Today, where screens rule our lives, the charm of tangible printed materials isn't diminishing. No matter whether it's for educational uses and creative work, or just adding personal touches to your space, Nps Tier 1 Eligible For Tax Benefit are now a useful source. This article will dive in the world of "Nps Tier 1 Eligible For Tax Benefit," exploring their purpose, where they are, and how they can add value to various aspects of your daily life.

Get Latest Nps Tier 1 Eligible For Tax Benefit Below

Nps Tier 1 Eligible For Tax Benefit

Nps Tier 1 Eligible For Tax Benefit -

NPS Tier I tax benefits As mentioned earlier you get the benefits of NPS tier 1 by investing in a Tier I Account of the NPS scheme These benefits are as follows Investment up to Rs 1 5

Employees contributing to NPS are eligible for following tax benefits on their own contribution Tax deduction up to 10 of salary Basic DA under section 80 CCD 1 within the overall

Nps Tier 1 Eligible For Tax Benefit include a broad assortment of printable materials that are accessible online for free cost. These resources come in various forms, including worksheets, templates, coloring pages, and much more. The beauty of Nps Tier 1 Eligible For Tax Benefit is in their versatility and accessibility.

More of Nps Tier 1 Eligible For Tax Benefit

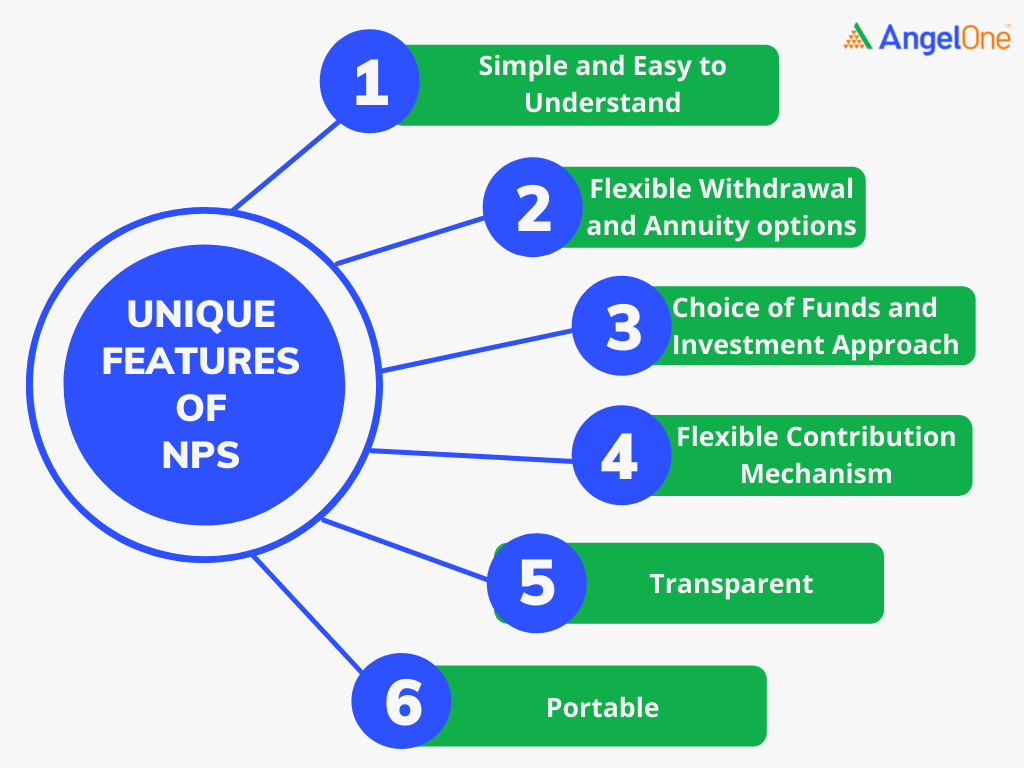

NPS All You Need To Know Angel One

NPS All You Need To Know Angel One

Learn how to claim tax deductions for National Pension System NPS under three sections of the Income tax Act 1961 in India Sections 80CCD 1 80CCD 1B and 80CCD

Both salaried and self employed NPS account holders with an investment of up to Rs 50 000 qualify for an additional tax exemption under Section 80CCD 1B of the Income Tax Act

Print-friendly freebies have gained tremendous popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the need to buy physical copies or expensive software.

-

Flexible: You can tailor print-ready templates to your specific requirements when it comes to designing invitations, organizing your schedule, or decorating your home.

