In a world when screens dominate our lives, the charm of tangible printed products hasn't decreased. If it's to aid in education in creative or artistic projects, or just adding the personal touch to your space, Ppf Tax Rebate Limit are now an essential source. With this guide, you'll dive into the sphere of "Ppf Tax Rebate Limit," exploring what they are, how to find them, and ways they can help you improve many aspects of your life.

Get Latest Ppf Tax Rebate Limit Below

Ppf Tax Rebate Limit

Ppf Tax Rebate Limit -

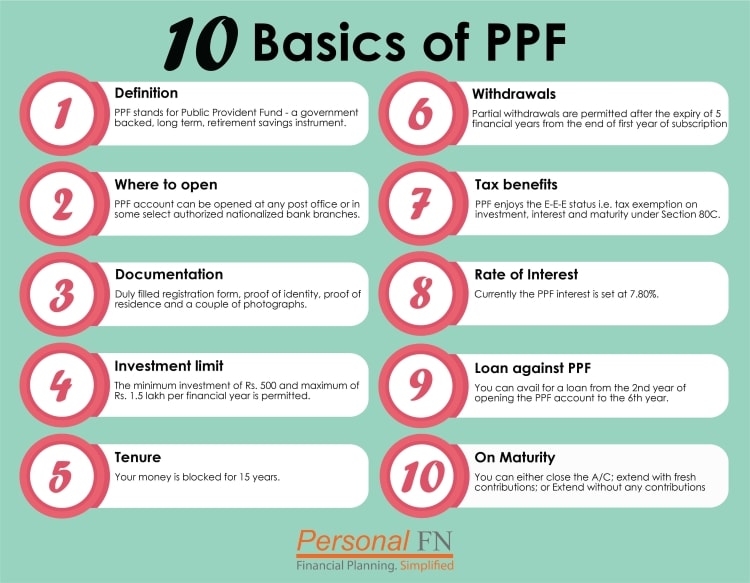

PPF contributions made every year are eligible for tax deductions under Section 80C of the Income Tax Act 1961 The deductions can be claimed by anyone for the same limit The deduction limit for PPF deposits was Rs 1 lakh which has been increased to Rs 1 5 lakhs from FY 2019 20 Check FREE Credit Score

Tax saving investments PPF offers tax exemptions at the time of investment accrual and withdrawal It has a current interest rate of 7 1 per annum and a maximum deposit limit of Rs 1 5 lakh per financial year PPF accounts

Ppf Tax Rebate Limit encompass a wide range of printable, free materials that are accessible online for free cost. They come in many forms, including worksheets, templates, coloring pages, and many more. The benefit of Ppf Tax Rebate Limit is in their variety and accessibility.

More of Ppf Tax Rebate Limit

How To Check PPF Loan Withdrawal Eligibility In Yono SBI

How To Check PPF Loan Withdrawal Eligibility In Yono SBI

Income tax exemptions are applicable on the principal amount invested in a PPF as an account The entire value of investment can be claimed for tax waiver under section 80C of the Income Tax Act of 1961

Important PPF Rules Tenure 15 years extendable in 5 year blocks Eligibility Only Indian residents can open a PPF account Deposit Limits Minimum 500 maximum 1 5 lakh per year Interest Rate Varies quarterly compounded annually Tax Benefits Deductions under Section 80C with interest and maturity tax free

Ppf Tax Rebate Limit have gained a lot of popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or costly software.

-

The ability to customize: We can customize the templates to meet your individual needs whether you're designing invitations, organizing your schedule, or even decorating your house.

-

Educational Impact: Free educational printables cater to learners of all ages, making them a useful source for educators and parents.

-

Easy to use: Quick access to a myriad of designs as well as templates can save you time and energy.

