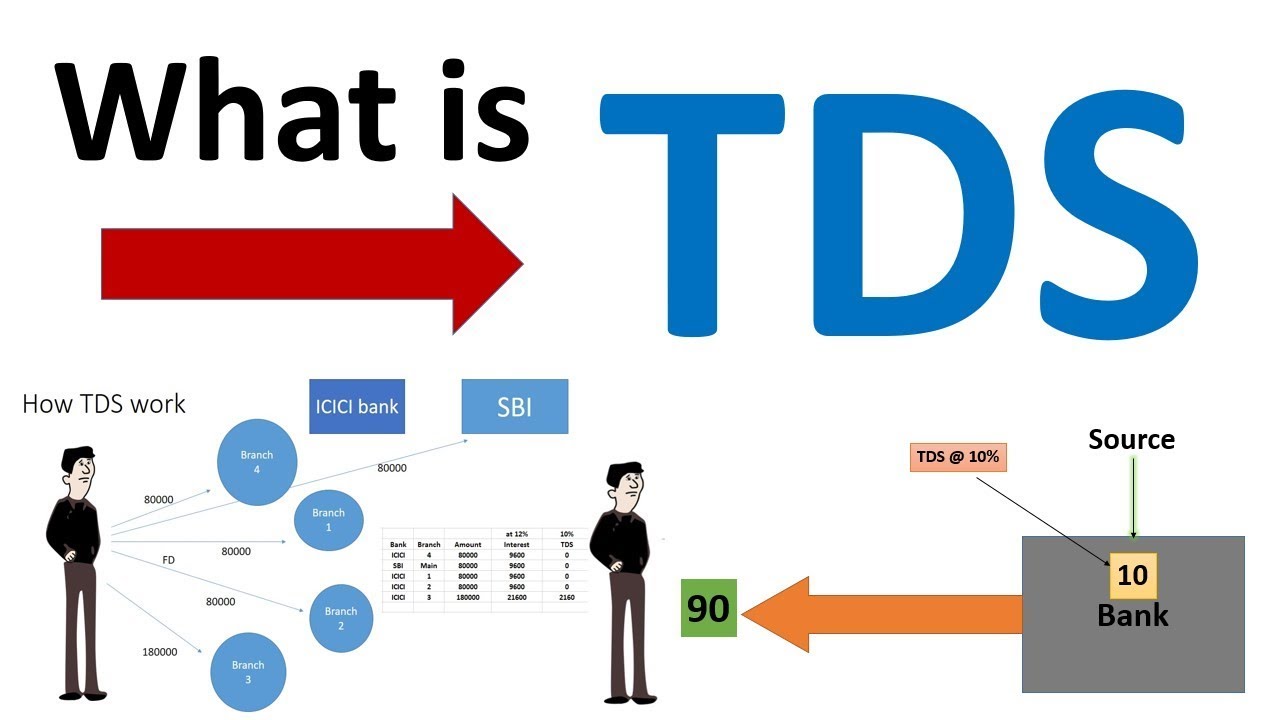

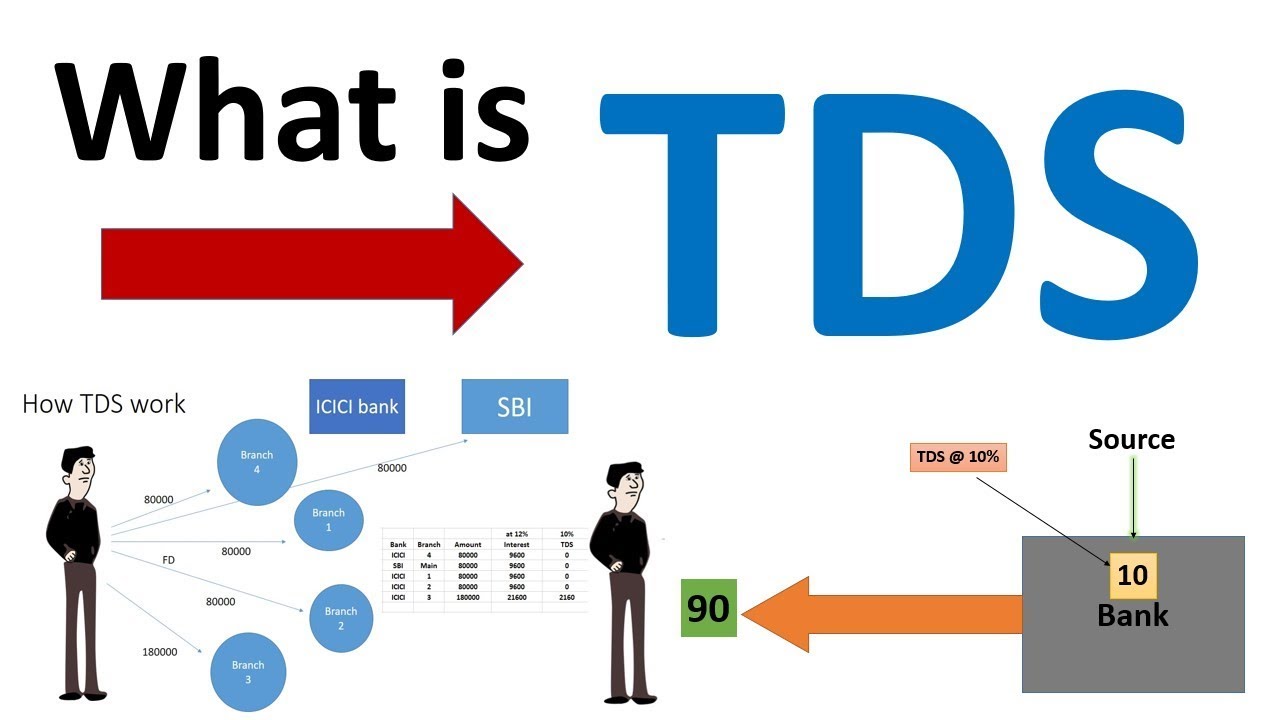

The Central Government introduced TDS Tax Deducted at Source to collect taxes from an individual s very source of income Under this concept the deductor who is liable to make payments to a deductee is

HMRC requires employers and other income sources using PAYE to deducted income tax at source and pay it to them directly on each payment date To have tax deducted at source means that you only receive the net amount of income after tax rather than the gross amount before

Meaning Of Tax Deduction At Source cover a large range of printable, free documents that can be downloaded online at no cost. They are available in numerous forms, including worksheets, templates, coloring pages, and much more. The benefit of Meaning Of Tax Deduction At Source is in their variety and accessibility.

More of Meaning Of Tax Deduction At Source

What Is Tax Deduction At Source TDS Meaning Definition And Various

What Is Tax Deduction At Source TDS Meaning Definition And Various

TDS Tax Deducted at Source is a form of indirect tax collection Find out everything related to TDS such as rates and types of TDS advantages of TDS and FAQ on TDS

When a person pays certain types of income such as salary commission rent professional fees interest etc they deduct a specific amount known as Tax Deducted at Source TDS The person who makes the payment deducted the TDS and the receiver of income

Meaning Of Tax Deduction At Source have garnered immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Individualization Your HTML0 customization options allow you to customize the templates to meet your individual needs, whether it's designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational Use: Printables for education that are free offer a wide range of educational content for learners of all ages, which makes them an essential source for educators and parents.

-

Affordability: instant access a variety of designs and templates saves time and effort.

Where to Find more Meaning Of Tax Deduction At Source

Tax Deduction At Source TDS In India The Ultimate Guide

Tax Deduction At Source TDS In India The Ultimate Guide

Tariffs dwindled as a source of federal revenue while income taxes expanded Today tariffs make up just 2 percent of federal revenue while income and payroll taxes make up about 94 percent

What is Tax Collected at Source TCS Tax collected at source TCS is the tax collected by the seller from the buyer on sale so that it can be deposited with the tax authorities Section 206C of the Income tax Act governs the goods on which the seller has to collect tax

After we've peaked your curiosity about Meaning Of Tax Deduction At Source Let's take a look at where you can find these elusive treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Meaning Of Tax Deduction At Source to suit a variety of uses.

