In this age of electronic devices, where screens have become the dominant feature of our lives yet the appeal of tangible printed objects isn't diminished. If it's to aid in education or creative projects, or just adding the personal touch to your space, Property Tax Exemption For Charities are a great source. The following article is a dive deeper into "Property Tax Exemption For Charities," exploring the different types of printables, where to find them and ways they can help you improve many aspects of your lives.

Get Latest Property Tax Exemption For Charities Below

Property Tax Exemption For Charities

Property Tax Exemption For Charities -

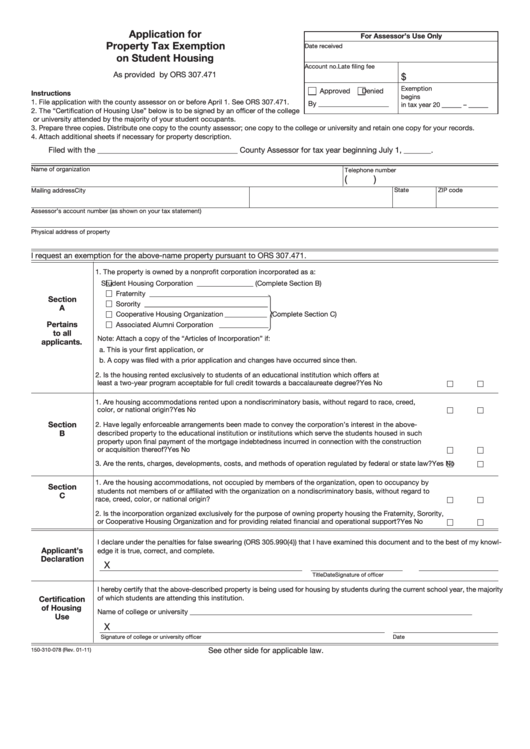

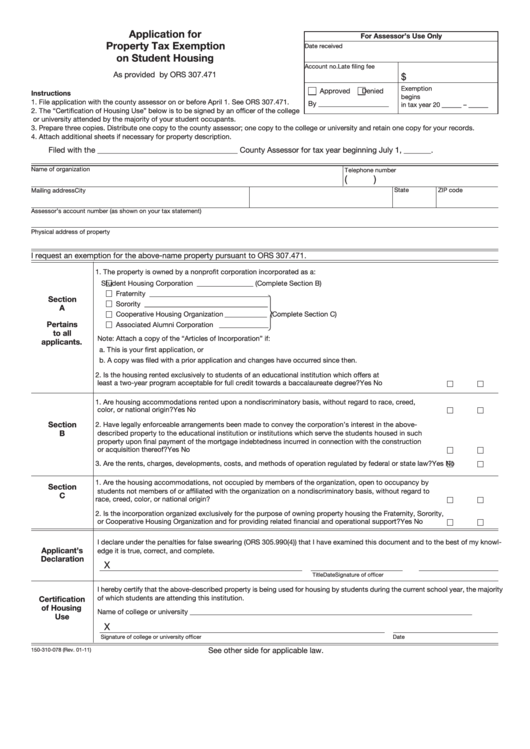

Certain properties owned by a charity or public body may be exempt from Local Property Tax LPT There are two exemptions available for properties owned by a charity or public body The exemption that may apply depends on the use of the property

Real estate tax check the tax decision and pay the tax Real estate tax is usually paid by the owner of the real estate unit How much tax is to be paid depends on the value of the property and the tax rate determined by the municipality

Printables for free cover a broad collection of printable documents that can be downloaded online at no cost. These printables come in different kinds, including worksheets templates, coloring pages and many more. The benefit of Property Tax Exemption For Charities lies in their versatility as well as accessibility.

More of Property Tax Exemption For Charities

Guide To Property Tax In Arlington TX 2022 Four 19 Properties

Guide To Property Tax In Arlington TX 2022 Four 19 Properties

Nonresidents are taxed on their Finnish sourced income divided into two categories income from capital and earned income These categories are taxed separately at different rates Nonresident individuals earning income from capital are taxed at progressive rates from 30 to 34

Some jurisdictions grant an overall exemption from taxation to organizations meeting certain definitions The United Kingdom for example provides an exemption from rates property taxes and income taxes for entities governed by the Charities Law This overall exemption may be somewhat limited by limited scope for taxation by the jurisdiction

Property Tax Exemption For Charities have gained immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or expensive software.

