In the age of digital, where screens have become the dominant feature of our lives, the charm of tangible printed objects isn't diminished. No matter whether it's for educational uses and creative work, or simply to add the personal touch to your space, Nys Tax Deductions can be an excellent resource. In this article, we'll dive into the world of "Nys Tax Deductions," exploring the benefits of them, where to find them and how they can improve various aspects of your daily life.

Get Latest Nys Tax Deductions Below

Nys Tax Deductions

Nys Tax Deductions -

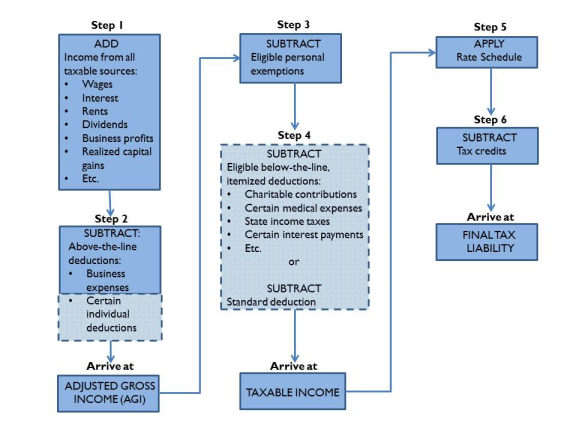

How Income Taxes Are Calculated First we calculate your adjusted gross income AGI by taking your total household income and reducing it by certain items such as contributions to your 401 k Next from AGI we subtract exemptions and deductions either itemized or standard to get your taxable income

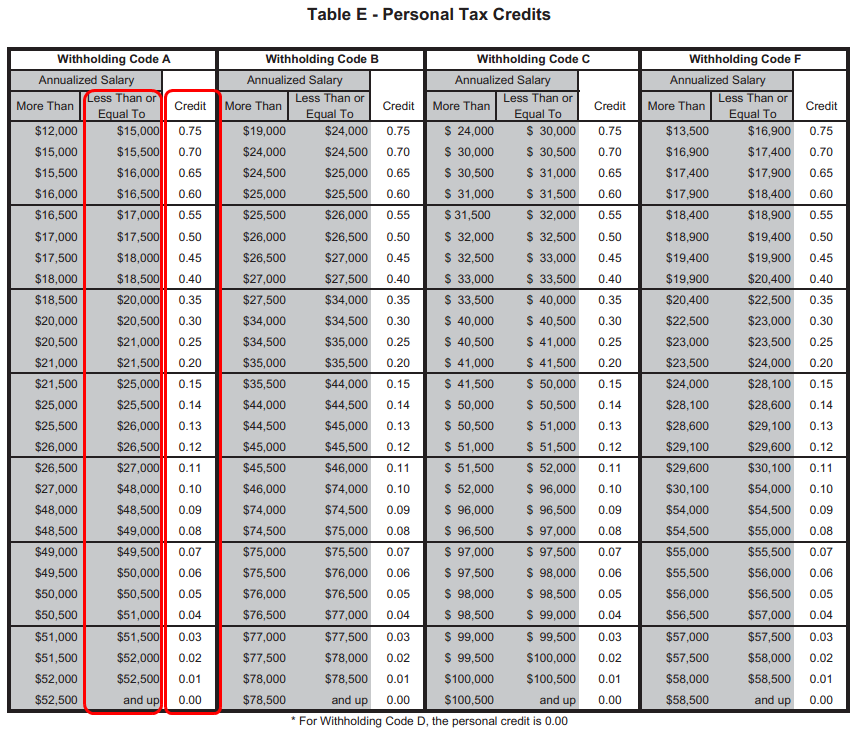

Standard deductions Filing status Standard deduction amount Single and can be claimed as a dependent on another taxpayer s federal return 3 100 Single and cannot be claimed as a dependent on another taxpayer s federal return 8 000 Married filing joint return 16 050 Married filing separate return 8 000

Printables for free cover a broad assortment of printable, downloadable resources available online for download at no cost. They are available in numerous forms, like worksheets coloring pages, templates and much more. The value of Nys Tax Deductions is their flexibility and accessibility.

