Today, where screens rule our lives and the appeal of physical printed objects hasn't waned. Be it for educational use project ideas, artistic or simply adding some personal flair to your area, Ppf Deduction Under Section are a great resource. For this piece, we'll take a dive into the world "Ppf Deduction Under Section," exploring their purpose, where they are, and how they can add value to various aspects of your life.

Get Latest Ppf Deduction Under Section Below

Ppf Deduction Under Section

Ppf Deduction Under Section -

Any investment in the Public Provident Fund PPF is allowed as a deduction under this section PPF deposits fall under the EEE Exempt Exempt Exempt tax category Of which all three things

Understanding the importance of Section 80CCD for tax savings in India covering deductions of 2 lakh rupees for contributions to National Pension System and

Ppf Deduction Under Section cover a large selection of printable and downloadable materials available online at no cost. The resources are offered in a variety styles, from worksheets to templates, coloring pages and much more. The beauty of Ppf Deduction Under Section lies in their versatility and accessibility.

More of Ppf Deduction Under Section

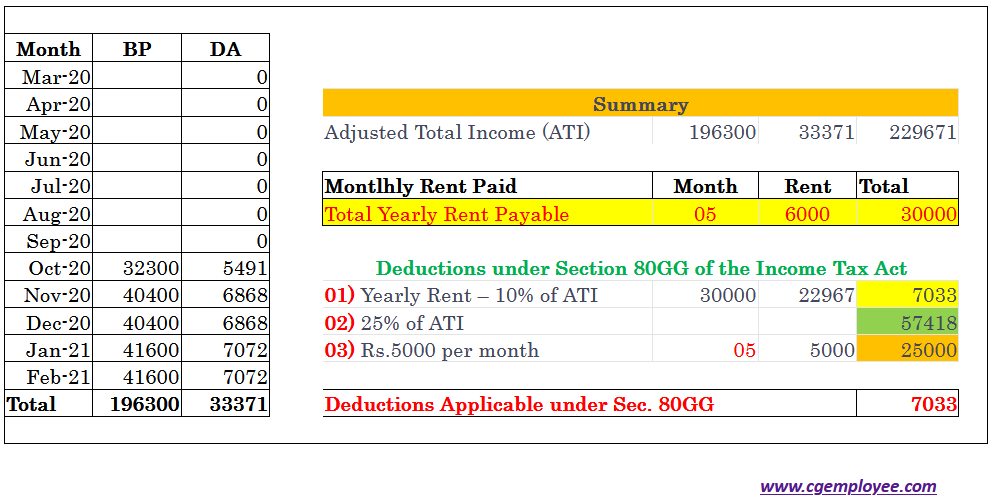

Section 80GG Tax Claim Deduction For Rent Paid CGEmployee

Section 80GG Tax Claim Deduction For Rent Paid CGEmployee

PPF contributions made every year are eligible for tax deductions under Section 80C of the Income Tax Act 1961 The deductions can be claimed by anyone for the same limit The

Interest on PPF is completely tax free without any limit It is not taxable at the time of accrual nor at the time of receipt under Section 10 11 Maturity as well as premature withdrawal is also exempt from tax

Ppf Deduction Under Section have garnered immense popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or costly software.

-

Flexible: Your HTML0 customization options allow you to customize printables to your specific needs be it designing invitations for your guests, organizing your schedule or decorating your home.

-

Educational Value Education-related printables at no charge provide for students of all ages, making these printables a powerful tool for parents and educators.

-

Affordability: Fast access various designs and templates saves time and effort.

Where to Find more Ppf Deduction Under Section

Deduction Under Section 80DD 80DDB And 80U

Deduction Under Section 80DD 80DDB And 80U

Public Provident Fund PPF and Employee Provident Fund EPF are investments with long term retirement benefits Both investments are entitled to

Only amounts up to Rs 1 5 lakh can be claimed as deduction under Section 80C of the Income Tax Act For e g if you contribute Rs 1 lakh toward your account and Rs 1 lakh

Since we've got your interest in printables for free we'll explore the places you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of printables that are free for a variety of purposes.

- Explore categories like decoration for your home, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free as well as flashcards and other learning materials.

- Perfect for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for no cost.

- These blogs cover a wide variety of topics, ranging from DIY projects to party planning.

Maximizing Ppf Deduction Under Section

Here are some innovative ways create the maximum value use of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Use free printable worksheets for teaching at-home either in the schoolroom or at home.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Get organized with printable calendars or to-do lists. meal planners.

Conclusion

Ppf Deduction Under Section are a treasure trove of practical and imaginative resources that cater to various needs and needs and. Their accessibility and flexibility make them a great addition to the professional and personal lives of both. Explore the endless world of Ppf Deduction Under Section and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really available for download?

- Yes you can! You can download and print these tools for free.

-

Do I have the right to use free printables for commercial purposes?

- It's determined by the specific terms of use. Always review the terms of use for the creator before using printables for commercial projects.

-

Are there any copyright violations with Ppf Deduction Under Section?

- Certain printables could be restricted on their use. Be sure to check the terms and condition of use as provided by the creator.

-

How do I print printables for free?

- Print them at home with printing equipment or visit any local print store for the highest quality prints.

-

What software do I require to open printables free of charge?

- The majority of printables are in the format of PDF, which can be opened with free software like Adobe Reader.

Deduction Under Section 80D Ultimate Guide

How To Calculate Tax Deduction From Salary Malaysia Printable Forms

Check more sample of Ppf Deduction Under Section below

Salaries Deduction Under Section 16 YouTube

Public Provident Fund PPF 5 Popular Investment Avenues For Tax

Section 80C Deductions Save Up To 1 5 Lakhs On Taxes

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

Public Provident Fund PPF 5 Popular Investment Avenues For Tax

Deduction Under SECTION 80 CCD YouTube

https://cleartax.in/s/section-80ccd

Understanding the importance of Section 80CCD for tax savings in India covering deductions of 2 lakh rupees for contributions to National Pension System and

https://www.financialexpress.com/money/ppf-tax...

PPF is one of India s most tax efficient plans for salaried people Contributions to the PPF account made every year are eligible for tax deductions under

Understanding the importance of Section 80CCD for tax savings in India covering deductions of 2 lakh rupees for contributions to National Pension System and

PPF is one of India s most tax efficient plans for salaried people Contributions to the PPF account made every year are eligible for tax deductions under

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

Public Provident Fund PPF 5 Popular Investment Avenues For Tax

Public Provident Fund PPF 5 Popular Investment Avenues For Tax

Deduction Under SECTION 80 CCD YouTube

Public Provident Fund PPF 5 Popular Investment Avenues For Tax

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Public Provident Fund PPF 5 Popular Investment Avenues For Tax