In this age of technology, where screens have become the dominant feature of our lives yet the appeal of tangible printed objects hasn't waned. In the case of educational materials or creative projects, or just adding personal touches to your home, printables for free are a great source. With this guide, you'll dive into the sphere of "Principal Amount Housing Loan Deduction," exploring their purpose, where they are, and what they can do to improve different aspects of your daily life.

Get Latest Principal Amount Housing Loan Deduction Below

Principal Amount Housing Loan Deduction

Principal Amount Housing Loan Deduction -

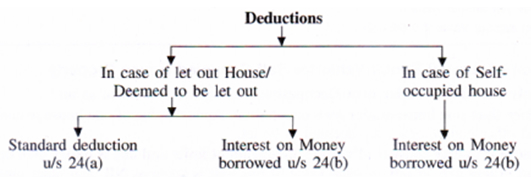

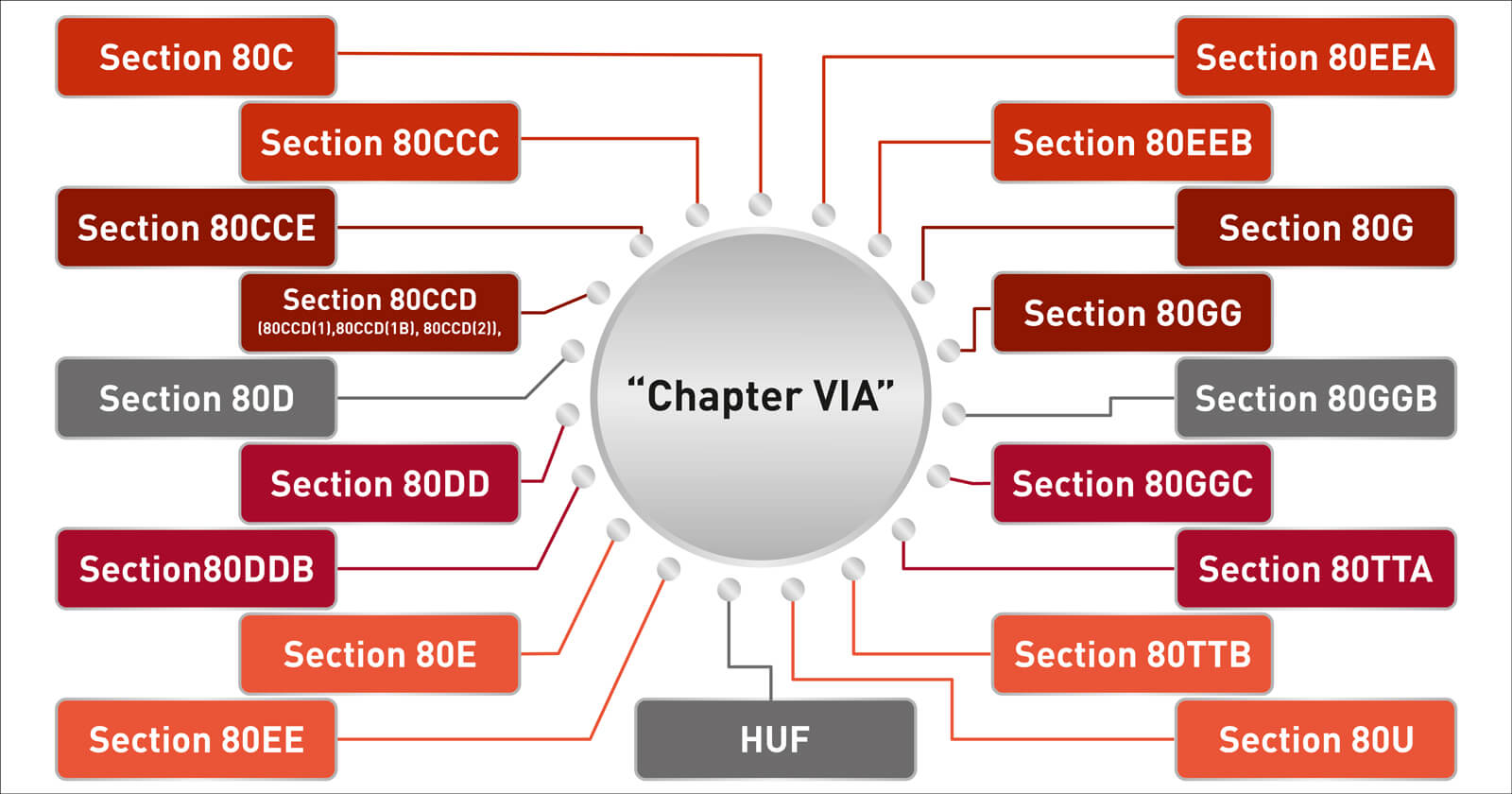

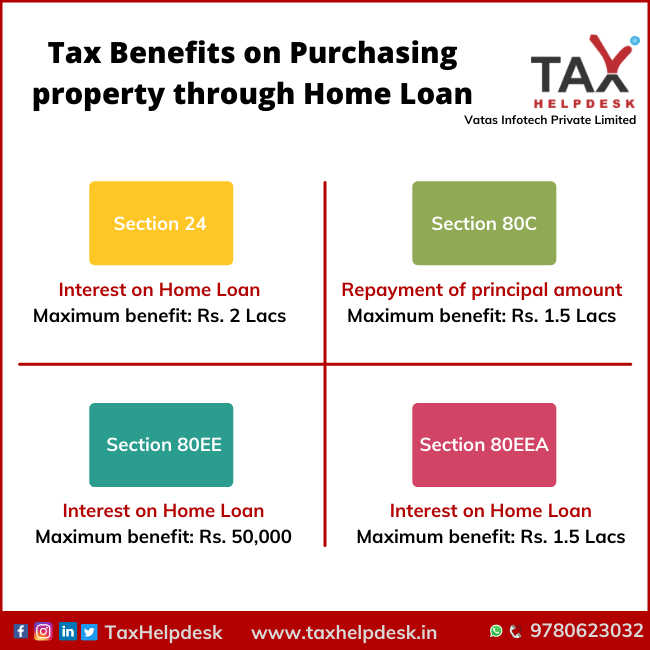

