In this age of electronic devices, where screens have become the dominant feature of our lives it's no wonder that the appeal of tangible printed materials isn't diminishing. No matter whether it's for educational uses or creative projects, or simply adding the personal touch to your space, Nys Solar Tax Credit Form are now a vital resource. We'll take a dive into the world of "Nys Solar Tax Credit Form," exploring what they are, where they are, and ways they can help you improve many aspects of your life.

Get Latest Nys Solar Tax Credit Form Below

Nys Solar Tax Credit Form

Nys Solar Tax Credit Form -

How to Claim NYS s Solar Tax Credit You can claim the state s solar tax credit by filling out form IT 255 when you file your taxes The New York State Solar Equipment Tax Credit is giving you an incredible opportunity to compound your solar savings So

You are entitled to claim this credit if you purchased solar energy system equipment entered into a written agreement for the lease of solar energy system equipment or entered into a written agreement that spans at least ten years for the purchase of power generated by solar energy system equipment not owned by you

Printables for free include a vast assortment of printable documents that can be downloaded online at no cost. These resources come in various styles, from worksheets to coloring pages, templates and many more. The great thing about Nys Solar Tax Credit Form is in their versatility and accessibility.

More of Nys Solar Tax Credit Form

100 COVID 19 Vaccine Reward Request Form Is Now Open closes Aug 15

100 COVID 19 Vaccine Reward Request Form Is Now Open closes Aug 15

By switching to solar in 2024 homeowners in New York can take advantage of ongoing federal state and local incentives These include tax credits rebates and beneficial net metering

New York offers a 25 state tax credit for home solar systems which can be combined with the 30 federal tax credit Unlike the NY Sun rebate which is available for homes and

Nys Solar Tax Credit Form have gained immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Individualization You can tailor the templates to meet your individual needs whether you're designing invitations making your schedule, or even decorating your house.

-

Educational Worth: Downloads of educational content for free cater to learners of all ages, making them an essential device for teachers and parents.

-

Accessibility: The instant accessibility to various designs and templates saves time and effort.

Where to Find more Nys Solar Tax Credit Form

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

The New York solar tax credit can reduce your state tax bill by 25 up to 5 000 Unlike the ITC you don t need to purchase your solar panel system to receive this tax credit If you enter into a written solar lease or power purchase agreement PPA that lasts at least 10 years you ll still qualify

This form is for New York state taxpayers who qualify for the Solar Energy System credit We last updated the Claim for Solar Energy System Equipment Credit in January 2024 so this is the latest version of Form IT 255 fully updated for tax year 2023

If we've already piqued your curiosity about Nys Solar Tax Credit Form Let's take a look at where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of Nys Solar Tax Credit Form to suit a variety of objectives.

- Explore categories like decorating your home, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing, flashcards, and learning tools.

- The perfect resource for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates, which are free.

- The blogs covered cover a wide variety of topics, that range from DIY projects to planning a party.

Maximizing Nys Solar Tax Credit Form

Here are some inventive ways ensure you get the very most use of printables that are free:

1. Home Decor

- Print and frame beautiful images, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Use printable worksheets from the internet to aid in learning at your home for the classroom.

3. Event Planning

- Design invitations, banners and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Nys Solar Tax Credit Form are an abundance of creative and practical resources that satisfy a wide range of requirements and interests. Their access and versatility makes them an invaluable addition to both professional and personal life. Explore the vast array of Nys Solar Tax Credit Form today to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Nys Solar Tax Credit Form really cost-free?

- Yes you can! You can download and print these files for free.

-

Can I download free printables for commercial use?

- It's dependent on the particular rules of usage. Always read the guidelines of the creator prior to printing printables for commercial projects.

-

Are there any copyright issues in Nys Solar Tax Credit Form?

- Some printables may contain restrictions on their use. Check the terms of service and conditions provided by the author.

-

How do I print Nys Solar Tax Credit Form?

- Print them at home with the printer, or go to the local print shops for the highest quality prints.

-

What program will I need to access Nys Solar Tax Credit Form?

- A majority of printed materials are in PDF format. They can be opened with free software like Adobe Reader.

