In this digital age, where screens dominate our lives it's no wonder that the appeal of tangible printed objects isn't diminished. Be it for educational use or creative projects, or simply to add some personal flair to your area, Pension Tax Relief Calculator Ireland can be an excellent source. We'll take a dive into the world of "Pension Tax Relief Calculator Ireland," exploring what they are, where to get them, as well as how they can enrich various aspects of your lives.

Get Latest Pension Tax Relief Calculator Ireland Below

Pension Tax Relief Calculator Ireland

Pension Tax Relief Calculator Ireland -

For example an employee who is aged 42 earns 40 000 per year They can get tax relief on annual pension contributions up to 10 000 Total earnings limit The maximum amount of earnings taken into account for calculating tax relief is

You can get Income Tax relief against earnings from your employment for your pension contributions including Additional Voluntary Contributions AVCs Pension contributions to the following pension plans may qualify for tax relief occupational pension schemes Personal Retirement Savings Accounts PRSAs Retirement Annuity

The Pension Tax Relief Calculator Ireland are a huge selection of printable and downloadable documents that can be downloaded online at no cost. These resources come in various types, like worksheets, coloring pages, templates and more. The appeal of printables for free is in their versatility and accessibility.

More of Pension Tax Relief Calculator Ireland

Pension Tax Relief Calculator Which

Pension Tax Relief Calculator Which

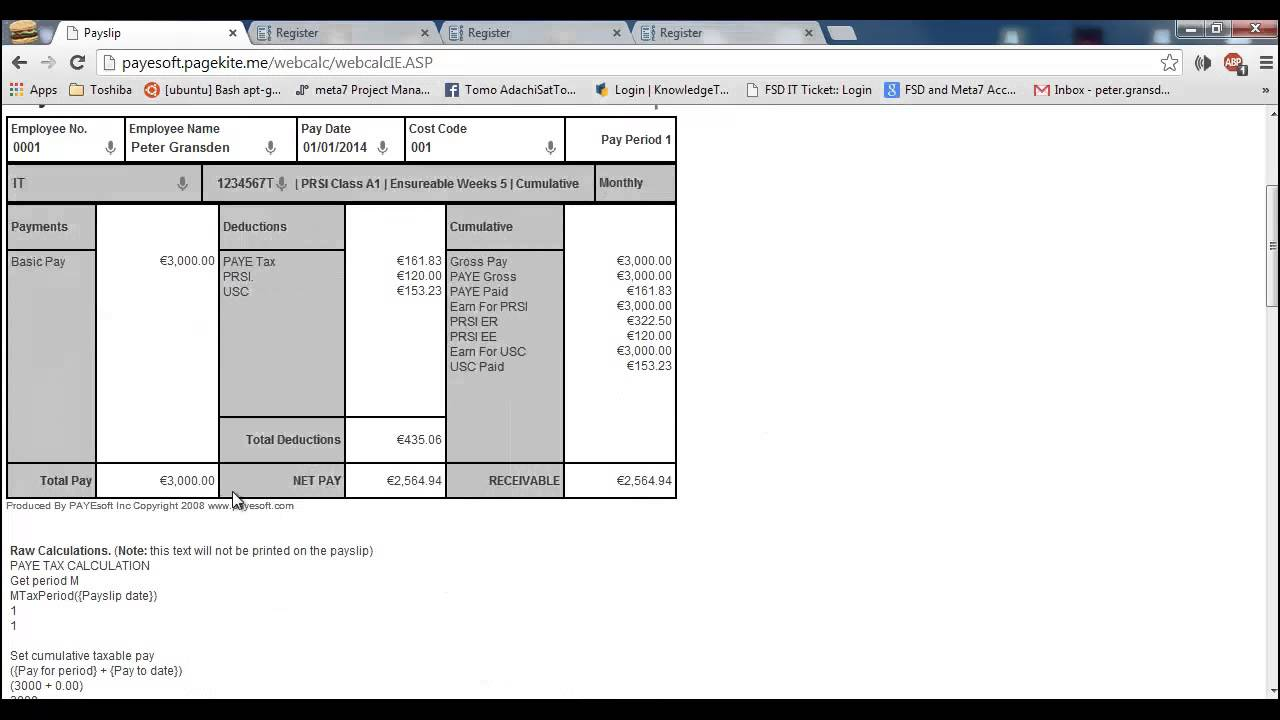

Tax Calculator Ireland Our income tax calculator will help to show you how to calculate your income tax return It is a useful tool that takes your personal circumstances and salary into consideration and gives instant results on your income tax return

This video explains how to claim tax relief for pension contributions It also explains how to use the pension relief calculator Note To make sure you are granted the correct relief you must enter your date of birth in the Personal Details panel

The Pension Tax Relief Calculator Ireland have gained huge popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Personalization Your HTML0 customization options allow you to customize print-ready templates to your specific requirements in designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational Value: Printing educational materials for no cost provide for students of all ages. This makes these printables a powerful instrument for parents and teachers.

