In this age of electronic devices, where screens dominate our lives The appeal of tangible printed materials isn't diminishing. For educational purposes project ideas, artistic or just adding an element of personalization to your area, Plug In Car Tax Rebate have proven to be a valuable resource. The following article is a take a dive through the vast world of "Plug In Car Tax Rebate," exploring what they are, how they are, and how they can improve various aspects of your daily life.

Get Latest Plug In Car Tax Rebate Below

Plug In Car Tax Rebate

Plug In Car Tax Rebate - Plug In Car Tax Credit, Plug In Car Tax Credit 2022, Plug In Vehicle Tax Credit Irs, Electric Car Tax Rebate California, Electric Car Tax Rebate Canada, Electric Car Tax Rebate List, Electric Car Tax Rebate Form, Electric Car Tax Rebate Texas, Electric Car Tax Rebate California 2022, Plug In Hybrid Car Tax Credit

Web 1 janv 2023 nbsp 0183 32 Pre owned all electric plug in hybrid and fuel cell electric vehicles purchased on or after January 1 2023 may be eligible for a federal income tax credit The credit equals 30 percent of the sale price up to a maximum credit of 4 000 The credit is nonrefundable so you can t get back more on the credit than you owe in taxes

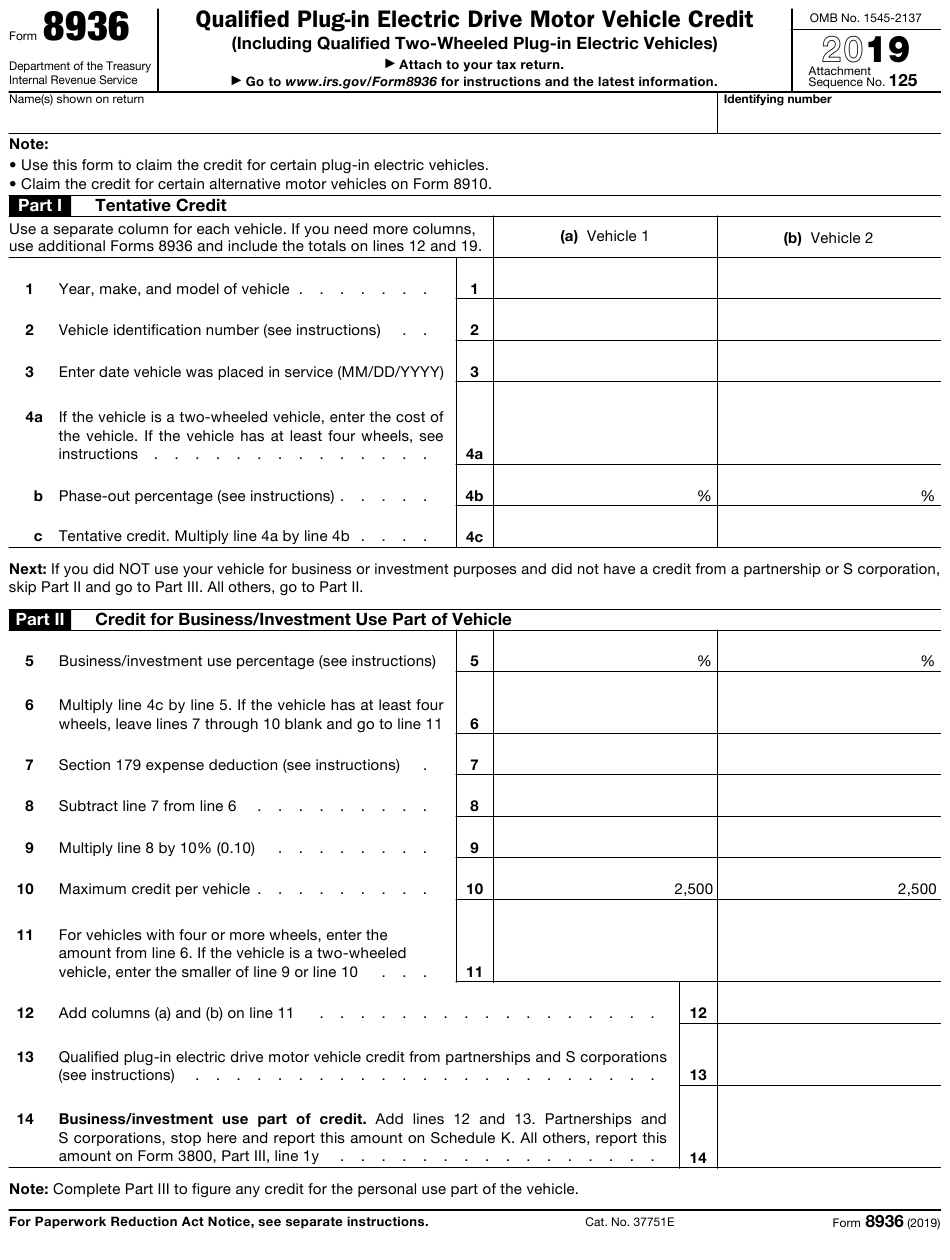

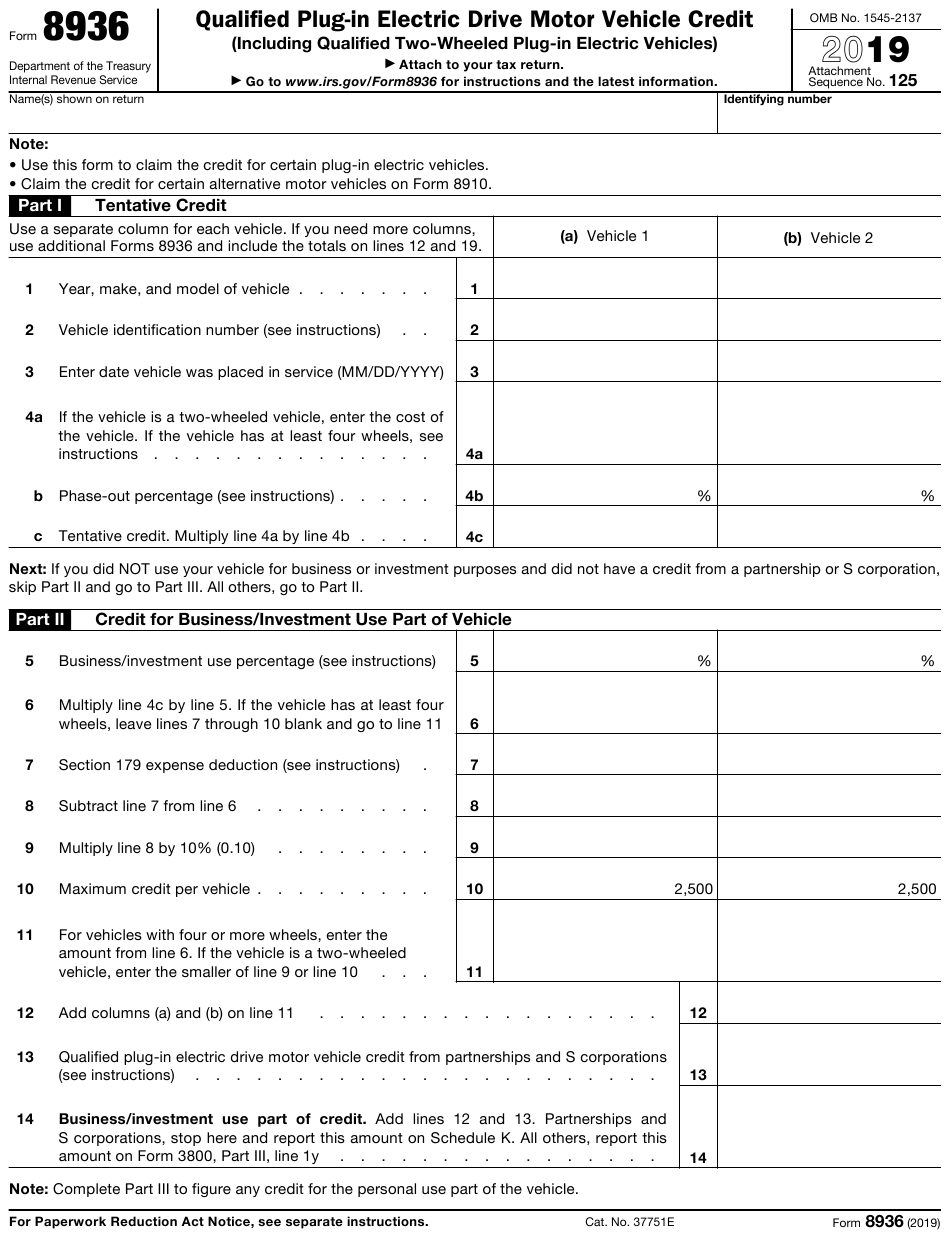

Web Form 8936 Rev January 2023 Department of the Treasury Internal Revenue Service Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled Plug in Electric Vehicles and New Clean Vehicles Attach to your tax return

