Today, where screens rule our lives however, the attraction of tangible printed materials isn't diminishing. Be it for educational use for creative projects, just adding an extra personal touch to your space, Medical Expenses In Income Tax are now a vital source. With this guide, you'll dive into the world of "Medical Expenses In Income Tax," exploring what they are, where to find them and ways they can help you improve many aspects of your daily life.

Get Latest Medical Expenses In Income Tax Below

Medical Expenses In Income Tax

Medical Expenses In Income Tax -

Can You Claim Medical Expenses on Your Taxes While many out of pocket medical bills are deductible you have two hurdles to overcome before you can

In Budget 2024 income tax relief limit for medical expenses has been increased from RM8 000 to RM10 000 This is effective from the year of assessment

Medical Expenses In Income Tax offer a wide range of printable, free items that are available online at no cost. The resources are offered in a variety formats, such as worksheets, templates, coloring pages, and many more. The benefit of Medical Expenses In Income Tax is their flexibility and accessibility.

More of Medical Expenses In Income Tax

Deduction Of Medical Expenses In Income Tax YouTube

Deduction Of Medical Expenses In Income Tax YouTube

Deducting medical expenses How to claim medical expense deductions Medical expense deductions checklist Key Takeaways You can only deduct

The medical expenditure incurred by an employer for an employee or on family members with respect to certain diseases and ailments as specified in Rule 3A of

Printables that are free have gained enormous popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or costly software.

-

Individualization The Customization feature lets you tailor the design to meet your needs when it comes to designing invitations planning your schedule or even decorating your house.

-

Educational Benefits: Printing educational materials for no cost can be used by students of all ages. This makes them a great tool for parents and educators.

-

Accessibility: Instant access to a plethora of designs and templates is time-saving and saves effort.

Where to Find more Medical Expenses In Income Tax

What Is Provision Of Claiming Medical Expenses In Income Tax Sec 80ddb

What Is Provision Of Claiming Medical Expenses In Income Tax Sec 80ddb

Individuals can claim some of the cost of medical dental and other health care related expenses on tax returns if they itemize Learn about the rules that apply

ITA home This interview will help you determine if your medical and dental expenses are deductible Information you ll need Filing status Type and amount of

We've now piqued your curiosity about Medical Expenses In Income Tax we'll explore the places you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection and Medical Expenses In Income Tax for a variety goals.

- Explore categories like furniture, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets with flashcards and other teaching materials.

- Ideal for parents, teachers, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers share their innovative designs with templates and designs for free.

- These blogs cover a broad array of topics, ranging that range from DIY projects to planning a party.

Maximizing Medical Expenses In Income Tax

Here are some new ways that you can make use use of Medical Expenses In Income Tax:

1. Home Decor

- Print and frame stunning images, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Print out free worksheets and activities for teaching at-home either in the schoolroom or at home.

3. Event Planning

- Invitations, banners as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Be organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Medical Expenses In Income Tax are an abundance of innovative and useful resources which cater to a wide range of needs and hobbies. Their access and versatility makes them a great addition to your professional and personal life. Explore the vast collection of Medical Expenses In Income Tax now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really completely free?

- Yes, they are! You can print and download these documents for free.

-

Can I use free printables for commercial uses?

- It's determined by the specific usage guidelines. Always verify the guidelines provided by the creator before utilizing printables for commercial projects.

-

Are there any copyright concerns when using Medical Expenses In Income Tax?

- Certain printables might have limitations on use. Check the terms of service and conditions provided by the designer.

-

How do I print printables for free?

- You can print them at home using either a printer or go to a local print shop to purchase high-quality prints.

-

What software do I need to open printables free of charge?

- The majority are printed in the format PDF. This can be opened using free software like Adobe Reader.

