In the digital age, where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible printed material hasn't diminished. In the case of educational materials as well as creative projects or just adding an individual touch to your space, Nps Income Tax Benefit Section have become a valuable resource. For this piece, we'll take a dive into the world "Nps Income Tax Benefit Section," exploring their purpose, where they can be found, and how they can add value to various aspects of your daily life.

Get Latest Nps Income Tax Benefit Section Below

Nps Income Tax Benefit Section

Nps Income Tax Benefit Section -

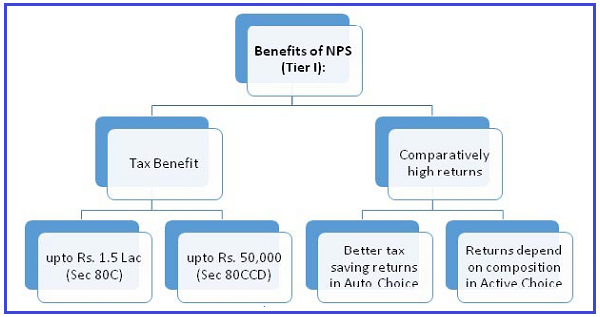

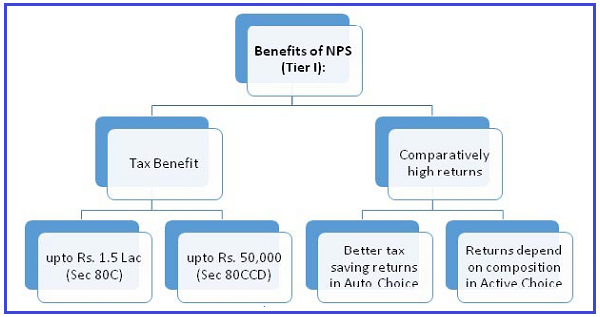

Income tax benefits for NPS You can claim tax deductions against NPS under three sections of the Income tax Act 1961 in India Sections 80CCD 1 80CCD 1B and 80CCD 2 under the old income tax regime Tax

NPS tax benefits apart from Section 80CCD include Partial withdrawals made under the NPS account are fully exempt Lumpsum withdrawal at age 60 is fully exempt 40 of the total NPS used to buy

Nps Income Tax Benefit Section offer a wide array of printable items that are available online at no cost. These printables come in different designs, including worksheets templates, coloring pages and many more. The value of Nps Income Tax Benefit Section is their flexibility and accessibility.

More of Nps Income Tax Benefit Section

NPS Deduction Income Tax I NPS Tax Benefit I Deduction U s 80CCD YouTube

NPS Deduction Income Tax I NPS Tax Benefit I Deduction U s 80CCD YouTube

What are the tax benefits of NPS Income Tax Act allows benefits under NPS as per the following sections On Employee s contribution Employee s own contribution is eligible for tax

Tax Benefits Under NPS As Per October 2024 The contributions to NPS are tax deductible under 80CCD 1 Section 80CCD 1B and Section 80CCD 2 of the Indian Income Tax Act 1961

Printables that are free have gained enormous popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

Individualization The Customization feature lets you tailor printing templates to your own specific requirements when it comes to designing invitations or arranging your schedule or decorating your home.

-

Education Value Education-related printables at no charge offer a wide range of educational content for learners of all ages, which makes them an essential tool for parents and teachers.

-

Convenience: instant access numerous designs and templates cuts down on time and efforts.

Where to Find more Nps Income Tax Benefit Section

NPS Subscribers Can Claim This Income Tax Benefit Even After Opting New

NPS Subscribers Can Claim This Income Tax Benefit Even After Opting New

Tax benefits on NPS are available through 3 sections 80CCD 1 80CCD 2 and 80CCD 1B All the tax benefits annuity restrictions exit and withdrawal rules are applicable to NPS Tier I account only NPS Tier II

Tax Benefits On NPS Tier 1 And Tier 2 returns You should be aware of the following NPS tier 1 and tier 2 tax benefits while investing Under Section 80CCE all NPS Tier

We hope we've stimulated your curiosity about Nps Income Tax Benefit Section we'll explore the places they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of printables that are free for a variety of needs.

- Explore categories like decoration for your home, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing including flashcards, learning tools.

- Perfect for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates free of charge.

- The blogs are a vast variety of topics, all the way from DIY projects to party planning.

Maximizing Nps Income Tax Benefit Section

Here are some creative ways in order to maximize the use use of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, or festive decorations to decorate your living areas.

2. Education

- Print out free worksheets and activities to reinforce learning at home either in the schoolroom or at home.

3. Event Planning

- Designs invitations, banners and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars or to-do lists. meal planners.

Conclusion

Nps Income Tax Benefit Section are an abundance of practical and imaginative resources designed to meet a range of needs and needs and. Their access and versatility makes them a great addition to both personal and professional life. Explore the many options of Nps Income Tax Benefit Section to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Nps Income Tax Benefit Section really for free?

- Yes they are! You can print and download these resources at no cost.

-

Can I make use of free printables in commercial projects?

- It is contingent on the specific conditions of use. Always verify the guidelines provided by the creator before using printables for commercial projects.

-

Are there any copyright issues in Nps Income Tax Benefit Section?

- Some printables may come with restrictions on their use. Check these terms and conditions as set out by the author.

-

How can I print Nps Income Tax Benefit Section?

- You can print them at home with printing equipment or visit a local print shop to purchase high-quality prints.