More of Nys Tax Deductions

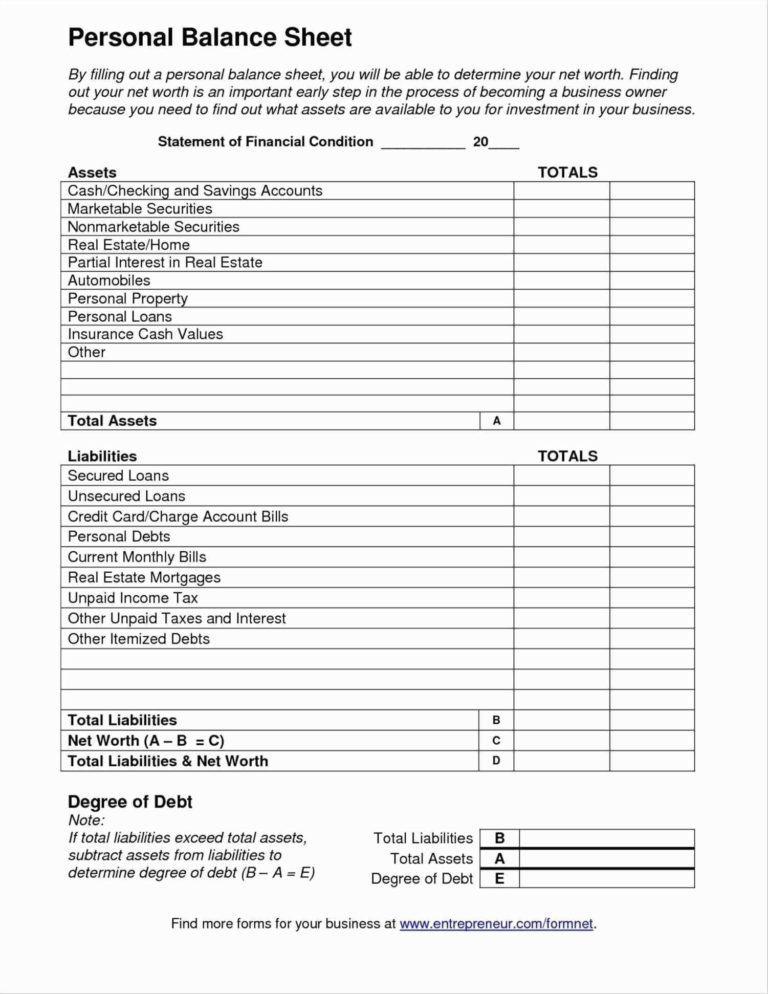

Pin On Business Template

Pin On Business Template

New York s income tax rates range from 4 to 10 9 The top tax rate is one of the highest in the country though only taxpayers whose taxable income exceeds 25 000 000 pay that rate What your tax burden looks like in New York depends on where in

Itemized deductions Beginning with tax year 2018 the Tax Law allows you to itemize your deductions for New York State income tax purposes whether or not you itemized your deductions on your federal income tax return See TSB M 18 6 I New York State Decouples from Certain Personal Income Tax Internal Revenue Code IRC

Print-friendly freebies have gained tremendous appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

Modifications: They can make designs to suit your personal needs, whether it's designing invitations and schedules, or even decorating your house.

-

Educational value: These Nys Tax Deductions are designed to appeal to students of all ages. This makes these printables a powerful source for educators and parents.

-

Convenience: Fast access numerous designs and templates will save you time and effort.

