In the age of digital, where screens have become the dominant feature of our lives The appeal of tangible printed items hasn't gone away. For educational purposes in creative or artistic projects, or simply adding some personal flair to your area, Mutual Fund Investment Deduction In Income Tax can be an excellent source. The following article is a take a dive through the vast world of "Mutual Fund Investment Deduction In Income Tax," exploring what they are, where to locate them, and the ways that they can benefit different aspects of your life.

Get Latest Mutual Fund Investment Deduction In Income Tax Below

Mutual Fund Investment Deduction In Income Tax

Mutual Fund Investment Deduction In Income Tax -

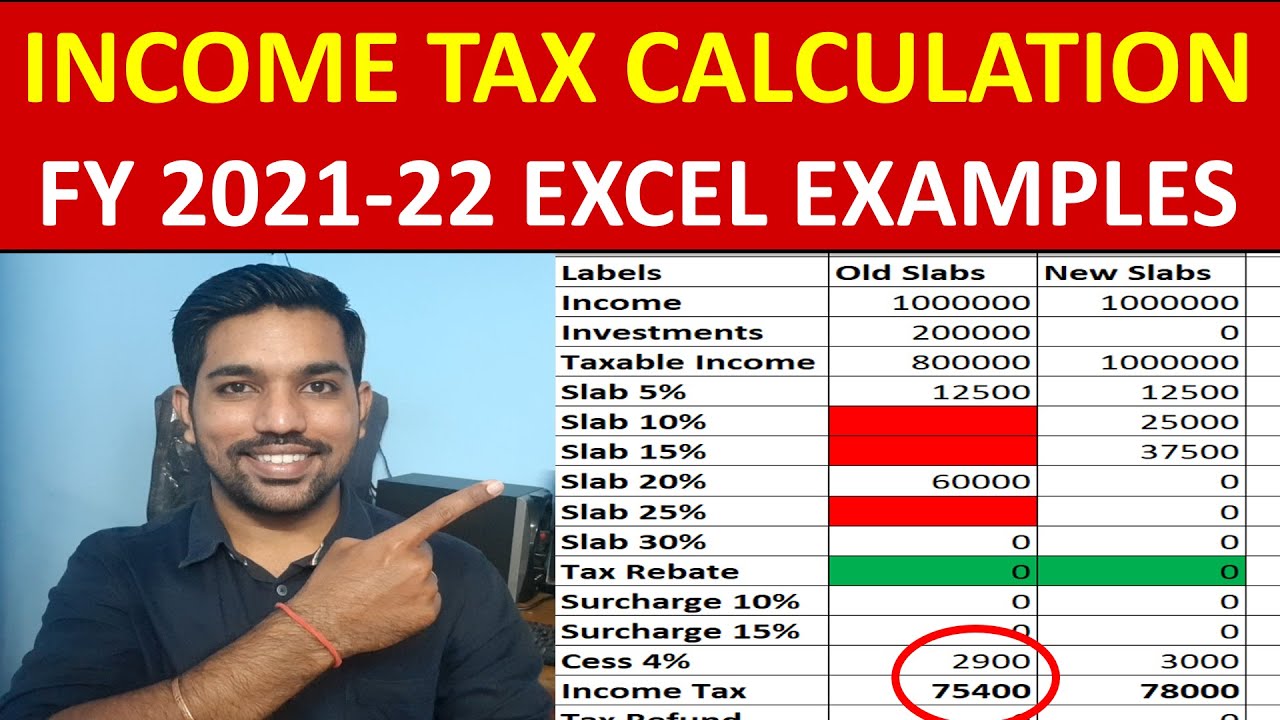

Learn the procedure for declaring mutual fund investments and disclosing capital gains in your Income Tax Return ITR Understand the specific forms and sections related to reporting mutual funds for accurate tax compliance

That s why you should check Section 80C of the Income Tax Act The law allows you to enjoy substantial tax deductions depending on where you invest One of the best investment options is ELSS mutual funds which offer a tax reduction of up to INR 1 5 lakh under Section 80C

Mutual Fund Investment Deduction In Income Tax include a broad range of downloadable, printable material that is available online at no cost. These resources come in many kinds, including worksheets templates, coloring pages and much more. The beauty of Mutual Fund Investment Deduction In Income Tax is their flexibility and accessibility.

More of Mutual Fund Investment Deduction In Income Tax

Section 194K TAX Deduction On Income From Mutual Fund Consult4india

Section 194K TAX Deduction On Income From Mutual Fund Consult4india

Mutual funds are not tax free except for ELSS equity linked savings schemes or tax saving funds and some retirement funds As per the Income Tax Act under Section 80C you can claim a deduction of up to Rs 1 5 lakh for investments made in ELSS and can save taxes up to Rs 46 800

In general most distributions you receive from a mutual fund must be declared as investment income on your yearly taxes

Mutual Fund Investment Deduction In Income Tax have risen to immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

The ability to customize: We can customize printed materials to meet your requirements, whether it's designing invitations, organizing your schedule, or even decorating your home.

