In this day and age with screens dominating our lives but the value of tangible printed items hasn't gone away. Be it for educational use in creative or artistic projects, or just adding a personal touch to your space, Nps Deduction Tax Benefit can be an excellent source. Here, we'll dive into the sphere of "Nps Deduction Tax Benefit," exploring their purpose, where to locate them, and the ways that they can benefit different aspects of your daily life.

Get Latest Nps Deduction Tax Benefit Below

Nps Deduction Tax Benefit

Nps Deduction Tax Benefit -

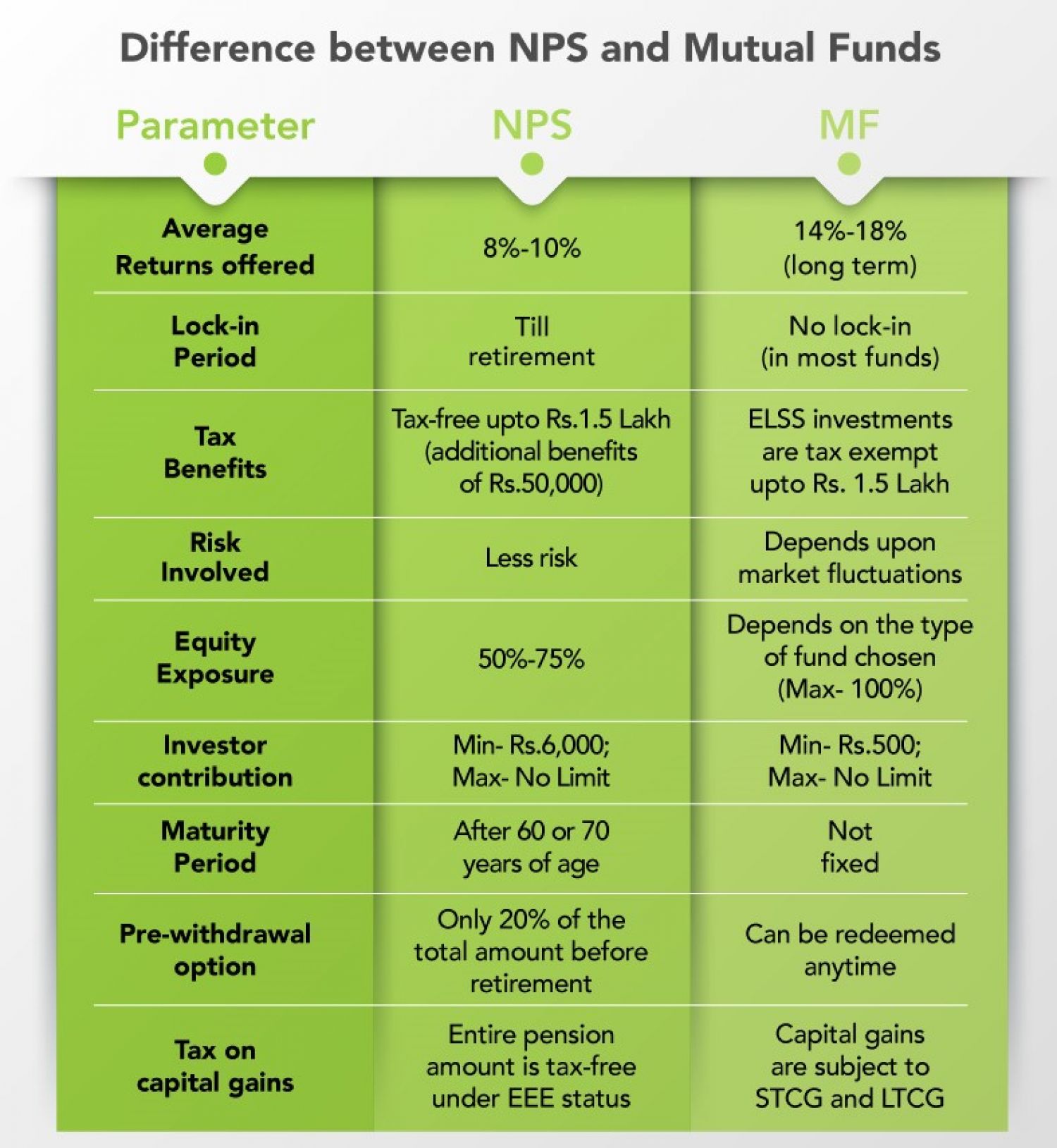

Here s our guide to make you understand all the tax benefits and exemptions related to NPS at length The contributions to NPS are tax deductible under 80CCD 1

Existing NPS subscribers can benefit from the deduction under Section 80CCD for their NPS contribution Section 80CCD 1 gives a tax deduction on NPS contributions up to 10 of their salary basic salary DA

Nps Deduction Tax Benefit encompass a wide range of printable, free resources available online for download at no cost. These resources come in various forms, like worksheets templates, coloring pages, and many more. The beauty of Nps Deduction Tax Benefit lies in their versatility and accessibility.

