In this day and age where screens dominate our lives it's no wonder that the appeal of tangible printed material hasn't diminished. If it's to aid in education such as creative projects or simply adding the personal touch to your space, Military Spouse Income Tax Exemption are a great source. In this article, we'll dive in the world of "Military Spouse Income Tax Exemption," exploring their purpose, where they are available, and how they can improve various aspects of your daily life.

Get Latest Military Spouse Income Tax Exemption Below

Military Spouse Income Tax Exemption

Military Spouse Income Tax Exemption -

Published February 22 2012 As a military spouse tax time can be a bit stressful to say the least There are regular tax questions What are the new changes to tax law What can I deduct

The MSRRA changes the basic rules of taxation with respect to military spouses who earn income from services performed in a State in which the spouse is present with the Service member SM in compliance with military orders when that State is not the spouse s domicile legal residence

Military Spouse Income Tax Exemption encompass a wide assortment of printable content that can be downloaded from the internet at no cost. They are available in a variety of forms, like worksheets templates, coloring pages, and more. The beauty of Military Spouse Income Tax Exemption is in their variety and accessibility.

More of Military Spouse Income Tax Exemption

Military Veteran Income Tax Exemption SobelCo

Military Veteran Income Tax Exemption SobelCo

So if you meet the requirements of the Military Spouses Residency Relief Act both your income and the military income earned by your spouse in the military are free from taxation in the duty station state Both spouses are subject to tax income and property in their home states

The spouse of a servicemember is exempt from income taxation by a state when he or she Currently resides in a state different than the state of domicile Resides in

Military Spouse Income Tax Exemption have risen to immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or expensive software.

-

customization: The Customization feature lets you tailor print-ready templates to your specific requirements for invitations, whether that's creating them to organize your schedule or decorating your home.

-

Educational Impact: Educational printables that can be downloaded for free cater to learners of all ages, making them a vital tool for teachers and parents.

-

An easy way to access HTML0: Access to a variety of designs and templates is time-saving and saves effort.

Where to Find more Military Spouse Income Tax Exemption

South Carolina Law Makers Pass Military Retirement Income Tax Exemption

South Carolina Law Makers Pass Military Retirement Income Tax Exemption

Published July 13 2021 You might have heard of a military spouses residency relief act a rule rumored to help military spouses But what is it and what does it mean and what does it

For tax years 2019 onward a military member s spouse may choose the military member s residency even if the couple did not share the residency prior to the move As you might guess there are some criteria you must meet to be eligible The MSRRA only applies when The spouse currently lives in a state different than their residency state

Now that we've piqued your interest in Military Spouse Income Tax Exemption we'll explore the places you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection in Military Spouse Income Tax Exemption for different reasons.

- Explore categories like decoration for your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets as well as flashcards and other learning tools.

- Great for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers offer their unique designs or templates for download.

- These blogs cover a broad array of topics, ranging from DIY projects to planning a party.

Maximizing Military Spouse Income Tax Exemption

Here are some innovative ways that you can make use use of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Print out free worksheets and activities to reinforce learning at home, or even in the classroom.

3. Event Planning

- Design invitations and banners and decorations for special events such as weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Military Spouse Income Tax Exemption are a treasure trove of fun and practical tools that satisfy a wide range of requirements and pursuits. Their accessibility and versatility make them an invaluable addition to both professional and personal life. Explore the wide world of Military Spouse Income Tax Exemption now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Military Spouse Income Tax Exemption truly absolutely free?

- Yes they are! You can download and print the resources for free.

-

Can I use the free printables for commercial purposes?

- It's all dependent on the terms of use. Always read the guidelines of the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Certain printables may be subject to restrictions on usage. Be sure to review the terms and conditions offered by the author.

-

How can I print printables for free?

- You can print them at home with either a printer at home or in the local print shops for superior prints.

-

What program do I need in order to open printables that are free?

- The majority of printables are in the format of PDF, which can be opened with free software, such as Adobe Reader.

