In this age of technology, in which screens are the norm The appeal of tangible printed materials isn't diminishing. It doesn't matter if it's for educational reasons project ideas, artistic or simply adding an element of personalization to your space, Medical Tax Deduction 2023 are a great source. For this piece, we'll take a dive deeper into "Medical Tax Deduction 2023," exploring the benefits of them, where they are available, and ways they can help you improve many aspects of your daily life.

Get Latest Medical Tax Deduction 2023 Below

Medical Tax Deduction 2023

Medical Tax Deduction 2023 -

Index Find out if this guide is for you This guide is for persons with medical expenses and their supporting family members The guide gives information on eligible medical expenses you can claim on your tax return This guide uses plain language to explain the most common tax situations

This publication explains the itemized deduction for medical and dental expenses that you claim on Schedule A Form 1040 It discusses what expenses and whose expenses you can and can t include in figuring the deduction It explains how to treat reimbursements and how to figure the deduction

Medical Tax Deduction 2023 offer a wide selection of printable and downloadable items that are available online at no cost. The resources are offered in a variety forms, like worksheets coloring pages, templates and much more. The beauty of Medical Tax Deduction 2023 is in their versatility and accessibility.

More of Medical Tax Deduction 2023

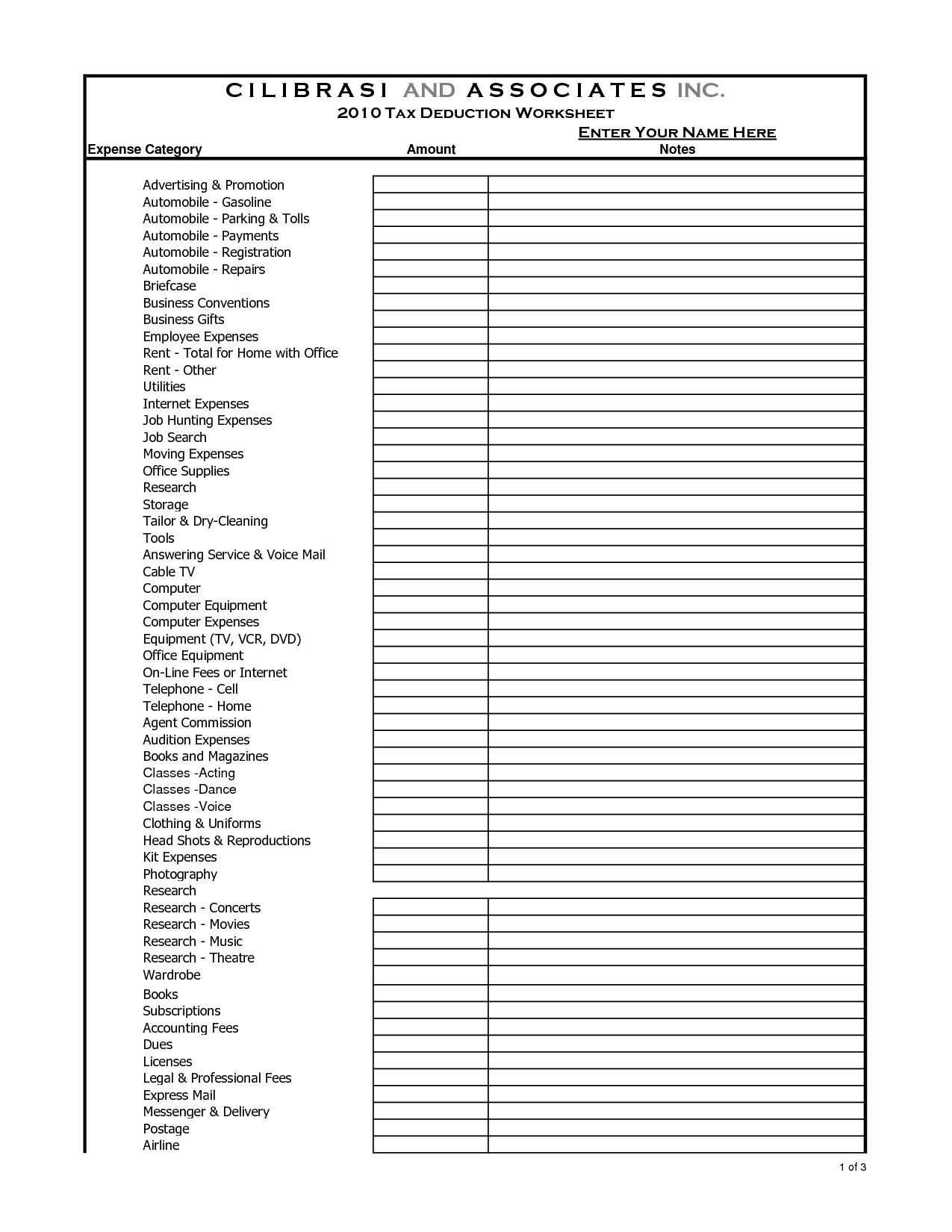

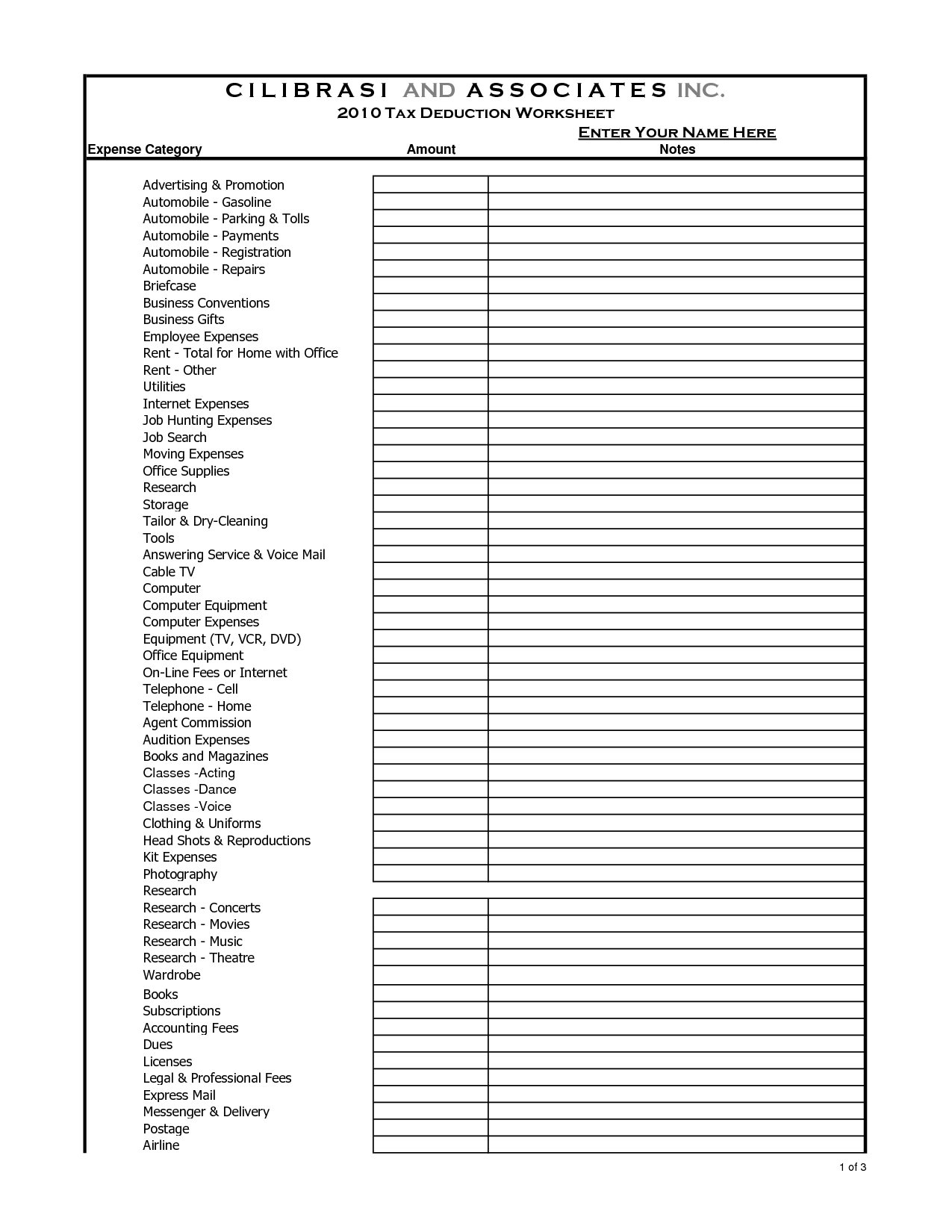

10 Home Based Business Tax Worksheet Worksheeto

10 Home Based Business Tax Worksheet Worksheeto

Medical expense deduction 2023 For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted

Topic no 502 Medical and dental expenses If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct the medical and dental expenses you paid for yourself your spouse and your dependents during the taxable year to the extent these expenses exceed 7 5 of

Medical Tax Deduction 2023 have gained immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Personalization The Customization feature lets you tailor printables to fit your particular needs be it designing invitations making your schedule, or even decorating your home.

