In this age of technology, where screens have become the dominant feature of our lives, the charm of tangible printed items hasn't gone away. If it's to aid in education in creative or artistic projects, or just adding an element of personalization to your home, printables for free have proven to be a valuable resource. The following article is a dive to the depths of "Nps Tax Free Limit," exploring the benefits of them, where you can find them, and how they can be used to enhance different aspects of your lives.

Get Latest Nps Tax Free Limit Below

Nps Tax Free Limit

Nps Tax Free Limit -

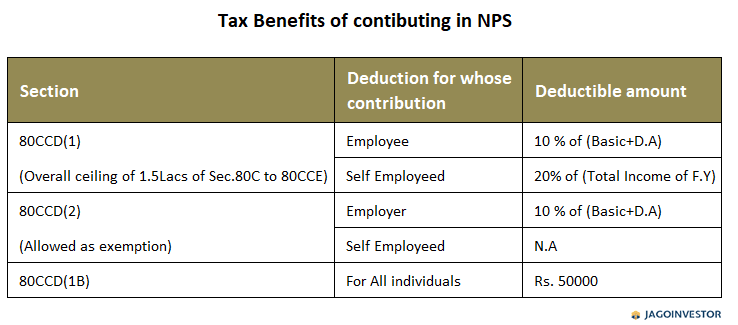

Tax Benefits Under NPS As Per October 2024 The contributions to NPS are tax deductible under 80CCD 1 Section 80CCD 1B and Section 80CCD 2 of the Indian Income Tax Act 1961

Is NPS tax free on maturity Yes Up to 60 of the corpus at maturity can be withdrawn directly into your bank account without any taxes The remaining tax free 40 invested in annuities is also exempt from tax

Nps Tax Free Limit encompass a wide collection of printable material that is available online at no cost. These printables come in different forms, like worksheets coloring pages, templates and many more. The value of Nps Tax Free Limit is their flexibility and accessibility.

More of Nps Tax Free Limit

Nps Contribution By Employee Werohmedia

Nps Contribution By Employee Werohmedia

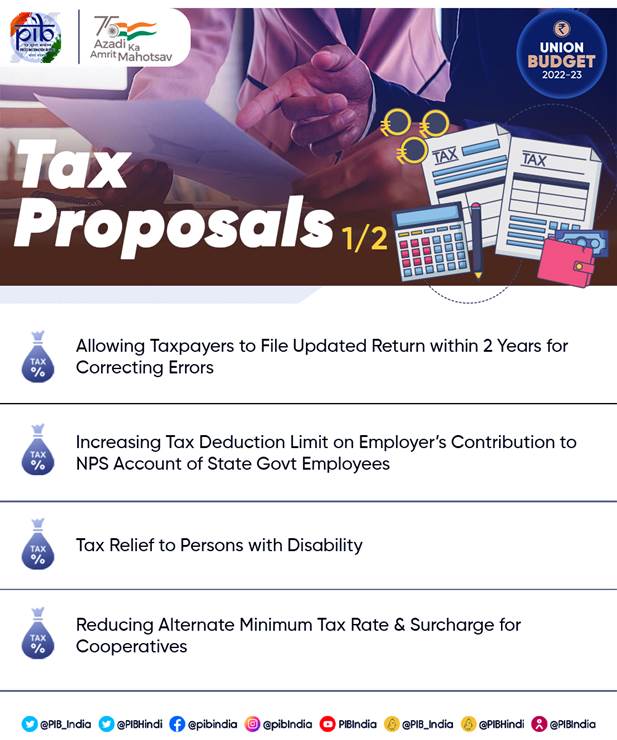

The deduction under Section 80CCD 2 is set to be raised from 10 to 14 of the basic salary This section permits you to contribute up to 10 of your basic pay to NPS tax free

In this case up to 60 of your corpus amount is exempt from tax under Section 10 of the Income Tax Act Under this act NPS tax saving can be availed if 60 of the accrued NPS funds are

Printables for free have gained immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

customization: Your HTML0 customization options allow you to customize designs to suit your personal needs be it designing invitations making your schedule, or even decorating your house.

-

Educational Impact: Printing educational materials for no cost offer a wide range of educational content for learners of all ages. This makes them a valuable tool for parents and educators.

-

Simple: The instant accessibility to a plethora of designs and templates, which saves time as well as effort.

Where to Find more Nps Tax Free Limit

What Is Dcps Nps Yojana Login Pages Info

What Is Dcps Nps Yojana Login Pages Info

NPS Tier 1 account is eligible for superannuation i e maturity after the NPS subscriber is 60 years old Withdrawals made after superannuation can be up to 60 of the Tier 1 account balance and this amount is tax free as per Section

The minimum contribution to NPS Vatsalya is Rs 1 000 per annum and there is no limit on the maximum contribution The initial enrollment contribution to NPS Vatsalya is

We've now piqued your interest in Nps Tax Free Limit Let's take a look at where they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of Nps Tax Free Limit to suit a variety of applications.

