In this digital age, with screens dominating our lives and the appeal of physical printed materials hasn't faded away. Whatever the reason, whether for education and creative work, or simply to add personal touches to your home, printables for free have proven to be a valuable source. For this piece, we'll take a dive into the world of "Michigan Property Tax Credit For Deceased Taxpayer," exploring the different types of printables, where to get them, as well as what they can do to improve different aspects of your daily life.

Get Latest Michigan Property Tax Credit For Deceased Taxpayer Below

Michigan Property Tax Credit For Deceased Taxpayer

Michigan Property Tax Credit For Deceased Taxpayer -

When claiming the Michigan property tax credit you need to file form 1040CR along with your income taxes Form MI 1040CR requires you to list multiple forms of income such as wages interest or alimony

Homeowners Enter the 2021 taxable value of your homestead see instructions If you did not check box 8 above and your taxable value is greater than 136 600 STOP you are not

The Michigan Property Tax Credit For Deceased Taxpayer are a huge array of printable materials that are accessible online for free cost. These materials come in a variety of styles, from worksheets to templates, coloring pages, and many more. The appeal of printables for free is their versatility and accessibility.

More of Michigan Property Tax Credit For Deceased Taxpayer

Michigan Property Tax Exemptions I Am Landlord

Michigan Property Tax Exemptions I Am Landlord

The 6 month residency rule does not apply to deceased taxpayers The taxes on which a credit may be based are those taxes billed to and paid by the claimant for the current tax year For

To qualify for the Michigan Homestead Property Tax Credit 1040CR Total household resources cannot be more than 67 300 If you are filing a part year credit for a deceased taxpayer or a part year resident you must annualize

Printables that are free have gained enormous popularity for several compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Personalization This allows you to modify printables to your specific needs, whether it's designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Worth: Printables for education that are free are designed to appeal to students of all ages, making them an essential tool for teachers and parents.

-

An easy way to access HTML0: Fast access the vast array of design and templates reduces time and effort.

Where to Find more Michigan Property Tax Credit For Deceased Taxpayer

Will I Get A Check Or Property Tax Credit For The Senior Freeze Nj

Will I Get A Check Or Property Tax Credit For The Senior Freeze Nj

If you own and occupy the property as your home you should file a Principal Residence Exemption Affidavit Form 2368 with your county city township or village and submit your

Homeowners Enter the 2019 taxable value of your homestead see instructions If you did not check box 8 above and your taxable value is greater than 135 000 STOP you are not

Now that we've piqued your curiosity about Michigan Property Tax Credit For Deceased Taxpayer Let's take a look at where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection with Michigan Property Tax Credit For Deceased Taxpayer for all purposes.

- Explore categories such as interior decor, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets along with flashcards, as well as other learning materials.

- Perfect for teachers, parents and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates, which are free.

- The blogs are a vast range of interests, that includes DIY projects to party planning.

Maximizing Michigan Property Tax Credit For Deceased Taxpayer

Here are some unique ways in order to maximize the use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or seasonal decorations that will adorn your living spaces.

2. Education

- Use free printable worksheets to help reinforce your learning at home or in the classroom.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Michigan Property Tax Credit For Deceased Taxpayer are an abundance of fun and practical tools that satisfy a wide range of requirements and passions. Their availability and versatility make them an essential part of each day life. Explore the endless world that is Michigan Property Tax Credit For Deceased Taxpayer today, and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really completely free?

- Yes they are! You can download and print these materials for free.

-

Can I utilize free printables to make commercial products?

- It depends on the specific conditions of use. Make sure you read the guidelines for the creator before utilizing printables for commercial projects.

-

Are there any copyright concerns with Michigan Property Tax Credit For Deceased Taxpayer?

- Certain printables might have limitations in use. Be sure to read the conditions and terms of use provided by the creator.

-

How can I print printables for free?

- Print them at home with either a printer or go to an area print shop for higher quality prints.

-

What software do I need in order to open Michigan Property Tax Credit For Deceased Taxpayer?

