In the digital age, with screens dominating our lives but the value of tangible printed materials isn't diminishing. Be it for educational use, creative projects, or simply to add the personal touch to your space, Medical Insurance Tax Benefit 80d have become a valuable source. With this guide, you'll take a dive in the world of "Medical Insurance Tax Benefit 80d," exploring what they are, where they can be found, and how they can add value to various aspects of your lives.

Get Latest Medical Insurance Tax Benefit 80d Below

Medical Insurance Tax Benefit 80d

Medical Insurance Tax Benefit 80d -

Verkko Per Section 80D you can claim tax benefits if you have paid the premiums through traceable means like net banking debit card credit card demand drafts or cheques Premiums paid via cash do not qualify for health insurance tax benefits The only time you can avail of deductions via cash payments is for payments made towards

Verkko 21 marrask 2023 nbsp 0183 32 The benefit under Section 80D is that a taxpayer can claim a deduction of up to 5 000 per year on expenses related to preventive health check ups This deduction is included within the maximum limit of the deduction available under Section 80D not over and above it For instance if an individual pays 22 000 as

Printables for free include a vast array of printable items that are available online at no cost. These resources come in many formats, such as worksheets, coloring pages, templates and more. The great thing about Medical Insurance Tax Benefit 80d is in their versatility and accessibility.

More of Medical Insurance Tax Benefit 80d

Deduction Under Section 80D Medical Insurance Tax Saving YouTube

Deduction Under Section 80D Medical Insurance Tax Saving YouTube

Verkko Health Insurance Tax Benefit under Section 80d of Income Tax Act Health Insurance Tax Deduction Under Section 80D No Pre policy Medical Check up Premium Discount on Multi Year Policy Secure Your Health and Save Tax up to 1 00 000 Get Additional Tax Benefits on Preventive Health Check up Individual Health Insurance

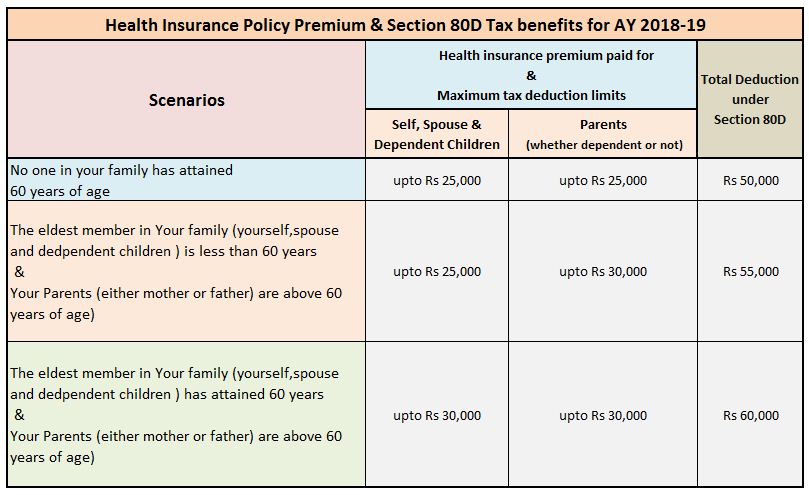

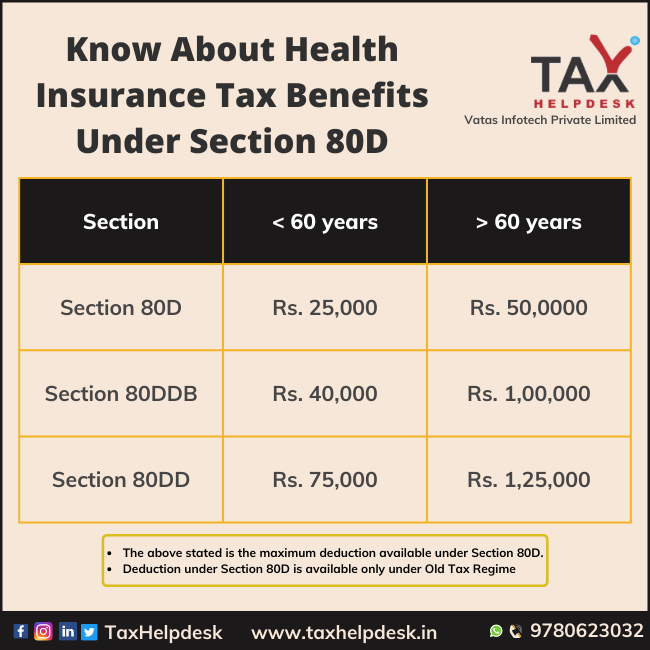

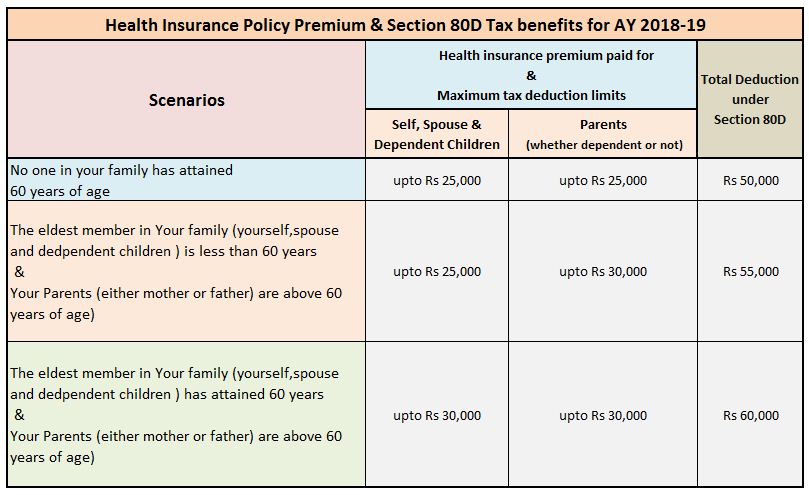

Verkko Individuals can claim maximum Rs 25000 every financial year as deduction under Section 80D of Income Tax Act For Senior citizens the 80D exemption limit is Rs 50 000 For parents below than 60 years of age the maximum limit is Rs 25 000 for health insurance premium paid

Medical Insurance Tax Benefit 80d have garnered immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or costly software.

