In this day and age with screens dominating our lives The appeal of tangible printed material hasn't diminished. Be it for educational use for creative projects, simply to add an individual touch to the home, printables for free have become an invaluable source. With this guide, you'll dive deeper into "Nps Tier 2 Tax Benefit For Government Employees," exploring the different types of printables, where to find them, and the ways that they can benefit different aspects of your daily life.

Get Latest Nps Tier 2 Tax Benefit For Government Employees Below

Nps Tier 2 Tax Benefit For Government Employees

Nps Tier 2 Tax Benefit For Government Employees -

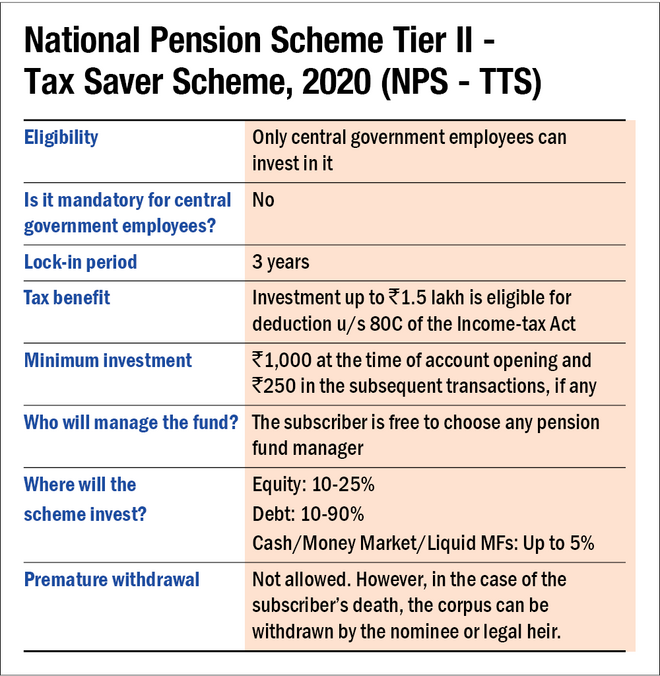

The deposits made in the NPS Tier II accounts are eligible for an income tax deduction under Section 80C of the Income Tax Act for government employees On the other hand there is no income tax deduction offered on NPS Tier II deposits for private sector employees and the gains in the NPS Tier 2 are taxable at the respective slab rates

For government employees tax benefit under Section 80C is also available on contributions towards the NPS Tier II account within the Rs 1 5 lakh upper limit with a lock in of 3 years

Nps Tier 2 Tax Benefit For Government Employees include a broad assortment of printable, downloadable content that can be downloaded from the internet at no cost. These printables come in different forms, like worksheets templates, coloring pages, and more. The attraction of printables that are free is in their versatility and accessibility.

More of Nps Tier 2 Tax Benefit For Government Employees

NPS Tier 2 Account nps Tier 2 Tax Saver nps Tier 2 Tax Benefit nps Tier

NPS Tier 2 Account nps Tier 2 Tax Saver nps Tier 2 Tax Benefit nps Tier

What are the tax benefits of NPS to employees on Employer contribution As per Section 80 CCD 2 if your employer is also contributing to your NPS account then you can claim a tax deduction of upto 0 of your salary Basic DA

For Government employees in a press conference held on 10th December 2018 Finance Minister Aun Jaitley announced that the NPS Tier 2 Account will be eligible for tax deduction under Section 80C up to Rs 1 5 lakh per annum

Nps Tier 2 Tax Benefit For Government Employees have gained immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or costly software.

-

Flexible: The Customization feature lets you tailor print-ready templates to your specific requirements such as designing invitations for your guests, organizing your schedule or decorating your home.

-

Educational Impact: The free educational worksheets can be used by students of all ages, which makes the perfect aid for parents as well as educators.

-

Convenience: You have instant access the vast array of design and templates reduces time and effort.

