In this day and age where screens dominate our lives it's no wonder that the appeal of tangible printed materials hasn't faded away. For educational purposes such as creative projects or simply adding an element of personalization to your area, Mileage Tax Deduction 2022 can be an excellent source. The following article is a dive into the world of "Mileage Tax Deduction 2022," exploring what they are, where to find them and how they can be used to enhance different aspects of your daily life.

Get Latest Mileage Tax Deduction 2022 Below

Mileage Tax Deduction 2022

Mileage Tax Deduction 2022 -

17 rowsThe standard mileage rates for 2023 are Self employed and business 65 5 cents mile Charities 14 cents mile Medical 22 cents mile Moving military only 22

The tax exempt kilometre allowances will increase by 2 cents and is going to be 46 cents per kilometre in 2022 when you use own car for the business trip 44 cents per kilometre in 2021 The tax exempt domestic full

Printables for free include a vast collection of printable resources available online for download at no cost. These resources come in various formats, such as worksheets, coloring pages, templates and more. The beauty of Mileage Tax Deduction 2022 lies in their versatility as well as accessibility.

More of Mileage Tax Deduction 2022

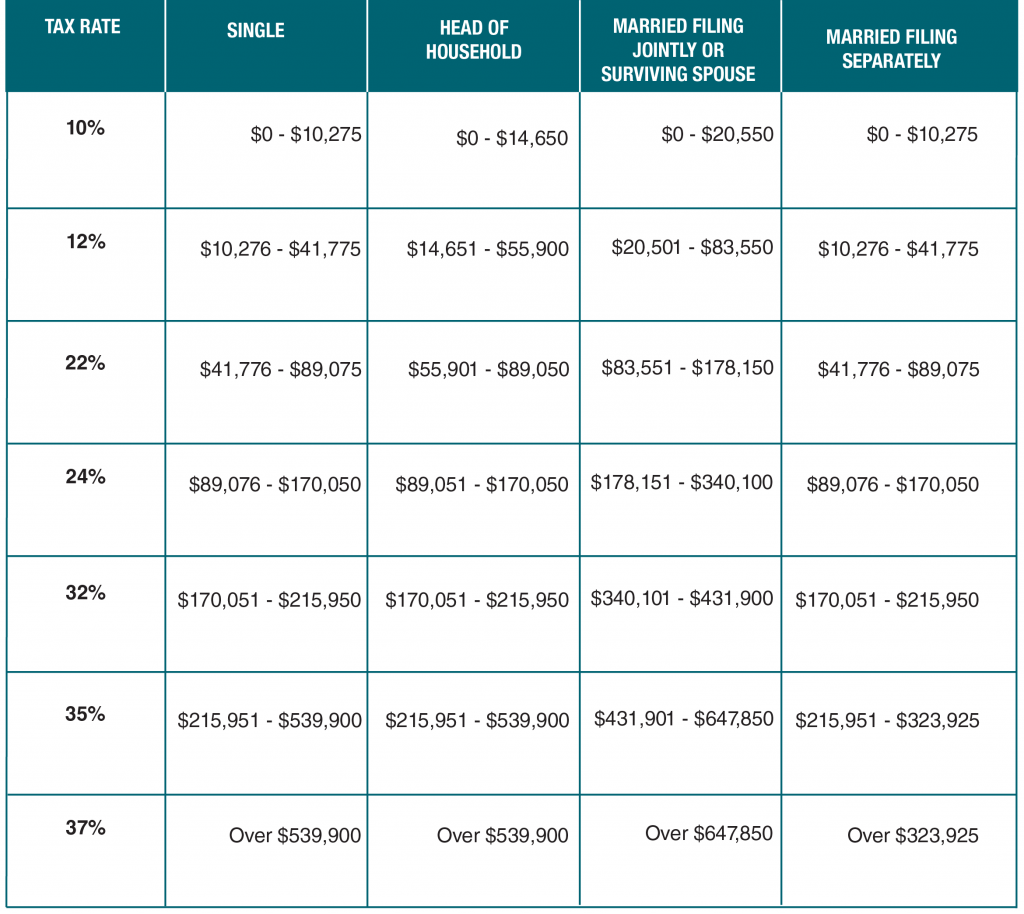

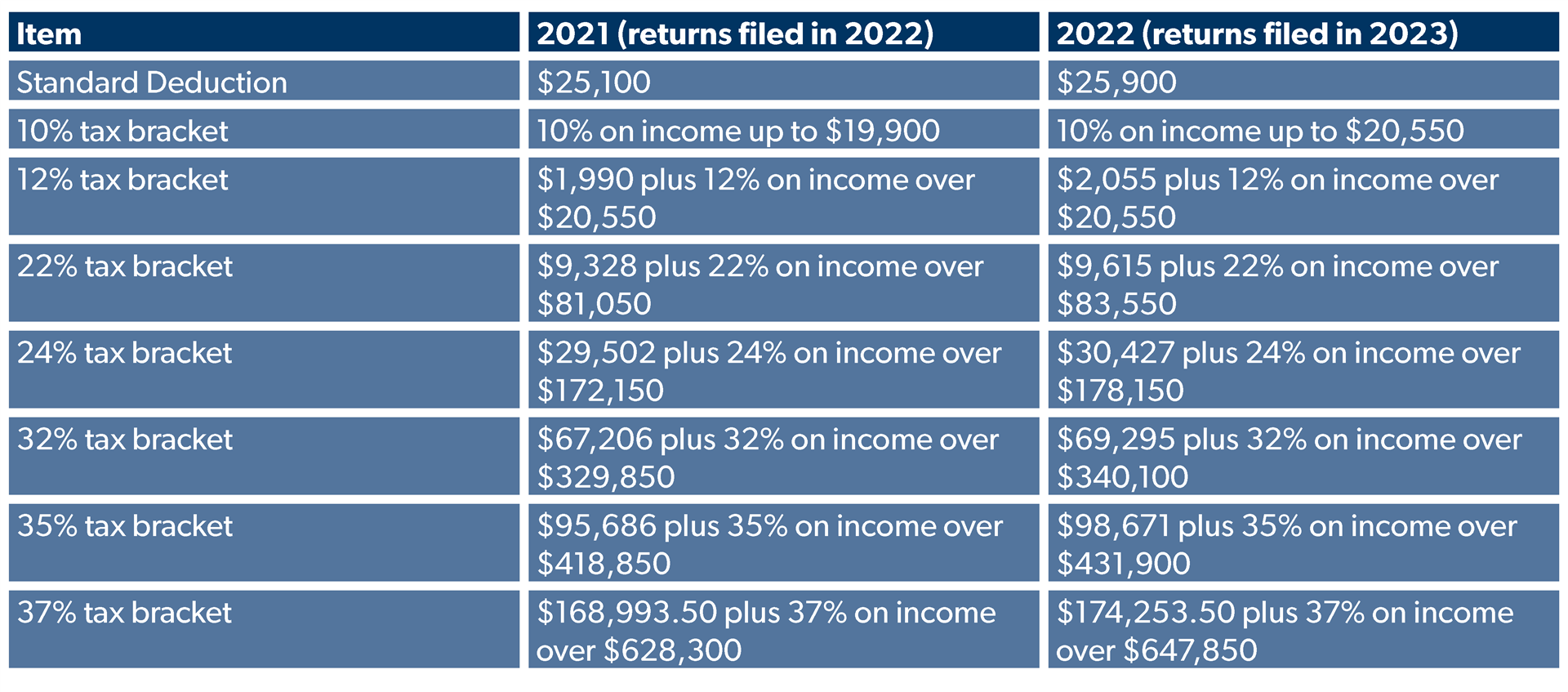

IRS Announces Inflation Adjustments To 2022 Tax Brackets Foundation

IRS Announces Inflation Adjustments To 2022 Tax Brackets Foundation

Claiming a tax deduction for mileage can be a good way to reduce how much you owe Uncle Sam but not everyone is eligible to write off their driving costs

For the 2022 tax year you re looking at two mileage rates for business use A rate of 58 5 cents a mile applies to travel from January through June last year and it s 62 5 cents per mile for

Mileage Tax Deduction 2022 have garnered immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

Individualization We can customize printables to your specific needs, whether it's designing invitations and schedules, or even decorating your home.

