In the age of digital, where screens dominate our lives but the value of tangible, printed materials hasn't diminished. Be it for educational use in creative or artistic projects, or simply to add an element of personalization to your space, Mileage Tax Deduction are a great resource. In this article, we'll dive through the vast world of "Mileage Tax Deduction," exploring what they are, how to find them, and the ways that they can benefit different aspects of your lives.

Get Latest Mileage Tax Deduction Below

Mileage Tax Deduction

Mileage Tax Deduction -

Learn the IRS rules and rates for deducting your mileage for business medical moving or charitable purposes Find out how to choose between standard mileage or actual costs and how to claim your

Learn who can claim mileage on taxes how to calculate it and what forms to use Find out the standard mileage rates for 2023 and the

Mileage Tax Deduction encompass a wide array of printable materials available online at no cost. These printables come in different forms, like worksheets templates, coloring pages and much more. The benefit of Mileage Tax Deduction is their versatility and accessibility.

More of Mileage Tax Deduction

24 Vehicle Lease Mileage Tracker Sample Excel Templates

24 Vehicle Lease Mileage Tracker Sample Excel Templates

Learn how to deduct mileage from vehicle use for business charity medical or moving purposes according to the IRS standard mileage rates Find out the rules requirements and tips for

1 Choose Your Method of Calculation 2 Collect All Relevant Documents 3 Calculate Your Eligible Deduction Standard Mileage Method Actual Expense Method 4 Fill Out

Mileage Tax Deduction have risen to immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

Individualization We can customize print-ready templates to your specific requirements, whether it's designing invitations or arranging your schedule or decorating your home.

-

Education Value Printables for education that are free are designed to appeal to students of all ages, which makes them a valuable aid for parents as well as educators.

-

Accessibility: The instant accessibility to a plethora of designs and templates helps save time and effort.

Where to Find more Mileage Tax Deduction

13 Proven Mileage Tax Deduction Tips The Handy Tax Guy

13 Proven Mileage Tax Deduction Tips The Handy Tax Guy

The rates for 2024 will be available on our website in 2025 If you are an employer go to Automobile and motor vehicle allowances Meal and vehicle rates for previous years are

Learn how to claim mileage deductions for business medical moving and charitable purposes on your 2022 tax return Find out the standard mileage rates for different periods and the factors that

Now that we've ignited your interest in Mileage Tax Deduction Let's take a look at where they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection and Mileage Tax Deduction for a variety goals.

- Explore categories like home decor, education, management, and craft.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. tools.

- Great for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates free of charge.

- The blogs are a vast range of topics, from DIY projects to party planning.

Maximizing Mileage Tax Deduction

Here are some innovative ways that you can make use of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes or other seasonal decorations to fill your living areas.

2. Education

- Print out free worksheets and activities to help reinforce your learning at home as well as in the class.

3. Event Planning

- Design invitations, banners, and decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Mileage Tax Deduction are a treasure trove of creative and practical resources for a variety of needs and hobbies. Their availability and versatility make them a wonderful addition to both professional and personal life. Explore the vast world of Mileage Tax Deduction to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really cost-free?

- Yes you can! You can download and print these resources at no cost.

-

Does it allow me to use free printing templates for commercial purposes?

- It is contingent on the specific rules of usage. Make sure you read the guidelines for the creator before utilizing their templates for commercial projects.

-

Are there any copyright issues with printables that are free?

- Some printables may have restrictions on use. You should read the terms and regulations provided by the creator.

-

How can I print Mileage Tax Deduction?

- Print them at home with the printer, or go to a local print shop to purchase higher quality prints.

-

What software do I need in order to open printables at no cost?

- Many printables are offered in PDF format. These can be opened using free software such as Adobe Reader.

How To Get A Business Mileage Tax Deduction Small Business Bookkeeping

This Year s Mileage Tax Deduction

/shutterstock_315151916.driving.business.car_.cropped-5bfc4134c9e77c00519fd5d7.jpg)