More of Nps Deduction Tax Benefit

Tax Benefit On NPS Save More Money

Tax Benefit On NPS Save More Money

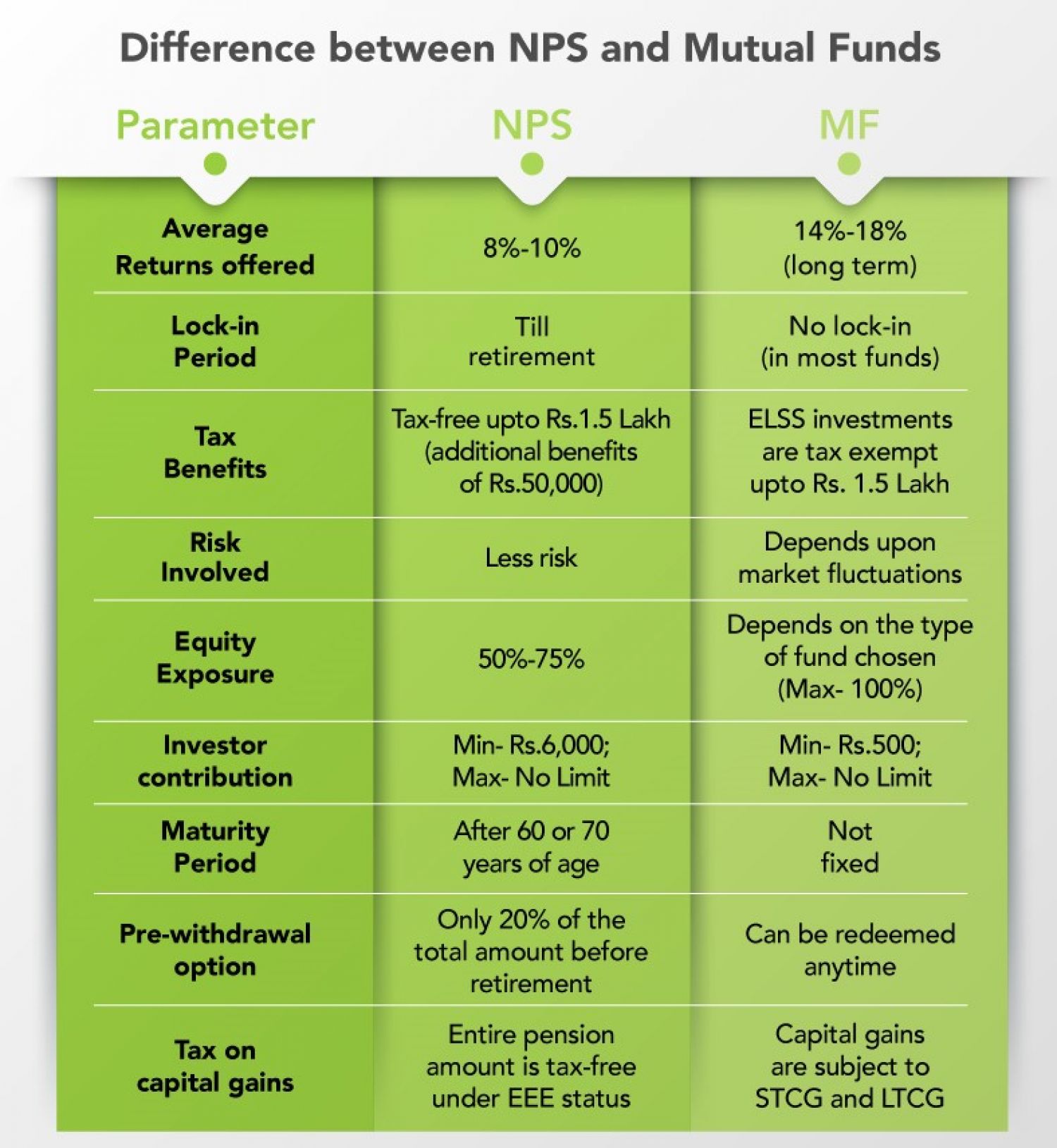

You can avail tax benefits for NPS under three sections of the Income tax Act 1961 in India Sections 80CCD 1 80CCD 1B and 80CCD 2 Now let s delve deeper into

Employer contributions to NPS are part of taxable salary and employees can claim deductions under 80CCD 1 80CCD 1B and 80CCD 2 Learn how to calculate deductions and maximize tax benefits with NPS

Printables for free have gained immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or expensive software.

-

customization: The Customization feature lets you tailor printables to fit your particular needs for invitations, whether that's creating them to organize your schedule or even decorating your home.