-

What program will I need to access printables at no cost?

- Most PDF-based printables are available in the format of PDF, which can be opened with free software such as Adobe Reader.

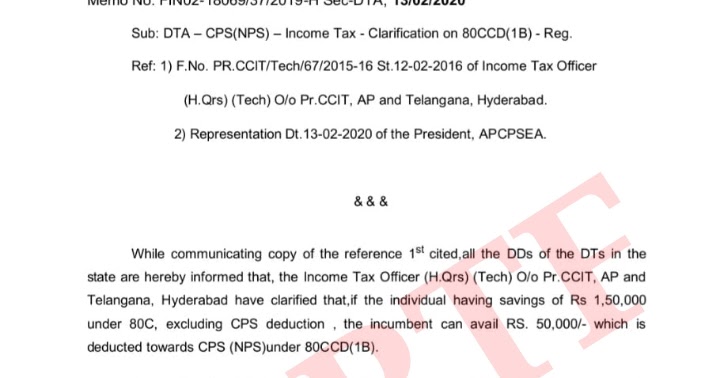

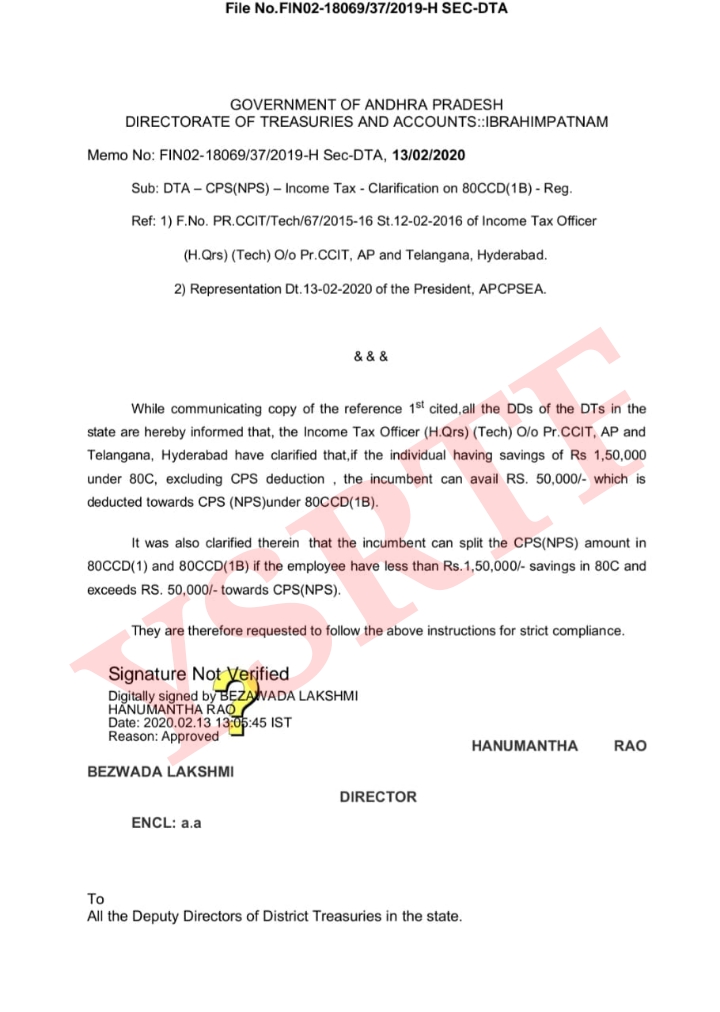

CPS NPS Income Tax Clarification On 80CCD 1B Memo No

NPS Tax Benefit Under Sec 80CCD 1b Of Rs 50 000 Business HimSky

-50000.jpg)

Check more sample of Nps Income Tax Benefit Section below

Section 80CCD 1B Deduction NPS Scheme Tax Benefits Alankit

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

Employer s NPS Contribution Of 14 For State And Central Government

Latest NPS Income Tax Benefits 2019 20 Tax Saving Through NPS

CPS NPS Income Tax Clarification On 80CCD 1B Memo No

NPS Invest Rs 5000 Per Month Get Rs 2 Lakh Monthly Pension From THIS

https://www.etmoney.com/learn/nps/np…

NPS tax benefits apart from Section 80CCD include Partial withdrawals made under the NPS account are fully exempt Lumpsum withdrawal at age 60 is fully exempt 40 of the total NPS used to buy

https://npstrust.org.in/benefits-of-nps

Tax Benefits under NPS Open NPS Account Now Tax benefits to employees on Self Contribution Employees contributing to NPS are eligible for following tax benefits on their own

NPS tax benefits apart from Section 80CCD include Partial withdrawals made under the NPS account are fully exempt Lumpsum withdrawal at age 60 is fully exempt 40 of the total NPS used to buy

Tax Benefits under NPS Open NPS Account Now Tax benefits to employees on Self Contribution Employees contributing to NPS are eligible for following tax benefits on their own

Latest NPS Income Tax Benefits 2019 20 Tax Saving Through NPS

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

CPS NPS Income Tax Clarification On 80CCD 1B Memo No

NPS Invest Rs 5000 Per Month Get Rs 2 Lakh Monthly Pension From THIS

Nps Contribution By Employee Werohmedia

TAX BENEFIT OF NPS SIMPLE TAX INDIA

TAX BENEFIT OF NPS SIMPLE TAX INDIA

NPS Tax Benefit Under Section 80CCD 1 80CCD 2 And 80CCD 1B