In the age of digital, where screens dominate our lives but the value of tangible printed material hasn't diminished. If it's to aid in education and creative work, or simply to add an individual touch to the home, printables for free have become a valuable resource. This article will dive into the world "New Jersey Property Tax Deduction For Senior Citizens," exploring the different types of printables, where to locate them, and how they can improve various aspects of your life.

Get Latest New Jersey Property Tax Deduction For Senior Citizens Below

New Jersey Property Tax Deduction For Senior Citizens

New Jersey Property Tax Deduction For Senior Citizens -

Murphy Assembly Speaker Craig Coughlin and Senate President Nicholas Scutari said homeowners 65 and older who make 500 000 or less will qualify for up to 6 500 in property tax relief under

This program reimburses eligible senior citizens and disabled persons for property tax or mobile home park site fee increases on their principal residence

New Jersey Property Tax Deduction For Senior Citizens cover a large range of printable, free documents that can be downloaded online at no cost. These resources come in various forms, like worksheets coloring pages, templates and many more. The appealingness of New Jersey Property Tax Deduction For Senior Citizens is their versatility and accessibility.

More of New Jersey Property Tax Deduction For Senior Citizens

80 TTA Deduction For Ay 2022 23 II 80ttb Deduction For Senior Citizens

80 TTA Deduction For Ay 2022 23 II 80ttb Deduction For Senior Citizens

The program will offer New Jersey homeowners 65 and over tax credits worth up to half of their property tax bills to a cap of 6 500 as long as they make no more than 500 000 a year We have heard from seniors across the state on this issue

New Jersey does indeed provide several property tax breaks for residents who are 65 or older One is the Senior Freeze property tax reimbursement program To qualify for the 2021

New Jersey Property Tax Deduction For Senior Citizens have risen to immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Flexible: This allows you to modify print-ready templates to your specific requirements be it designing invitations to organize your schedule or even decorating your house.

-

Educational value: These New Jersey Property Tax Deduction For Senior Citizens are designed to appeal to students of all ages. This makes them a great tool for parents and educators.

-

Convenience: Quick access to various designs and templates saves time and effort.