- Most printables come with PDF formats, which can be opened using free software like Adobe Reader.

20 Property Tax Credit For Montgomery County Homeowners Ages 65 Who

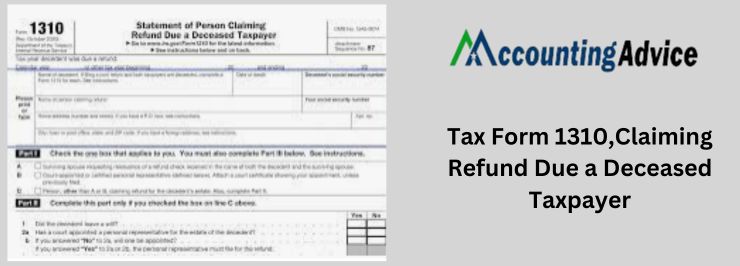

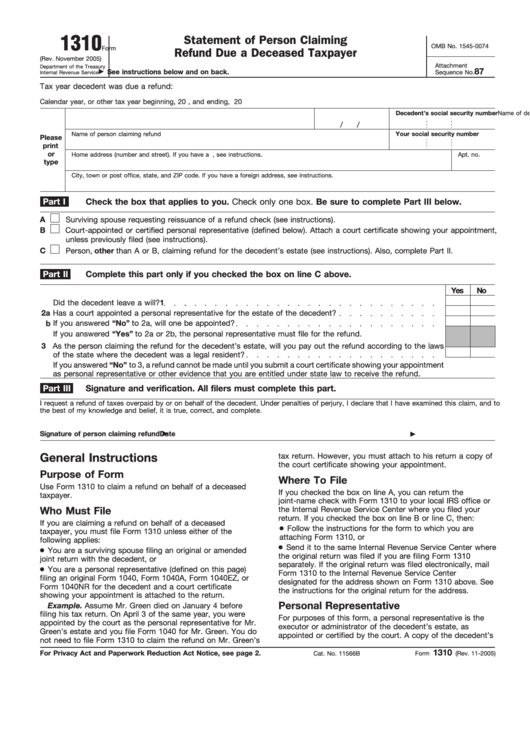

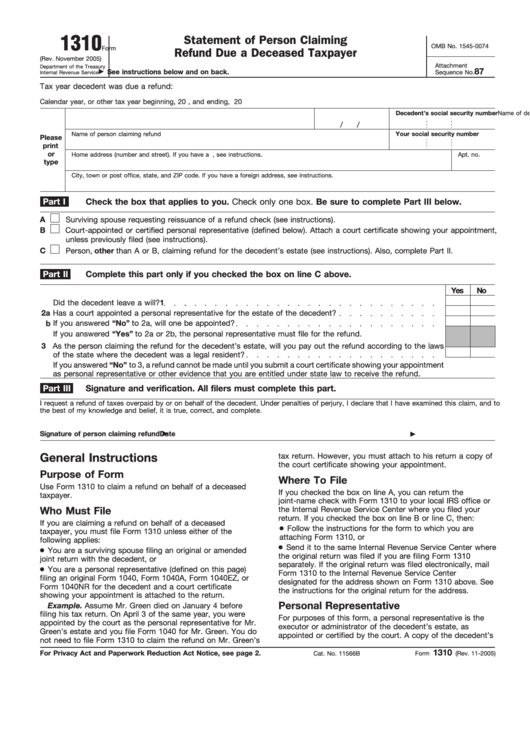

Tax Form 1310 Claiming Refund Due A Deceased Taxpayer

Check more sample of Michigan Property Tax Credit For Deceased Taxpayer below

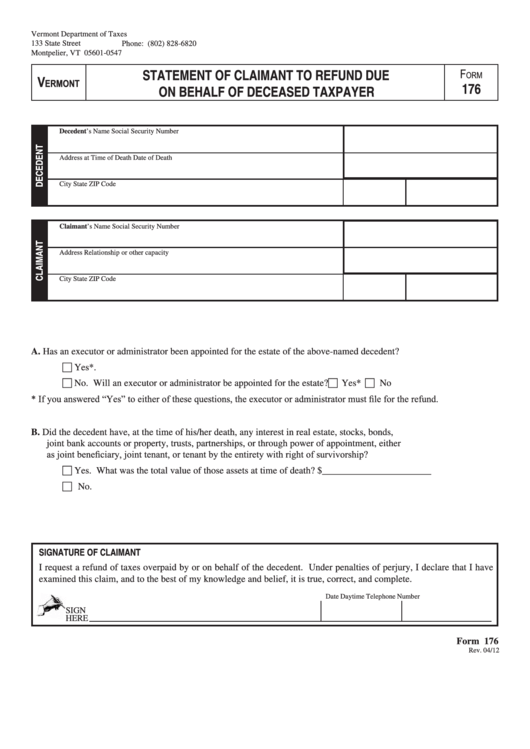

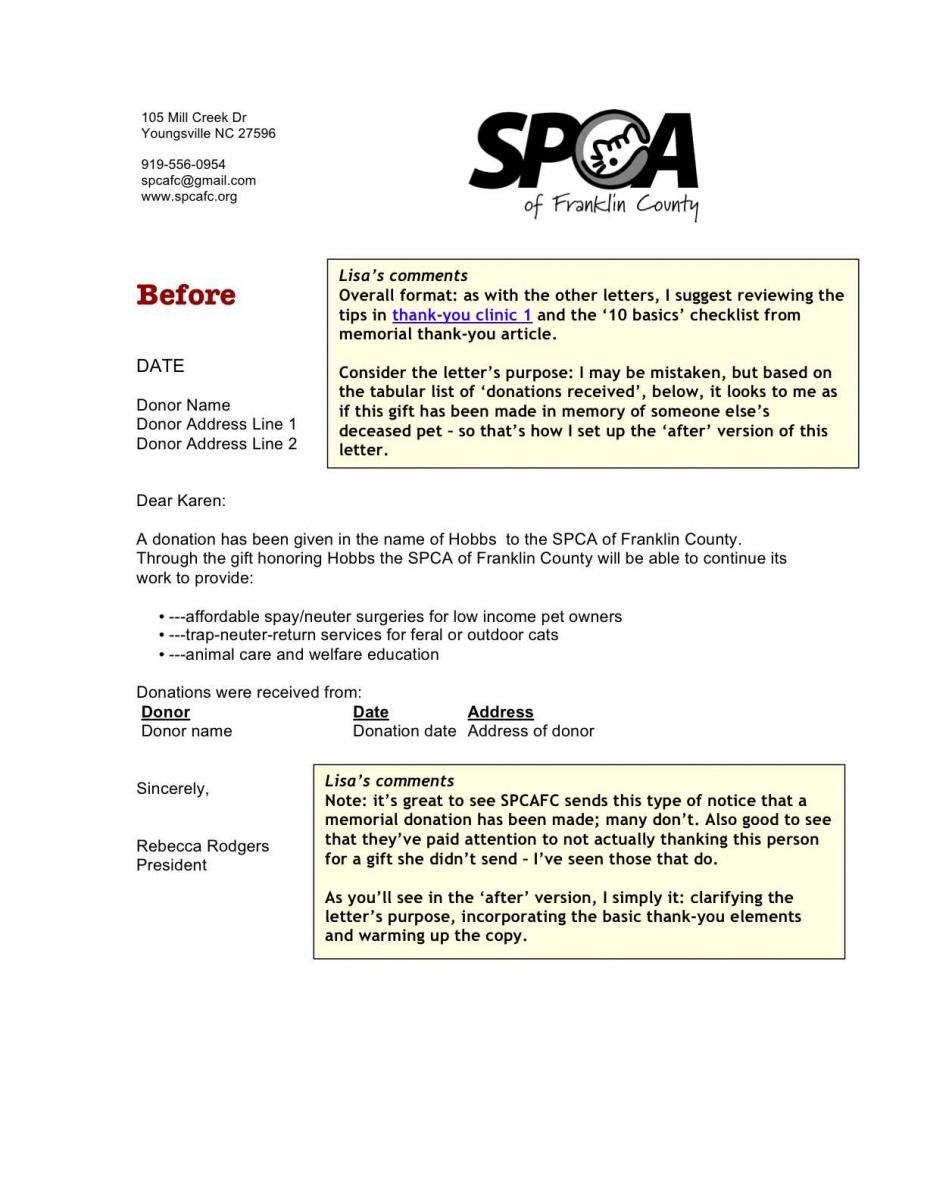

Form 176 Statement Of Claimant To Refund Due On Behalf Of Deceased

Michigan Non Homestead Property Tax PROPERTY HJE

Maryland Homestead Property Tax Credit Program

Filing A Deceased Person s Final Tax Return Form 1040 Or 1040 SR

