In the digital age, where screens dominate our lives The appeal of tangible printed material hasn't diminished. Whatever the reason, whether for education for creative projects, just adding some personal flair to your area, Medical Reimbursement Deduction In Income Tax have proven to be a valuable source. With this guide, you'll take a dive deep into the realm of "Medical Reimbursement Deduction In Income Tax," exploring the benefits of them, where they are available, and ways they can help you improve many aspects of your life.

Get Latest Medical Reimbursement Deduction In Income Tax Below

Medical Reimbursement Deduction In Income Tax

Medical Reimbursement Deduction In Income Tax -

Medical Reimbursement is tax free perquisites under Section 17 2 till INR 15000 However the employee can incur an amount higher than INR 15 000 on medical bills In this case the excess amount is added to the head salary of the employee at the time of filing ITR on the Income Tax Portal

There are primarily three ways of funding your medical expenses 1 To pay medical expenses out of your own source It happens in case of non insured self employed persons or for non insured salaried people where employer does not provide any medical benefit 2 Medical reimbursement provided by employer in case of salaried people only

Medical Reimbursement Deduction In Income Tax cover a large assortment of printable materials that are accessible online for free cost. These resources come in many designs, including worksheets templates, coloring pages, and more. The appeal of printables for free is their versatility and accessibility.