-

Educational Impact: These Nps Deduction Tax Benefit cater to learners of all ages, making them a valuable source for educators and parents.

-

Simple: The instant accessibility to a myriad of designs as well as templates cuts down on time and efforts.

Where to Find more Nps Deduction Tax Benefit

NPS Deduction Income Tax I NPS Tax Benefit I Deduction U s 80CCD YouTube

NPS Deduction Income Tax I NPS Tax Benefit I Deduction U s 80CCD YouTube

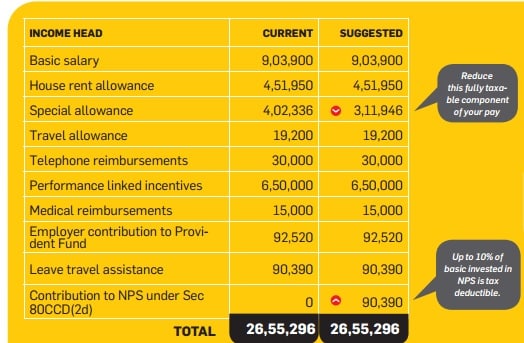

Under the updated tax regulations individuals can avail the advantage of employer contributions to their National Pension System NPS account as per Section 80CCD 2 of the Income Tax Act

What are the tax benefits of NPS Income Tax Act allows benefits under NPS as per the following sections On Employee s contribution Employee s own contribution is eligible for tax deduction

Since we've got your interest in printables for free, let's explore where you can get these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of printables that are free for a variety of purposes.

- Explore categories such as design, home decor, management, and craft.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets including flashcards, learning tools.

- Perfect for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for free.

- The blogs are a vast variety of topics, ranging from DIY projects to planning a party.

Maximizing Nps Deduction Tax Benefit

Here are some inventive ways that you can make use use of Nps Deduction Tax Benefit:

1. Home Decor

- Print and frame stunning art, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Utilize free printable worksheets to enhance your learning at home and in class.

3. Event Planning

- Design invitations, banners, and decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable planners with to-do lists, planners, and meal planners.

Conclusion

Nps Deduction Tax Benefit are a treasure trove filled with creative and practical information for a variety of needs and preferences. Their accessibility and versatility make them a great addition to every aspect of your life, both professional and personal. Explore the world of Nps Deduction Tax Benefit today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free gratis?

- Yes, they are! You can print and download these tools for free.

-

Can I download free printables to make commercial products?

- It's based on specific terms of use. Always read the guidelines of the creator before utilizing their templates for commercial projects.

-

Do you have any copyright issues when you download Nps Deduction Tax Benefit?

- Certain printables might have limitations in use. Always read the terms and condition of use as provided by the designer.

-

How do I print printables for free?

- You can print them at home using an printer, or go to the local print shops for superior prints.

-

What software do I require to open printables for free?

- The majority of printed documents are as PDF files, which is open with no cost software such as Adobe Reader.

Different Types Of National Pension Scheme Accounts And Tax Benefits

NPS Tax Benefits Know More About NPS Tax Deduction Alankit

Check more sample of Nps Deduction Tax Benefit below

NPS Tax Benefits How To Avail NPS Income Tax Benefits

NPS Deduction Under Income Tax Act NPS Tax Benefit U s 80ccd 1 80ccd

Change in salary nps save tax

Creating NPS Deduction Pay Head For Employees Payroll

How To Save Tax Via NPS By Investing Rs 50 000 Additionally B2b

Nps Contribution By Employee Werohmedia

https://cleartax.in/s/section-80-ccd-1b

Existing NPS subscribers can benefit from the deduction under Section 80CCD for their NPS contribution Section 80CCD 1 gives a tax deduction on NPS contributions up to 10 of their salary basic salary DA

https://npstrust.org.in/benefits-of-nps

Employees contributing to NPS are eligible for following tax benefits on their own contribution Tax deduction up to 10 of salary Basic DA under section 80 CCD 1 within the overall ceiling

Existing NPS subscribers can benefit from the deduction under Section 80CCD for their NPS contribution Section 80CCD 1 gives a tax deduction on NPS contributions up to 10 of their salary basic salary DA

Employees contributing to NPS are eligible for following tax benefits on their own contribution Tax deduction up to 10 of salary Basic DA under section 80 CCD 1 within the overall ceiling

Creating NPS Deduction Pay Head For Employees Payroll

NPS Deduction Under Income Tax Act NPS Tax Benefit U s 80ccd 1 80ccd

How To Save Tax Via NPS By Investing Rs 50 000 Additionally B2b

Nps Contribution By Employee Werohmedia

NPS Tax Benefits Explained I Deduction Under Section 80C 80CCD I Tax

Creating Employees NPS Deduction Pay Head

Creating Employees NPS Deduction Pay Head

Latest NPS Income Tax Benefits 2019 20 Tax Saving Through NPS