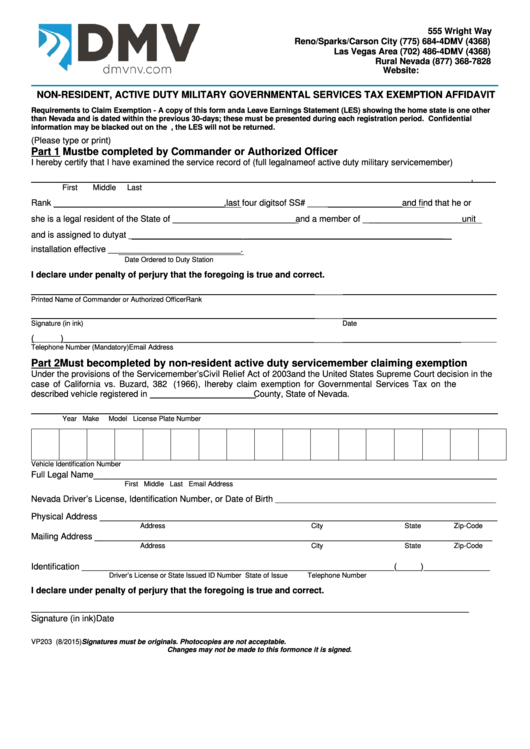

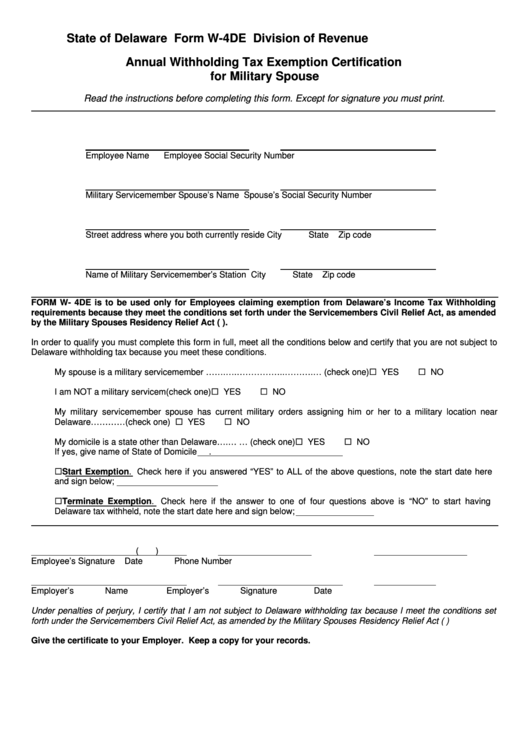

Nevada Dmv Military Tax Exemption Form ExemptForm

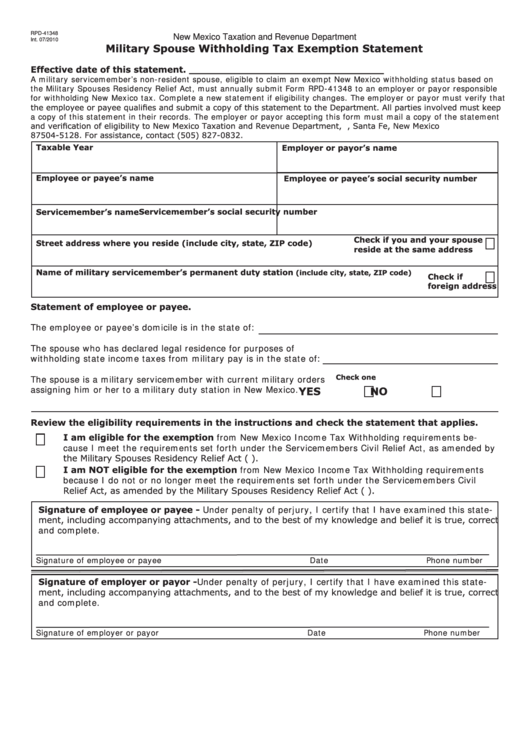

Military Spouse Tax Exemption Form California ExemptForm

Check more sample of Military Spouse Income Tax Exemption below

Tax Formula Finance Clever

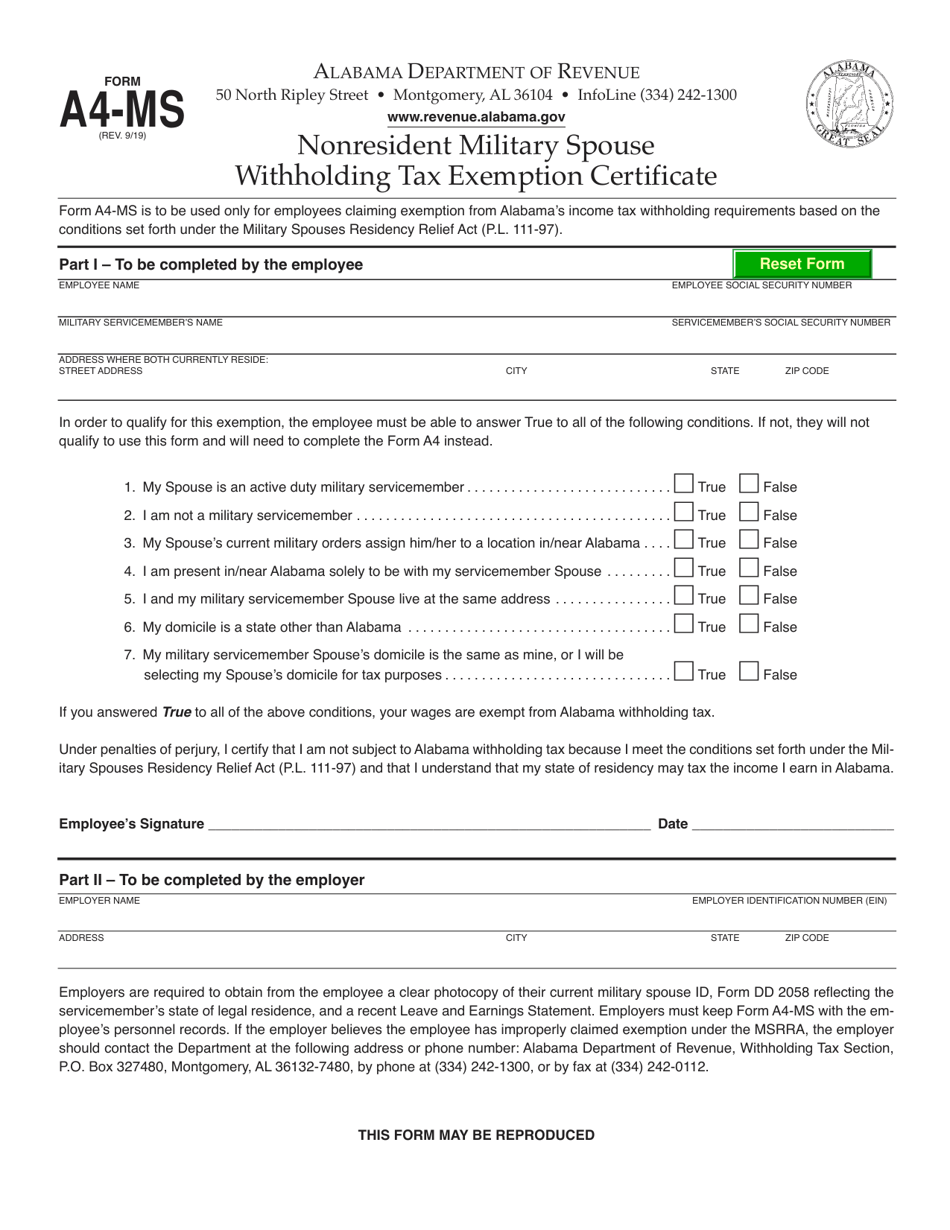

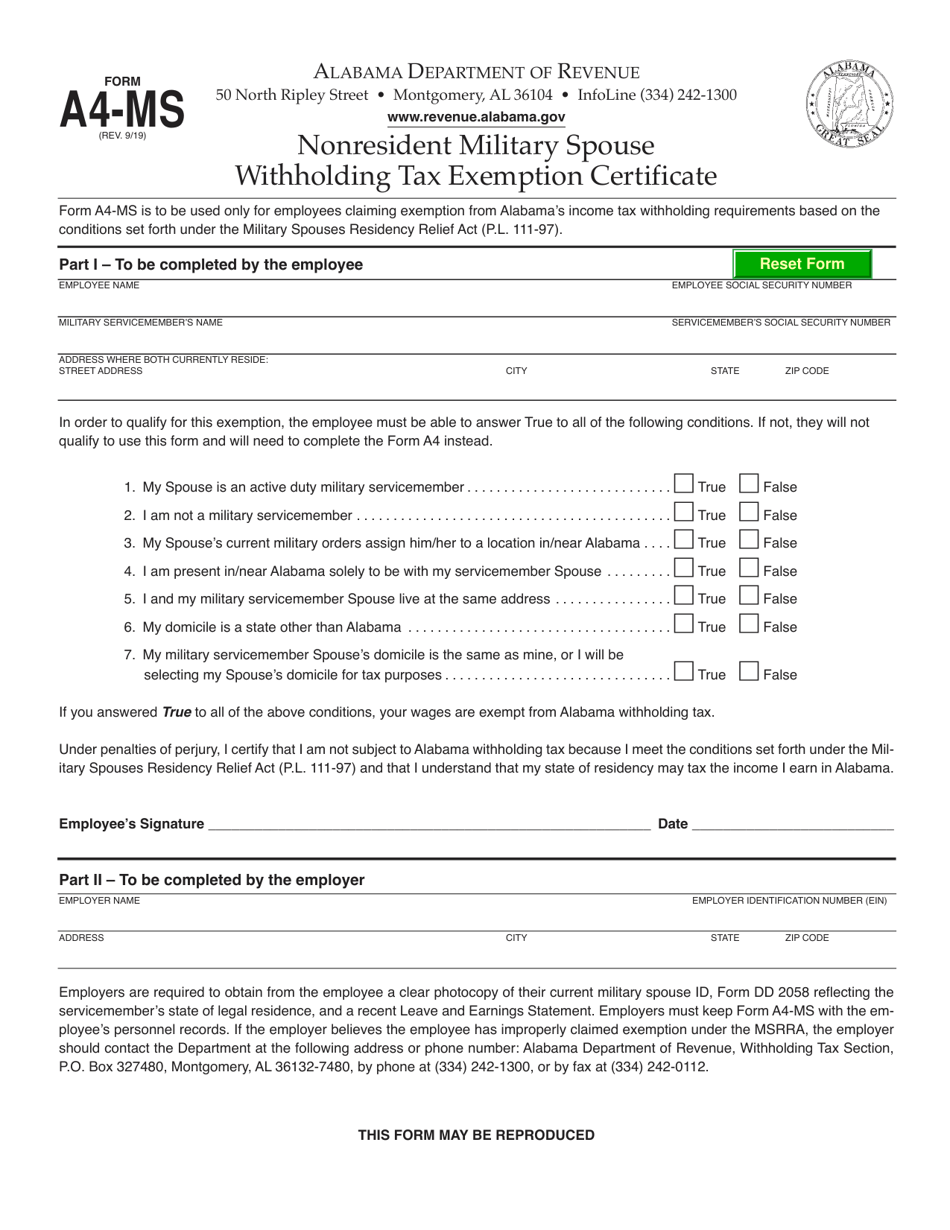