Printables for free include a vast collection of printable material that is available online at no cost. The resources are offered in a variety designs, including worksheets templates, coloring pages, and much more. The attraction of printables that are free is in their versatility and accessibility.

More of Plug In Car Tax Rebate

California Electric Car Tax Rebate ElectricCarTalk

California Electric Car Tax Rebate ElectricCarTalk

Web If you place in service a new plug in electric vehicle EV or fuel cell vehicle FCV in 2023 or after you may qualify for a clean vehicle tax credit Find information on credits for used clean vehicles qualified commercial clean vehicles and new plug in

Web Complete Form 8936 Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled Plug in Electric Vehicles and New Clean Vehicles and file it with your tax return for the year you took possession of

Printables for free have gained immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

Modifications: We can customize printed materials to meet your requirements in designing invitations or arranging your schedule or decorating your home.

-

Education Value Printing educational materials for no cost can be used by students from all ages, making them a great instrument for parents and teachers.

-

An easy way to access HTML0: Access to an array of designs and templates can save you time and energy.

Where to Find more Plug In Car Tax Rebate

Electric Car Tax Rebate California ElectricCarTalk

Electric Car Tax Rebate California ElectricCarTalk

Web 16 ao 251 t 2022 nbsp 0183 32 If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D Manufacturers and Models for New Qualified Clean Vehicles Purchased in 2022 and Before Internal Revenue Service

Web 5 sept 2023 nbsp 0183 32 As of Aug 28 2023 the following fully electric and plug in hybrid vehicles are eligible for either a full or partial tax credit if delivered on or after April 18 2023 per FuelEconomy Car

After we've peaked your curiosity about Plug In Car Tax Rebate We'll take a look around to see where you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety and Plug In Car Tax Rebate for a variety motives.

- Explore categories such as decorating your home, education, management, and craft.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing along with flashcards, as well as other learning tools.

- Ideal for teachers, parents and students looking for extra sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs with templates and designs for free.

- These blogs cover a broad array of topics, ranging starting from DIY projects to planning a party.

Maximizing Plug In Car Tax Rebate

Here are some creative ways in order to maximize the use of Plug In Car Tax Rebate:

1. Home Decor

- Print and frame beautiful artwork, quotes or seasonal decorations to adorn your living areas.

2. Education

- Use printable worksheets from the internet to help reinforce your learning at home (or in the learning environment).

3. Event Planning

- Designs invitations, banners and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable planners for to-do list, lists of chores, and meal planners.