Where to Find more Nps Tier 2 Tax Benefit For Government Employees

NPS Tier II Account Features Benefits Taxation NPS Tier 2 For Tax

NPS Tier II Account Features Benefits Taxation NPS Tier 2 For Tax

The Investment in Tier 2 Tax Saver scheme is directly done in primary account and no option would be given to Subscriber to decide investment in E C G asset class The investment is done as per PFRDA guidelines

Non central government employees cannot use Tier II for tax saving From 1st April 2019 onwards central government employees with mandatory NPS accounts can save tax with a tier II account However the total tax saving benefit will be limited to

We've now piqued your interest in printables for free and other printables, let's discover where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of Nps Tier 2 Tax Benefit For Government Employees suitable for many objectives.

- Explore categories such as decorating your home, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing including flashcards, learning materials.

- Perfect for teachers, parents and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates at no cost.

- These blogs cover a broad variety of topics, including DIY projects to party planning.

Maximizing Nps Tier 2 Tax Benefit For Government Employees

Here are some inventive ways how you could make the most use of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Use printable worksheets from the internet to aid in learning at your home, or even in the classroom.

3. Event Planning

- Invitations, banners and decorations for special events like weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Nps Tier 2 Tax Benefit For Government Employees are a treasure trove of practical and imaginative resources which cater to a wide range of needs and desires. Their accessibility and flexibility make these printables a useful addition to any professional or personal life. Explore the world of printables for free today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free absolutely free?

- Yes they are! You can print and download these documents for free.

-

Can I make use of free printables for commercial uses?

- It's contingent upon the specific terms of use. Always check the creator's guidelines before utilizing their templates for commercial projects.

-

Do you have any copyright problems with printables that are free?

- Some printables may have restrictions regarding usage. Check the terms and condition of use as provided by the designer.

-

How can I print printables for free?

- You can print them at home using either a printer or go to a print shop in your area for high-quality prints.

-

What software is required to open printables at no cost?

- Many printables are offered in PDF format. They can be opened using free programs like Adobe Reader.

New NPS Tier II Scheme Gives Tax Benefit To Central Government

Activate NPS Tier 2 Account National Pension System Invest In

Check more sample of Nps Tier 2 Tax Benefit For Government Employees below

NPS Tier 2 Tax Benefit

NPS Tier II Account Income Tax Benefits Certiom Consultants

National Pension Scheme NPS Scheme NPS Tier 1 And Tier 2 NPS Tax

NPS Tier 2 Withdrawal Procedure NPS Tier 2 Withdrawal Process Online

NPS Tier 2 Account Best Fund Manager For NPS NPS Scheme NPS Tier

Govt Employees NPS Tier 2

https://www.etmoney.com/learn/nps/how-nps-works...

For government employees tax benefit under Section 80C is also available on contributions towards the NPS Tier II account within the Rs 1 5 lakh upper limit with a lock in of 3 years

https://www.livemint.com/money/personal-finance/...

1 Only central government employees are eligible for income tax benefits under NPS Tier II scheme Private sector employees contributions to the NPS tier II account will

For government employees tax benefit under Section 80C is also available on contributions towards the NPS Tier II account within the Rs 1 5 lakh upper limit with a lock in of 3 years

1 Only central government employees are eligible for income tax benefits under NPS Tier II scheme Private sector employees contributions to the NPS tier II account will

NPS Tier 2 Withdrawal Procedure NPS Tier 2 Withdrawal Process Online

NPS Tier II Account Income Tax Benefits Certiom Consultants

NPS Tier 2 Account Best Fund Manager For NPS NPS Scheme NPS Tier

Govt Employees NPS Tier 2

NPS Tier II Account Income Tax Benefits Rules For Govt Employees

Benefits Of The NPS Tier II Tax saving Scheme YouTube

Benefits Of The NPS Tier II Tax saving Scheme YouTube

Government Employee NPS Tier II Tax Saver Scheme Guidelines Released