In the digital age, with screens dominating our lives however, the attraction of tangible printed materials hasn't faded away. In the case of educational materials such as creative projects or simply adding personal touches to your home, printables for free can be an excellent source. In this article, we'll take a dive deeper into "Payroll Tax Credit Cares Act 2021," exploring what they are, how to locate them, and how they can add value to various aspects of your lives.

Get Latest Payroll Tax Credit Cares Act 2021 Below

Payroll Tax Credit Cares Act 2021

Payroll Tax Credit Cares Act 2021 -

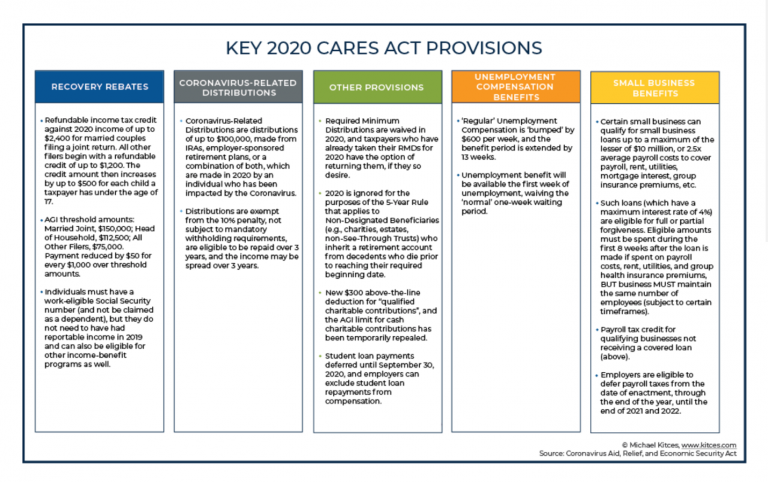

The ERC is a refundable tax credit equal to 50 of up to 10 000 in wages paid by an eligible employer whose business has been financially impacted by COVID

The ERC is now available for all four quarters of 2021 up to 7 000 per quarter The level of qualifying business disruption has been reduced so that a 20 decline in gross

Payroll Tax Credit Cares Act 2021 cover a large range of printable, free content that can be downloaded from the internet at no cost. These resources come in many kinds, including worksheets templates, coloring pages and much more. The great thing about Payroll Tax Credit Cares Act 2021 is in their variety and accessibility.

More of Payroll Tax Credit Cares Act 2021

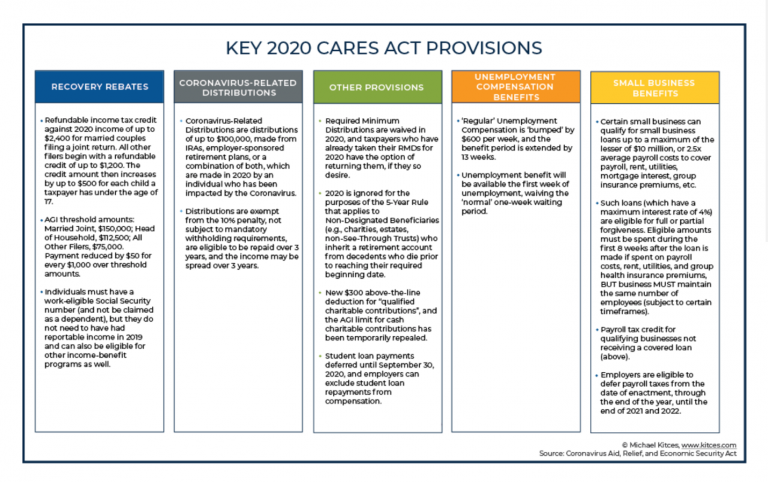

CARES Act Payroll Tax Deferment Rules GTM Business

CARES Act Payroll Tax Deferment Rules GTM Business

Employee Retention Credit The American Rescue Plan extends the availability of the Employee Retention Credit for small businesses through December 2021 and allows

ERC was discontinued for most businesses after September 30 2021 but can be claimed retroactively Jump to What is the Employee Retention Credit Who is

Payroll Tax Credit Cares Act 2021 have gained immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or costly software.

-

The ability to customize: We can customize designs to suit your personal needs such as designing invitations and schedules, or decorating your home.

-

Education Value Downloads of educational content for free provide for students from all ages, making them a great tool for parents and educators.

