In the digital age, where screens dominate our lives it's no wonder that the appeal of tangible printed objects isn't diminished. Whatever the reason, whether for education or creative projects, or just adding personal touches to your area, Medical Insurance Income Tax Benefits India have become an invaluable source. Through this post, we'll dive to the depths of "Medical Insurance Income Tax Benefits India," exploring what they are, how they are, and how they can improve various aspects of your lives.

Get Latest Medical Insurance Income Tax Benefits India Below

Medical Insurance Income Tax Benefits India

Medical Insurance Income Tax Benefits India -

Where one family member self spouse or children is over 60 one can claim up to Rs 50 000 in tax benefit on medical insurance Additionally for parents over 60 medical insurance paid can fetch up to Rs 50 000 in tax

Under Section 80D of the Income Tax Act you can get a tax deduction of up to Rs 25 000 each year for health insurance premiums For senior citizens this increases to Rs

Printables for free include a vast selection of printable and downloadable material that is available online at no cost. The resources are offered in a variety styles, from worksheets to templates, coloring pages, and more. The appealingness of Medical Insurance Income Tax Benefits India lies in their versatility as well as accessibility.

More of Medical Insurance Income Tax Benefits India

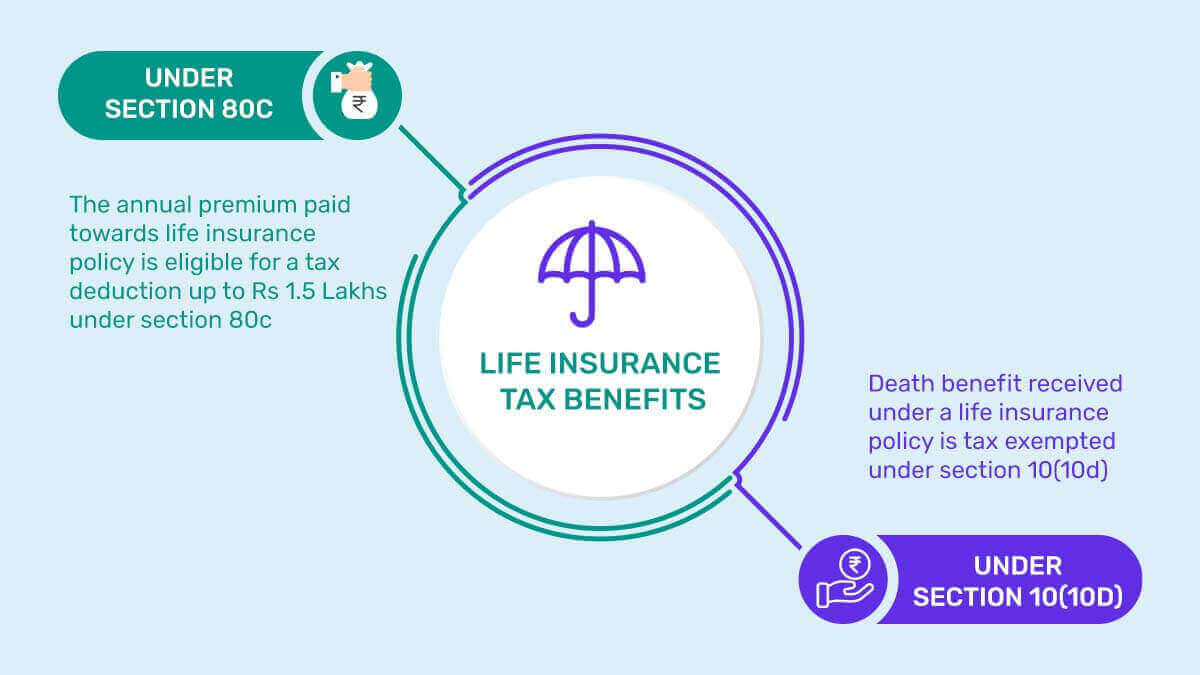

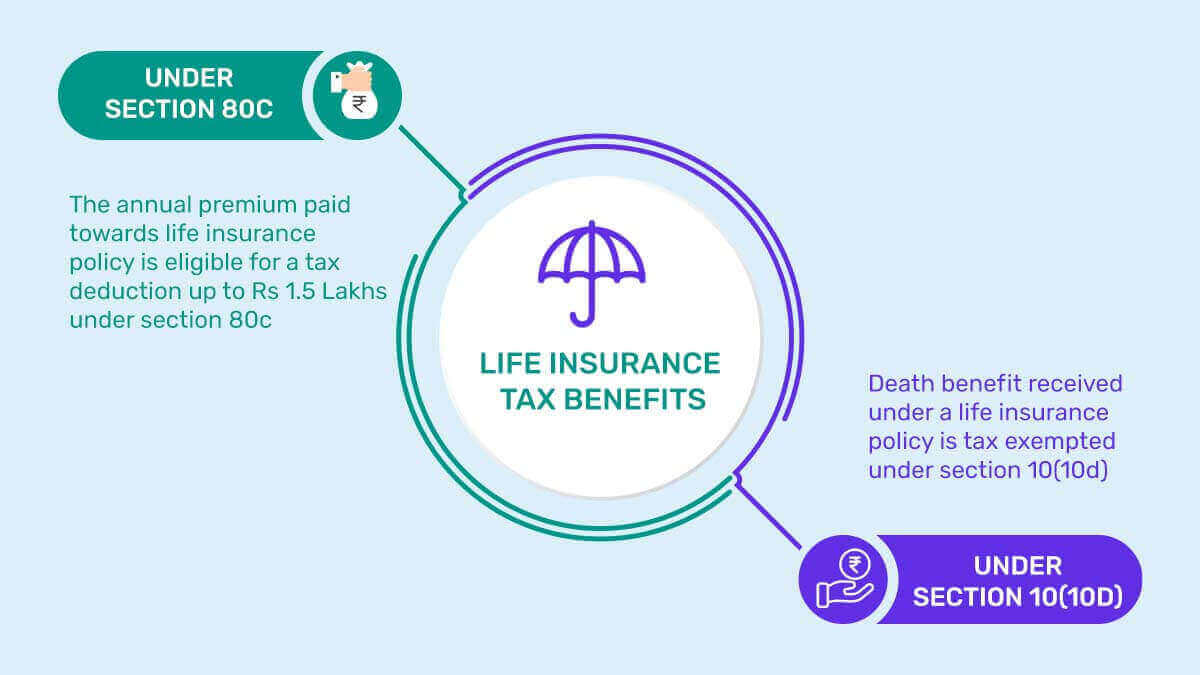

Life Insurance Tax Benefits In India 2023 PolicyBachat

Life Insurance Tax Benefits In India 2023 PolicyBachat

Read on to learn about the different ways in which you can seek tax relief while opting for medical insurance and the different Indian laws which enable you to do so Income Tax Section Pertaining to Health Insurance Tax

TAX BENEFITS DUE TO LIFE INSURANCE POLICY HEALTH INSURANCE POLICY AND EXPENDITURE ON MEDICAL TREATMENT Introduction Payment of premium on life insurance policy and health

The Medical Insurance Income Tax Benefits India have gained huge recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

Personalization The Customization feature lets you tailor printables to your specific needs be it designing invitations, organizing your schedule, or even decorating your house.

-

Educational value: Free educational printables cater to learners from all ages, making the perfect source for educators and parents.

-

An easy way to access HTML0: immediate access an array of designs and templates cuts down on time and efforts.

