Today, when screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed products hasn't decreased. Whether it's for educational purposes for creative projects, simply adding some personal flair to your area, Nps Tax Benefit Under Section 80c are a great source. In this article, we'll take a dive into the sphere of "Nps Tax Benefit Under Section 80c," exploring the benefits of them, where they are available, and what they can do to improve different aspects of your daily life.

Get Latest Nps Tax Benefit Under Section 80c Below

Nps Tax Benefit Under Section 80c

Nps Tax Benefit Under Section 80c -

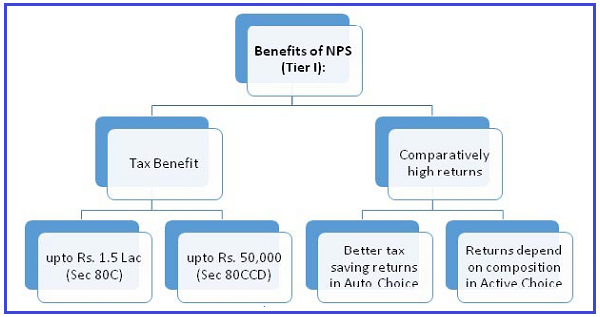

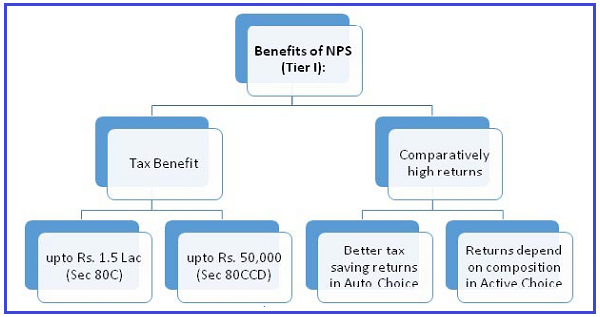

Verkko 20 syysk 2022 nbsp 0183 32 The second is Section 80CCD 1B which is an additional tax benefit only given to NPS investors Under this section one can claim deductions for investment in NPS for up to Rs 50 000 This is over and above the Section 80C deductions In other words one can claim a tax deduction of up to Rs 2 lakh by simply investing in NPS

Verkko 30 tammik 2023 nbsp 0183 32 Mandatory Own Contribution NPS subscribers are eligible to claim tax benefits up to INR 1 5 lakh under Section 80C Additional Contribution NPS subscribers also have an option to claim further

Nps Tax Benefit Under Section 80c cover a large assortment of printable, downloadable material that is available online at no cost. They are available in a variety of kinds, including worksheets templates, coloring pages and much more. The appeal of printables for free lies in their versatility and accessibility.

More of Nps Tax Benefit Under Section 80c

TAX Benefits On NPS YouTube

TAX Benefits On NPS YouTube

Verkko Tax Benefits of NPS The NPS has its share of income tax benefits both at the time of making contributions and at the time of withdrawal on maturity Individual taxpayers can claim deduction on contributions under Tier I NPS up to Rs 1 5 lakh in a financial year under Section 80C

Verkko 7 huhtik 2023 nbsp 0183 32 The taxpayers must be within the age bracket of 18 to 60 years to get the tax benefit under section 80CCD 1 The following limits apply to the deduction available The total amount of deduction is limited to Rs 1 5 lakh including the deductions claimed under section 80C

Nps Tax Benefit Under Section 80c have garnered immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or costly software.

-

Modifications: The Customization feature lets you tailor designs to suit your personal needs for invitations, whether that's creating them making your schedule, or even decorating your home.

-

Educational Use: Educational printables that can be downloaded for free can be used by students of all ages, making these printables a powerful source for educators and parents.

-

An easy way to access HTML0: The instant accessibility to various designs and templates can save you time and energy.

Where to Find more Nps Tax Benefit Under Section 80c

NPS Tax Benefit Under Sec 80CCD 1b Of Rs 50 000 Business HimSky

-50000.jpg)

NPS Tax Benefit Under Sec 80CCD 1b Of Rs 50 000 Business HimSky

Verkko 21 marrask 2023 nbsp 0183 32 Firstly tax deductions of up to 50 000 can be claimed per year over and above the ceiling of 1 5 lakh that an individual is eligible for under section 80C of the income tax Act

Verkko 21 marrask 2023 nbsp 0183 32 Employers can claim a tax benefit for contributing to the National Pension System NPS under Section 80CCD 2 of the Income Tax Act

Now that we've piqued your curiosity about Nps Tax Benefit Under Section 80c Let's look into where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection with Nps Tax Benefit Under Section 80c for all motives.