-

Educational Value Printing educational materials for no cost cater to learners of all ages, which makes them a great aid for parents as well as educators.

-

Convenience: Instant access to a variety of designs and templates can save you time and energy.

Where to Find more Mileage Tax Deduction 2022

IRS Raises 2022 Standard Mileage Tax Deduction Rates To Cover Higher

IRS Raises 2022 Standard Mileage Tax Deduction Rates To Cover Higher

Beginning on Jan 1 2022 the standard mileage rates for the use of a car also vans pickups or panel trucks will be 58 5 cents per mile driven for business use up 2 5

The 2022 rate for charitable use of an automobile is 14 cents per mile the same as in 2021 Standard mileage rates can be used instead of calculating the actual expenses that are deductible

Since we've got your interest in Mileage Tax Deduction 2022 Let's see where you can find these elusive treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety and Mileage Tax Deduction 2022 for a variety uses.

- Explore categories such as design, home decor, the arts, and more.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free, flashcards, and learning materials.

- This is a great resource for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs or templates for download.

- The blogs are a vast array of topics, ranging that includes DIY projects to planning a party.

Maximizing Mileage Tax Deduction 2022

Here are some creative ways create the maximum value of Mileage Tax Deduction 2022:

1. Home Decor

- Print and frame stunning artwork, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Use printable worksheets for free for teaching at-home for the classroom.

3. Event Planning

- Design invitations, banners, and decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Mileage Tax Deduction 2022 are a treasure trove of useful and creative resources that cater to various needs and interest. Their accessibility and versatility make them an invaluable addition to every aspect of your life, both professional and personal. Explore the vast collection of Mileage Tax Deduction 2022 and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really absolutely free?

- Yes, they are! You can print and download these files for free.

-

Can I download free printables in commercial projects?

- It is contingent on the specific usage guidelines. Be sure to read the rules of the creator before using printables for commercial projects.

-

Are there any copyright problems with Mileage Tax Deduction 2022?

- Some printables may have restrictions regarding usage. Make sure you read the terms of service and conditions provided by the creator.

-

How do I print printables for free?

- You can print them at home with printing equipment or visit a local print shop for the highest quality prints.

-

What program do I need in order to open printables that are free?

- The majority of PDF documents are provided as PDF files, which is open with no cost programs like Adobe Reader.

Business Use Of Vehicle Tax Deductions

2018 Mileage Tax Deductions Grant Management Nonprofit Fund Accounting

Check more sample of Mileage Tax Deduction 2022 below

2020 Mileage Tax Deductions Grant Management Nonprofit Fund Accounting

How To Get A Business Mileage Tax Deduction Small Business Bookkeeping

This Year s Mileage Tax Deduction

/shutterstock_315151916.driving.business.car_.cropped-5bfc4134c9e77c00519fd5d7.jpg)

