In this age of electronic devices, where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible printed material hasn't diminished. In the case of educational materials such as creative projects or simply to add some personal flair to your area, Nps Tax Benefit 80ccd 2 are a great source. Here, we'll dive into the world "Nps Tax Benefit 80ccd 2," exploring their purpose, where they are available, and how they can be used to enhance different aspects of your lives.

Get Latest Nps Tax Benefit 80ccd 2 Below

Nps Tax Benefit 80ccd 2

Nps Tax Benefit 80ccd 2 -

If your employer contributes to your NPS account your employer gets a tax benefit under section 80CCD 2 This tax benefit is limited to 20 of the total income of the employer in the previous year Sections 80CCD1 and 2 fall under the larger section 80CCD of the Income Tax Act 1961

Section 80CCD relates to the tax deduction for the contributions made in the National Pension System NPS and the Atal Pension Yojana APY Under this section you can claim a deduction of up to 2 lakh in a financial year apart from the employer s contribution as detailed below

Nps Tax Benefit 80ccd 2 include a broad assortment of printable, downloadable materials available online at no cost. The resources are offered in a variety styles, from worksheets to templates, coloring pages, and more. The benefit of Nps Tax Benefit 80ccd 2 is in their versatility and accessibility.

More of Nps Tax Benefit 80ccd 2

NPS Tax Benefits How To Avail NPS Income Tax Benefits

NPS Tax Benefits How To Avail NPS Income Tax Benefits

Tax benefits to employees on Self Contribution Employees contributing to NPS are eligible for following tax benefits on their own contribution Tax deduction up to 10 of salary Basic DA under section 80 CCD 1 within the overall ceiling of

Employer contributions to NPS are part of taxable salary and employees can claim deductions under 80CCD 1 80CCD 1B and 80CCD 2 Learn how to calculate deductions and maximize tax benefits with NPS

Nps Tax Benefit 80ccd 2 have gained a lot of popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or costly software.

-

customization: This allows you to modify printables to fit your particular needs for invitations, whether that's creating them or arranging your schedule or even decorating your house.

-

Educational Value: These Nps Tax Benefit 80ccd 2 can be used by students of all ages. This makes them a valuable aid for parents as well as educators.

-

Simple: You have instant access a myriad of designs as well as templates saves time and effort.

Where to Find more Nps Tax Benefit 80ccd 2

NPS Deduction Income Tax I NPS Tax Benefit I Deduction U s 80CCD YouTube

NPS Deduction Income Tax I NPS Tax Benefit I Deduction U s 80CCD YouTube

What are the tax benefits of NPS Income Tax Act allows benefits under NPS as per the following sections On Employee s contribution Employee s own contribution is eligible for tax deduction under sec 80 CCD 1 of Income Tax Act up to 10 of salary Basic DA

Section 80CCD offers income tax deductions on contributions to the National Pension Scheme NPS and the Atal Pension Yojana APY The section covers NPS contributions made by employees and employers and is categorised into two sub sections Sections 80CCD 1 and 80CCD 2

Now that we've piqued your interest in Nps Tax Benefit 80ccd 2 Let's look into where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety with Nps Tax Benefit 80ccd 2 for all goals.

- Explore categories like the home, decor, crafting, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets along with flashcards, as well as other learning materials.

- The perfect resource for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates free of charge.

- These blogs cover a wide range of topics, ranging from DIY projects to party planning.

Maximizing Nps Tax Benefit 80ccd 2

Here are some creative ways that you can make use use of Nps Tax Benefit 80ccd 2:

1. Home Decor

- Print and frame stunning artwork, quotes as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print worksheets that are free to enhance learning at home, or even in the classroom.

3. Event Planning

- Make invitations, banners and other decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable planners as well as to-do lists and meal planners.

Conclusion

Nps Tax Benefit 80ccd 2 are a treasure trove of creative and practical resources which cater to a wide range of needs and preferences. Their availability and versatility make them a wonderful addition to the professional and personal lives of both. Explore the vast collection of Nps Tax Benefit 80ccd 2 today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free for free?