-

Personalization Your HTML0 customization options allow you to customize printing templates to your own specific requirements, whether it's designing invitations and schedules, or even decorating your house.

-

Educational Value: Downloads of educational content for free can be used by students of all ages. This makes them a vital tool for parents and teachers.

-

Accessibility: You have instant access many designs and templates reduces time and effort.

Where to Find more Medical Insurance Tax Benefit 80d

Section 80D Deduction In Respect Of Health Or Medical Insurance

Section 80D Deduction In Respect Of Health Or Medical Insurance

Verkko 12 toukok 2023 nbsp 0183 32 Health insurance policyholders are eligible to benefit under Section 80D of the Income Tax Act 1961 which reduces yearly income tax burdens Policyholders pay premiums towards their own and their family members health insurance policies As you may know Section 80D falls under Chapter VI A of the Income Tax Act 1961 for

Verkko 21 marrask 2023 nbsp 0183 32 Keep them in a safe and easily accessible place Do Understand Deduction Limits Understand the deduction limits under Section 80D As of 2023 for individuals below 60 years of age the maximum deduction allowed is 25 000 for self spouse and children with an additional 25 000 for parents 50 000 if parents are

In the event that we've stirred your interest in Medical Insurance Tax Benefit 80d Let's find out where they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection and Medical Insurance Tax Benefit 80d for a variety applications.

- Explore categories such as design, home decor, the arts, and more.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets or flashcards as well as learning materials.

- Great for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates free of charge.

- The blogs covered cover a wide array of topics, ranging including DIY projects to party planning.

Maximizing Medical Insurance Tax Benefit 80d

Here are some ways ensure you get the very most use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Print free worksheets for reinforcement of learning at home (or in the learning environment).

3. Event Planning

- Design invitations and banners as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable planners with to-do lists, planners, and meal planners.

Conclusion

Medical Insurance Tax Benefit 80d are an abundance of useful and creative resources which cater to a wide range of needs and pursuits. Their availability and versatility make them an essential part of the professional and personal lives of both. Explore the endless world of Medical Insurance Tax Benefit 80d today to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really available for download?

- Yes you can! You can print and download these materials for free.

-

Do I have the right to use free templates for commercial use?

- It's determined by the specific terms of use. Always check the creator's guidelines prior to utilizing the templates for commercial projects.

-

Do you have any copyright problems with printables that are free?

- Certain printables may be subject to restrictions in use. Check the terms and condition of use as provided by the creator.

-

How can I print Medical Insurance Tax Benefit 80d?

- Print them at home with a printer or visit an in-store print shop to get premium prints.

-

What program must I use to open printables at no cost?

- The majority are printed as PDF files, which can be opened with free software like Adobe Reader.

Health Insurance Tax Benefits Under Section 80D FY2020 Personal

Preventive Check Up 80d Wkcn

Check more sample of Medical Insurance Tax Benefit 80d below

Health Insurance Sec 80D Tax Deduction FY 2020 21 AY 2021 22

Want To Claim Tax Deductions For Buying Medical Insurance Section 80D

Health Insurance Tax Benefits Under Section 80D

Section 80d Preventive Health Check Up Tax Deduction The Gray Tower

Tax Saving On Health Insurance Section 80D Detailed Guide For FY

The Premium Paid For Health Insurance Is Deductible Under Sec 80D Of

https://www.bajajallianz.com/blog/health-insurance-articles/commonly...

Verkko 21 marrask 2023 nbsp 0183 32 The benefit under Section 80D is that a taxpayer can claim a deduction of up to 5 000 per year on expenses related to preventive health check ups This deduction is included within the maximum limit of the deduction available under Section 80D not over and above it For instance if an individual pays 22 000 as

https://www.financialexpress.com/money/income-tax-tax-benefits-u-s-80d...

Verkko 4 elok 2020 nbsp 0183 32 Section 80D provides that the single premium paid should be divided over the years for which the benefit of health insurance is available While filing the Income Tax Return ITR Arup

Verkko 21 marrask 2023 nbsp 0183 32 The benefit under Section 80D is that a taxpayer can claim a deduction of up to 5 000 per year on expenses related to preventive health check ups This deduction is included within the maximum limit of the deduction available under Section 80D not over and above it For instance if an individual pays 22 000 as

Verkko 4 elok 2020 nbsp 0183 32 Section 80D provides that the single premium paid should be divided over the years for which the benefit of health insurance is available While filing the Income Tax Return ITR Arup

Section 80d Preventive Health Check Up Tax Deduction The Gray Tower

Want To Claim Tax Deductions For Buying Medical Insurance Section 80D

Tax Saving On Health Insurance Section 80D Detailed Guide For FY

The Premium Paid For Health Insurance Is Deductible Under Sec 80D Of

Section 80D Of Income Tax 80D Deduction For Medical Insurance Mediclaim

80D Deduction For The AY 2022 23 Health Insurance Medical Expenditure

80D Deduction For The AY 2022 23 Health Insurance Medical Expenditure

Anything To Everything Income Tax Guide For Individuals Including