More of Medical Reimbursement Deduction In Income Tax

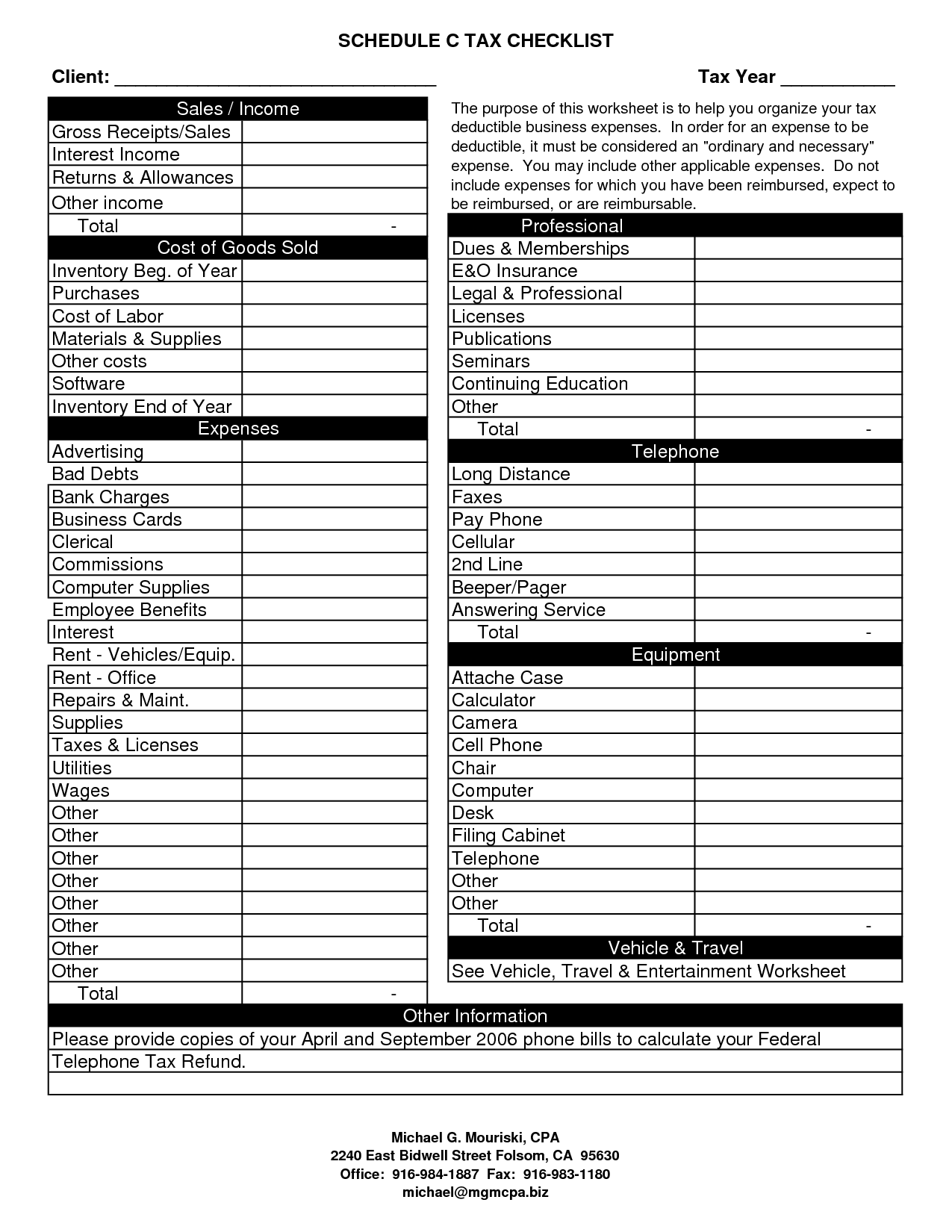

5 Itemized Tax Deduction Worksheet Worksheeto

5 Itemized Tax Deduction Worksheet Worksheeto

As per section 80D a taxpayer can claim a tax deduction on premiums paid towards medical insurance for self spouse parents and dependent children Individuals and HUF can claim this deduction This also covers

Claiming medical expense deductions on your tax return is one way to lower your tax bill To accomplish this your deductions must be from a list approved by the Internal Revenue Service and you must itemize your deductions TABLE OF CONTENTS Deducting medical expenses How to claim medical expense deductions

Medical Reimbursement Deduction In Income Tax have gained immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

customization There is the possibility of tailoring the templates to meet your individual needs be it designing invitations, organizing your schedule, or even decorating your house.

-

Educational Worth: Downloads of educational content for free offer a wide range of educational content for learners of all ages, which makes them an invaluable tool for teachers and parents.

-

Convenience: You have instant access numerous designs and templates, which saves time as well as effort.