Alabama Form A 4 Employee S Withholding Tax Exemption Certificate 2023

H R Block Is Offering A Military Scholarship For Military Spouses And

Military Spouse Tax Exemption Form California ExemptForm

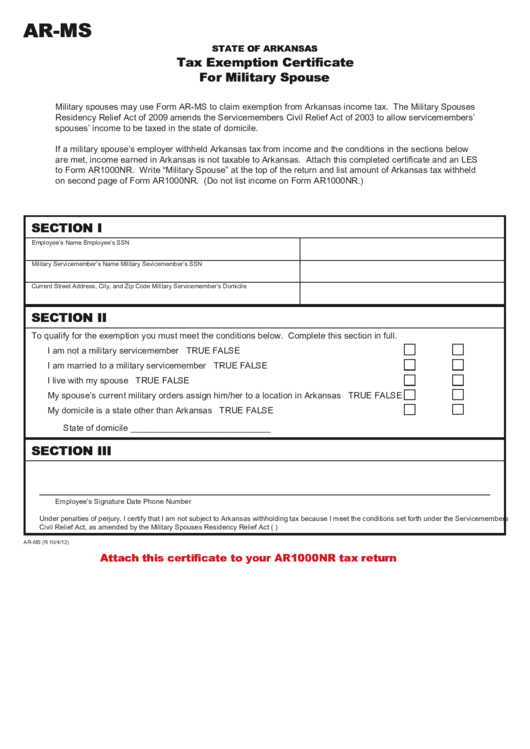

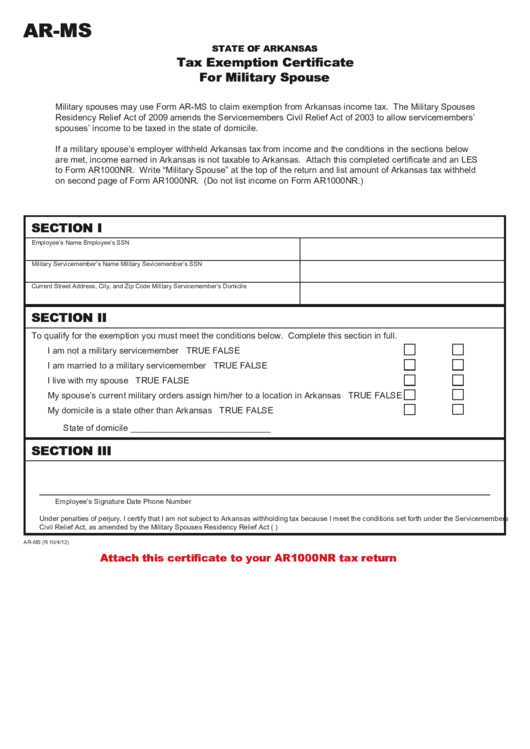

Fillable Form Ar Ms Tax Exemption Certificate For Military Spouse

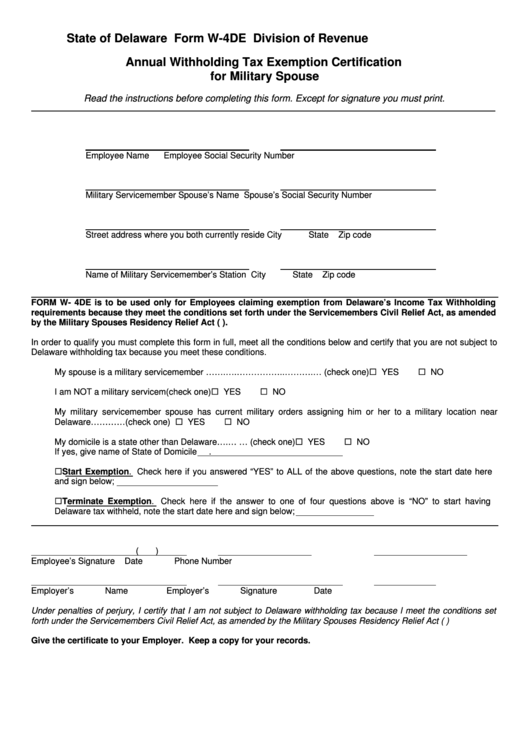