Can A Senior Citizen Mother Claim Her Medical Expenses In Income Tax

What Are Miscellaneous Expenses Quickbooks Canada Blog

Check more sample of Medical Expenses In Income Tax below

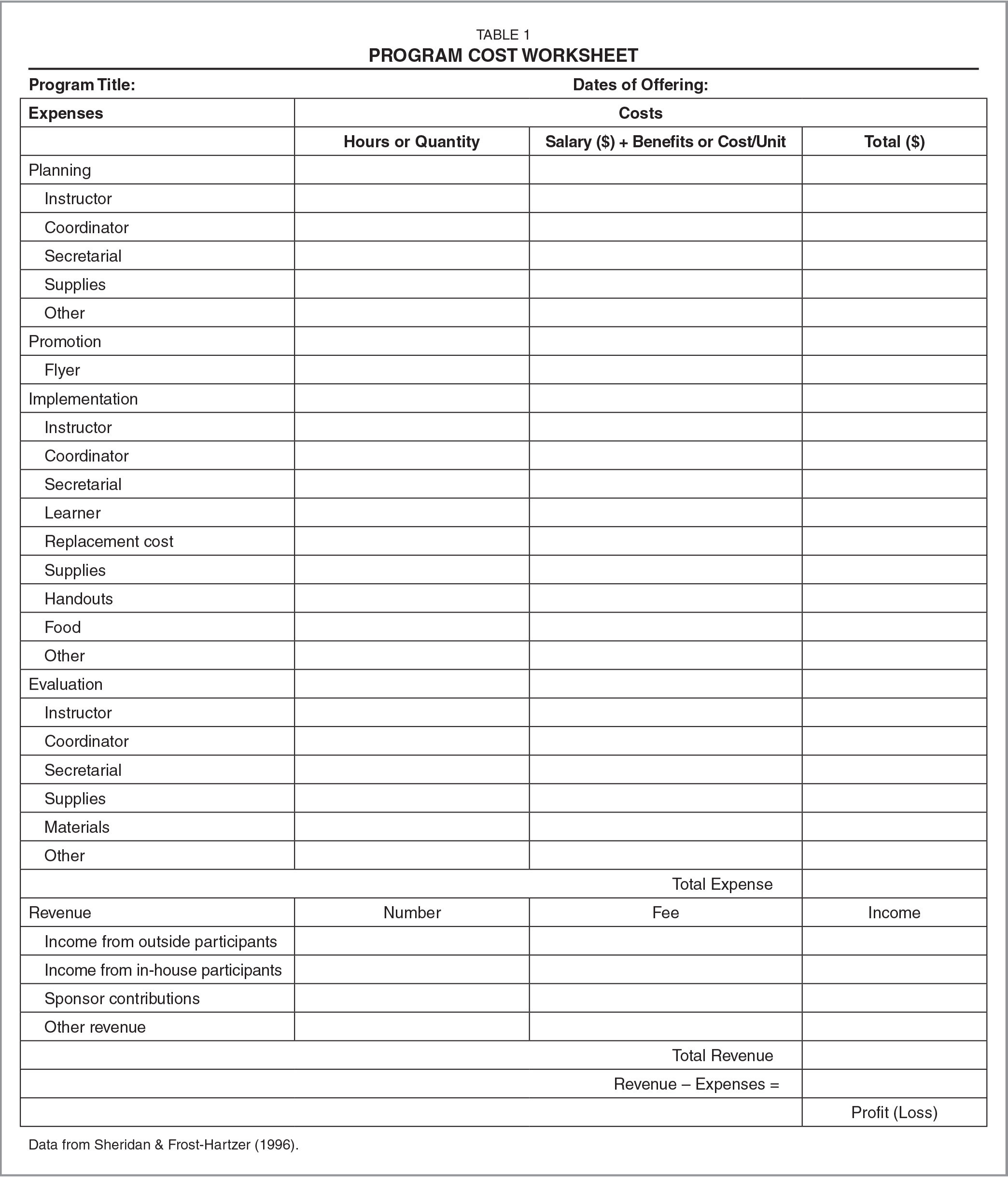

Deduction For Medical Expenses FF 05 27 2019 Tax Policy Center

How Does The Medical Expense Tax Credit Work In Canada

Claim Medical Expenses On Taxes Income Tax Preparation Us Tax

PPT Can A Senior Citizen Mother Claim Her Medical Expenses In Income

Save Tax By Claiming Children Education Expenses In Income Tax Income

Medical Expenses Eligible For Deduction On Your 2019 Tax Return Think

https://www.imoney.my/articles/what-can-claim-tax-relief-medical

In Budget 2024 income tax relief limit for medical expenses has been increased from RM8 000 to RM10 000 This is effective from the year of assessment