Check more sample of Mileage Tax Deduction below

How To Get A Business Mileage Tax Deduction Small Business Sarah

How To Get A Business Mileage Tax Deduction Tax Deductions Business

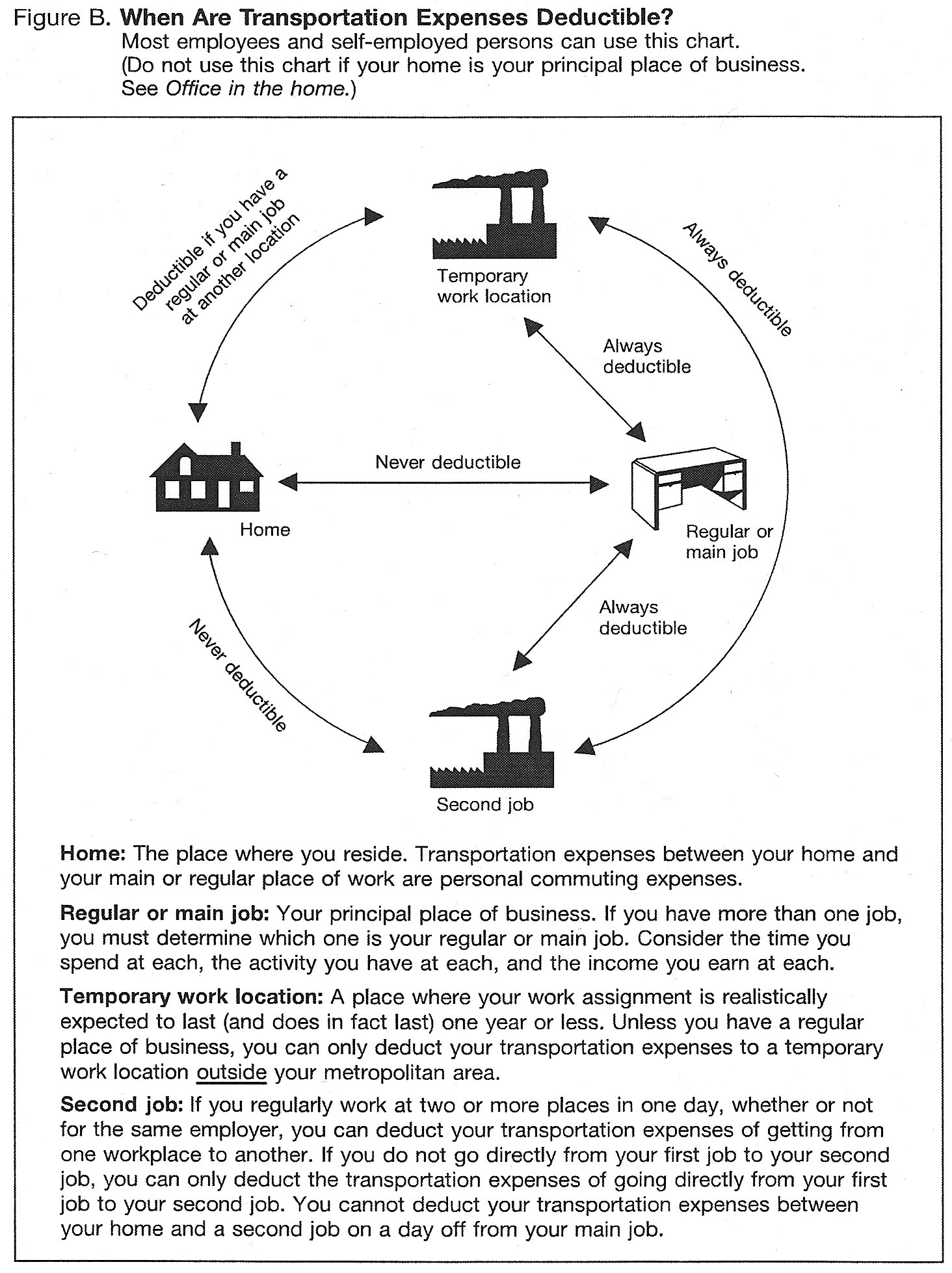

Commuting Brian Kornblum CPA LLC

Easily Calculate Your Business Mileage Tax Deduction YouTube

IRS Raises 2022 Standard Mileage Tax Deduction Rates To Cover Higher

13 Proven Mileage Tax Deduction Tips The Handy Tax Guy

https://www. hrblock.com /.../mileage-d…

Learn who can claim mileage on taxes how to calculate it and what forms to use Find out the standard mileage rates for 2023 and the

https://www. investopedia.com /terms/s/standardmileagerate.asp

Learn how to calculate the standard mileage rate for business medical or charitable purposes and when to use it instead of actual expenses Find out the

Learn who can claim mileage on taxes how to calculate it and what forms to use Find out the standard mileage rates for 2023 and the

Learn how to calculate the standard mileage rate for business medical or charitable purposes and when to use it instead of actual expenses Find out the

Easily Calculate Your Business Mileage Tax Deduction YouTube

How To Get A Business Mileage Tax Deduction Tax Deductions Business

IRS Raises 2022 Standard Mileage Tax Deduction Rates To Cover Higher

13 Proven Mileage Tax Deduction Tips The Handy Tax Guy

How To Decide Which Mileage Tax Deduction Is Best 13 Steps

Mileage Tax Deduction Tracking Log 2019

Mileage Tax Deduction Tracking Log 2019

How To Deduct Mileage For Taxes Business Tips Online Business Tax