Where to Find more New Jersey Property Tax Deduction For Senior Citizens

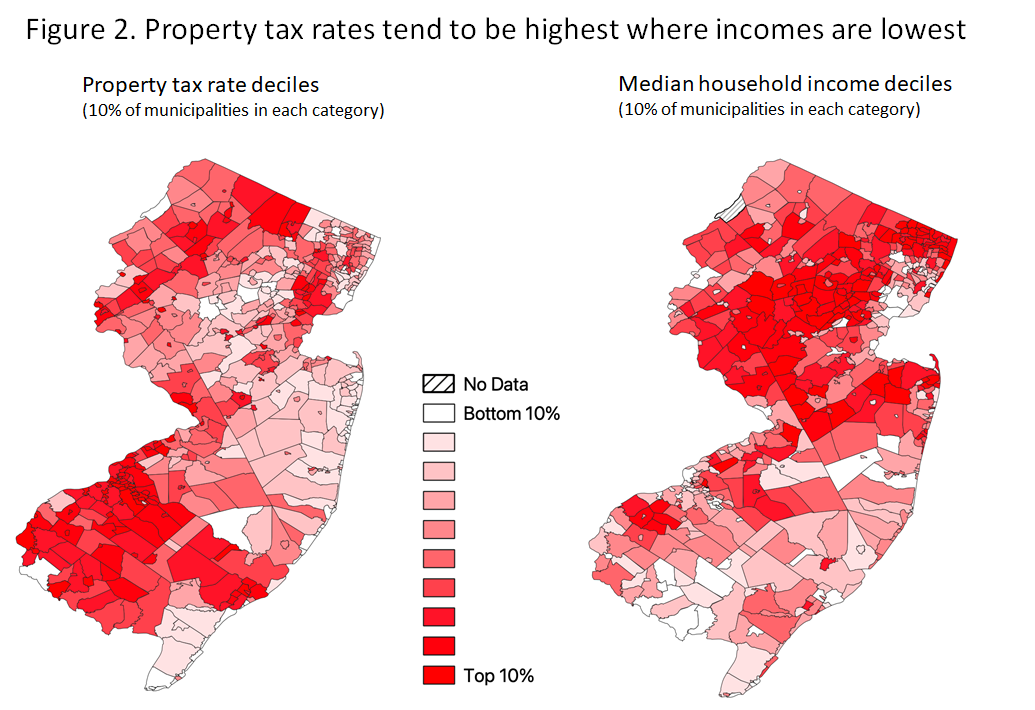

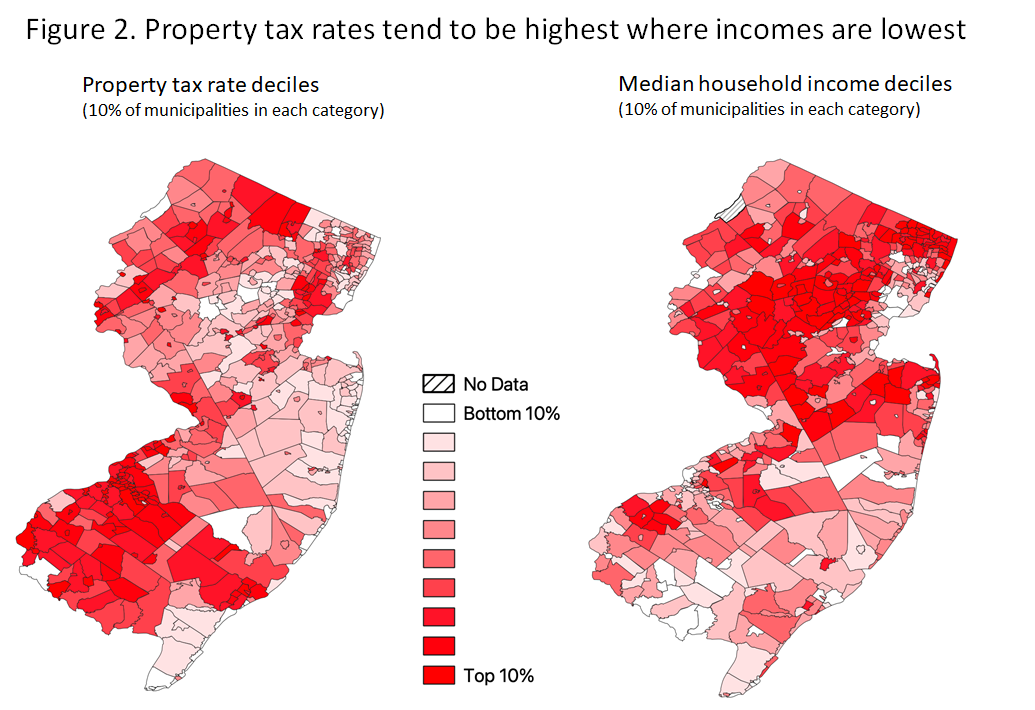

NJ Property Taxes Who Pays The Least On 3 Million Homes

NJ Property Taxes Who Pays The Least On 3 Million Homes

The Senior Freeze Property Tax Reimbursement program reimburses senior citizens and disabled persons for property tax increases Because you applied for and were eligible for a 2021 Senior Freeze you only need to show us that you met the eligibility requirements for

According to the law eligible homeowners and renters 65 and older in the Garden State will get an immediate increase of 250 in the fiscal year that starts Saturday under an existing rebate

We hope we've stimulated your curiosity about New Jersey Property Tax Deduction For Senior Citizens Let's look into where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of New Jersey Property Tax Deduction For Senior Citizens suitable for many objectives.

- Explore categories like decoration for your home, education, management, and craft.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing, flashcards, and learning tools.