-

Affordability: Access to a plethora of designs and templates saves time and effort.

Where to Find more Pension Tax Relief Calculator Ireland

Pension Tax Relief Pareto IFA

Pension Tax Relief Pareto IFA

Tax Free Pension Lump Sum Calculator Ireland Please note Any income received from a pension after your tax free lump is paid out is subject to normal tax deduction under the PAYE system The provider of the pension is required to operate PAYE USC and PRSI if applicable on the income

Check out the Pension Tax Relief Calculator in Ireland and choose the best plans for you Contact us for the best financial advice

We've now piqued your interest in Pension Tax Relief Calculator Ireland Let's take a look at where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection in Pension Tax Relief Calculator Ireland for different needs.

- Explore categories such as decorations for the home, education and management, and craft.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free for flashcards, lessons, and worksheets. tools.

- Ideal for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates at no cost.

- The blogs are a vast range of topics, that range from DIY projects to party planning.

Maximizing Pension Tax Relief Calculator Ireland

Here are some unique ways ensure you get the very most of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Use printable worksheets from the internet to enhance learning at home also in the classes.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable planners for to-do list, lists of chores, and meal planners.

Conclusion

Pension Tax Relief Calculator Ireland are a treasure trove filled with creative and practical information that meet a variety of needs and desires. Their access and versatility makes them an essential part of both professional and personal lives. Explore the world of Pension Tax Relief Calculator Ireland and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly for free?

- Yes you can! You can download and print the resources for free.

-

Can I download free printouts for commercial usage?

- It depends on the specific rules of usage. Always verify the guidelines of the creator prior to printing printables for commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Some printables may come with restrictions in use. Be sure to check the terms and conditions offered by the designer.

-

How do I print printables for free?

- You can print them at home with your printer or visit a print shop in your area for better quality prints.

-

What software will I need to access Pension Tax Relief Calculator Ireland?

- Most printables come in PDF format. These is open with no cost programs like Adobe Reader.

Joe Bruen Bruen Financial Services

Income Tax And Tax Relief Calculator My Continuum

Check more sample of Pension Tax Relief Calculator Ireland below

Pension Tax Relief Calculator TaxScouts

Pension Tax Relief Calculator Investor Weekly

Pension Tax Relief Knowledge Gap

UK Pension Tax Relief Understand The Benefits IVCM

Pension Planning Make The Most Of A SIPP HL

Tax Relief On Pension Contributions Gooding Accounts

https://www.revenue.ie/en/jobs-and-pensions/pension/relief/index.aspx

You can get Income Tax relief against earnings from your employment for your pension contributions including Additional Voluntary Contributions AVCs Pension contributions to the following pension plans may qualify for tax relief occupational pension schemes Personal Retirement Savings Accounts PRSAs Retirement Annuity

https://www.citizensinformation.ie/en/money-and...

Revenue has a video explaining how to claim tax relief for pension contributions Page edited 6 June 2023 You can get income tax relief on your pension contributions You can also get tax relief on a lump sum pension payment when you retire

You can get Income Tax relief against earnings from your employment for your pension contributions including Additional Voluntary Contributions AVCs Pension contributions to the following pension plans may qualify for tax relief occupational pension schemes Personal Retirement Savings Accounts PRSAs Retirement Annuity

Revenue has a video explaining how to claim tax relief for pension contributions Page edited 6 June 2023 You can get income tax relief on your pension contributions You can also get tax relief on a lump sum pension payment when you retire

UK Pension Tax Relief Understand The Benefits IVCM

Pension Tax Relief Calculator Investor Weekly

Pension Planning Make The Most Of A SIPP HL

Tax Relief On Pension Contributions Gooding Accounts

4 Tips On How To Look For The Ideal Tax Relief Company Cecra

Could Pension Tax Relief Be Scrapped Completely Nucleusfinancial

Could Pension Tax Relief Be Scrapped Completely Nucleusfinancial

Salary Calculator Ireland Tax Withholding Estimator 2021