Where to Find more Medical Insurance Income Tax Benefits India

ADHD Medical Insurance Battles How To Cut Costs

ADHD Medical Insurance Battles How To Cut Costs

Section 80D allows a tax deduction of up to 25 000 per financial year on medical insurance premiums for non senior citizens and 50 000 for senior citizens This limit also includes a 5 000 deduction for any expenses paid towards

Recognizing this the Indian government has incentivized health insurance through tax benefits under Section 80D of the Income Tax Act This article explores how you can leverage these

Now that we've piqued your curiosity about Medical Insurance Income Tax Benefits India and other printables, let's discover where the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of Medical Insurance Income Tax Benefits India designed for a variety applications.

- Explore categories such as furniture, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. materials.

- Ideal for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers share their creative designs as well as templates for free.

- The blogs covered cover a wide variety of topics, starting from DIY projects to party planning.

Maximizing Medical Insurance Income Tax Benefits India

Here are some ways create the maximum value use of Medical Insurance Income Tax Benefits India:

1. Home Decor

- Print and frame stunning art, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Print out free worksheets and activities for reinforcement of learning at home or in the classroom.

3. Event Planning

- Invitations, banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep track of your schedule with printable calendars or to-do lists. meal planners.

Conclusion

Medical Insurance Income Tax Benefits India are a treasure trove with useful and creative ideas designed to meet a range of needs and preferences. Their access and versatility makes these printables a useful addition to both professional and personal lives. Explore the vast world of Medical Insurance Income Tax Benefits India to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Medical Insurance Income Tax Benefits India truly are they free?

- Yes you can! You can download and print these items for free.

-

Does it allow me to use free printables in commercial projects?

- It's contingent upon the specific usage guidelines. Always read the guidelines of the creator prior to using the printables in commercial projects.

-

Are there any copyright problems with Medical Insurance Income Tax Benefits India?

- Some printables may have restrictions in their usage. Always read the terms and regulations provided by the author.

-

How can I print Medical Insurance Income Tax Benefits India?

- You can print them at home with either a printer or go to a local print shop to purchase more high-quality prints.

-

What software do I need to run Medical Insurance Income Tax Benefits India?

- Most printables come in PDF format. They can be opened using free software such as Adobe Reader.

Medical Insurance Income Tax Benefits By Sue Kneeland Medium

Income Tax Benefits On Medical Treatment And Health Insurance Health

Check more sample of Medical Insurance Income Tax Benefits India below

Section 80D Of Income Tax Act Deductions Under 80D Forbes Advisor INDIA

A CASE STUDY ON LIFE INSURANCE CORPORATION S SWOC By Scholarly Research

Section 194DA TDS On Insurance Policy Maturity Amount

Leah Berry Marketing Analyst At Aegis Advisers Aegis Advisers

PDF Awareness Of Tax Benefits For Health Insurance Schemes In An

Benefits Of Making Insurance Part Of Your Retirement Plan Must Insurance

https://www.hdfclife.com › insurance-knowledge...

Under Section 80D of the Income Tax Act you can get a tax deduction of up to Rs 25 000 each year for health insurance premiums For senior citizens this increases to Rs

https://www.forbesindia.com › article › e…

Section 80D of the Income Tax Act of 1961 allows taxpayers to claim deductions for the premiums paid on health or medical insurance policies The section is implemented to urge people

Under Section 80D of the Income Tax Act you can get a tax deduction of up to Rs 25 000 each year for health insurance premiums For senior citizens this increases to Rs

Section 80D of the Income Tax Act of 1961 allows taxpayers to claim deductions for the premiums paid on health or medical insurance policies The section is implemented to urge people

Leah Berry Marketing Analyst At Aegis Advisers Aegis Advisers

A CASE STUDY ON LIFE INSURANCE CORPORATION S SWOC By Scholarly Research

PDF Awareness Of Tax Benefits For Health Insurance Schemes In An

Benefits Of Making Insurance Part Of Your Retirement Plan Must Insurance

Au Pair Global Exchange International

Analysing Tax Deductions In India And Exemptions On Life Insurance

Analysing Tax Deductions In India And Exemptions On Life Insurance

Yessenias Insurance Income Tax Home