-

Educational Use: Downloads of educational content for free are designed to appeal to students from all ages, making these printables a powerful tool for parents and teachers.

-

Affordability: instant access many designs and templates can save you time and energy.

Where to Find more Mutual Fund Investment Deduction In Income Tax

Deduction In Income Tax deduction Under 80c To 80u 80u 80jja 80qqb

Deduction In Income Tax deduction Under 80c To 80u 80u 80jja 80qqb

These funds help investors Individual and HUF save taxes under Section 80C of the Income Tax Act 1961 Investing in ELSS qualifies for a tax deduction of up to Rs 1 5 lakh Tax saving mutual fund typically invest in the growth oriented equity market

That means you may owe tax on mutual funds you ve invested in even if you haven t sold any of the shares or received any cash from your investments Here s an overview of how and when you pay tax

Now that we've ignited your interest in Mutual Fund Investment Deduction In Income Tax Let's see where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection with Mutual Fund Investment Deduction In Income Tax for all objectives.

- Explore categories such as furniture, education, management, and craft.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free with flashcards and other teaching tools.

- It is ideal for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates, which are free.

- These blogs cover a broad variety of topics, all the way from DIY projects to party planning.

Maximizing Mutual Fund Investment Deduction In Income Tax

Here are some unique ways in order to maximize the use use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Use these printable worksheets free of charge to build your knowledge at home as well as in the class.

3. Event Planning

- Invitations, banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Mutual Fund Investment Deduction In Income Tax are an abundance of practical and innovative resources that cater to various needs and passions. Their access and versatility makes them a fantastic addition to any professional or personal life. Explore the many options of Mutual Fund Investment Deduction In Income Tax to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really for free?

- Yes, they are! You can print and download these documents for free.

-

Do I have the right to use free printables for commercial use?

- It's all dependent on the conditions of use. Be sure to read the rules of the creator prior to using the printables in commercial projects.

-

Are there any copyright rights issues with Mutual Fund Investment Deduction In Income Tax?

- Certain printables could be restricted on their use. Make sure to read these terms and conditions as set out by the creator.

-

How do I print Mutual Fund Investment Deduction In Income Tax?

- You can print them at home with either a printer or go to the local print shops for premium prints.

-

What software do I need to run Mutual Fund Investment Deduction In Income Tax?

- Most printables come in PDF format. They can be opened using free software such as Adobe Reader.

CBI Group Says Investment Deduction Would Boost Economy Up To 40

Material Requirement Form House Rent Deduction In Income Tax Section

Check more sample of Mutual Fund Investment Deduction In Income Tax below

Section 194K Tax Deduction On Income From Mutual Fund Units

Standard Deduction For Assessment Year 2021 22 Standard Deduction 2021

Standard Deduction In Income Tax With Examples InstaFiling

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

Deduction In Income Tax The Income Tax Department Has Thou Flickr

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

https://choiceindia.com/blog/list-of-mutual-funds...

That s why you should check Section 80C of the Income Tax Act The law allows you to enjoy substantial tax deductions depending on where you invest One of the best investment options is ELSS mutual funds which offer a tax reduction of up to INR 1 5 lakh under Section 80C

https://cleartax.in/s/different-mutual-funds-taxed

Can mutual fund investments help me get a rebate on income tax Under Section 80C of the Income Tax Act tax benefits are applicable in the case of ELSS or Equity Linked Saving Schemes You can get up to Rs 1 5 lakh in tax deduction and save around Rs 46 800 each year on taxes

That s why you should check Section 80C of the Income Tax Act The law allows you to enjoy substantial tax deductions depending on where you invest One of the best investment options is ELSS mutual funds which offer a tax reduction of up to INR 1 5 lakh under Section 80C

Can mutual fund investments help me get a rebate on income tax Under Section 80C of the Income Tax Act tax benefits are applicable in the case of ELSS or Equity Linked Saving Schemes You can get up to Rs 1 5 lakh in tax deduction and save around Rs 46 800 each year on taxes

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

Standard Deduction For Assessment Year 2021 22 Standard Deduction 2021

Deduction In Income Tax The Income Tax Department Has Thou Flickr

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

House Rent Deduction In Income Tax TOP CHARTERED ACCOUNTANT IN

Ciudadanos Promises To Recover The Deduction In The Regional Section Of

Ciudadanos Promises To Recover The Deduction In The Regional Section Of

Income Tax Rebate Astonishingceiyrs