In a world where screens rule our lives, the charm of tangible printed material hasn't diminished. Be it for educational use such as creative projects or simply adding some personal flair to your space, Medical Insurance Claim In Income Tax Return have become a valuable resource. For this piece, we'll take a dive into the world "Medical Insurance Claim In Income Tax Return," exploring what they are, where you can find them, and how they can improve various aspects of your life.

Get Latest Medical Insurance Claim In Income Tax Return Below

Medical Insurance Claim In Income Tax Return

Medical Insurance Claim In Income Tax Return -

Claiming medical expense deductions on your tax return is one way to lower your tax bill To accomplish this your deductions must be from a list approved by

To claim the payments of your health plan premium include them with your other eligible medical expenses and claim the credit on line 33099 of your return If you

Medical Insurance Claim In Income Tax Return offer a wide selection of printable and downloadable materials available online at no cost. These resources come in many types, like worksheets, templates, coloring pages and many more. The value of Medical Insurance Claim In Income Tax Return is their flexibility and accessibility.

More of Medical Insurance Claim In Income Tax Return

File Income Tax Return How To E File Your Income Tax Return Online

File Income Tax Return How To E File Your Income Tax Return Online

General information The medical expense tax credit is a non refundable tax credit that you can use to reduce the tax that you paid or may have to pay If you paid for healthcare

Let s say your taxable income for the year was 100 000 and you spent 12 000 on healthcare You d be eligible to deduct health expenses because 7 5 of 100 000 equals 7 500 which is

Printables that are free have gained enormous recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the need to buy physical copies of the software or expensive hardware.

-

customization: There is the possibility of tailoring printed materials to meet your requirements be it designing invitations to organize your schedule or even decorating your home.

-

Educational value: The free educational worksheets are designed to appeal to students of all ages, which makes them a useful resource for educators and parents.

-

The convenience of You have instant access various designs and templates, which saves time as well as effort.

Where to Find more Medical Insurance Claim In Income Tax Return

IRS Claim Your 1 200 Stimulus Check By November 21 Irs Student

IRS Claim Your 1 200 Stimulus Check By November 21 Irs Student

On your tax return you can deduct qualified expenses over 4 500 7 5 of 60 000 That s 10 500 worth of qualifying medical expenses 15 000 minus 4 500

133 rowsYou can claim only eligible medical expenses on your tax return if you or your spouse or common law partner paid for the medical expenses in any 12 month period

We hope we've stimulated your interest in printables for free Let's look into where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection in Medical Insurance Claim In Income Tax Return for different motives.

- Explore categories like furniture, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free, flashcards, and learning tools.

- It is ideal for teachers, parents or students in search of additional sources.

3. Creative Blogs

- Many bloggers post their original designs as well as templates for free.

- These blogs cover a wide array of topics, ranging everything from DIY projects to planning a party.

Maximizing Medical Insurance Claim In Income Tax Return

Here are some new ways create the maximum value of Medical Insurance Claim In Income Tax Return:

1. Home Decor

- Print and frame beautiful images, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Print worksheets that are free for reinforcement of learning at home also in the classes.

3. Event Planning

- Designs invitations, banners and other decorations for special occasions like weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars or to-do lists. meal planners.

Conclusion

Medical Insurance Claim In Income Tax Return are an abundance of innovative and useful resources catering to different needs and preferences. Their access and versatility makes them a valuable addition to the professional and personal lives of both. Explore the endless world of Medical Insurance Claim In Income Tax Return right now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Medical Insurance Claim In Income Tax Return truly absolutely free?

- Yes, they are! You can print and download these items for free.

-

Can I use free printables for commercial use?

- It's based on specific rules of usage. Make sure you read the guidelines for the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright violations with Medical Insurance Claim In Income Tax Return?

- Some printables may contain restrictions regarding usage. Check the terms and conditions provided by the creator.

-

How do I print Medical Insurance Claim In Income Tax Return?

- You can print them at home with any printer or head to an area print shop for superior prints.

-

What software must I use to open printables free of charge?

- A majority of printed materials are in PDF format, which can be opened using free software like Adobe Reader.