-

Affordability: immediate access various designs and templates reduces time and effort.

Where to Find more Payroll Tax Credit Cares Act 2021

IRS TAX CREDIT PROS ERC EMPLOYMENT RETENTION CREDIT APPLICATION CARES ACT

IRS TAX CREDIT PROS ERC EMPLOYMENT RETENTION CREDIT APPLICATION CARES ACT

The Act amends the employee retention credit to be equal to 70 of qualified wages paid to employees after December 31 2020 and before July 1 2021 During the first two

OVERVIEW Congress passed several laws to stimulate the economy during the COVID 19 crisis This includes a payroll tax credit and other stimulus measures

Since we've got your interest in printables for free we'll explore the places you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Payroll Tax Credit Cares Act 2021 designed for a variety purposes.

- Explore categories such as decorating your home, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets, flashcards, and learning materials.

- This is a great resource for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs or templates for download.

- These blogs cover a broad range of topics, that includes DIY projects to party planning.

Maximizing Payroll Tax Credit Cares Act 2021

Here are some inventive ways to make the most of Payroll Tax Credit Cares Act 2021:

1. Home Decor

- Print and frame beautiful images, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use free printable worksheets for reinforcement of learning at home, or even in the classroom.

3. Event Planning

- Design invitations, banners and decorations for special events like weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Payroll Tax Credit Cares Act 2021 are a treasure trove of useful and creative resources catering to different needs and interest. Their accessibility and versatility make these printables a useful addition to both professional and personal lives. Explore the vast array of Payroll Tax Credit Cares Act 2021 now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really cost-free?

- Yes they are! You can print and download these items for free.

-

Can I use free printables for commercial purposes?

- It depends on the specific rules of usage. Always check the creator's guidelines prior to printing printables for commercial projects.

-

Are there any copyright issues with Payroll Tax Credit Cares Act 2021?

- Some printables may have restrictions in their usage. Always read these terms and conditions as set out by the creator.

-

How can I print Payroll Tax Credit Cares Act 2021?

- Print them at home using either a printer at home or in an area print shop for premium prints.

-

What software is required to open printables at no cost?

- Most PDF-based printables are available with PDF formats, which is open with no cost software, such as Adobe Reader.

IRS TAX CREDIT PROS ERC EMPLOYMENT RETENTION CREDIT APPLICATION CARES ACT

Paycheck Protection Program SBA Help For Small Business Owners In

Check more sample of Payroll Tax Credit Cares Act 2021 below

Nebraska Employee Retention Tax Credit Nebraska Employee Retention

IRS TAX CREDIT PROS ERC EMPLOYMENT RETENTION CREDIT APPLICATION CARES ACT

IRS TAX CREDIT PROS ERC EMPLOYMENT RETENTION CREDIT APPLICATION CARES ACT

Employee Retention Credit For Employers Meadows Urquhart Acree And

New Mexico Employee Retention Tax Credit New Mexico Employee

3 30 20 CARES Act Passed

https://home.treasury.gov/system/files/136/ERC-Flyer-4.13.21.pdf

The ERC is now available for all four quarters of 2021 up to 7 000 per quarter The level of qualifying business disruption has been reduced so that a 20 decline in gross

https://home.treasury.gov/system/files/136/ERC...

For 2021 the employee retention credit ERC is a quarterly tax credit against the employer s share of certain payroll taxes The tax credit is 70 of the first 10 000 in

The ERC is now available for all four quarters of 2021 up to 7 000 per quarter The level of qualifying business disruption has been reduced so that a 20 decline in gross

For 2021 the employee retention credit ERC is a quarterly tax credit against the employer s share of certain payroll taxes The tax credit is 70 of the first 10 000 in

Employee Retention Credit For Employers Meadows Urquhart Acree And

IRS TAX CREDIT PROS ERC EMPLOYMENT RETENTION CREDIT APPLICATION CARES ACT

New Mexico Employee Retention Tax Credit New Mexico Employee

3 30 20 CARES Act Passed

CARES Act Payroll Tax Deferral YouTube

Employee Retention Tax Credit Under The CARES Act The Gillespie Law Group

Employee Retention Tax Credit Under The CARES Act The Gillespie Law Group

TAX CREDIT PROS ERC EMPLOYMENT RETENTION CREDIT APPLICATION CARES ACT