Conclusion

Plug In Car Tax Rebate are an abundance of useful and creative resources catering to different needs and needs and. Their access and versatility makes they a beneficial addition to your professional and personal life. Explore the many options of Plug In Car Tax Rebate now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Plug In Car Tax Rebate truly completely free?

- Yes, they are! You can download and print these materials for free.

-

Can I use free templates for commercial use?

- It's all dependent on the terms of use. Always verify the guidelines of the creator before using printables for commercial projects.

-

Are there any copyright issues when you download printables that are free?

- Certain printables might have limitations regarding their use. Be sure to read the terms and conditions provided by the creator.

-

How can I print printables for free?

- You can print them at home using a printer or visit a print shop in your area for more high-quality prints.

-

What software do I need to run Plug In Car Tax Rebate?

- The majority of PDF documents are provided in PDF format, which can be opened with free software like Adobe Reader.

Ma Tax Rebates Electric Cars 2023 Carrebate

Delaware Electric Car Tax Rebate Printable Rebate Form

Check more sample of Plug In Car Tax Rebate below

Electric Car Rebates Washington State 2023 Carrebate

Tax Rebates Electric Cars 2023 Carrebate

Tax Rebates For Electric Cars Michigan 2022 Carrebate

Tax Form For Federal Tax Rebate For Plug in Car 2023 Carrebate

Tax Rebate Lease Electric Car 2022 2023 Carrebate

Nys Charges Tax On Car Rebates 2023 Carrebate

https://www.irs.gov/pub/irs-pdf/f8936.pdf

Web Form 8936 Rev January 2023 Department of the Treasury Internal Revenue Service Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled Plug in Electric Vehicles and New Clean Vehicles Attach to your tax return

https://www.consumerreports.org/cars/hybrids-evs/electric-cars-plug-in...

Web 7 sept 2023 nbsp 0183 32 Consumer Reports details the list of 2022 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the Inflation Reduction Act

Web Form 8936 Rev January 2023 Department of the Treasury Internal Revenue Service Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled Plug in Electric Vehicles and New Clean Vehicles Attach to your tax return

Web 7 sept 2023 nbsp 0183 32 Consumer Reports details the list of 2022 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the Inflation Reduction Act

Tax Form For Federal Tax Rebate For Plug in Car 2023 Carrebate

Tax Rebates Electric Cars 2023 Carrebate

Tax Rebate Lease Electric Car 2022 2023 Carrebate

Nys Charges Tax On Car Rebates 2023 Carrebate

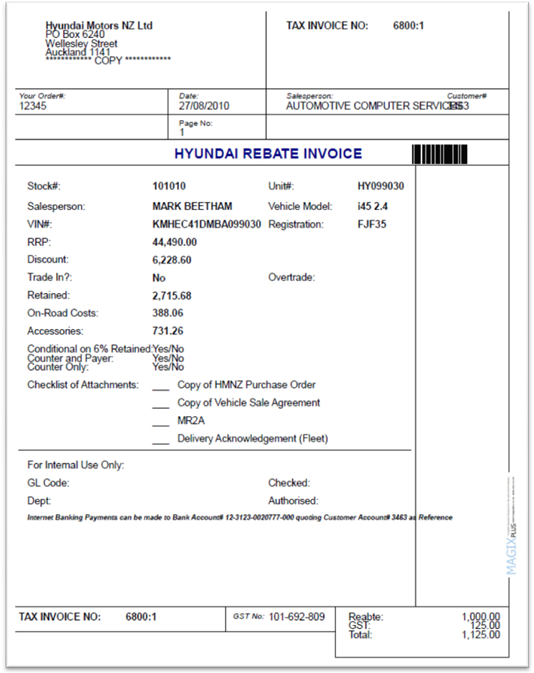

Hyundai Rebate Invoices

Tax Rebates For Electric Car 2023 Carrebate

Tax Rebates For Electric Car 2023 Carrebate

Tax Rebates For Electric Cars Michigan 2023 Carrebate