In this digital age, where screens dominate our lives however, the attraction of tangible printed material hasn't diminished. No matter whether it's for educational uses and creative work, or just adding a personal touch to your area, Plug In Hybrid Tax Credit 2023 California can be an excellent resource. Through this post, we'll take a dive deeper into "Plug In Hybrid Tax Credit 2023 California," exploring their purpose, where you can find them, and ways they can help you improve many aspects of your lives.

Get Latest Plug In Hybrid Tax Credit 2023 California Below

Plug In Hybrid Tax Credit 2023 California

Plug In Hybrid Tax Credit 2023 California -

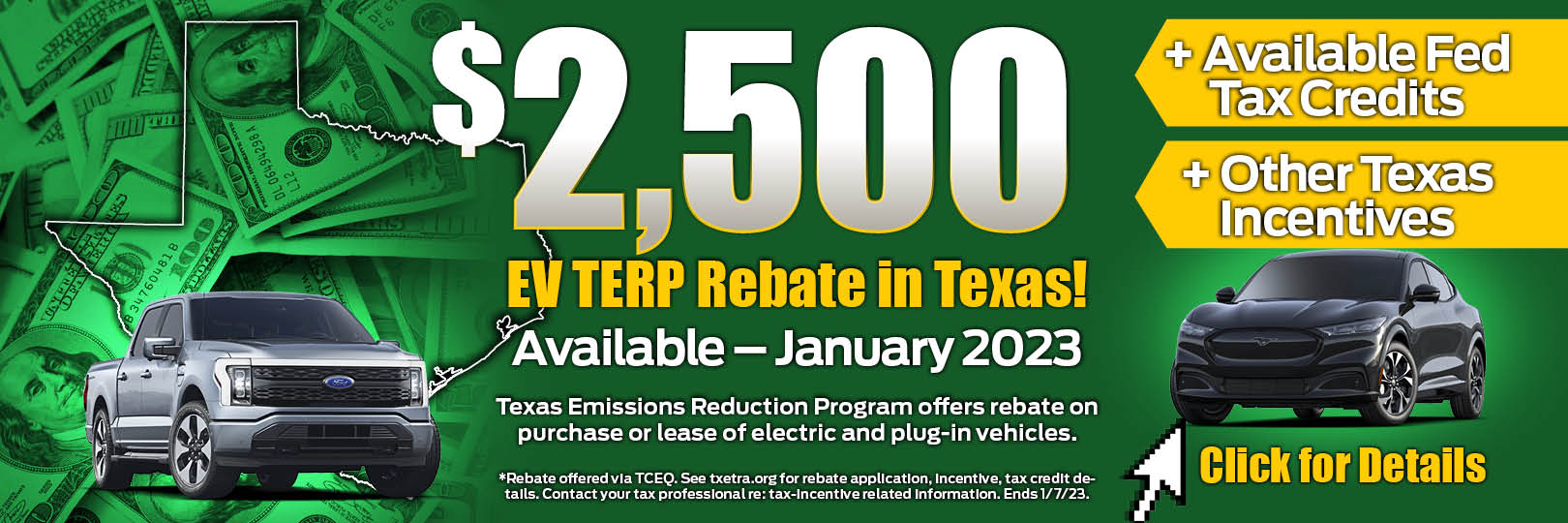

Pre owned all electric plug in hybrid and fuel cell electric vehicles purchased on or after January 1 2023 may be eligible for a federal income tax credit The credit equals 30 percent of the sale price up to a maximum credit of 4 000

Federal tax credits are available for the purchase of all electric and plug in hybrid vehicles The tax credits are up to dollar 7 500 Please note Sales or use tax is due on the total selling price of the vehicle

Plug In Hybrid Tax Credit 2023 California encompass a wide array of printable materials available online at no cost. They are available in a variety of styles, from worksheets to templates, coloring pages, and much more. The beauty of Plug In Hybrid Tax Credit 2023 California lies in their versatility as well as accessibility.

More of Plug In Hybrid Tax Credit 2023 California

2022 EV Tax Credit How To Get A Tax Refund On A New EV Or PHEV

2022 EV Tax Credit How To Get A Tax Refund On A New EV Or PHEV

The Clean Vehicle Rebate Project offers lower income consumers a low interest loan and a vehicle price buy down to purchase a new or used zero emission plug in hybrid electric or hybrid vehicle

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

Plug In Hybrid Tax Credit 2023 California have gained immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

The ability to customize: There is the possibility of tailoring the templates to meet your individual needs when it comes to designing invitations, organizing your schedule, or decorating your home.