- Explore categories like decoration for your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets Flashcards, worksheets, and other educational tools.

- Ideal for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates free of charge.

- The blogs are a vast selection of subjects, including DIY projects to planning a party.

Maximizing Nps Tax Free Limit

Here are some innovative ways for you to get the best of Nps Tax Free Limit:

1. Home Decor

- Print and frame beautiful artwork, quotes or other seasonal decorations to fill your living areas.

2. Education

- Use free printable worksheets for teaching at-home, or even in the classroom.

3. Event Planning

- Make invitations, banners and other decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Nps Tax Free Limit are a treasure trove of useful and creative resources for a variety of needs and interests. Their access and versatility makes them an invaluable addition to both professional and personal life. Explore the vast world of Nps Tax Free Limit now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Nps Tax Free Limit truly available for download?

- Yes, they are! You can download and print these resources at no cost.

-

Can I use free printouts for commercial usage?

- It depends on the specific usage guidelines. Always check the creator's guidelines prior to utilizing the templates for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Some printables could have limitations in their usage. Be sure to review these terms and conditions as set out by the creator.

-

How can I print Nps Tax Free Limit?

- Print them at home with your printer or visit a local print shop for high-quality prints.

-

What program is required to open printables for free?

- The majority of printed documents are in the format PDF. This can be opened with free software such as Adobe Reader.

Income Tax Slabs 2022 23 LIVE Updates Will Sitharaman Give Much Needed

Tax Deduction Limit Increased To 14 On Employers Contribution To NPS

Check more sample of Nps Tax Free Limit below

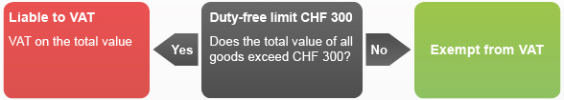

Value Added Tax VAT CHF 300 Tax free Limit

NPS Income Tax Benefits FY 2020 21 Old New Tax Regimes

NPS Tax Benefits Compare Apply Loans Credit Cards In India

NPS Tax Benefits As Per The New Tax Regime And Old Tax Regime Fintoo Blog

NPS Tax Free EEE Exemption 2019 Beneficial To You Paisa Health

NPS Tax free Withdrawal Raised To 60 Pct Other Tax Benefits For Employees

https://www.etmoney.com/learn/nps/np…

Is NPS tax free on maturity Yes Up to 60 of the corpus at maturity can be withdrawn directly into your bank account without any taxes The remaining tax free 40 invested in annuities is also exempt from tax

https://npstrust.org.in/benefits-of-nps

Employees contributing to NPS are eligible for following tax benefits on their own contribution Tax deduction up to 10 of salary Basic DA under section 80 CCD 1 within the overall ceiling

Is NPS tax free on maturity Yes Up to 60 of the corpus at maturity can be withdrawn directly into your bank account without any taxes The remaining tax free 40 invested in annuities is also exempt from tax

Employees contributing to NPS are eligible for following tax benefits on their own contribution Tax deduction up to 10 of salary Basic DA under section 80 CCD 1 within the overall ceiling

NPS Tax Benefits As Per The New Tax Regime And Old Tax Regime Fintoo Blog

NPS Income Tax Benefits FY 2020 21 Old New Tax Regimes

NPS Tax Free EEE Exemption 2019 Beneficial To You Paisa Health

NPS Tax free Withdrawal Raised To 60 Pct Other Tax Benefits For Employees

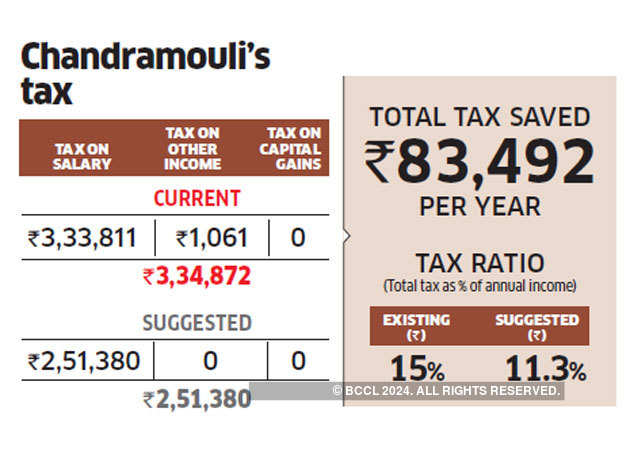

Save Income Tax Tax Optimiser Chandramouli Can Cut Tax By Rs 83 000

NPS National Pension Scheme Tax Saving Benefit And Retirement Plan

NPS National Pension Scheme Tax Saving Benefit And Retirement Plan

Regarding Government s Contribution Of NPS Income Tax