In a world where screens dominate our lives, the charm of tangible printed products hasn't decreased. No matter whether it's for educational uses in creative or artistic projects, or simply to add an extra personal touch to your home, printables for free are now a vital resource. For this piece, we'll dive in the world of "Mobile Phone Tax Deduction Uk," exploring their purpose, where you can find them, and how they can be used to enhance different aspects of your lives.

Get Latest Mobile Phone Tax Deduction Uk Below

Mobile Phone Tax Deduction Uk

Mobile Phone Tax Deduction Uk -

According to HMRC a company can provide staff with one mobile phone for business use As such you re not required to report to HMRC or make tax or National Insurance deductions if you re using one mobile phone or SIM card and the phone contract is between your limited company and the phone supplier

If you pay the 20 basic rate of tax and claim tax relief on 6 a week you would get 1 20 per week in tax relief 20 of 6 You ll usually get tax relief through a change to your tax

Printables for free cover a broad assortment of printable, downloadable materials that are accessible online for free cost. These materials come in a variety of styles, from worksheets to templates, coloring pages, and many more. The appealingness of Mobile Phone Tax Deduction Uk is in their variety and accessibility.

More of Mobile Phone Tax Deduction Uk

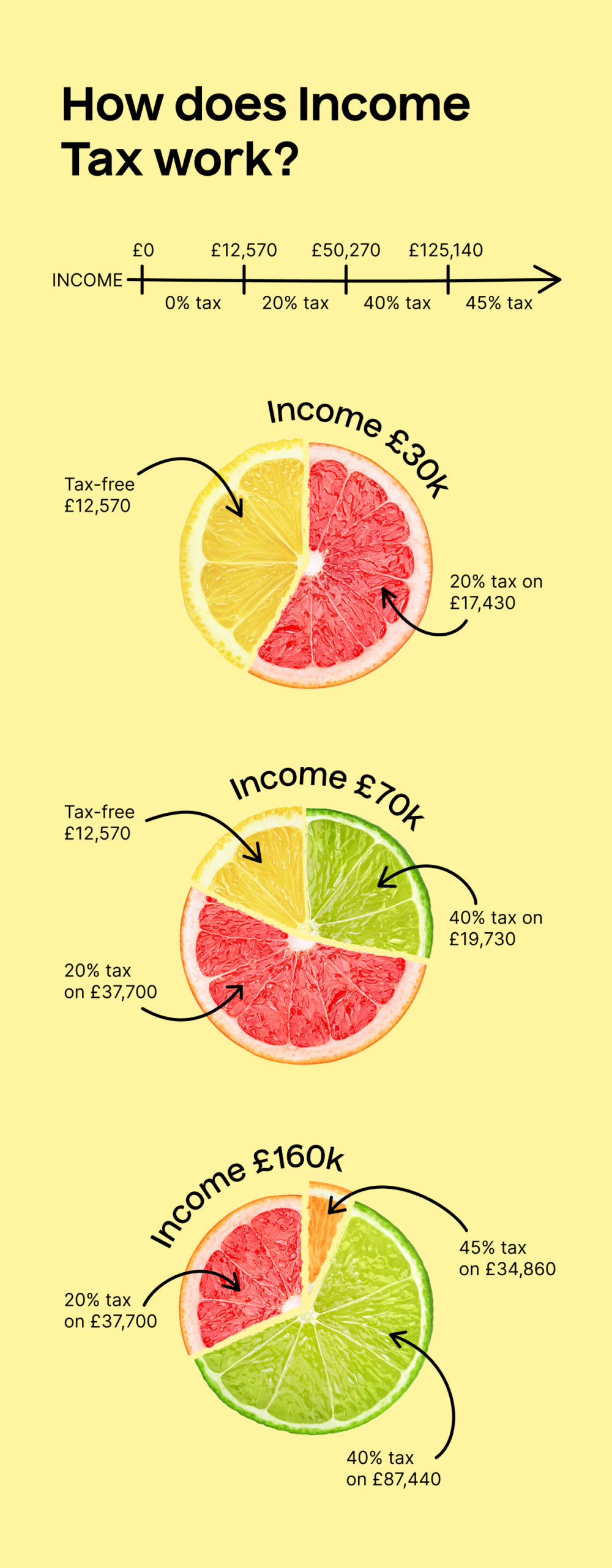

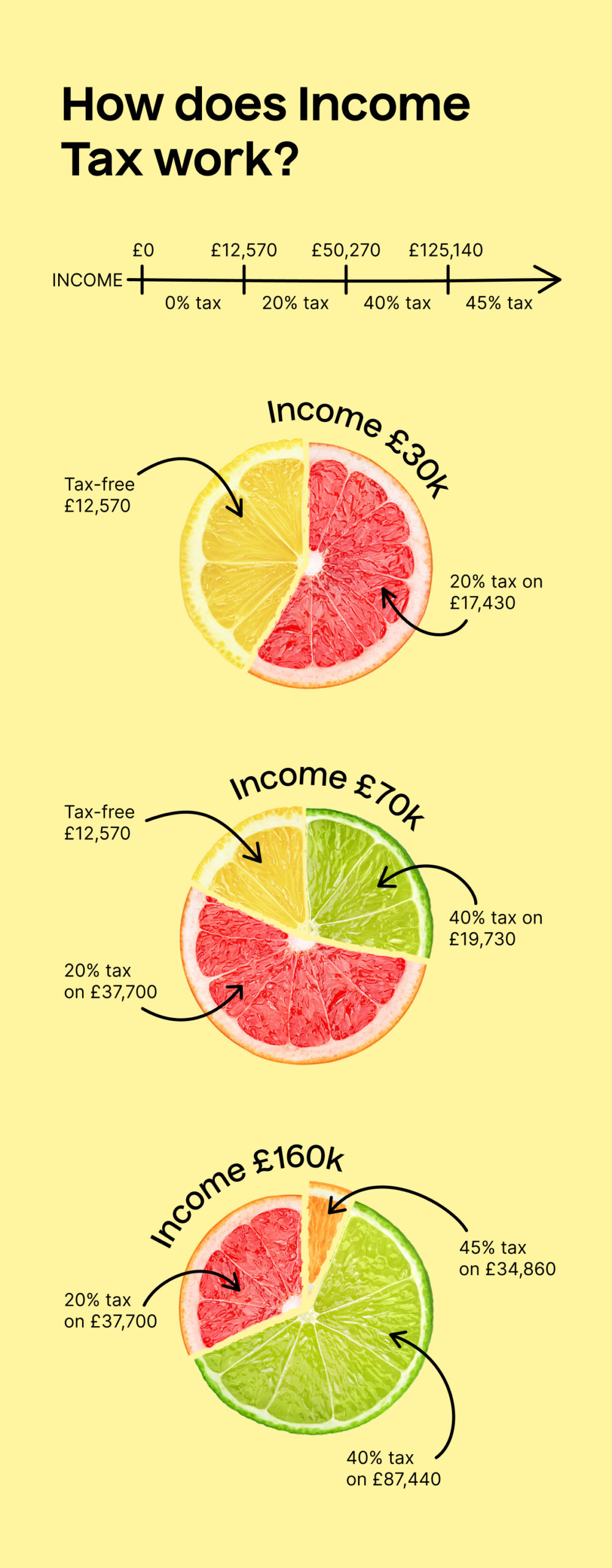

Income Tax Rates In The UK TaxScouts

Income Tax Rates In The UK TaxScouts

Published 13 September 2021 HMRC expenses rules state that you can make available for use to an employee one mobile phone for business purposes which is exempt from tax on the individual as a Benefit in Kind BIK and a legitimate allowable expense against corporation tax Rules vary depending on the chosen model

HMRC allow the full costs of your mobile phone bills as a tax allowable expense providing the mobile phone contract is held in the name of the limited company and the payments are made directly from the business bank account This applies even if the phone is used for personal use as well as business use

Mobile Phone Tax Deduction Uk have gained a lot of popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies of the software or expensive hardware.

-

customization There is the possibility of tailoring the design to meet your needs, whether it's designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational Worth: The free educational worksheets provide for students of all ages, which makes them a useful tool for parents and educators.

-

It's easy: Quick access to various designs and templates can save you time and energy.