- Yes, they are! You can print and download these tools for free.

-

Can I utilize free printables for commercial uses?

- It is contingent on the specific terms of use. Be sure to read the rules of the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright issues with printables that are free?

- Certain printables could be restricted regarding usage. Make sure you read these terms and conditions as set out by the author.

-

How do I print printables for free?

- Print them at home with either a printer or go to an area print shop for better quality prints.

-

What software must I use to open printables at no cost?

- The majority of printed documents are as PDF files, which is open with no cost software, such as Adobe Reader.

Section 80CCD 1B Deduction NPS Scheme Tax Benefits Alankit

NPS Tax Benefit Under Sec 80CCD 1b Of Rs 50 000 Business HimSky

-50000.jpg)

Check more sample of Nps Tax Benefit 80ccd 2 below

NPS Deduction Under Income Tax Act NPS Tax Benefit U s 80ccd 1 80ccd

NPS Tax Benefit U s 80ccd1 80ccd2 And 80ccd 1b NPS Tax Benefits

Know That These Rules Of NPS Are Different For Government And Private

NPS Income Tax Benefits FY 2020 21 Old New Tax Regimes

Nps Tax Benefit U s 80ccd 1 80ccd 2 And 80ccd 1b Tax Benefits

NPS Tax Benefits Explained I Deduction Under Section 80C 80CCD I Tax

https://www.etmoney.com/learn/income-tax/section-80ccd-deductions

Section 80CCD relates to the tax deduction for the contributions made in the National Pension System NPS and the Atal Pension Yojana APY Under this section you can claim a deduction of up to 2 lakh in a financial year apart from the employer s contribution as detailed below

https://www.taxbuddy.com/blog/section-80ccd1-and-80ccd2

Understand Section 80CCD 1 and 80CCD 2 of the Income Tax Act covering tax deductions for contributions to the National Pension System NPS Learn about eligibility limits and benefits

Section 80CCD relates to the tax deduction for the contributions made in the National Pension System NPS and the Atal Pension Yojana APY Under this section you can claim a deduction of up to 2 lakh in a financial year apart from the employer s contribution as detailed below

Understand Section 80CCD 1 and 80CCD 2 of the Income Tax Act covering tax deductions for contributions to the National Pension System NPS Learn about eligibility limits and benefits