-

Educational value: Printing educational materials for no cost are designed to appeal to students of all ages. This makes them a valuable resource for educators and parents.

-

Easy to use: Instant access to many designs and templates cuts down on time and efforts.

Where to Find more Medical Tax Deduction 2023

Printable Small Business Tax Deductions Worksheet

Printable Small Business Tax Deductions Worksheet

By William Perez Updated on January 12 2023 Reviewed by Eric Estevez In This Article View All Photo sturti Getty Images Individuals can claim some of the cost of medical dental and other health care related expenses on tax returns if they itemize Learn about the rules that apply

What is Section 80D Every individual or HUF can claim a deduction for medical insurance premiums paid in the financial year under Section 80D This deduction is also available for top up health plans and critical illness plans The best part is that it is over and above the Rs 1 5 lakh limit deductions claimed under Section 80C

We hope we've stimulated your curiosity about Medical Tax Deduction 2023 We'll take a look around to see where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Medical Tax Deduction 2023 designed for a variety uses.

- Explore categories like furniture, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free as well as flashcards and other learning tools.

- It is ideal for teachers, parents, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers post their original designs as well as templates for free.

- These blogs cover a wide range of topics, from DIY projects to party planning.

Maximizing Medical Tax Deduction 2023

Here are some inventive ways for you to get the best of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use free printable worksheets for teaching at-home and in class.

3. Event Planning

- Design invitations, banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized by using printable calendars or to-do lists. meal planners.

Conclusion

Medical Tax Deduction 2023 are an abundance of practical and innovative resources that cater to various needs and hobbies. Their accessibility and versatility make them a wonderful addition to your professional and personal life. Explore the endless world of Medical Tax Deduction 2023 today to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free free?

- Yes they are! You can download and print these documents for free.

-

Are there any free printables to make commercial products?

- It depends on the specific usage guidelines. Make sure you read the guidelines for the creator prior to printing printables for commercial projects.

-

Do you have any copyright issues with printables that are free?

- Some printables may contain restrictions in their usage. Be sure to read the terms and regulations provided by the designer.

-

How do I print printables for free?

- You can print them at home using printing equipment or visit any local print store for premium prints.

-

What software do I need to open printables free of charge?

- The majority are printed in the format PDF. This can be opened using free software like Adobe Reader.

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

Disk U e Zvuk Schedule 1 Kuhinja Rezidencija Ekspertiza

Check more sample of Medical Tax Deduction 2023 below

Confusion About Medical Tax Deduction Nj

2021 Section 179 Up To 1 Million In Tax Credits But Time Is Short

People Cannot Take A Medical Marijuana Tax Deduction IRS Says

Printable Itemized Deductions Worksheet

Medical Expenses Deduction Under Income Tax Act 2023 Update

Printable Itemized Deductions Worksheet

https://www.irs.gov/publications/p502

This publication explains the itemized deduction for medical and dental expenses that you claim on Schedule A Form 1040 It discusses what expenses and whose expenses you can and can t include in figuring the deduction It explains how to treat reimbursements and how to figure the deduction

https://www.usatoday.com/story/money/taxes/2023/03/...

The rule for claiming a medical expense deduction is that you can only write off healthcare costs that exceed 7 5 of your adjusted gross income And that s where things get a little

This publication explains the itemized deduction for medical and dental expenses that you claim on Schedule A Form 1040 It discusses what expenses and whose expenses you can and can t include in figuring the deduction It explains how to treat reimbursements and how to figure the deduction

The rule for claiming a medical expense deduction is that you can only write off healthcare costs that exceed 7 5 of your adjusted gross income And that s where things get a little

Printable Itemized Deductions Worksheet

2021 Section 179 Up To 1 Million In Tax Credits But Time Is Short

Medical Expenses Deduction Under Income Tax Act 2023 Update

Printable Itemized Deductions Worksheet

IRS Updates Medical Expenses Tax Deduction For 2023 U S Commodity

Printable Itemized Deductions Worksheet

Printable Itemized Deductions Worksheet

Can You Claim A Tax Deduction For Medical Expenses OVLG