In the digital age, with screens dominating our lives however, the attraction of tangible printed objects isn't diminished. Whether it's for educational purposes such as creative projects or simply to add an element of personalization to your space, New Home Tax Credit 2023 are now a useful source. This article will dive deep into the realm of "New Home Tax Credit 2023," exploring what they are, where to get them, as well as how they can add value to various aspects of your daily life.

Get Latest New Home Tax Credit 2023 Below

New Home Tax Credit 2023

New Home Tax Credit 2023 -

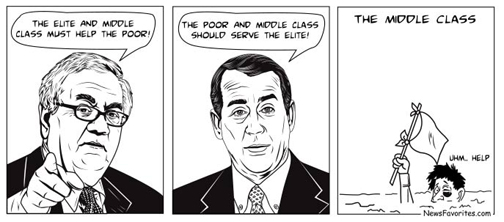

Homebuyer tax credits 2021 to 2023 The First Time Homebuyer Act was introduced by U S Reps Earl Blumenauer D Ore and Jimmy Panetta D Calif in

President Biden is calling on Congress to pass a mortgage relief credit that would provide middle class first time homebuyers with an annual tax credit of 5 000 a

Printables for free cover a broad array of printable materials available online at no cost. The resources are offered in a variety forms, including worksheets, templates, coloring pages and many more. The appeal of printables for free is their versatility and accessibility.

More of New Home Tax Credit 2023

JOB OPENING Dyersville DieCast Customer Service Representative

JOB OPENING Dyersville DieCast Customer Service Representative

President Biden proposed a 10 000 tax credit for first time and current homeowners in his 2024 State of the Union address The credits would lower the cost of

10 Tax Breaks You Have as a New Homebuyer Tax credits and breaks for first time home buyers in 2023 and 2024 can be an attractive incentive that makes

New Home Tax Credit 2023 have garnered immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or expensive software.

-

customization Your HTML0 customization options allow you to customize designs to suit your personal needs for invitations, whether that's creating them for your guests, organizing your schedule or even decorating your home.

-

Education Value The free educational worksheets are designed to appeal to students from all ages, making them a useful resource for educators and parents.

-

Affordability: Instant access to various designs and templates helps save time and effort.

Where to Find more New Home Tax Credit 2023

TOMY International Inc Dyersville Economic Development Corporation

TOMY International Inc Dyersville Economic Development Corporation

First time home buyers who acquire a qualifying home can claim a non refundable tax credit of up to 750 The value of the HBTC is calculated by multiplying 5 000 by the lowest

Learn about tax incentives and benefits for buying building selling or renovating a home in 2023 Find out how to claim the HBTC the GST HST new housing

Since we've got your interest in printables for free Let's take a look at where you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection in New Home Tax Credit 2023 for different applications.

- Explore categories like the home, decor, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free or flashcards as well as learning tools.

- Perfect for teachers, parents, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for free.

- The blogs covered cover a wide range of topics, that range from DIY projects to party planning.

Maximizing New Home Tax Credit 2023

Here are some inventive ways for you to get the best use of New Home Tax Credit 2023:

1. Home Decor

- Print and frame stunning artwork, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Use printable worksheets for free to enhance your learning at home and in class.

3. Event Planning

- Designs invitations, banners as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable planners for to-do list, lists of chores, and meal planners.

Conclusion

New Home Tax Credit 2023 are an abundance of creative and practical resources catering to different needs and hobbies. Their accessibility and flexibility make they a beneficial addition to every aspect of your life, both professional and personal. Explore the vast collection that is New Home Tax Credit 2023 today, and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly available for download?

- Yes, they are! You can download and print these free resources for no cost.

-

Can I download free templates for commercial use?

- It's based on the terms of use. Always verify the guidelines provided by the creator before using their printables for commercial projects.

-

Do you have any copyright issues in New Home Tax Credit 2023?

- Some printables could have limitations in their usage. Be sure to read the conditions and terms of use provided by the designer.

-

How do I print New Home Tax Credit 2023?

- You can print them at home with your printer or visit the local print shops for premium prints.

-

What program will I need to access printables for free?

- Many printables are offered in the format PDF. This can be opened using free software such as Adobe Reader.

45L New Energy Efficient Home Tax Credit Quality Built

Cassab Associates E Newsletter Issue 15

Check more sample of New Home Tax Credit 2023 below

How To Apply For New Home Tax Credit Pausebear

:max_bytes(150000):strip_icc()/ScreenShot2021-02-23at12.21.54PM-9f1fd40798a54df0b41b2473e3541290.png)

NC Offers New Home Tax Credit

Save The Economy By Hiding From The Census Casey Research

Referral Program

Horace Reinstates New Home Tax Break

335 E 100 N Hyrum UT 84319 ZeroDown

https://www.whitehouse.gov/briefing-room/statements...

President Biden is calling on Congress to pass a mortgage relief credit that would provide middle class first time homebuyers with an annual tax credit of 5 000 a

https://www.irs.gov/newsroom/irs-builders-of...

IR 2023 142 Aug 7 2023 The Internal Revenue Service reminds eligible contractors who build or substantially reconstruct qualified new energy efficient homes that they

President Biden is calling on Congress to pass a mortgage relief credit that would provide middle class first time homebuyers with an annual tax credit of 5 000 a

IR 2023 142 Aug 7 2023 The Internal Revenue Service reminds eligible contractors who build or substantially reconstruct qualified new energy efficient homes that they

Referral Program

NC Offers New Home Tax Credit

/cloudfront-us-east-1.images.arcpublishing.com/gray/QSAPDXYRPJFFDBTIYFDSIL4JQU.PNG)

Horace Reinstates New Home Tax Break

335 E 100 N Hyrum UT 84319 ZeroDown

Cabin Creek Timber Frames Tiny House Blog

Funny Craigslist Ad Www Lanyardstore

Funny Craigslist Ad Www Lanyardstore

Decker Concrete Dyersville Economic Development Corporation