In the age of digital, where screens dominate our lives, the charm of tangible printed material hasn't diminished. It doesn't matter if it's for educational reasons for creative projects, simply to add personal touches to your area, National Pension Scheme Under 80ccd have become an invaluable source. In this article, we'll dive into the world of "National Pension Scheme Under 80ccd," exploring their purpose, where they are, and how they can enhance various aspects of your daily life.

Get Latest National Pension Scheme Under 80ccd Below

National Pension Scheme Under 80ccd

National Pension Scheme Under 80ccd -

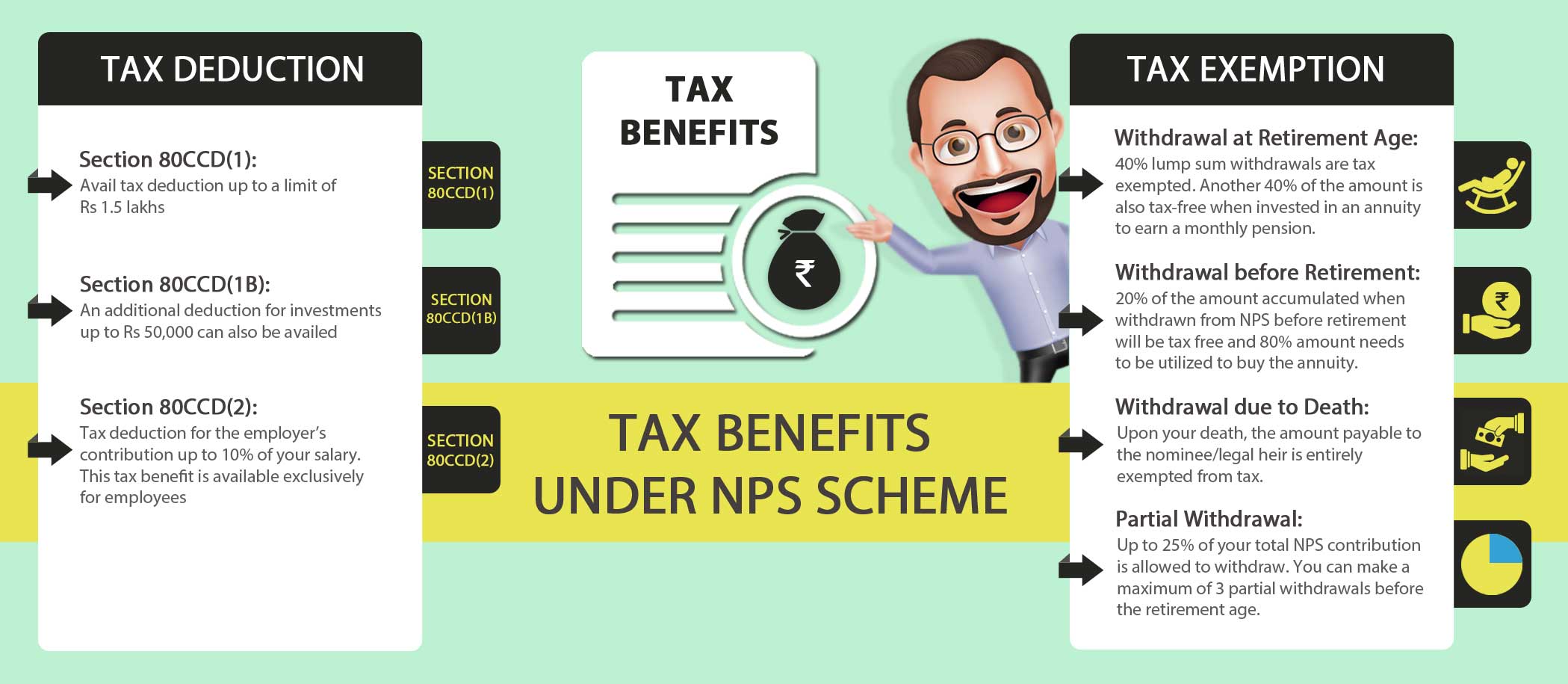

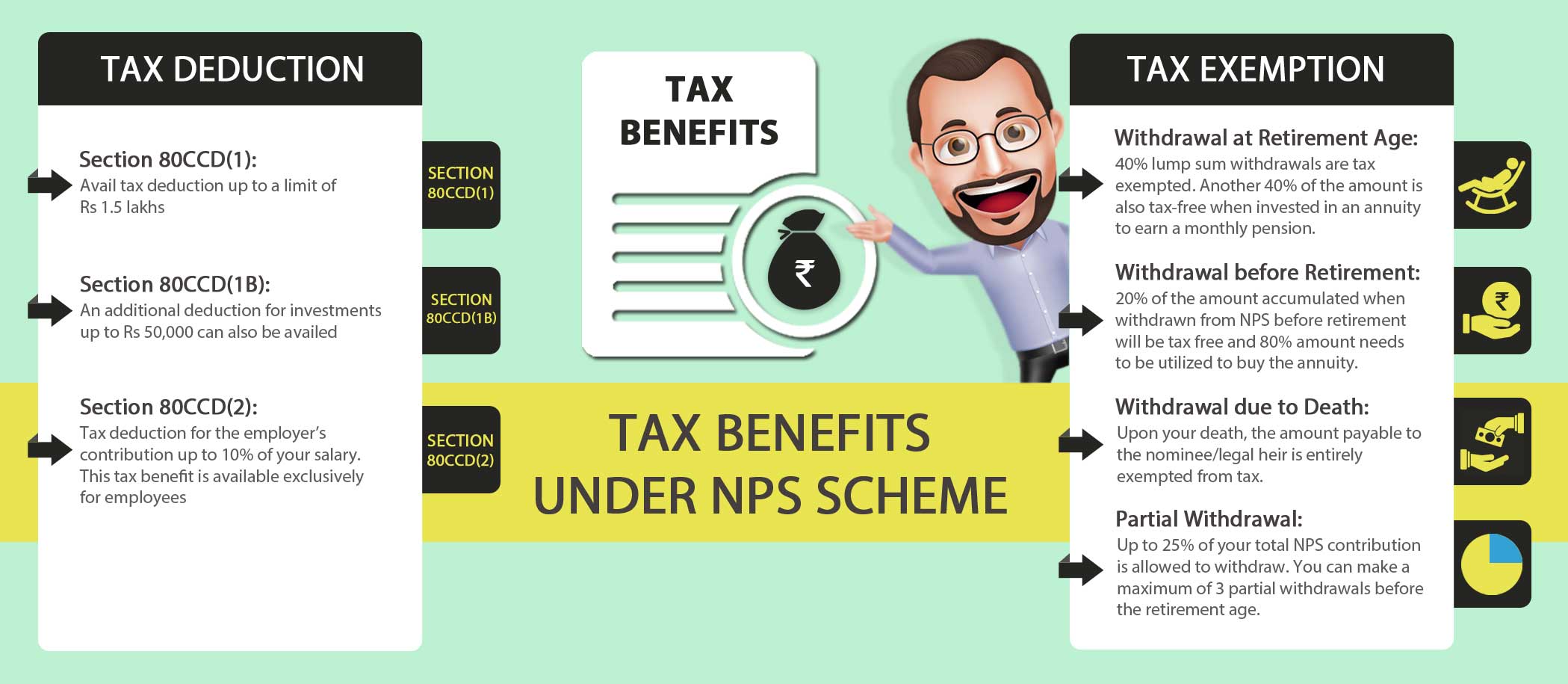

In essence by investing in NPS you can claim tax deductions of up to Rs 2 lakhs in total Rs 1 5 lakhs under Section 80C and an additional Rs 50 000 under Section 80CCD 1B This means that if you belong to the 30 tax bracket you could potentially save Rs 62 400 in taxes Tax Benefits under Section 80CCD 2 Contributions by the