- Perfect for teachers, parents and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers post their original designs and templates for free.

- These blogs cover a wide variety of topics, that includes DIY projects to party planning.

Maximizing New Jersey Property Tax Deduction For Senior Citizens

Here are some inventive ways to make the most of New Jersey Property Tax Deduction For Senior Citizens:

1. Home Decor

- Print and frame beautiful images, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print free worksheets for teaching at-home and in class.

3. Event Planning

- Designs invitations, banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

New Jersey Property Tax Deduction For Senior Citizens are a treasure trove of creative and practical resources designed to meet a range of needs and preferences. Their accessibility and flexibility make they a beneficial addition to any professional or personal life. Explore the vast collection of New Jersey Property Tax Deduction For Senior Citizens now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are New Jersey Property Tax Deduction For Senior Citizens truly available for download?

- Yes they are! You can download and print these resources at no cost.

-

Can I download free printables for commercial use?

- It's dependent on the particular rules of usage. Make sure you read the guidelines for the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright problems with printables that are free?

- Some printables may come with restrictions on their use. Be sure to read these terms and conditions as set out by the author.

-

How can I print printables for free?

- You can print them at home using an printer, or go to an area print shop for more high-quality prints.

-

What software do I need to open printables for free?

- The majority of PDF documents are provided in the PDF format, and is open with no cost software, such as Adobe Reader.