Where to Find more Medical Reimbursement Deduction In Income Tax

Qualified Business Income Deduction And The Self Employed The CPA Journal

Qualified Business Income Deduction And The Self Employed The CPA Journal

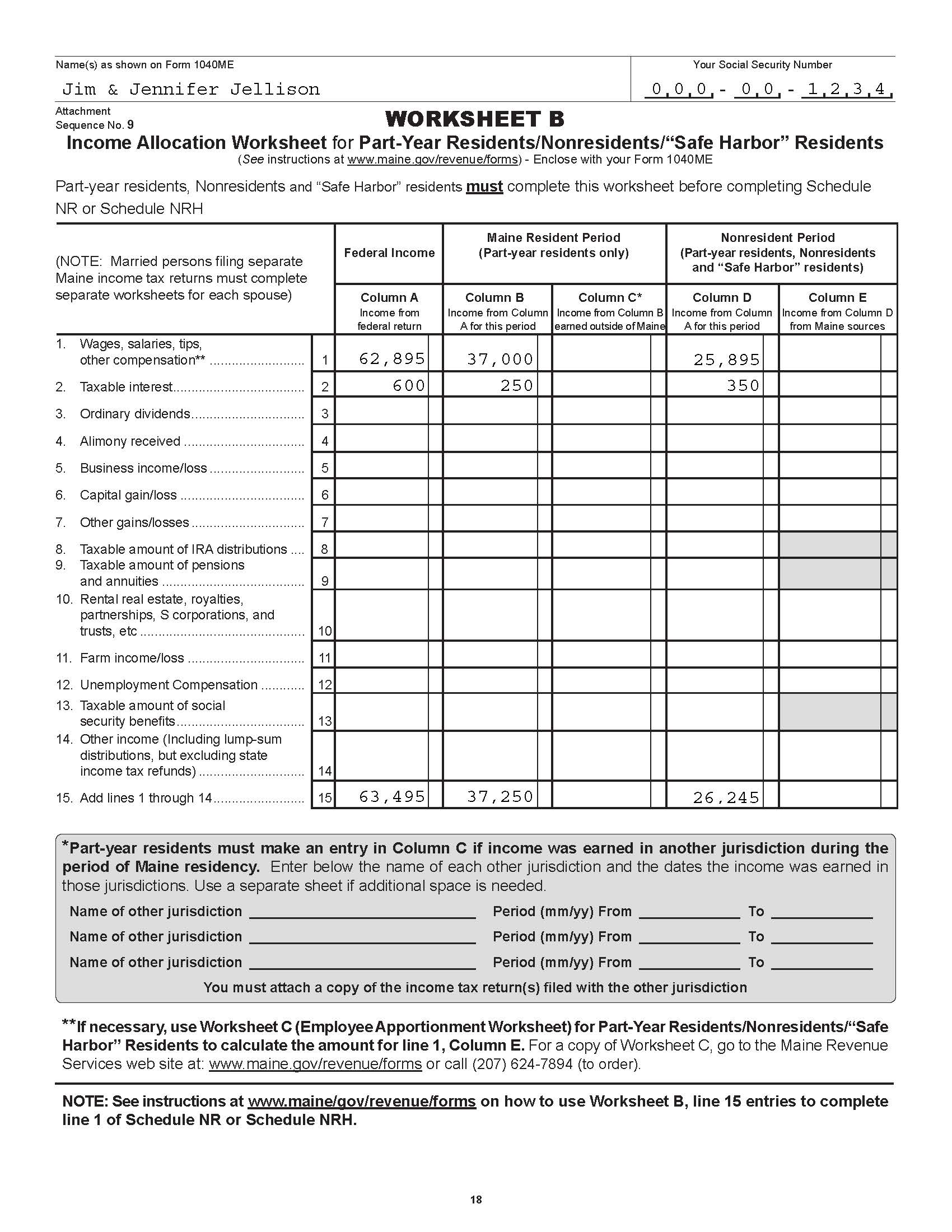

For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross income The 7 5 threshold used to be 10

If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct the medical and dental expenses you paid for yourself your spouse and your dependents during the taxable year to the extent these expenses exceed 7 5 of your adjusted gross income for the year

We've now piqued your interest in printables for free Let's find out where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety in Medical Reimbursement Deduction In Income Tax for different uses.

- Explore categories such as furniture, education, organizing, and crafts.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets Flashcards, worksheets, and other educational tools.

- Great for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers post their original designs as well as templates for free.

- These blogs cover a wide range of topics, that range from DIY projects to party planning.

Maximizing Medical Reimbursement Deduction In Income Tax

Here are some fresh ways for you to get the best of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Print worksheets that are free to build your knowledge at home (or in the learning environment).

3. Event Planning

- Make invitations, banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized by using printable calendars as well as to-do lists and meal planners.

Conclusion

Medical Reimbursement Deduction In Income Tax are an abundance of useful and creative resources designed to meet a range of needs and passions. Their availability and versatility make these printables a useful addition to every aspect of your life, both professional and personal. Explore the many options of Medical Reimbursement Deduction In Income Tax today to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free are they free?

- Yes you can! You can download and print these free resources for no cost.

-

Can I use free printables for commercial purposes?

- It's based on specific rules of usage. Always read the guidelines of the creator before utilizing their templates for commercial projects.

-

Are there any copyright issues when you download Medical Reimbursement Deduction In Income Tax?

- Certain printables may be subject to restrictions on use. Always read the terms and conditions set forth by the designer.

-

How do I print printables for free?

- You can print them at home with printing equipment or visit a local print shop for top quality prints.

-

What software do I need to open printables that are free?

- Many printables are offered with PDF formats, which can be opened with free software, such as Adobe Reader.

2018 Standard Deduction Chart

Deduction In Income Tax The Income Tax Department Has Thou Flickr

Check more sample of Medical Reimbursement Deduction In Income Tax below

Printable Itemized Deductions Worksheet

Standard Deduction 2020 Self Employed Standard Deduction 2021

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

House Rent Deduction In Income Tax TOP CHARTERED ACCOUNTANT IN

What Is The Standard Federal Tax Deduction Ericvisser

Standard Deduction In Income Tax 2022

https://taxguru.in/income-tax/taxability-medical...

There are primarily three ways of funding your medical expenses 1 To pay medical expenses out of your own source It happens in case of non insured self employed persons or for non insured salaried people where employer does not provide any medical benefit 2 Medical reimbursement provided by employer in case of salaried people only

https://cleartax.in/s/get-certificate-claiming-deduction-section-80ddb

Taxpayers can claim deductions on their income tax return through Section 80DDB for specified diseases treatment The deduction is subject to specific conditions and has a maximum limit which varies based on the

There are primarily three ways of funding your medical expenses 1 To pay medical expenses out of your own source It happens in case of non insured self employed persons or for non insured salaried people where employer does not provide any medical benefit 2 Medical reimbursement provided by employer in case of salaried people only

Taxpayers can claim deductions on their income tax return through Section 80DDB for specified diseases treatment The deduction is subject to specific conditions and has a maximum limit which varies based on the

House Rent Deduction In Income Tax TOP CHARTERED ACCOUNTANT IN

Standard Deduction 2020 Self Employed Standard Deduction 2021

What Is The Standard Federal Tax Deduction Ericvisser

Standard Deduction In Income Tax 2022

14 Best Images Of IRS Itemized Deductions Worksheet Tax Itemized

Income Tax 80c Deduction Fy 2021 22 TAX

Income Tax 80c Deduction Fy 2021 22 TAX

Quality Assurance Hot selling Products 1 NIP BAY DE NOC LURE CO THE