Medical Insurance Claim Guide For Malaysians

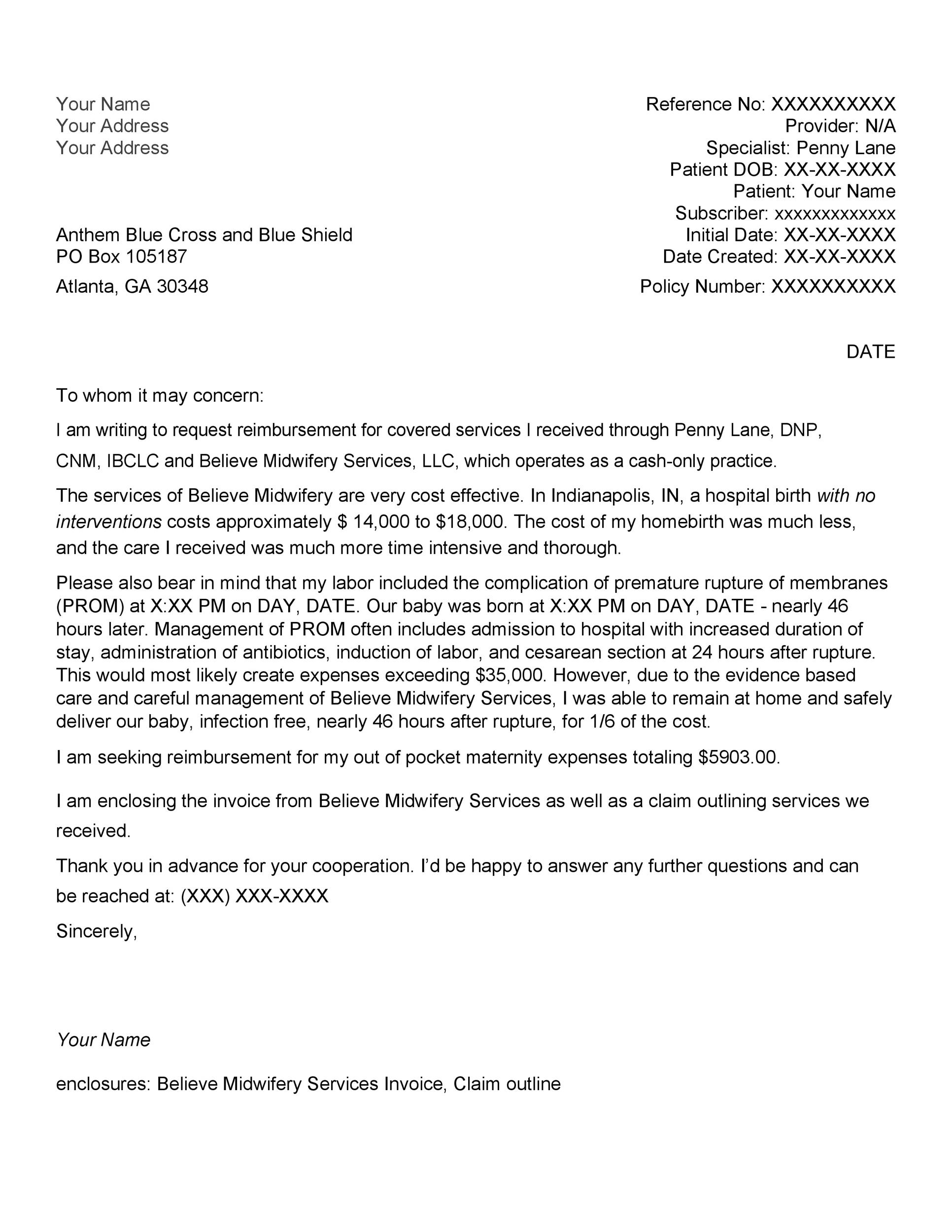

How Write A Claim Letter Riset

Check more sample of Medical Insurance Claim In Income Tax Return below

Income Tax Return Filed Prior To Death Of Assesse Shall Be The Basis Of

Car Payment Disability Income Insurance Sick Financial Medical

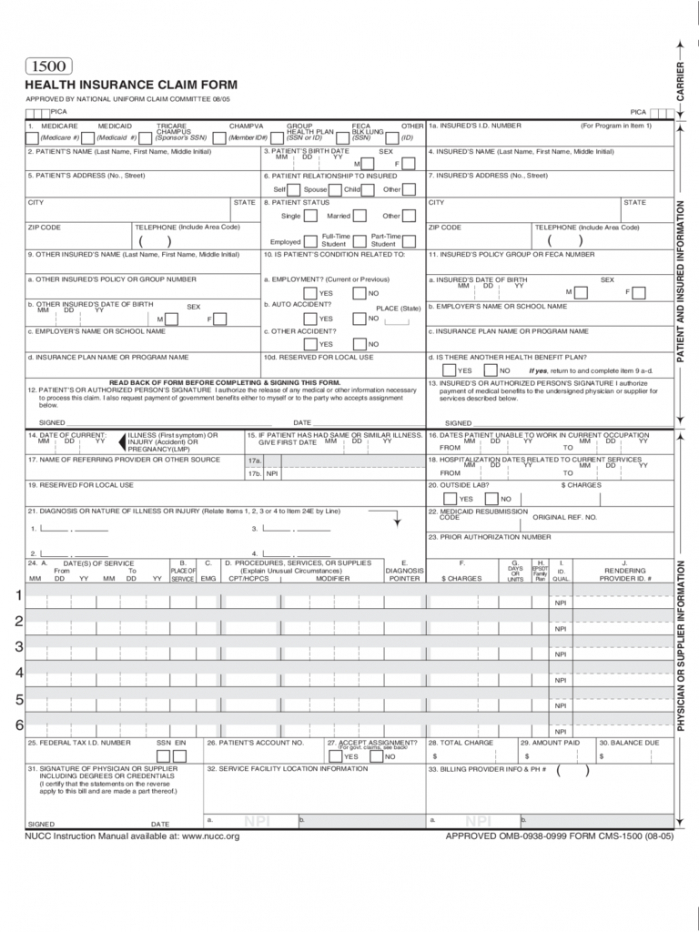

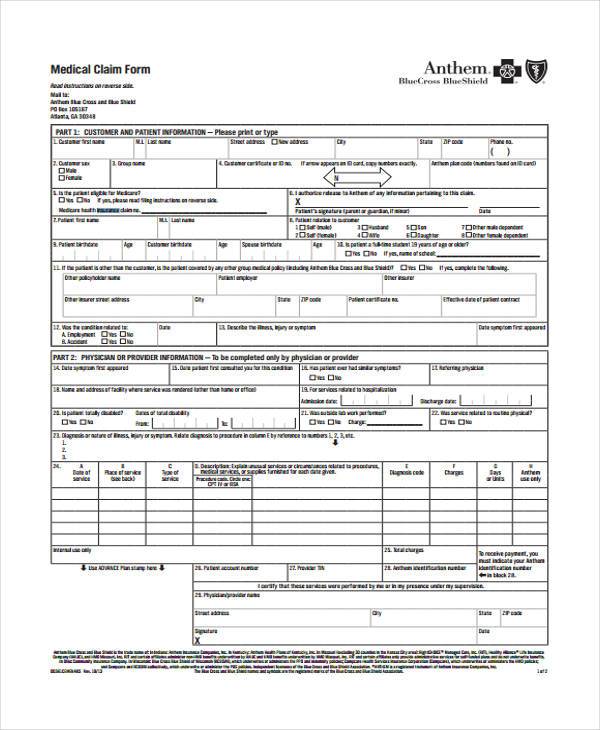

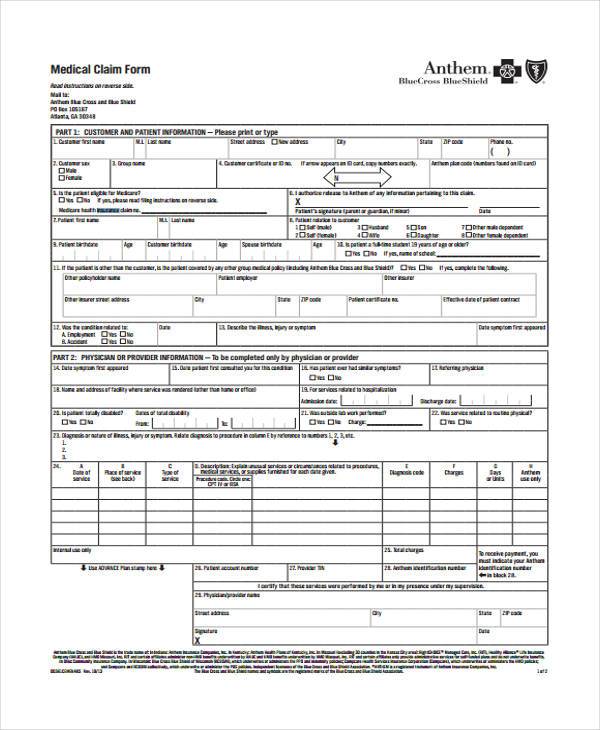

Sample Insurance Claim Form 3 Free Templates In Pdf Word Excel Medical

Sample Medical Treatment Claim Form Printable Medical Forms Letters

Relation Between Loan Amount And Tax Deduction

Section 80D Deduction For Medical Insurance Health Checkups 2019

https:// turbotax.intuit.ca /tips/deducting-premiums...

To claim the payments of your health plan premium include them with your other eligible medical expenses and claim the credit on line 33099 of your return If you

https://www. forbes.com /advisor/health …

Health insurance premiums and costs may be tax deductible but whether you should deduct health care from your taxes

To claim the payments of your health plan premium include them with your other eligible medical expenses and claim the credit on line 33099 of your return If you

Health insurance premiums and costs may be tax deductible but whether you should deduct health care from your taxes

Sample Medical Treatment Claim Form Printable Medical Forms Letters

Car Payment Disability Income Insurance Sick Financial Medical

Relation Between Loan Amount And Tax Deduction

Section 80D Deduction For Medical Insurance Health Checkups 2019

When To Get A Mortgage Loan AGRIM HOUSING FINANCE

Medical Expenses You Can Claim On Your Canadian Income Tax Return The

Medical Expenses You Can Claim On Your Canadian Income Tax Return The

Medical Insurance Claim Form High Res Stock Photo Getty Images