New York Solar Panel Tax Credit Incentives Infinity Energy

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

Check more sample of Nys Solar Tax Credit Form below

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

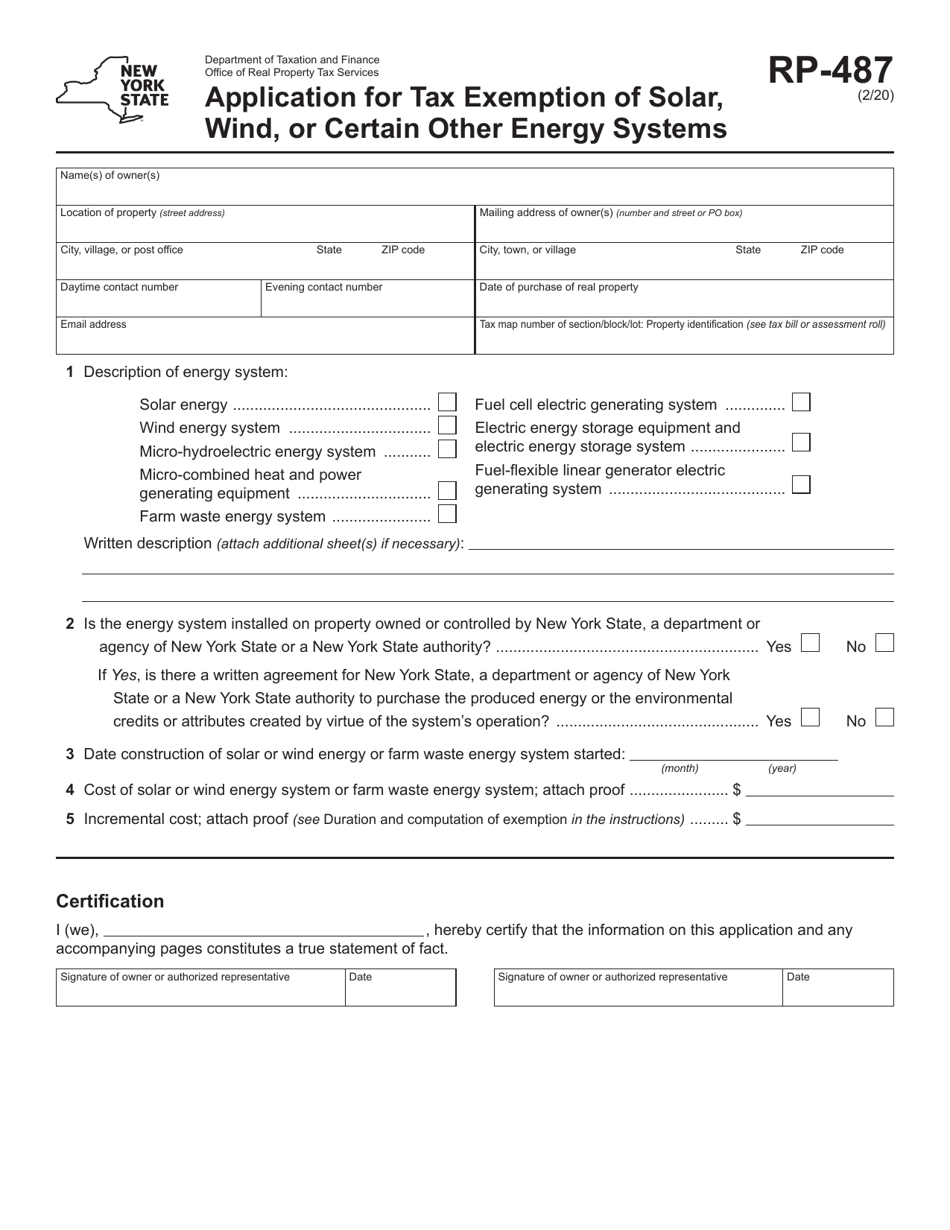

Form RP 487 Fill Out Sign Online And Download Fillable PDF New York

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

Irs Solar Tax Credit 2022 Form

NJ Solar Tax Credit Explained

https://www.tax.ny.gov/pit/credits/solar_energy...

You are entitled to claim this credit if you purchased solar energy system equipment entered into a written agreement for the lease of solar energy system equipment or entered into a written agreement that spans at least ten years for the purchase of power generated by solar energy system equipment not owned by you

https://www.tax.ny.gov/pdf/current_forms/it/it255i.pdf

Tax Law section 606 g 1 provides for the solar energy system equipment credit The credit is allowed for certain solar energy system equipment expenditures To qualify for the credit the solar energy system must use solar radiation to produce energy for heating cooling hot water or electricity for residential use

You are entitled to claim this credit if you purchased solar energy system equipment entered into a written agreement for the lease of solar energy system equipment or entered into a written agreement that spans at least ten years for the purchase of power generated by solar energy system equipment not owned by you

Tax Law section 606 g 1 provides for the solar energy system equipment credit The credit is allowed for certain solar energy system equipment expenditures To qualify for the credit the solar energy system must use solar radiation to produce energy for heating cooling hot water or electricity for residential use

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

Irs Solar Tax Credit 2022 Form

NJ Solar Tax Credit Explained

Who Qualifies For Federal Tax Credit Leia Aqui Do I Qualify For

Form St 127 Nys And Local Sales And Use Tax Exemption Certificate

Form St 127 Nys And Local Sales And Use Tax Exemption Certificate

Solar Tax Credit Calculator NikiZsombor