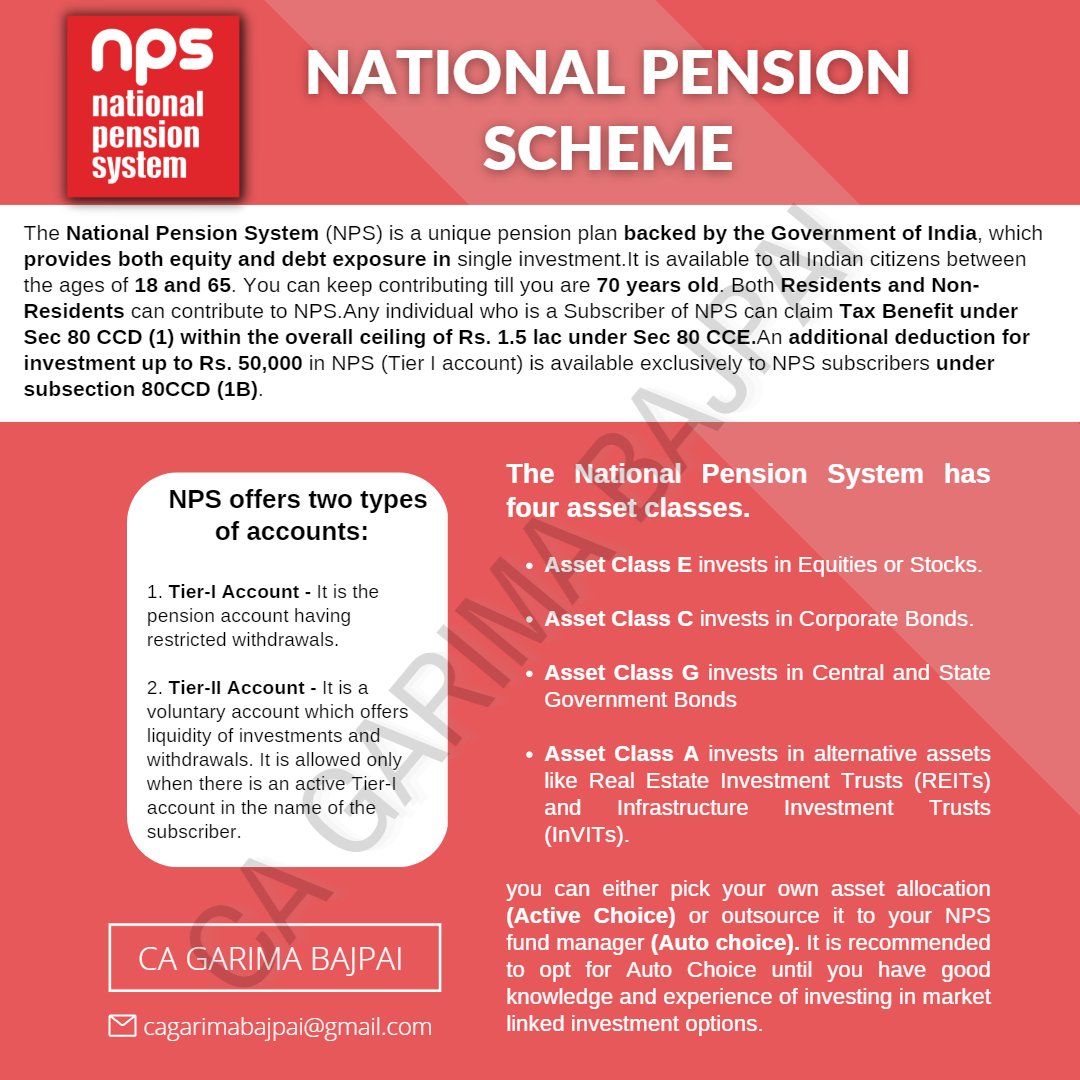

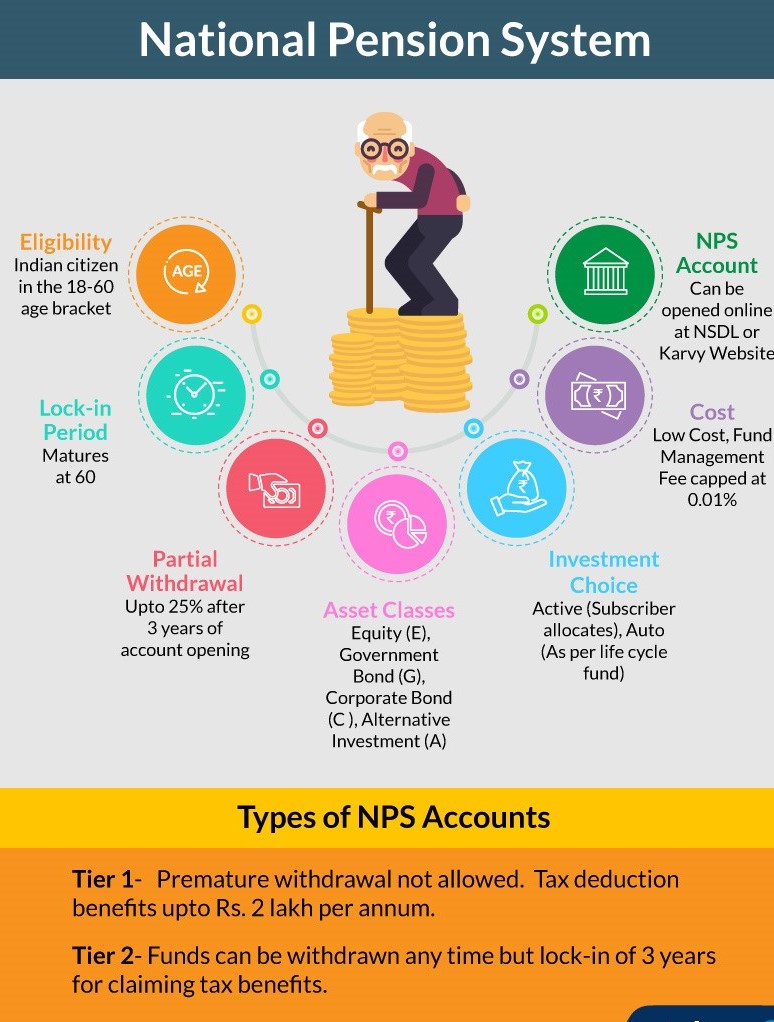

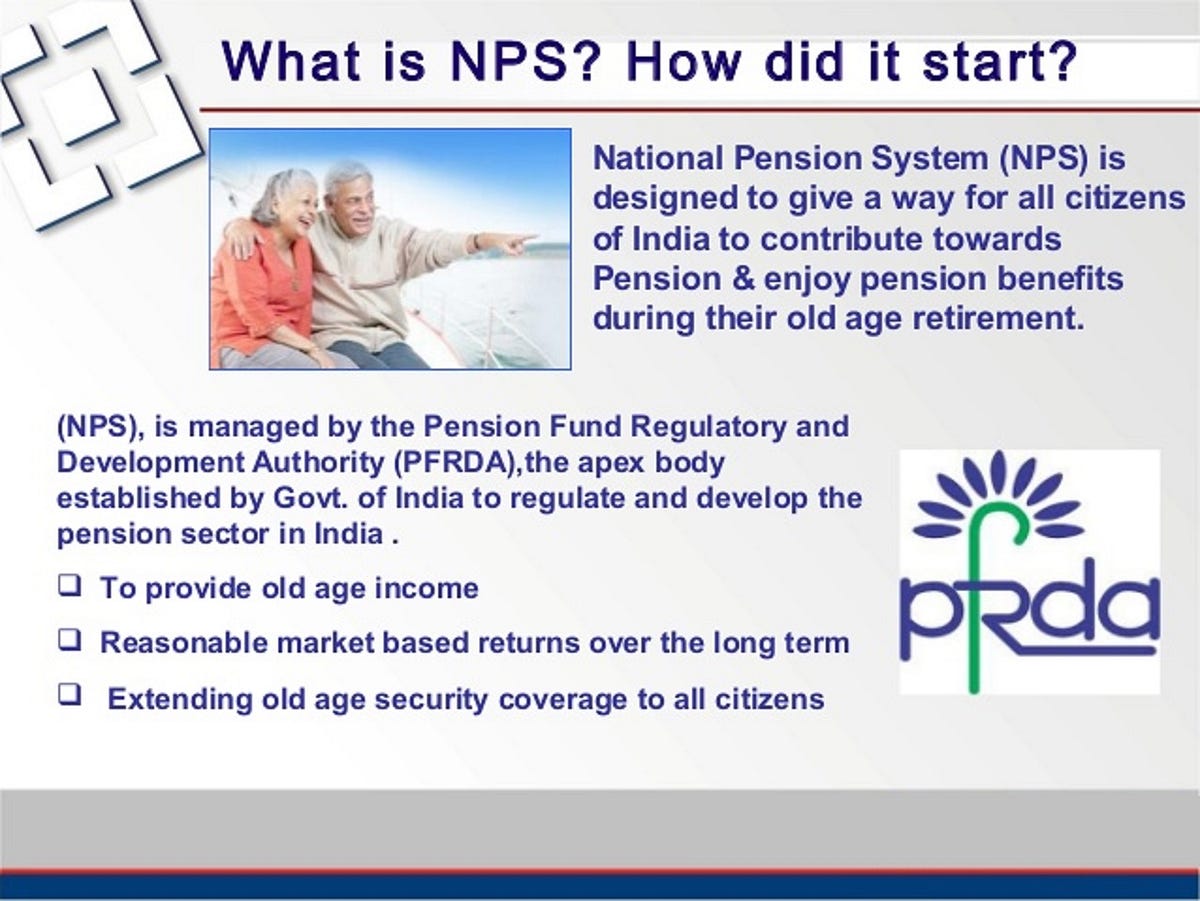

National Pension Scheme under 80CCD NPS is an organized pension scheme for self employed private and government employees It is a useful investment instrument for creating a retirement corpus An individual must contribute to NPS until the age of 70 It is compulsory for Central Government employees For other individuals it is voluntary

Printables for free include a vast range of printable, free materials online, at no cost. These resources come in many kinds, including worksheets templates, coloring pages, and more. The value of National Pension Scheme Under 80ccd is their versatility and accessibility.

More of National Pension Scheme Under 80ccd

What Is The National Pension System Section 80CCD 1B In Hindi

What Is The National Pension System Section 80CCD 1B In Hindi