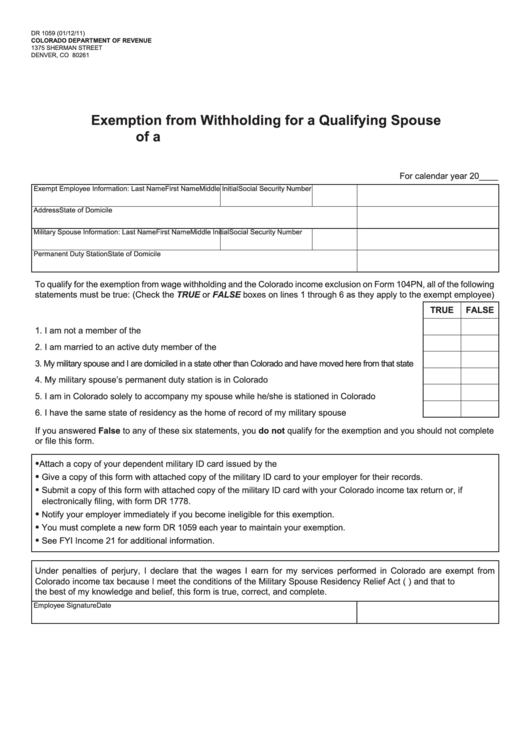

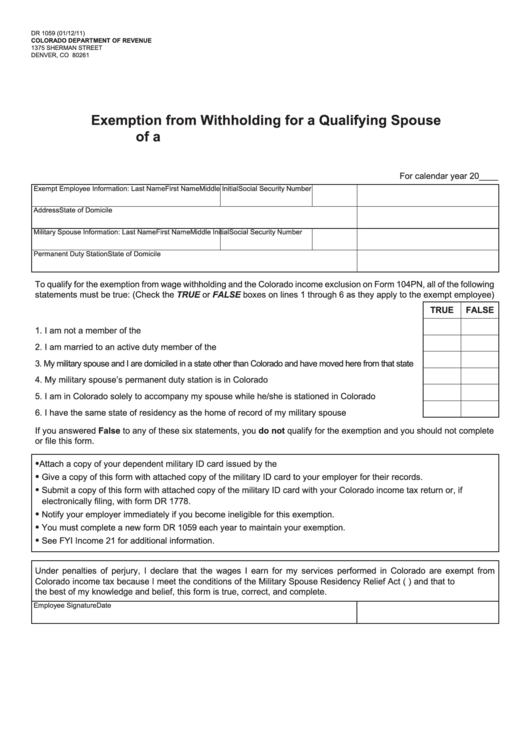

Form Dr 1059 Exemption From Withholding For A Qualifying Spouse Of A

https://download.militaryonesource.mil/12038/MOS...

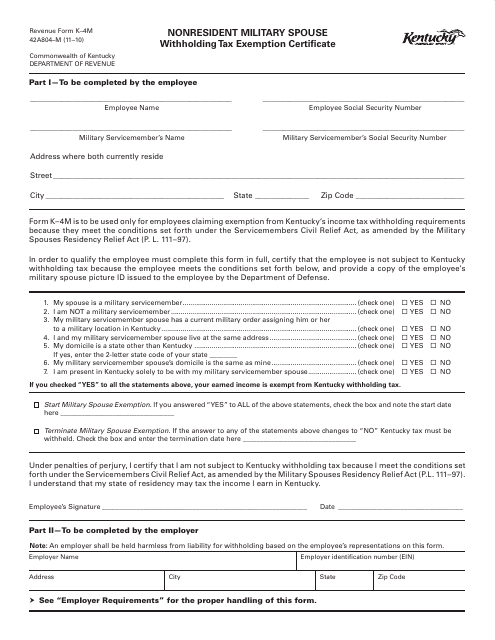

The MSRRA changes the basic rules of taxation with respect to military spouses who earn income from services performed in a State in which the spouse is present with the Service member SM in compliance with military orders when that State is not the spouse s domicile legal residence

https://home.army.mil/knox/application/files/2515/...

EXPLANATION A state cannot tax income earned in that state by the military spouse if the military spouse and servicemember have each established a domicile outside the state and are

The MSRRA changes the basic rules of taxation with respect to military spouses who earn income from services performed in a State in which the spouse is present with the Service member SM in compliance with military orders when that State is not the spouse s domicile legal residence

EXPLANATION A state cannot tax income earned in that state by the military spouse if the military spouse and servicemember have each established a domicile outside the state and are