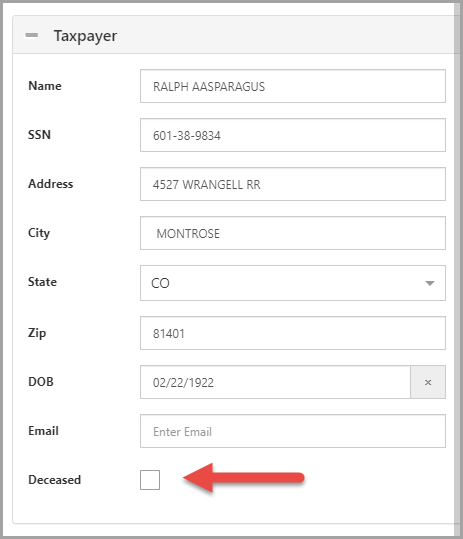

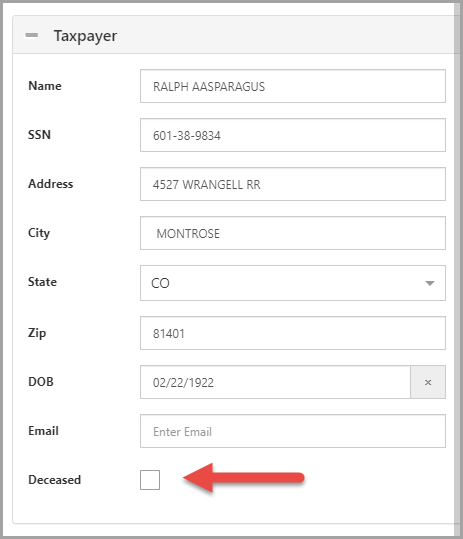

Deceased Taxpayer Option For 1040 Returns SafeSend Returns

Iowa Homestead Tax Credit Johnson County

https://www.michigan.gov › taxes › media › Project › ...

Homeowners Enter the 2021 taxable value of your homestead see instructions If you did not check box 8 above and your taxable value is greater than 136 600 STOP you are not

https://www.michigan.gov › ... › deceased-taxpayers

To claim a refund for a deceased taxpayer file a Form MI 1310 Claim for Refund Due a Deceased Taxpayer include a copy of the death certificate and mail to Michigan Department

Homeowners Enter the 2021 taxable value of your homestead see instructions If you did not check box 8 above and your taxable value is greater than 136 600 STOP you are not

To claim a refund for a deceased taxpayer file a Form MI 1310 Claim for Refund Due a Deceased Taxpayer include a copy of the death certificate and mail to Michigan Department

Filing A Deceased Person s Final Tax Return Form 1040 Or 1040 SR

Michigan Non Homestead Property Tax PROPERTY HJE

Deceased Taxpayer Option For 1040 Returns SafeSend Returns

Iowa Homestead Tax Credit Johnson County

Affidavit For 1099 Tax Form For Deceased Taxpayer AffidavitForm

Irs Form 1310 Printable Portal Tutorials

Irs Form 1310 Printable Portal Tutorials

Groups Want Property Tax Credit For Iowa Veterans Doubled Radio Iowa