-

Customization: This allows you to modify designs to suit your personal needs in designing invitations making your schedule, or even decorating your house.

-

Educational Use: Free educational printables offer a wide range of educational content for learners of all ages. This makes them a useful source for educators and parents.

-

Accessibility: Fast access many designs and templates, which saves time as well as effort.

Where to Find more Property Tax Exemption For Charities

Hecht Group Oklahoma Property Tax Exemption For Disabled Veterans

Hecht Group Oklahoma Property Tax Exemption For Disabled Veterans

National Insurance The rate that employers pay in contributions will rise from 13 8 to 15 on a worker s earnings above 175 from April The threshold at which employers start paying the tax on

Recently opposition from revenue starved local governments has mounted in the form of frontal attacks on the charity exemption and demands for payments in lieu of taxes This collection of essays seeks to put the debate in larger context

We've now piqued your curiosity about Property Tax Exemption For Charities Let's look into where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of printables that are free for a variety of uses.

- Explore categories such as furniture, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets Flashcards, worksheets, and other educational tools.

- This is a great resource for parents, teachers, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs as well as templates for free.

- The blogs covered cover a wide selection of subjects, all the way from DIY projects to party planning.

Maximizing Property Tax Exemption For Charities

Here are some creative ways ensure you get the very most use of Property Tax Exemption For Charities:

1. Home Decor

- Print and frame beautiful images, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Utilize free printable worksheets to aid in learning at your home, or even in the classroom.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Keep your calendars organized by printing printable calendars with to-do lists, planners, and meal planners.

Conclusion

Property Tax Exemption For Charities are an abundance filled with creative and practical information for a variety of needs and hobbies. Their access and versatility makes them an invaluable addition to any professional or personal life. Explore the plethora of Property Tax Exemption For Charities now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really gratis?

- Yes you can! You can download and print these materials for free.

-

Does it allow me to use free printables in commercial projects?

- It's all dependent on the rules of usage. Always check the creator's guidelines before utilizing their templates for commercial projects.

-

Are there any copyright concerns with printables that are free?

- Certain printables could be restricted concerning their use. Make sure you read the conditions and terms of use provided by the creator.

-

How do I print Property Tax Exemption For Charities?

- Print them at home with either a printer at home or in a local print shop to purchase better quality prints.

-

What program must I use to open printables at no cost?

- The majority of PDF documents are provided in PDF format. They is open with no cost software like Adobe Reader.

Iowa Seniors Have Until July 1 To Apply For New Property Tax Exemption

Hecht Group Property Tax Exemption For Seniors In Alabama

Check more sample of Property Tax Exemption For Charities below

Jefferson County Property Tax Exemption Form ExemptForm

Jefferson County Property Tax Exemption Form ExemptForm

Tax Exemption Form For Veterans ExemptForm

Hecht Group Property Tax Exemption For Seniors In Alabama

Developers Rajeev Puri James Schuepbach To Receive Full Property Tax

Water District Offers Property Tax Exemption For Low income Seniors

https://www.vero.fi/en/individuals/property/real-estate-tax

Real estate tax check the tax decision and pay the tax Real estate tax is usually paid by the owner of the real estate unit How much tax is to be paid depends on the value of the property and the tax rate determined by the municipality

https://www.taxpolicycenter.org/sites/default/...

Properties owned by chari table nonprofits and used for a tax exempt purpose are exempt from property taxes under state law in all 50 states even though municipalities still need to pay to provide these nonprofits with public services like police and fire protection and street maintenance Gallagher 2002 3 3 For cities heavily reliant on the p

Real estate tax check the tax decision and pay the tax Real estate tax is usually paid by the owner of the real estate unit How much tax is to be paid depends on the value of the property and the tax rate determined by the municipality

Properties owned by chari table nonprofits and used for a tax exempt purpose are exempt from property taxes under state law in all 50 states even though municipalities still need to pay to provide these nonprofits with public services like police and fire protection and street maintenance Gallagher 2002 3 3 For cities heavily reliant on the p

Hecht Group Property Tax Exemption For Seniors In Alabama

Jefferson County Property Tax Exemption Form ExemptForm

Developers Rajeev Puri James Schuepbach To Receive Full Property Tax

Water District Offers Property Tax Exemption For Low income Seniors

Download PDF Epub Property Tax Exemption For Charities Mapping

Property Tax Exemption For Disabled Veterans

Property Tax Exemption For Disabled Veterans

Texas Veteran Property Tax Exemption Disabled Veteran Benefits