Where to Find more Nys Tax Deductions

Jon Philips Made The Following 2019 Payments NYS NYC Tax Withheld From

Jon Philips Made The Following 2019 Payments NYS NYC Tax Withheld From

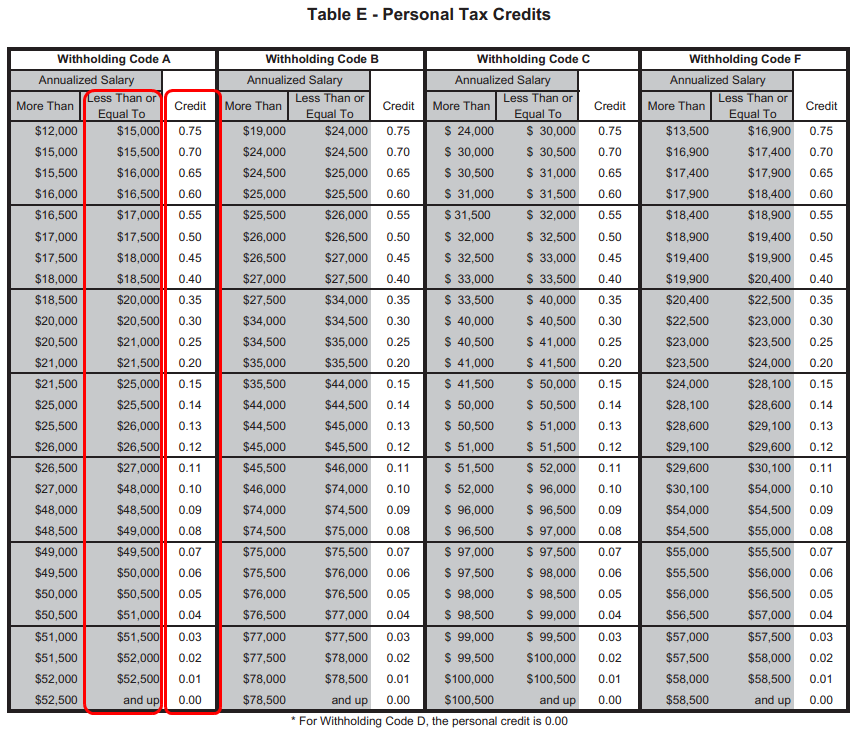

The Income tax rates and personal allowances in New York are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below include the tax rates thresholds and allowances included in the New York Tax Calculator 2023 New York Single Filer Standard Deduction

New York State income tax rates range from 4 to 10 90 for the 2022 tax year depending on a taxpayer s income These rates are the result of legislation passed and sent to the governor in April 2021

After we've peaked your interest in printables for free Let's take a look at where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of Nys Tax Deductions designed for a variety objectives.

- Explore categories like the home, decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing or flashcards as well as learning materials.

- Perfect for teachers, parents and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates, which are free.

- The blogs covered cover a wide array of topics, ranging ranging from DIY projects to party planning.

Maximizing Nys Tax Deductions

Here are some innovative ways how you could make the most of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print worksheets that are free to build your knowledge at home and in class.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Make sure you are organized with printable calendars, to-do lists, and meal planners.

Conclusion

Nys Tax Deductions are an abundance of creative and practical resources for a variety of needs and preferences. Their access and versatility makes they a beneficial addition to any professional or personal life. Explore the vast collection of printables for free today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free free?

- Yes they are! You can download and print these documents for free.

-

Do I have the right to use free templates for commercial use?

- It's dependent on the particular terms of use. Always verify the guidelines of the creator prior to using the printables in commercial projects.

-

Are there any copyright issues when you download Nys Tax Deductions?

- Certain printables could be restricted on their use. Be sure to review the terms and conditions offered by the author.

-

How do I print printables for free?

- You can print them at home with either a printer at home or in a local print shop to purchase more high-quality prints.

-

What program do I need in order to open printables that are free?

- The majority are printed in the PDF format, and can be opened with free software like Adobe Reader.