Suppose your contribution to National Pension Scheme is Rs 75 000 in a financial year then you are allowed to claim tax deductions under Section 80CCD 1 You taxable income will be reduced to Rs 10 25 lakh 11 lakh 75 000 after the deduction

Section 80CCD deduction of income tax act allows individuals between the age of 18 60 years to avail of tax deduction against any contribution made towards the Pension Scheme of the Central Government National Pension Scheme NPS or Atal Pension Yojna APY

Print-friendly freebies have gained tremendous recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the need to buy physical copies of the software or expensive hardware.

-

customization: The Customization feature lets you tailor the templates to meet your individual needs when it comes to designing invitations as well as organizing your calendar, or even decorating your house.

-

Education Value Education-related printables at no charge are designed to appeal to students from all ages, making them a vital tool for parents and teachers.

-

Easy to use: Fast access an array of designs and templates can save you time and energy.

Where to Find more National Pension Scheme Under 80ccd

National Pension System NPS Dev Investments

National Pension System NPS Dev Investments

Section 80CCD of the Income Tax Act 1961 focuses on income tax deductions that individual income tax assesses are eligible to avail on contributions made towards the New Pension Scheme NPS and Atal Pension Yojana APY NPS is a notified pension scheme offered by the Central Government

Section 80CCD of the Income Tax Act 1961 provides deductions for contributions to the National Pension System NPS or Atal Pension Yojana APY The National Pension Scheme and Atal Pension Yojana are retirement oriented investment schemes launched by the Government of India Both schemes provide pension income

After we've peaked your interest in National Pension Scheme Under 80ccd We'll take a look around to see where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of National Pension Scheme Under 80ccd designed for a variety goals.