-

Education Value Printing educational materials for no cost offer a wide range of educational content for learners of all ages. This makes them a vital resource for educators and parents.

-

Accessibility: Fast access a myriad of designs as well as templates saves time and effort.

Where to Find more Plug In Hybrid Tax Credit 2023 California

The Tesla EV Tax Credit 2023

.jpg)

The Tesla EV Tax Credit 2023

Plug in hybrids may be eligible for a variety of incentives such as the Clean Air Vehicle decal California s Clean Vehicle Rebate Project and programs to support clean transportation ownership in low income and disadvantage communities To

The Clean Vehicle Rebate Project CVRP promoted clean vehicle adoption in California by offering rebates from 1 000 to 7 500 for the purchase or lease of new eligible zero emission vehicles including electric plug in hybrid electric and fuel cell vehicles

Now that we've piqued your interest in Plug In Hybrid Tax Credit 2023 California Let's look into where you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection in Plug In Hybrid Tax Credit 2023 California for different needs.

- Explore categories like decoration for your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. materials.

- Perfect for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for free.

- The blogs are a vast spectrum of interests, that range from DIY projects to planning a party.

Maximizing Plug In Hybrid Tax Credit 2023 California

Here are some creative ways that you can make use use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes as well as seasonal decorations, to embellish your living areas.

2. Education

- Print out free worksheets and activities to enhance learning at home as well as in the class.

3. Event Planning

- Designs invitations, banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable planners checklists for tasks, as well as meal planners.

Conclusion

Plug In Hybrid Tax Credit 2023 California are a treasure trove with useful and creative ideas catering to different needs and preferences. Their accessibility and flexibility make them a wonderful addition to both personal and professional life. Explore the world of Plug In Hybrid Tax Credit 2023 California today to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly completely free?

- Yes, they are! You can download and print these documents for free.

-

Can I use the free printing templates for commercial purposes?

- It's contingent upon the specific conditions of use. Always verify the guidelines provided by the creator before using printables for commercial projects.

-

Are there any copyright issues when you download printables that are free?

- Certain printables might have limitations regarding usage. You should read the terms and conditions set forth by the designer.

-

How can I print printables for free?

- You can print them at home with either a printer at home or in any local print store for the highest quality prints.

-

What program do I need to run printables at no cost?

- The majority of PDF documents are provided as PDF files, which can be opened with free software such as Adobe Reader.

What Does The EV Tax Credit Overhaul Mean For Car Shoppers News

Car Spy Shots News Reviews And Insights Motor Authority Page 43

Check more sample of Plug In Hybrid Tax Credit 2023 California below

Chrysler Pacifica Hybrid Tax Credit

Chrysler Pacifica Hybrid Tax Credit

Honda Cr V Hybrid Tax Credit Aaron jude

Has Irs Extended The Credit For Electric Cars OsVehicle

Kia America Announces 2022 Niro Plug In Hybrid

BMW Electric Plug in Hybrid Vehicle Tax Credit Update For 2023

https://www.cdtfa.ca.gov/industry/green-technology/vehicles.htm

Federal tax credits are available for the purchase of all electric and plug in hybrid vehicles The tax credits are up to dollar 7 500 Please note Sales or use tax is due on the total selling price of the vehicle

https://www.findmyelectric.com/blog/california-ev...

In this article we re going to take a quick look at California s state and local incentives We ll discuss the terms of the California Clean Vehicle Rebate how to find local incentives for EV buyers and what to do if you don t qualify for EV rebates in California

Federal tax credits are available for the purchase of all electric and plug in hybrid vehicles The tax credits are up to dollar 7 500 Please note Sales or use tax is due on the total selling price of the vehicle

In this article we re going to take a quick look at California s state and local incentives We ll discuss the terms of the California Clean Vehicle Rebate how to find local incentives for EV buyers and what to do if you don t qualify for EV rebates in California

Has Irs Extended The Credit For Electric Cars OsVehicle

Chrysler Pacifica Hybrid Tax Credit

Kia America Announces 2022 Niro Plug In Hybrid

BMW Electric Plug in Hybrid Vehicle Tax Credit Update For 2023

Planet Ford EV Plug in Hybrid Vehicle Rebate Program Randall Reed s

Federal Tax Credit For Electric Cars FAQ Wesley Chapel Honda

Federal Tax Credit For Electric Cars FAQ Wesley Chapel Honda

2022 Toyota Corolla Cross Gas Tank Size