In this age of technology, in which screens are the norm but the value of tangible printed materials isn't diminishing. It doesn't matter if it's for educational reasons in creative or artistic projects, or simply adding some personal flair to your home, printables for free can be an excellent source. In this article, we'll dive in the world of "Nm Solar Tax Credit Form," exploring what they are, how they are, and how they can be used to enhance different aspects of your life.

Get Latest Nm Solar Tax Credit Form Below

Nm Solar Tax Credit Form

Nm Solar Tax Credit Form -

Enter the amount of tax credit per kilowatt hour to be applied to electricity produced during the current tax year See THE AMOUNT OF THE CREDIT in the instructions

Step 1 Purchase and install an operating solar energy system Step 2 Obtain required documents from installation contractor Step 3 Apply for a tax credit here with Energy Minerals and Natural Resources Department EMNRD Step 4 Receive a certificate of eligibility from EMNRD

The Nm Solar Tax Credit Form are a huge range of downloadable, printable materials that are accessible online for free cost. These materials come in a variety of types, like worksheets, templates, coloring pages, and much more. The value of Nm Solar Tax Credit Form lies in their versatility and accessibility.

More of Nm Solar Tax Credit Form

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

The State Of New Mexico offers the New Solar Market Development Tax Credit which is available for up to 10 of the equipment materials and labor costs of a solar energy system which may not exceed 6 000 The taxpayer s system may be eligible for the federal tax credit incentive which is 26 30 of the system cost

The New Mexico solar tax credit is the Solar Market Development Tax Credit SMDTC and is managed by the Natural Resources Department It works this way After installing solar panels

The Nm Solar Tax Credit Form have gained huge popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Personalization The Customization feature lets you tailor the design to meet your needs whether you're designing invitations making your schedule, or even decorating your house.

-

Educational Benefits: Free educational printables can be used by students of all ages, making them a great tool for parents and teachers.

-

It's easy: Fast access a plethora of designs and templates helps save time and effort.