Income Tax Slabs For Senior Citizens FY 2022 23 AY 2023 24

Chiba Can Sports Betting Lower New Jersey Property Tax Gambling911

Check more sample of New Jersey Property Tax Deduction For Senior Citizens below

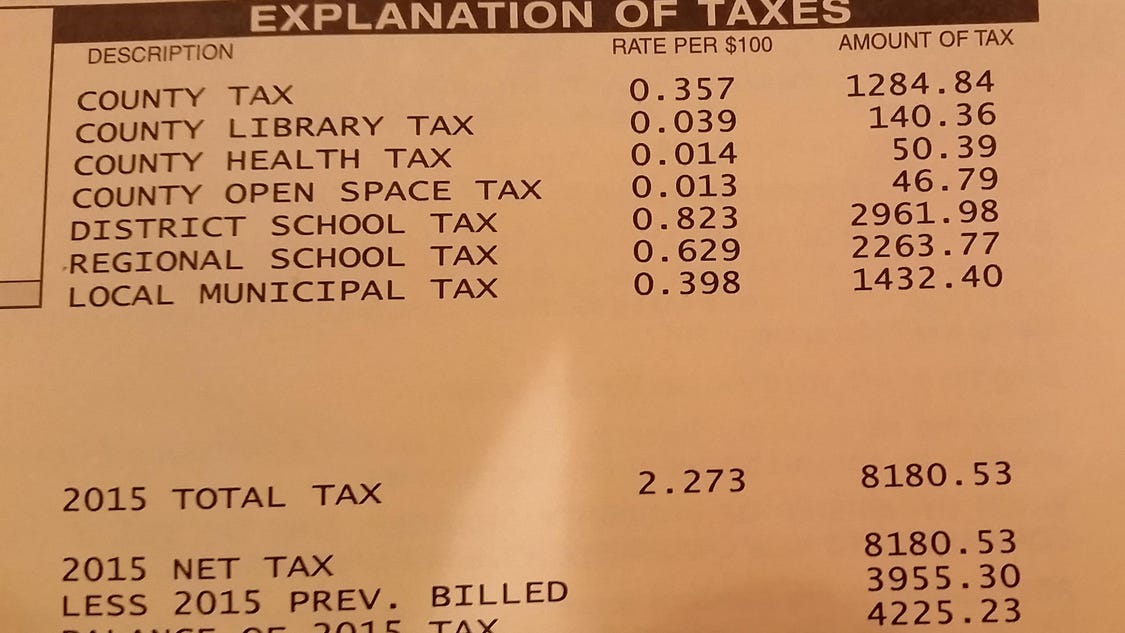

NEW JERSEY PROPERTY TAX

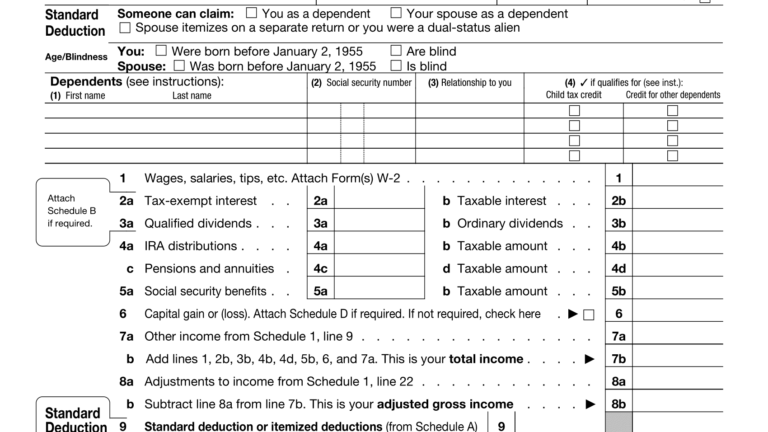

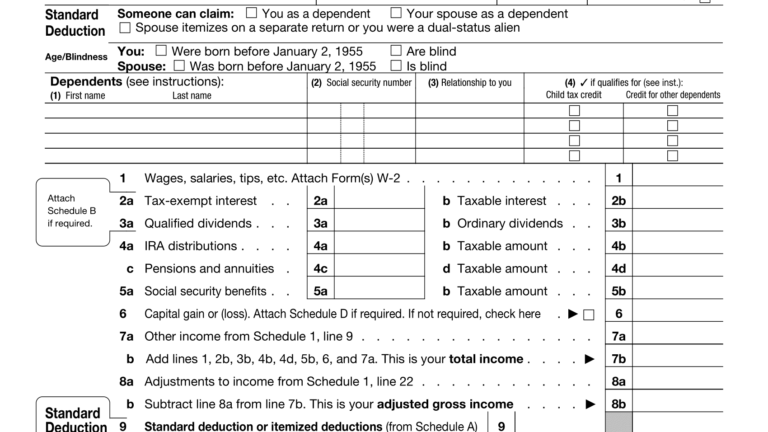

Irs Standard Deduction For Seniors 2020 Standard Deduction 2021

Every Year When Tax Season Rolls Around Everyone Is Looking To

Veterans Eligible For New Jersey Property Tax Deduction SobelCo

What Is The Standard Federal Tax Deduction Ericvisser

Where Do New Jersey s Property Tax Bills Hit The Hardest LaptrinhX

https://www.nj.gov/treasury/taxation/ptr

This program reimburses eligible senior citizens and disabled persons for property tax or mobile home park site fee increases on their principal residence

https://www.nj.gov/treasury/taxation/pdf/lpt/pt...

An annual 250 deduction from real property taxes may be granted for the dwelling of a qualified senior citizen disabled person or their surviving spouse

This program reimburses eligible senior citizens and disabled persons for property tax or mobile home park site fee increases on their principal residence

An annual 250 deduction from real property taxes may be granted for the dwelling of a qualified senior citizen disabled person or their surviving spouse

Veterans Eligible For New Jersey Property Tax Deduction SobelCo

Irs Standard Deduction For Seniors 2020 Standard Deduction 2021

What Is The Standard Federal Tax Deduction Ericvisser

Where Do New Jersey s Property Tax Bills Hit The Hardest LaptrinhX

Section 80TTB Tax Deduction For Senior Citizens PulseHRM

Fighting Your New Jersey Property Tax

Fighting Your New Jersey Property Tax

Standard Deduction For Assessment Year 2021 22 Standard Deduction 2021