- Explore categories like furniture, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free or flashcards as well as learning tools.

- Ideal for teachers, parents and students looking for extra sources.

3. Creative Blogs

- Many bloggers post their original designs and templates, which are free.

- These blogs cover a broad range of interests, that range from DIY projects to party planning.

Maximizing Meaning Of Tax Deduction At Source

Here are some creative ways that you can make use use of printables that are free:

1. Home Decor

- Print and frame gorgeous images, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Print worksheets that are free for reinforcement of learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations and banners and decorations for special occasions such as weddings and birthdays.

4. Organization

- Get organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Meaning Of Tax Deduction At Source are an abundance of fun and practical tools that can meet the needs of a variety of people and desires. Their availability and versatility make them a valuable addition to the professional and personal lives of both. Explore the vast array of Meaning Of Tax Deduction At Source to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really free?

- Yes they are! You can print and download these free resources for no cost.

-

Can I download free printables for commercial purposes?

- It's determined by the specific conditions of use. Always read the guidelines of the creator before using their printables for commercial projects.

-

Do you have any copyright rights issues with Meaning Of Tax Deduction At Source?

- Some printables could have limitations regarding their use. Always read the terms and condition of use as provided by the author.

-

How do I print Meaning Of Tax Deduction At Source?

- Print them at home with your printer or visit a local print shop for top quality prints.

-

What program will I need to access printables that are free?

- Most PDF-based printables are available with PDF formats, which is open with no cost software like Adobe Reader.

What Is TDS How Tax Deduction At Source Works

Your Ultimate Guide To TDS Tax Deduction At Source Samco

Check more sample of Meaning Of Tax Deduction At Source below

Tds What Is Tax Deducted At Source What Are The Tds Rates Scripbox Vrogue

TDS On GST Tax Deduction At Source On GST MyBillBook

Pin On Income Tax Blogs

What Is TDS Tax Deduction At Source How To Calculate TDS Tax

Payment To Advertising Agency Attracts TDS Under Section 194C

What Is The Full Form Of TDS Meaning Example Of TDS

https://www.taxrebateservices.co.uk › tax-guides › tax...

HMRC requires employers and other income sources using PAYE to deducted income tax at source and pay it to them directly on each payment date To have tax deducted at source means that you only receive the net amount of income after tax rather than the gross amount before

https://en.wikipedia.org › wiki › Tax_deduction_at_source

Tax deduction at source TDS is an Indian withholding tax that is a means of collecting tax on income dividends or asset sales by requiring the payer or legal intermediary to deduct tax due before paying the balance to the payee and the tax to the revenue authority Under the Indian Income Tax Act of 1961 income tax must be deducted at source as per the provisions of the Income Tax Act 1961 Any payment covered under these provisions shall be p

HMRC requires employers and other income sources using PAYE to deducted income tax at source and pay it to them directly on each payment date To have tax deducted at source means that you only receive the net amount of income after tax rather than the gross amount before

Tax deduction at source TDS is an Indian withholding tax that is a means of collecting tax on income dividends or asset sales by requiring the payer or legal intermediary to deduct tax due before paying the balance to the payee and the tax to the revenue authority Under the Indian Income Tax Act of 1961 income tax must be deducted at source as per the provisions of the Income Tax Act 1961 Any payment covered under these provisions shall be p

What Is TDS Tax Deduction At Source How To Calculate TDS Tax

TDS On GST Tax Deduction At Source On GST MyBillBook

Payment To Advertising Agency Attracts TDS Under Section 194C

What Is The Full Form Of TDS Meaning Example Of TDS

Demystifying Tax Deduction At Source TDS Interest On Securities

Tax Deduction At Source From Commission 2022 23 Chartered Journal

Tax Deduction At Source From Commission 2022 23 Chartered Journal

What Is TDS 2020 TDS Tax Deduction At Source Basic