Where to Find more Mobile Phone Tax Deduction Uk

Have You Claimed All The Tax Deductions You Are Eligible For In UK

Have You Claimed All The Tax Deductions You Are Eligible For In UK

If you use your phone mobile and internet for personal and business use you ll need to demonstrate a realistic way of dividing the costs and can only claim tax back on the part for business use You can t claim any tax back if you can t show this

If you are VAT registered you need to include the VAT only on the business portion of your calls For Limited companies everything depends on the type of mobile phone contract If the mobile phone or sim card is registered in a

Since we've got your curiosity about Mobile Phone Tax Deduction Uk Let's see where you can locate these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of Mobile Phone Tax Deduction Uk designed for a variety reasons.

- Explore categories like decorations for the home, education and the arts, and more.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets Flashcards, worksheets, and other educational tools.

- The perfect resource for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for free.

- The blogs are a vast variety of topics, everything from DIY projects to planning a party.

Maximizing Mobile Phone Tax Deduction Uk

Here are some new ways create the maximum value use of printables for free:

1. Home Decor

- Print and frame gorgeous art, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Print out free worksheets and activities for teaching at-home (or in the learning environment).

3. Event Planning

- Designs invitations, banners and other decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized by using printable calendars or to-do lists. meal planners.

Conclusion

Mobile Phone Tax Deduction Uk are a treasure trove with useful and creative ideas catering to different needs and pursuits. Their accessibility and versatility make they a beneficial addition to both personal and professional life. Explore the world of Mobile Phone Tax Deduction Uk today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really for free?

- Yes, they are! You can print and download these items for free.

-

Can I utilize free printables in commercial projects?

- It is contingent on the specific terms of use. Be sure to read the rules of the creator before utilizing their templates for commercial projects.

-

Are there any copyright issues when you download Mobile Phone Tax Deduction Uk?

- Certain printables might have limitations in use. Be sure to review the terms and conditions set forth by the designer.

-

How can I print printables for free?

- Print them at home using an printer, or go to a print shop in your area for more high-quality prints.

-

What software do I need in order to open printables for free?

- The majority of PDF documents are provided in PDF format, which is open with no cost programs like Adobe Reader.

Cameroon Govt Introduces New Mobile Phone Tax Collection System

Pakistan Increases Tax On Mobile Phone Recharge

Check more sample of Mobile Phone Tax Deduction Uk below

Mobile Phone Tax Calculator For Import Of Mobile Phones In Pakistan

UK Super deduction Learn How You Can Save With Capital Allowance

HMRC Tax Rates And Allowances For 2022 23 Simmons Simmons

What Is The Super deduction And Am I Eligible Conveney Nicholls

130 Super Deduction HMA Tax

HMRC Tax Rates And Allowances For 2022 23 Simmons Simmons

https://www.gov.uk/tax-relief-for-employees/working-at-home

If you pay the 20 basic rate of tax and claim tax relief on 6 a week you would get 1 20 per week in tax relief 20 of 6 You ll usually get tax relief through a change to your tax

https://www.thp.co.uk/mobile-phone-tax-deductible

You can therefore claim 140 of your mobile phone costs against tax If you are VAT registered you can also claim back the relevant proportion of the VAT you pay unless you are on a flat rate scheme A second option is to have two mobile phones with one being used exclusively for business

If you pay the 20 basic rate of tax and claim tax relief on 6 a week you would get 1 20 per week in tax relief 20 of 6 You ll usually get tax relief through a change to your tax

You can therefore claim 140 of your mobile phone costs against tax If you are VAT registered you can also claim back the relevant proportion of the VAT you pay unless you are on a flat rate scheme A second option is to have two mobile phones with one being used exclusively for business

What Is The Super deduction And Am I Eligible Conveney Nicholls

UK Super deduction Learn How You Can Save With Capital Allowance

130 Super Deduction HMA Tax

HMRC Tax Rates And Allowances For 2022 23 Simmons Simmons

UK Super deduction Learn How You Can Save With Capital Allowance

Bethlehem Turn On The Light Of Hope Pro Terra Sancta

Bethlehem Turn On The Light Of Hope Pro Terra Sancta

What Would Labour Do To Sort The Power Sharing Issues In Northern