https://www.nerdwallet.com/article/tax…

For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross income The 7 5 threshold used to be 10

In Budget 2024 income tax relief limit for medical expenses has been increased from RM8 000 to RM10 000 This is effective from the year of assessment

For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross income The 7 5 threshold used to be 10

PPT Can A Senior Citizen Mother Claim Her Medical Expenses In Income

How Does The Medical Expense Tax Credit Work In Canada

Save Tax By Claiming Children Education Expenses In Income Tax Income

Medical Expenses Eligible For Deduction On Your 2019 Tax Return Think

Medical Expenses Deduction Under Income Tax Act 2023 Update

Medical Expenses Islamicmyte

Medical Expenses Islamicmyte

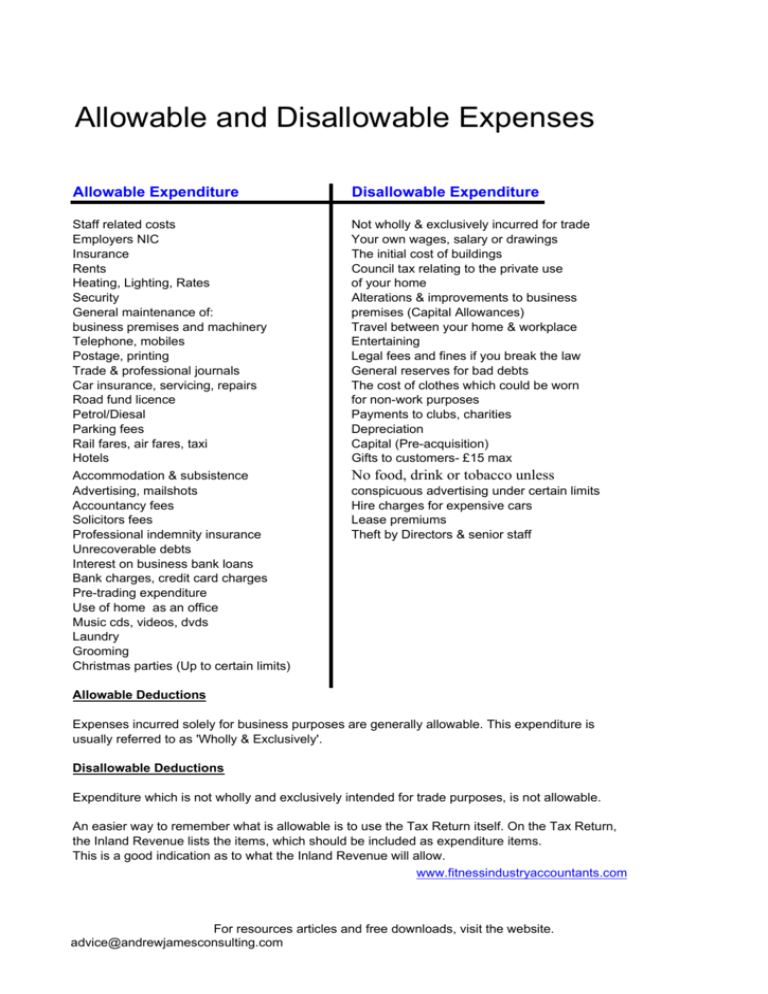

Allowable Disallowable Expenses