Where to Find more Nm Solar Tax Credit Form

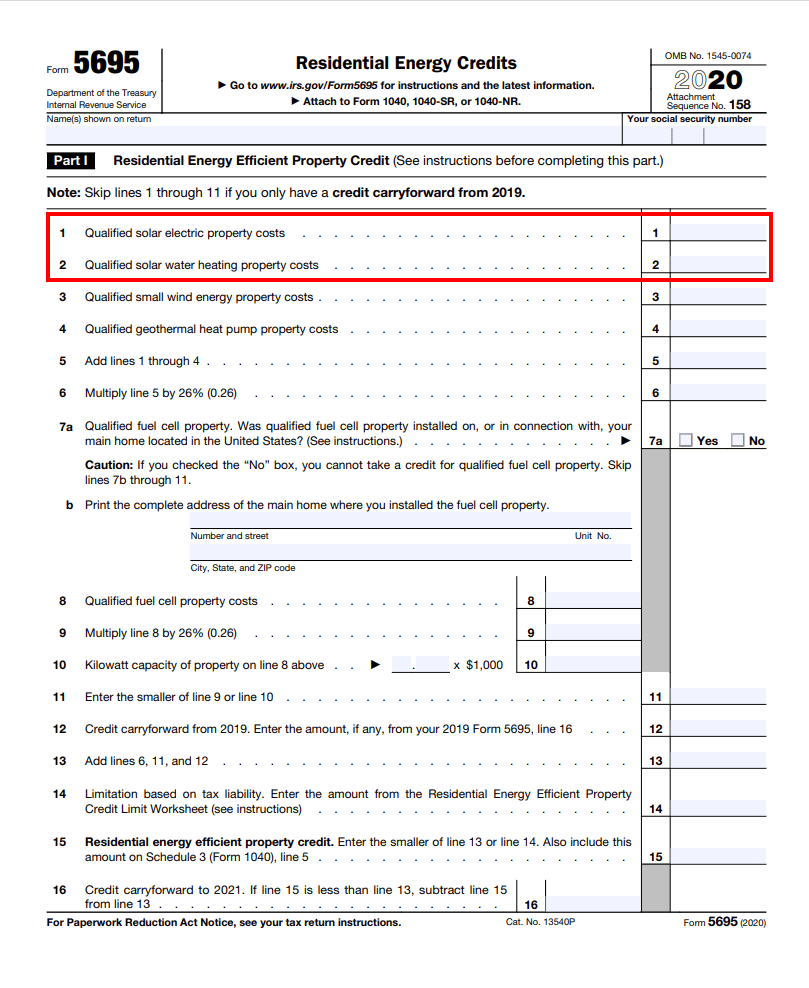

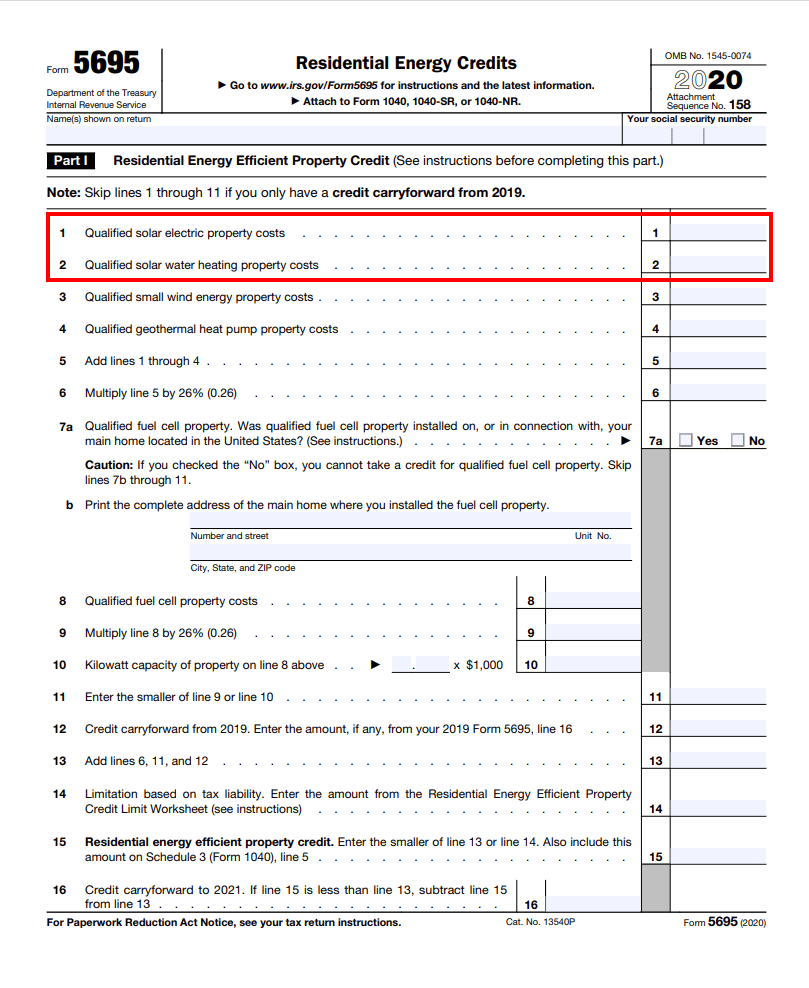

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

Form RPD 41317 Solar Market Development Tax Credit Claim Form is used by a taxpayer who has been certified for a solar market development tax credit by the Energy Minerals and Natural Resources Department EMNRD and wishes to claim the credit against personal or fiduciary income tax liability

This area of the site summarizes New Mexico s business related tax credits and the procedures for claiming them General types of tax credits are personal income tax credits conservation and preservation tax credits general industry incentive tax credits specific industry incentive tax credits employment enhancement tax credits and

We hope we've stimulated your interest in printables for free Let's see where you can locate these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Nm Solar Tax Credit Form to suit a variety of needs.

- Explore categories such as interior decor, education, management, and craft.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets along with flashcards, as well as other learning materials.

- The perfect resource for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their creative designs or templates for download.

- These blogs cover a broad array of topics, ranging ranging from DIY projects to planning a party.

Maximizing Nm Solar Tax Credit Form

Here are some inventive ways in order to maximize the use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes as well as seasonal decorations, to embellish your living areas.

2. Education

- Print worksheets that are free to aid in learning at your home for the classroom.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Keep track of your schedule with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Nm Solar Tax Credit Form are a treasure trove of fun and practical tools that cater to various needs and desires. Their access and versatility makes they a beneficial addition to both personal and professional life. Explore the wide world of Nm Solar Tax Credit Form right now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Nm Solar Tax Credit Form really are they free?

- Yes, they are! You can print and download the resources for free.

-

Does it allow me to use free printables for commercial uses?

- It depends on the specific terms of use. Always review the terms of use for the creator before utilizing printables for commercial projects.

-

Are there any copyright violations with printables that are free?

- Some printables may have restrictions on use. You should read the conditions and terms of use provided by the designer.

-

How can I print Nm Solar Tax Credit Form?

- You can print them at home using either a printer or go to an in-store print shop to get the highest quality prints.

-

What software do I require to view printables at no cost?

- The majority of printables are in PDF format, which is open with no cost programs like Adobe Reader.

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

Arizona Solar Tax Credit Form Donny Somers

Check more sample of Nm Solar Tax Credit Form below

Tax Attorney Albuquerque Nm Solar Tax Credit Chart Energy Sage

NJ Solar Tax Credit Explained

Irs Solar Tax Credit 2022 Form

Tax Credit ITC Sungenia Solar

Who Qualifies For Federal Tax Credit Leia Aqui Do I Qualify For

Solar Tax Credit Calculator NikiZsombor

https://www.emnrd.nm.gov/ecmd/tax-incentives/solar...

Step 1 Purchase and install an operating solar energy system Step 2 Obtain required documents from installation contractor Step 3 Apply for a tax credit here with Energy Minerals and Natural Resources Department EMNRD Step 4 Receive a certificate of eligibility from EMNRD

https://realfile.tax.newmexico.gov/trd-41406.pdf

Purpose of Form Form TRD 41406 New Solar Market Development Tax Credit Claim Form is to claim a new solar market development tax credit certified by the Energy Minerals and Natural Resources Department EMNRD against personal or fiduciary income tax liability Section 7 2 18 31 NMSA 1978

Step 1 Purchase and install an operating solar energy system Step 2 Obtain required documents from installation contractor Step 3 Apply for a tax credit here with Energy Minerals and Natural Resources Department EMNRD Step 4 Receive a certificate of eligibility from EMNRD

Purpose of Form Form TRD 41406 New Solar Market Development Tax Credit Claim Form is to claim a new solar market development tax credit certified by the Energy Minerals and Natural Resources Department EMNRD against personal or fiduciary income tax liability Section 7 2 18 31 NMSA 1978

Tax Credit ITC Sungenia Solar

NJ Solar Tax Credit Explained

Who Qualifies For Federal Tax Credit Leia Aqui Do I Qualify For

Solar Tax Credit Calculator NikiZsombor

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

New Mexico Solar Tax Credit 2022 Deafening Bloggers Pictures

New Mexico Solar Tax Credit 2022 Deafening Bloggers Pictures

How To File Solar Tax Credit IRS Form 5695 Green Ridge Solar