- Explore categories such as decorating your home, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. materials.

- Ideal for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates free of charge.

- These blogs cover a broad range of interests, everything from DIY projects to party planning.

Maximizing Nps Tax Benefit Under Section 80c

Here are some ideas of making the most of printables that are free:

1. Home Decor

- Print and frame beautiful images, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Print out free worksheets and activities to enhance your learning at home either in the schoolroom or at home.

3. Event Planning

- Make invitations, banners as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Keep track of your schedule with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Nps Tax Benefit Under Section 80c are an abundance of practical and imaginative resources which cater to a wide range of needs and passions. Their accessibility and versatility make them a wonderful addition to both professional and personal life. Explore the many options of Nps Tax Benefit Under Section 80c today to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really absolutely free?

- Yes you can! You can download and print these tools for free.

-

Can I make use of free templates for commercial use?

- It's all dependent on the usage guidelines. Always review the terms of use for the creator before using any printables on commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Some printables could have limitations on usage. Check these terms and conditions as set out by the author.

-

How can I print printables for free?

- You can print them at home using the printer, or go to an in-store print shop to get the highest quality prints.

-

What software is required to open printables free of charge?

- The majority are printed in the PDF format, and is open with no cost programs like Adobe Reader.

Will All Kinds Of Tuition Fees Qualify For Tax Benefit Under Section

How To Save Tax Via NPS By Investing Rs 50 000 Additionally B2b

Check more sample of Nps Tax Benefit Under Section 80c below

Unlock The Term Insurance Tax Benefit Under Section 80C 80D Loan Papa

NPS TAX Benefit U s 80C 80CCD1 80CCD1B 80CCD2 Tax Benefit

Income Tax Return ITR Filing EPF Gives You Tax Benefit Under Section

NPS Tax Benefits Explained I Deduction Under Section 80C 80CCD I Tax

NPS Tax Benefit Under Section 80CCD 1 80CCD 2 And 80CCD 1B

TAX BENEFIT OF NPS SIMPLE TAX INDIA

https://www.forbes.com/advisor/in/retirement/nps-tax-benefit

Verkko 30 tammik 2023 nbsp 0183 32 Mandatory Own Contribution NPS subscribers are eligible to claim tax benefits up to INR 1 5 lakh under Section 80C Additional Contribution NPS subscribers also have an option to claim further

https://taxguru.in/income-tax/income-tax-benefits-national-pension...

Verkko 1 syysk 2020 nbsp 0183 32 Below are the tax benefits available under section 80CCD 1 a The maximum tax deductions allowed is Rs 1 50 000 This limit is inclusive of section 80C limit b In case of salaried individual the maximum deduction cannot exceed 14 of salary of Individual employed by the Central Government on or after 01 01 2004

Verkko 30 tammik 2023 nbsp 0183 32 Mandatory Own Contribution NPS subscribers are eligible to claim tax benefits up to INR 1 5 lakh under Section 80C Additional Contribution NPS subscribers also have an option to claim further

Verkko 1 syysk 2020 nbsp 0183 32 Below are the tax benefits available under section 80CCD 1 a The maximum tax deductions allowed is Rs 1 50 000 This limit is inclusive of section 80C limit b In case of salaried individual the maximum deduction cannot exceed 14 of salary of Individual employed by the Central Government on or after 01 01 2004

NPS Tax Benefits Explained I Deduction Under Section 80C 80CCD I Tax

NPS TAX Benefit U s 80C 80CCD1 80CCD1B 80CCD2 Tax Benefit

NPS Tax Benefit Under Section 80CCD 1 80CCD 2 And 80CCD 1B

TAX BENEFIT OF NPS SIMPLE TAX INDIA

Section 80D Income Tax Act Dialabank Best Offers

Tax Saving Options Other Than 80C Online Demat Trading And Mutual

Tax Saving Options Other Than 80C Online Demat Trading And Mutual

Section 80d Of Income Tax Act Ay 2020 21 Worthen Althiche