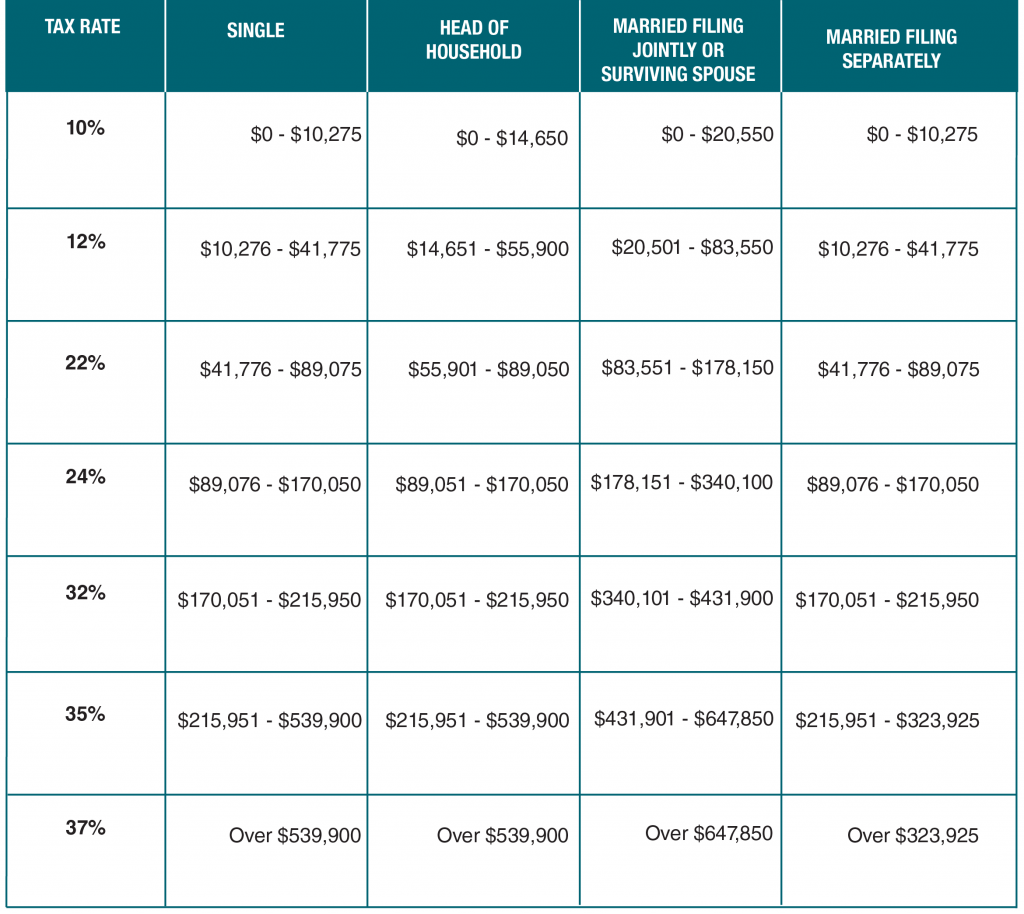

2022 Tax Tables Married Filing Jointly Printable Form Templates And

Standard Mileage Rates For 2022 New York Society Of Tax Accountants

Contoh Akta Pendirian Koperasi Konsumen 2022 Mileage Tax Deduction

https://finrepo.fi/en/news-kilometre-and-…

The tax exempt kilometre allowances will increase by 2 cents and is going to be 46 cents per kilometre in 2022 when you use own car for the business trip 44 cents per kilometre in 2021 The tax exempt domestic full

https://www.thebalancemoney.com/how …

You can deduct your mileage at the standard rate of 18 cents per mile for 2022 and 22 cents per mile for 2023 or you can deduct your actual costs of gas and oil Deducting parking costs and tolls is also allowed

The tax exempt kilometre allowances will increase by 2 cents and is going to be 46 cents per kilometre in 2022 when you use own car for the business trip 44 cents per kilometre in 2021 The tax exempt domestic full

You can deduct your mileage at the standard rate of 18 cents per mile for 2022 and 22 cents per mile for 2023 or you can deduct your actual costs of gas and oil Deducting parking costs and tolls is also allowed

2022 Tax Tables Married Filing Jointly Printable Form Templates And

How To Get A Business Mileage Tax Deduction Small Business Bookkeeping

Standard Mileage Rates For 2022 New York Society Of Tax Accountants

Contoh Akta Pendirian Koperasi Konsumen 2022 Mileage Tax Deduction

2021 Mileage Reimbursement Calculator

Mileage Tax Deduction Tracking Log 2019

Mileage Tax Deduction Tracking Log 2019

Free Mileage Log Template For Delivery Drivers Driversnote