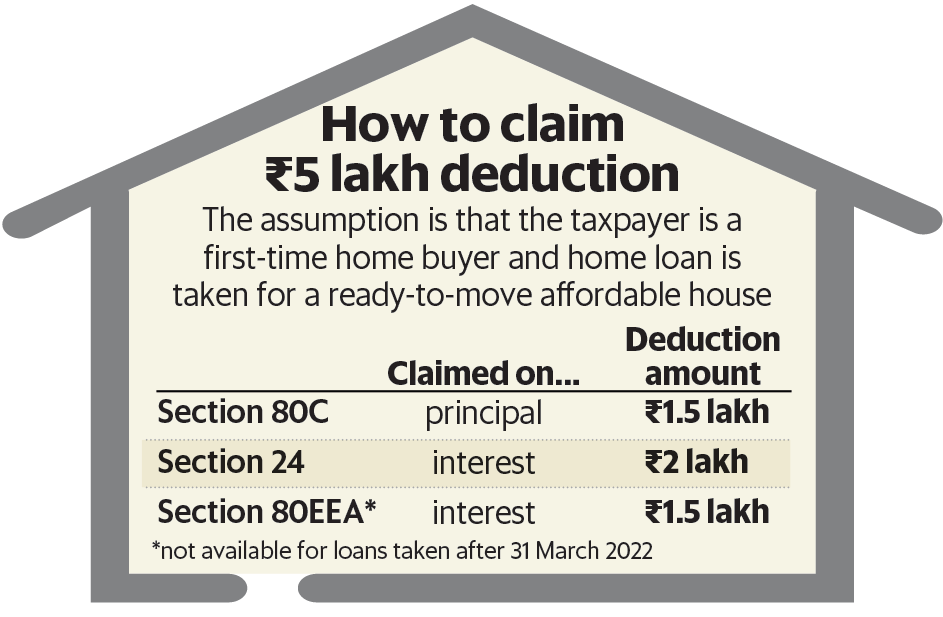

Both the interest paid on a home loan and the principal paid back on the loan are deductible by an individual filing taxes Section 24 permits a deduction of interest paid on a

This publication discusses the rules for deducting home mortgage interest Part I contains general information on home mortgage interest including points It also explains how to report

Principal Amount Housing Loan Deduction offer a wide assortment of printable, downloadable materials available online at no cost. They are available in numerous kinds, including worksheets coloring pages, templates and much more. The appealingness of Principal Amount Housing Loan Deduction is in their variety and accessibility.