Federal Tax Tables 2017 Elcho Table

10 2014 Itemized Deductions Worksheet Worksheeto

Check more sample of Nys Tax Deductions below

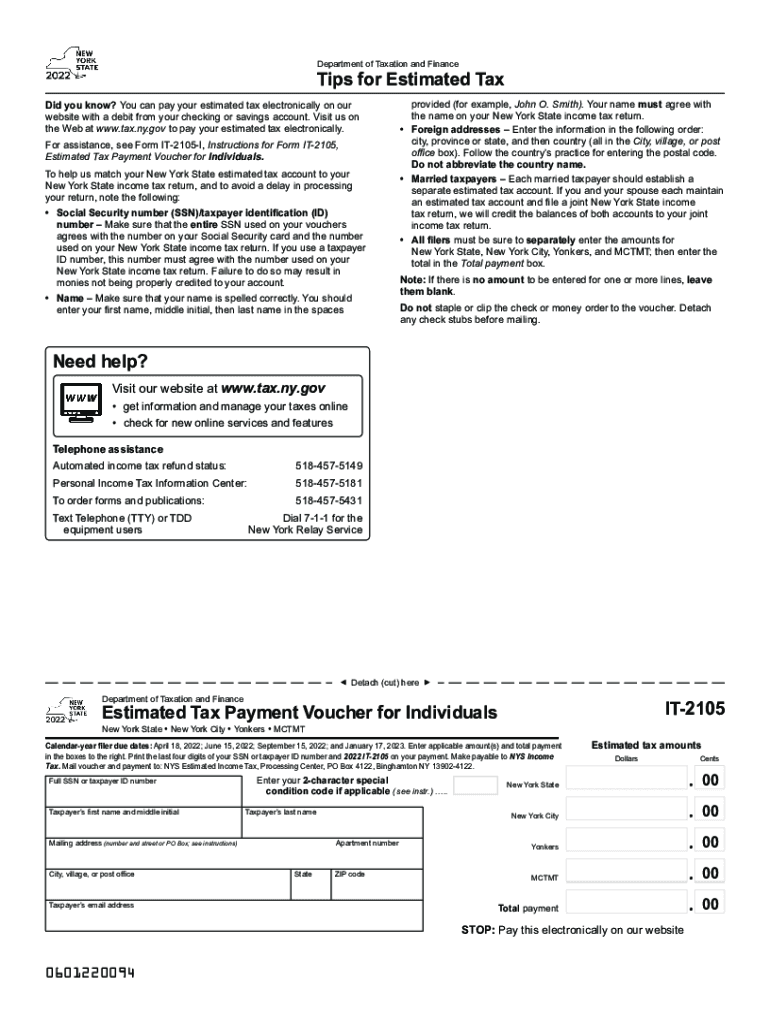

2022 Form NY IT 2105Fill Online Printable Fillable Blank PdfFiller

Get Your Receipts Ready NYS Is Letting You File SALT Deductions With

Itemized Deductions Spreadsheet In Business Itemized Deductions

50 Best Ideas For Coloring Printable New York State Tax Forms

2022 Schedule A Form And Instructions Form 1040

Income Tax Deductions Income Tax Deductions Table 2016

https://www.tax.ny.gov/pit/file/standard_deductions.htm

Standard deductions Filing status Standard deduction amount Single and can be claimed as a dependent on another taxpayer s federal return 3 100 Single and cannot be claimed as a dependent on another taxpayer s federal return 8 000 Married filing joint return 16 050 Married filing separate return 8 000

https://www.forbes.com/advisor/income-tax-calculator/new-york

New York state tax 3 413 Gross income 70 000 Total income tax 11 074 After Tax Income 58 926 Disclaimer Calculations are estimates based on tax rates as of Jan 2023 and data

Standard deductions Filing status Standard deduction amount Single and can be claimed as a dependent on another taxpayer s federal return 3 100 Single and cannot be claimed as a dependent on another taxpayer s federal return 8 000 Married filing joint return 16 050 Married filing separate return 8 000

New York state tax 3 413 Gross income 70 000 Total income tax 11 074 After Tax Income 58 926 Disclaimer Calculations are estimates based on tax rates as of Jan 2023 and data

50 Best Ideas For Coloring Printable New York State Tax Forms

Get Your Receipts Ready NYS Is Letting You File SALT Deductions With

2022 Schedule A Form And Instructions Form 1040

Income Tax Deductions Income Tax Deductions Table 2016

NY Sends Tiny Checks To Pay Interest On Last Year s Tax Refund

Printable List Of Tax Deductions Form Fill Out And Sign Printable PDF

Printable List Of Tax Deductions Form Fill Out And Sign Printable PDF

Source Harvey S Rosen Public Finance 7 Th Ed New York NY