-

Educational value: These Nps Tier 1 Eligible For Tax Benefit offer a wide range of educational content for learners of all ages. This makes them an invaluable source for educators and parents.

-

The convenience of The instant accessibility to a myriad of designs as well as templates can save you time and energy.

Where to Find more Nps Tier 1 Eligible For Tax Benefit

nps How To Withdrawal NPS 25 Amount To Tier 1 Account Online

nps How To Withdrawal NPS 25 Amount To Tier 1 Account Online

NPS Tier 1 Tax Benefits Investments in NPS Tier 1 make you eligible to get various tax benefits Here is a breakdown of the tax benefits of NPS Tier 1 According to the

Contributions to NPS Tier 1 accounts are eligible for a tax deduction up to Rs 1 5 lakh per annum Additionally an extra deduction of Rs 50 000 is available under Section

If we've already piqued your curiosity about Nps Tier 1 Eligible For Tax Benefit, let's explore where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of Nps Tier 1 Eligible For Tax Benefit to suit a variety of applications.

- Explore categories such as design, home decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing, flashcards, and learning materials.

- Perfect for teachers, parents as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers share their innovative designs as well as templates for free.

- The blogs are a vast range of topics, ranging from DIY projects to party planning.

Maximizing Nps Tier 1 Eligible For Tax Benefit

Here are some ideas for you to get the best use of Nps Tier 1 Eligible For Tax Benefit:

1. Home Decor

- Print and frame gorgeous art, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Use these printable worksheets free of charge to reinforce learning at home or in the classroom.

3. Event Planning

- Make invitations, banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Get organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Nps Tier 1 Eligible For Tax Benefit are an abundance of useful and creative resources for a variety of needs and interest. Their access and versatility makes them a wonderful addition to any professional or personal life. Explore the vast world of Nps Tier 1 Eligible For Tax Benefit to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really cost-free?

- Yes they are! You can print and download the resources for free.

-

Can I download free printouts for commercial usage?

- It's based on specific rules of usage. Always review the terms of use for the creator prior to using the printables in commercial projects.

-

Are there any copyright problems with Nps Tier 1 Eligible For Tax Benefit?

- Certain printables could be restricted in use. Check the terms of service and conditions provided by the author.

-

How can I print Nps Tier 1 Eligible For Tax Benefit?

- You can print them at home with your printer or visit an in-store print shop to get the highest quality prints.

-

What software must I use to open Nps Tier 1 Eligible For Tax Benefit?

- A majority of printed materials are in PDF format, which can be opened with free software such as Adobe Reader.

NPS Tier 1 Annuity Service Provider NPS And

National Pension Scheme NPS Scheme NPS Tier 1 And Tier 2 NPS Tax

Check more sample of Nps Tier 1 Eligible For Tax Benefit below

NPS Tier 1 Vs Tier 2 Check Eligibility Tax Benefits

Additional Tax Saving On 50000 Should You Invest In NPS Tier 1 For

NPS Tier 1 Its Features And Difference Between NPS Tier 1 And Tier 2

NPS Tier 1 Vs Tier 2 Account Eligibility Tax Benefits Withdrawal

NPS Tier II Account Income Tax Benefits Certiom Consultants

Similarities And Difference Between NPS Tier 1 And Tier 2

https://npstrust.org.in › benefits-of-nps

Employees contributing to NPS are eligible for following tax benefits on their own contribution Tax deduction up to 10 of salary Basic DA under section 80 CCD 1 within the overall

https://www.livemint.com › money › pers…

Learn how to manage your NPS Tier 1 account under the new tax regime announced in Budget 2023 Compare the deduction limits and eligibility criteria for individual and employer

Employees contributing to NPS are eligible for following tax benefits on their own contribution Tax deduction up to 10 of salary Basic DA under section 80 CCD 1 within the overall

Learn how to manage your NPS Tier 1 account under the new tax regime announced in Budget 2023 Compare the deduction limits and eligibility criteria for individual and employer

NPS Tier 1 Vs Tier 2 Account Eligibility Tax Benefits Withdrawal

Additional Tax Saving On 50000 Should You Invest In NPS Tier 1 For

NPS Tier II Account Income Tax Benefits Certiom Consultants

Similarities And Difference Between NPS Tier 1 And Tier 2

Which NPS Fund Manager Is Best For You Paisabazaar

NPS National Pension System NPS Scheme NPS Calculator NPS Tier

NPS National Pension System NPS Scheme NPS Calculator NPS Tier

NPS Tax Benefits Compare Apply Loans Credit Cards In India