More of Principal Amount Housing Loan Deduction

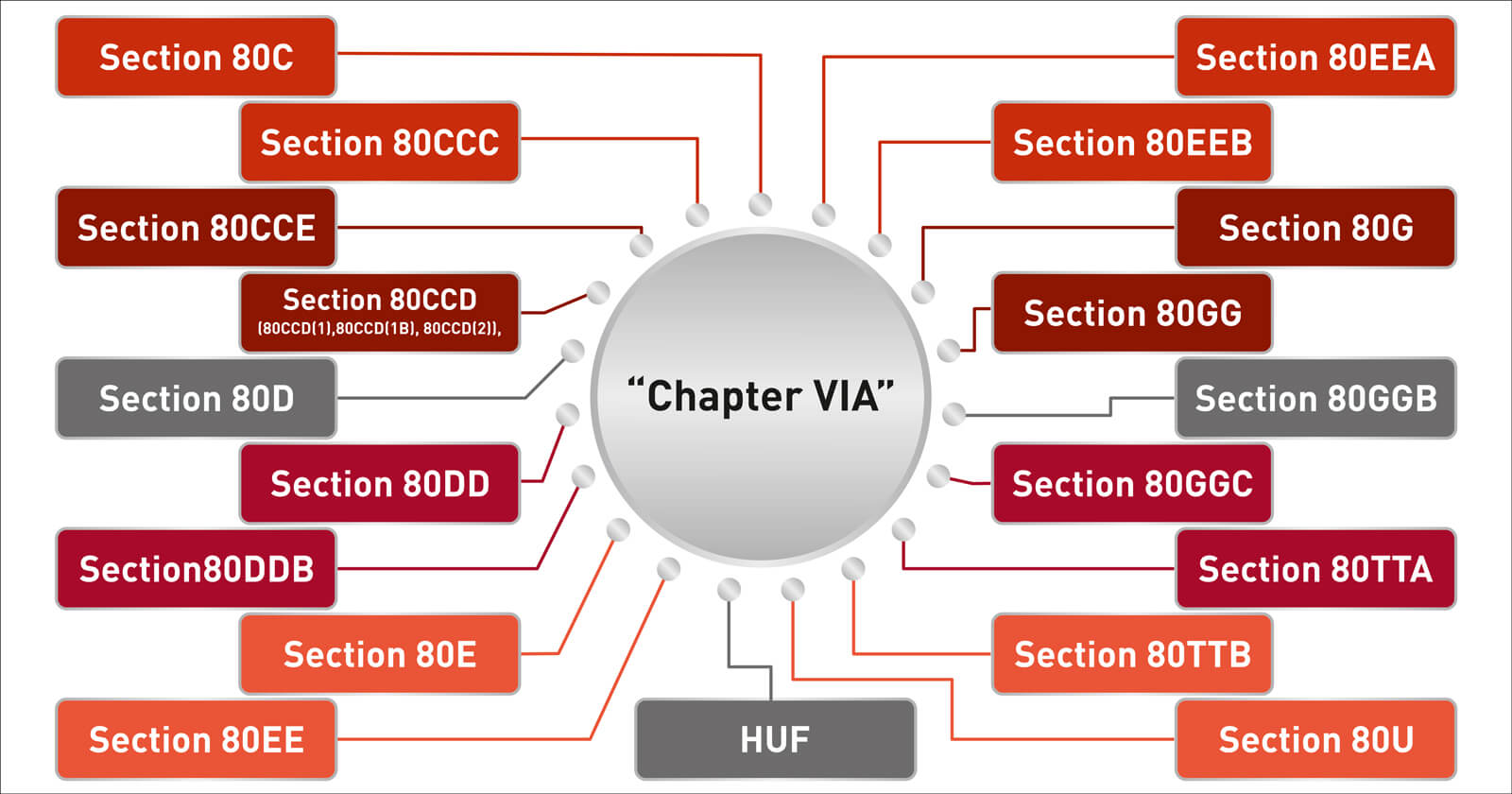

Tax Benefits On Home Loan Know More At Taxhelpdesk

Tax Benefits On Home Loan Know More At Taxhelpdesk

If you have made a principal repayment during the year check your loan instalment details principal repayments can be claimed as a deduction under Section 80C However the

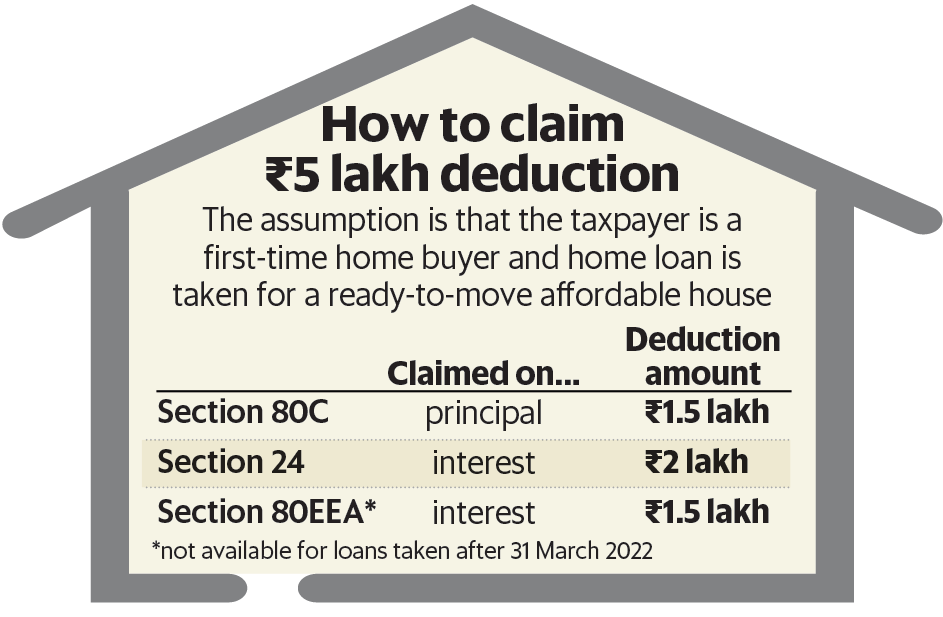

Thus the total deduction available to an individual taxpayer on the interest payment on a housing loan taken to buy an affordable house is Rs 3 5 lakh in a financial year

Printables for free have gained immense popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

Personalization This allows you to modify designs to suit your personal needs such as designing invitations making your schedule, or even decorating your home.

-

Educational Benefits: Education-related printables at no charge can be used by students of all ages. This makes the perfect tool for parents and teachers.

-

An easy way to access HTML0: The instant accessibility to many designs and templates helps save time and effort.