- Explore categories such as home decor, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free as well as flashcards and other learning tools.

- The perfect resource for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates, which are free.

- These blogs cover a broad range of topics, that includes DIY projects to planning a party.

Maximizing National Pension Scheme Under 80ccd

Here are some creative ways that you can make use use of printables that are free:

1. Home Decor

- Print and frame beautiful images, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Utilize free printable worksheets to help reinforce your learning at home, or even in the classroom.

3. Event Planning

- Design invitations and banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Be organized by using printable calendars, to-do lists, and meal planners.

Conclusion

National Pension Scheme Under 80ccd are an abundance with useful and creative ideas for a variety of needs and desires. Their accessibility and flexibility make them an invaluable addition to every aspect of your life, both professional and personal. Explore the wide world of National Pension Scheme Under 80ccd today to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly for free?

- Yes you can! You can print and download these resources at no cost.

-

Can I utilize free printouts for commercial usage?

- It's determined by the specific rules of usage. Always read the guidelines of the creator before utilizing their templates for commercial projects.

-

Do you have any copyright issues in National Pension Scheme Under 80ccd?

- Certain printables may be subject to restrictions in their usage. Check the terms of service and conditions provided by the designer.

-

How can I print printables for free?

- You can print them at home with an printer, or go to an in-store print shop to get premium prints.

-

What software do I need in order to open printables that are free?

- Most PDF-based printables are available as PDF files, which can be opened with free software, such as Adobe Reader.

NPS Tax Benefits How To Avail NPS Income Tax Benefits

Deduction Under Section 80CCD 2 For Employer s Contribution To

Check more sample of National Pension Scheme Under 80ccd below

Taxation Updates On Twitter RT garimabajpai National Pension

National Pension System NPS A Tax Saving Instrument ComparePolicy

All About Of National Pension Scheme NPS CA Rajput Jain

National Pension Scheme 80CCD 1B How To Claim Onlineideation

How To Claim Section 80CCD 1B TaxHelpdesk

Nps Contribution By Employee Werohmedia

https://groww.in/p/tax/section-80ccd

National Pension Scheme under 80CCD NPS is an organized pension scheme for self employed private and government employees It is a useful investment instrument for creating a retirement corpus An individual must contribute to NPS until the age of 70 It is compulsory for Central Government employees For other individuals it is voluntary

https://cleartax.in/s/section-80-ccd-1b

Let us explore Section 80CCD 1B which offers an additional deduction of up to Rs 50 000 for contributions made to the National Pension System NPS What is Section 80CCD 1B Section 80CCD 1B provides an additional deduction of up to Rs 50 000 for contributions made to NPS

National Pension Scheme under 80CCD NPS is an organized pension scheme for self employed private and government employees It is a useful investment instrument for creating a retirement corpus An individual must contribute to NPS until the age of 70 It is compulsory for Central Government employees For other individuals it is voluntary

Let us explore Section 80CCD 1B which offers an additional deduction of up to Rs 50 000 for contributions made to the National Pension System NPS What is Section 80CCD 1B Section 80CCD 1B provides an additional deduction of up to Rs 50 000 for contributions made to NPS

National Pension Scheme 80CCD 1B How To Claim Onlineideation

National Pension System NPS A Tax Saving Instrument ComparePolicy

How To Claim Section 80CCD 1B TaxHelpdesk

Nps Contribution By Employee Werohmedia

Deduction Under Section 80CCD 2 For Employer s Contribution To

Section 80CCD Deduction For National Pension Scheme

Section 80CCD Deduction For National Pension Scheme

Should I Invest In NPS Should You Invest In NPS National By