Where to Find more Ppf Tax Rebate Limit

PPF Tax Benefits 2022 PPF Tax Exemption Know Here Hindiholic

PPF Tax Benefits 2022 PPF Tax Exemption Know Here Hindiholic

Contributions made are eligible for tax rebate under 80C of Income Tax 1961 upto a ceiling of 1 5 lakhs as per old Tax regime Withdrawal Facility available Loan Facility available

Income tax savings PPF vs VPF taxation rules Your PPF investments qualify for Exempt Exempt Exempt or EEE status The amount you invest qualifies for a tax deduction of up to Rs 1 5 lakh under Section 80C of the Income tax Act 1961 The interest you earn from a PPF account is also tax free

After we've peaked your interest in Ppf Tax Rebate Limit Let's look into where you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Ppf Tax Rebate Limit designed for a variety objectives.

- Explore categories like interior decor, education, craft, and organization.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free or flashcards as well as learning tools.

- It is ideal for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates, which are free.

- The blogs are a vast array of topics, ranging all the way from DIY projects to party planning.

Maximizing Ppf Tax Rebate Limit

Here are some inventive ways that you can make use use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or festive decorations to decorate your living areas.

2. Education

- Use these printable worksheets free of charge for teaching at-home as well as in the class.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Ppf Tax Rebate Limit are an abundance filled with creative and practical information for a variety of needs and desires. Their access and versatility makes them an essential part of your professional and personal life. Explore the endless world of Ppf Tax Rebate Limit right now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Ppf Tax Rebate Limit really absolutely free?

- Yes, they are! You can download and print these materials for free.

-

Can I make use of free printables in commercial projects?

- It's based on specific rules of usage. Always verify the guidelines of the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright problems with Ppf Tax Rebate Limit?

- Some printables may come with restrictions in use. You should read the terms and conditions set forth by the creator.

-

How can I print printables for free?

- You can print them at home using an printer, or go to the local print shops for superior prints.

-

What software will I need to access printables that are free?

- Most PDF-based printables are available in PDF format. These can be opened using free software, such as Adobe Reader.

PUBLIC PROVIDENT FUND PPF SCHEME INCOME TAX BENEFIT INVESTMENT LIMIT

PPF Rules Investment Limit Will Be Doubled Tax And Returns Will Also

Check more sample of Ppf Tax Rebate Limit below

Public Provident Fund Full Details What Is PPF In English Benefits

Budget 2023 Summary Of Direct Tax Proposals

PPF Tax Exemption In Hindi

Ppf Account In Post Office Ppf Account Benefits Ppf Tax Free Scheme

Tricks To Maximize Returns In PPF Thinking Tamizha Tax Saving In

PPF Tax Exemption What Does It Mean Investment Simplified

https://economictimes.indiatimes.com › wealth › tax › ...

Tax saving investments PPF offers tax exemptions at the time of investment accrual and withdrawal It has a current interest rate of 7 1 per annum and a maximum deposit limit of Rs 1 5 lakh per financial year PPF accounts

https://www.financialexpress.com › money › ppf-tax...

The deduction limit for PPF deposits was increased to Rs 1 5 lakh from the earlier limit of Rs 1 lakh from FY 2014 15 The rate of return for the PPF deposit is currently 7 60 per cent The

Tax saving investments PPF offers tax exemptions at the time of investment accrual and withdrawal It has a current interest rate of 7 1 per annum and a maximum deposit limit of Rs 1 5 lakh per financial year PPF accounts

The deduction limit for PPF deposits was increased to Rs 1 5 lakh from the earlier limit of Rs 1 lakh from FY 2014 15 The rate of return for the PPF deposit is currently 7 60 per cent The

Ppf Account In Post Office Ppf Account Benefits Ppf Tax Free Scheme

Budget 2023 Summary Of Direct Tax Proposals

Tricks To Maximize Returns In PPF Thinking Tamizha Tax Saving In

PPF Tax Exemption What Does It Mean Investment Simplified

PPF Tax Rules 2021 PPF Account Tax Exemption

Bookmark This Page

Bookmark This Page

Best Tax Saving Scheme Under 80 C PPF VS ELSS YouTube