In the age of digital, where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible printed objects hasn't waned. Whether it's for educational purposes, creative projects, or simply to add the personal touch to your home, printables for free are now an essential source. Here, we'll take a dive in the world of "Property Transfer Tax Return Bc," exploring the benefits of them, where they can be found, and how they can improve various aspects of your daily life.

What Are Property Transfer Tax Return Bc?

Property Transfer Tax Return Bc include a broad assortment of printable, downloadable materials available online at no cost. These resources come in various forms, including worksheets, coloring pages, templates and many more. The great thing about Property Transfer Tax Return Bc lies in their versatility and accessibility.

Property Transfer Tax Return Bc

Property Transfer Tax Return Bc

Property Transfer Tax Return Bc -

[desc-5]

[desc-1]

How Much Is Property Transfer Tax In BC Canada And Who Pays It Sage

How Much Is Property Transfer Tax In BC Canada And Who Pays It Sage

[desc-4]

[desc-6]

Property Transfer Tax In British Columbia

Property Transfer Tax In British Columbia

[desc-9]

[desc-7]

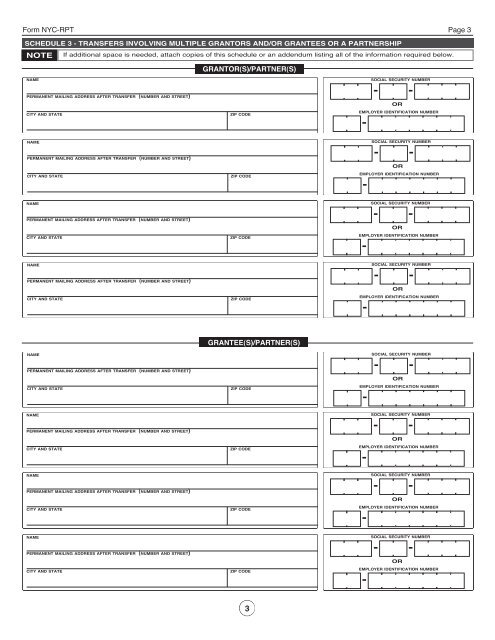

Real Property Transfer Tax Return New York City Free Download

Form NYC

BC 20

BC 20

Real Property Transfer Tax Return New York Free Download

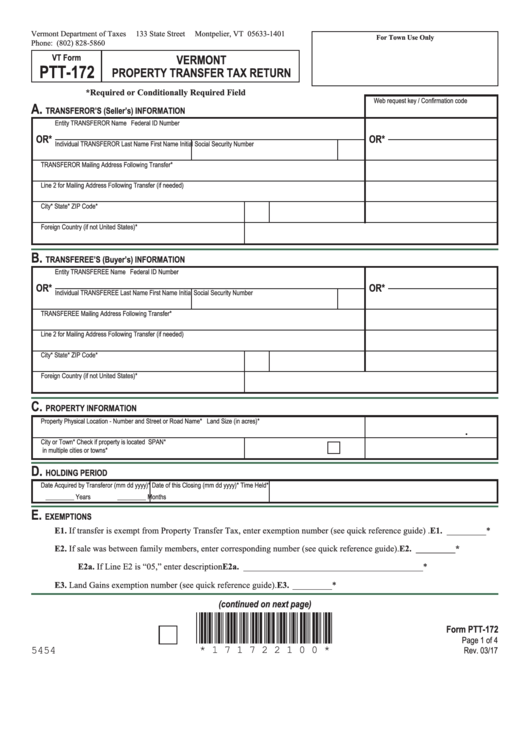

Fillable Form Pt 172 B Property Transfer Tax Return Printable Pdf

Fillable Form Pt 172 B Property Transfer Tax Return Printable Pdf

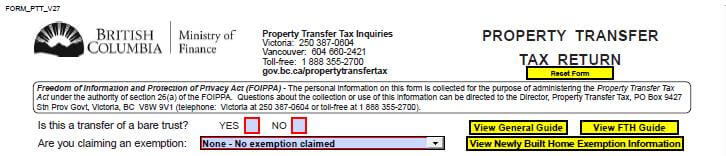

File A Property Transfer Tax Return LTSA Help