NPS Income Tax Benefits FY 2020 21 Old New Tax Regimes

NPS Tax Benefit U s 80ccd1 80ccd2 And 80ccd 1b NPS Tax Benefits

Nps Tax Benefit U s 80ccd 1 80ccd 2 And 80ccd 1b Tax Benefits

NPS Tax Benefits Explained I Deduction Under Section 80C 80CCD I Tax

How To Save Tax Via NPS By Investing Rs 50 000 Additionally B2b

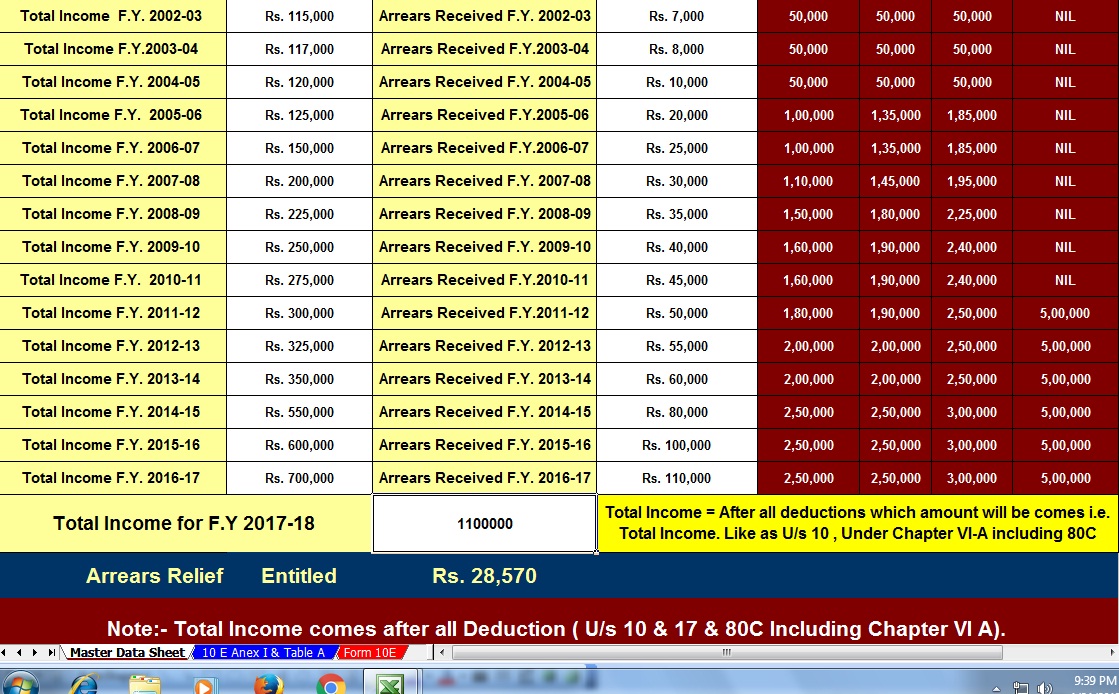

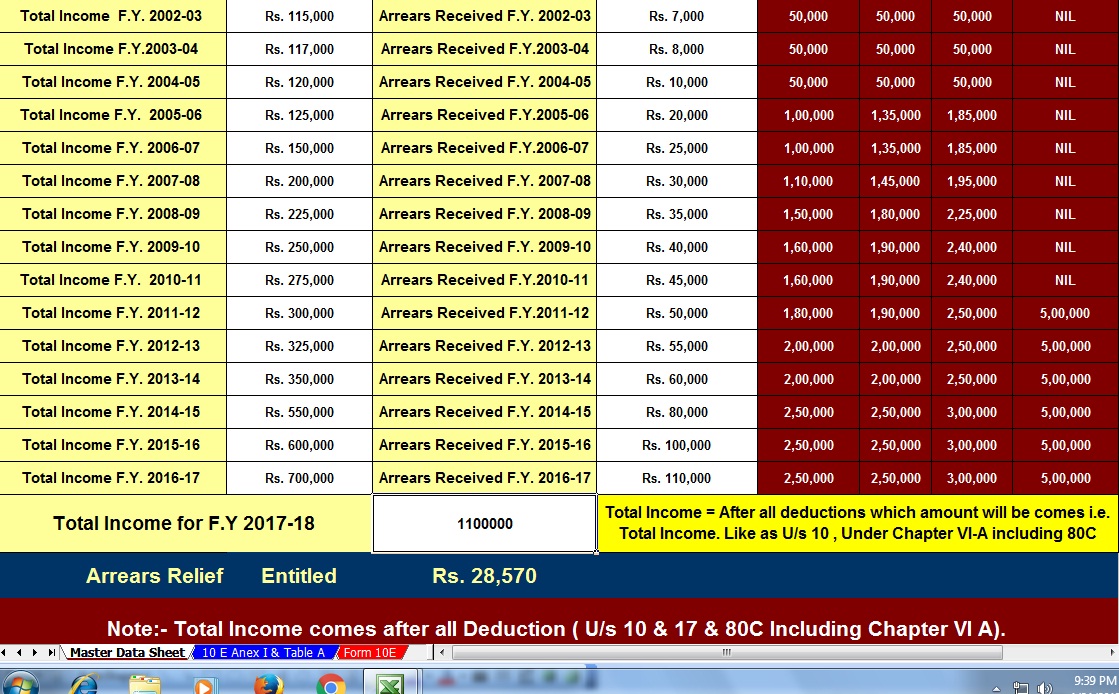

NPS Tax Benefits Sec 80CCD 1 80CCD 2 And 80CCD 1B With Automated

NPS Tax Benefits Sec 80CCD 1 80CCD 2 And 80CCD 1B With Automated

NPS Tax Benefit Under Section 80CCD 1 80CCD 2 And 80CCD 1B