Military Spouse Tax Exemption Form California ExemptForm

Alabama Form A 4 Employee S Withholding Tax Exemption Certificate 2023

Fillable Form Ar Ms Tax Exemption Certificate For Military Spouse

Form Dr 1059 Exemption From Withholding For A Qualifying Spouse Of A

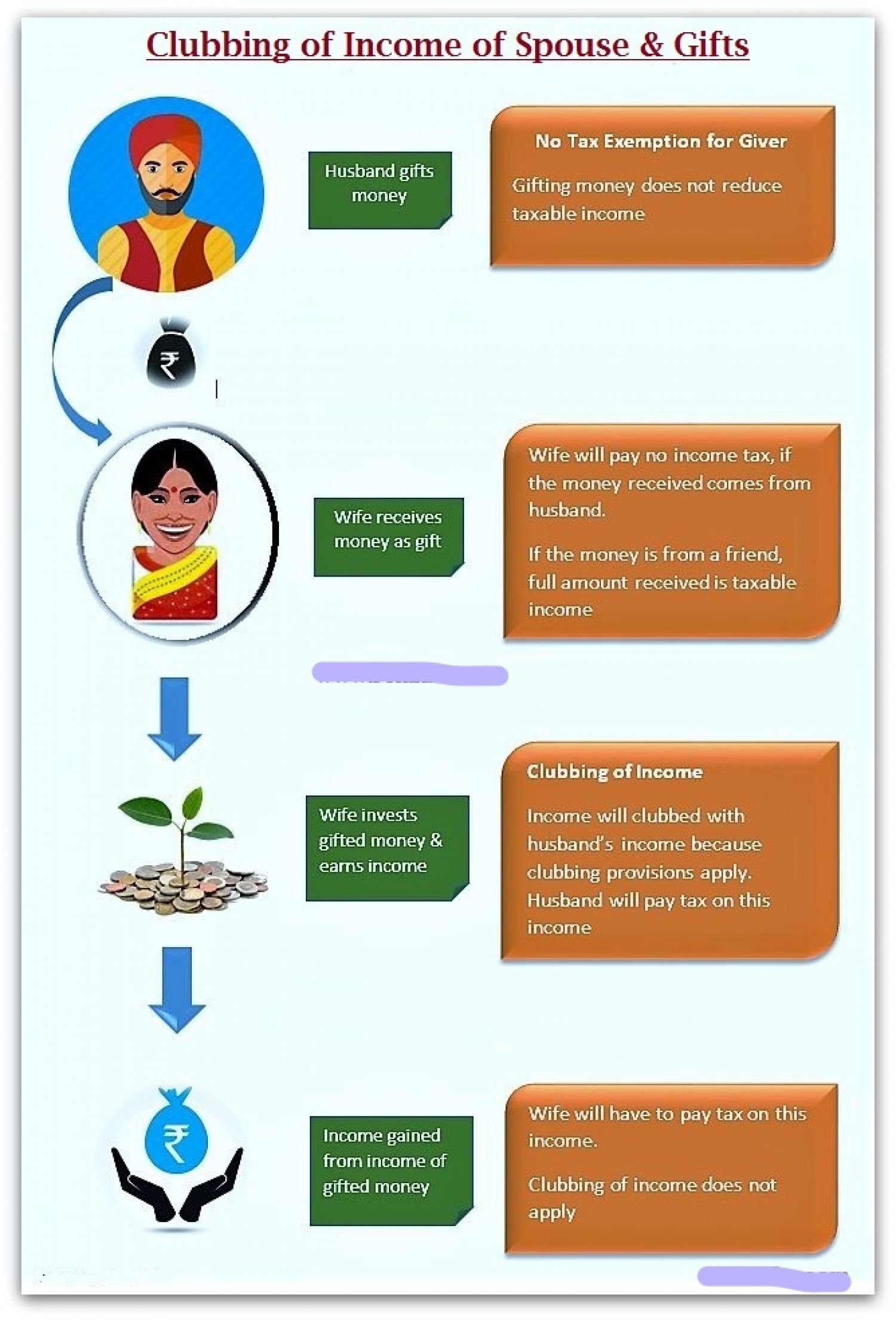

Income From Assets Transferred To Spouse Clubbing Of Income

HRA Tax Exemption Allowed For Rent Paid To Spouse ITAT

HRA Tax Exemption Allowed For Rent Paid To Spouse ITAT

Ky Revenue Form K 3 2021 Essentially cyou 2022