Where to Find more Principal Amount Housing Loan Deduction

Letter For Stop EMI Deduction Sample Letter To Bank Manager YouTube

Letter For Stop EMI Deduction Sample Letter To Bank Manager YouTube

If a home loan is taken jointly each borrower can claim deduction on home loan interest up to Rs 2 lakh under Section 24 b and tax deduction on the principal repayment up to Rs 1 5 lakh

Starting in 2018 deductible interest for new loans is limited to principal amounts of 750 000 Loans from before December 16 2017 or under a contract that closes before April

Now that we've piqued your interest in printables for free Let's find out where you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of Principal Amount Housing Loan Deduction designed for a variety goals.

- Explore categories such as design, home decor, organizing, and crafts.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets, flashcards, and learning materials.

- The perfect resource for parents, teachers or students in search of additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates free of charge.

- These blogs cover a broad range of topics, from DIY projects to planning a party.

Maximizing Principal Amount Housing Loan Deduction

Here are some ways ensure you get the very most use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes as well as seasonal decorations, to embellish your living areas.

2. Education

- Print worksheets that are free to enhance your learning at home as well as in the class.

3. Event Planning

- Design invitations for banners, invitations and decorations for special events like weddings or birthdays.

4. Organization

- Stay organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Principal Amount Housing Loan Deduction are a treasure trove filled with creative and practical information that satisfy a wide range of requirements and desires. Their access and versatility makes them a valuable addition to your professional and personal life. Explore the wide world of Principal Amount Housing Loan Deduction right now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Principal Amount Housing Loan Deduction truly gratis?

- Yes, they are! You can print and download these items for free.

-

Can I utilize free printables for commercial uses?

- It depends on the specific conditions of use. Always check the creator's guidelines prior to utilizing the templates for commercial projects.

-

Do you have any copyright rights issues with Principal Amount Housing Loan Deduction?

- Some printables may come with restrictions on usage. Be sure to review the terms and conditions offered by the author.

-

How do I print printables for free?

- Print them at home using a printer or visit an in-store print shop to get superior prints.

-

What program do I need to run printables for free?

- Many printables are offered in PDF format. These can be opened with free software like Adobe Reader.

DEDUCTIONS U S 24 Out Of Net Annual Value NAV Of House Property Income

Tax Benefits On Home Loan 2022 2023

Check more sample of Principal Amount Housing Loan Deduction below

Deduction Of Interest On Housing Loan In Case Of Co ownership

How First time Home Buyers Can Get Up To 5 Lakh Tax Rebate Mint

Deduction Of Principal Component And Interest Paid On Housing Loan

Interest On Housing Loan Deduction Under Income Tax Section 24 Taxwink

Section 80EE And 80EEA Interest On Housing Loan Deduction

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

https://www.irs.gov/publications/p936

This publication discusses the rules for deducting home mortgage interest Part I contains general information on home mortgage interest including points It also explains how to report

https://taxguru.in/income-tax/faq-on-housing-loan...

The repayment of the principal amount of loan is claimed as a deduction under section 80C of the Income Tax Act up to a maximum amount of Rs 1 50 Rs 1 Lakh up to

This publication discusses the rules for deducting home mortgage interest Part I contains general information on home mortgage interest including points It also explains how to report

The repayment of the principal amount of loan is claimed as a deduction under section 80C of the Income Tax Act up to a maximum amount of Rs 1 50 Rs 1 Lakh up to

Interest On Housing Loan Deduction Under Income Tax Section 24 Taxwink

How First time Home Buyers Can Get Up To 5 Lakh Tax Rebate Mint

Section 80EE And 80EEA Interest On Housing Loan Deduction

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Tax Query Can I Claim Deduction On Housing Loan Under New Tax Regime

Housing Loan And Deduction Of The Principal Of The Interest Portion

Housing Loan And Deduction Of The Principal Of The Interest Portion

Section 24 Of Income Tax Act House Property Deduction