In this age of technology, where screens have become the dominant feature of our lives The appeal of tangible printed objects hasn't waned. It doesn't matter if it's for educational reasons such as creative projects or just adding some personal flair to your space, Pros And Cons Of Amending Tax Return are now an essential source. With this guide, you'll take a dive deep into the realm of "Pros And Cons Of Amending Tax Return," exploring what they are, where to find them, and how they can be used to enhance different aspects of your daily life.

Get Latest Pros And Cons Of Amending Tax Return Below

Pros And Cons Of Amending Tax Return

Pros And Cons Of Amending Tax Return -

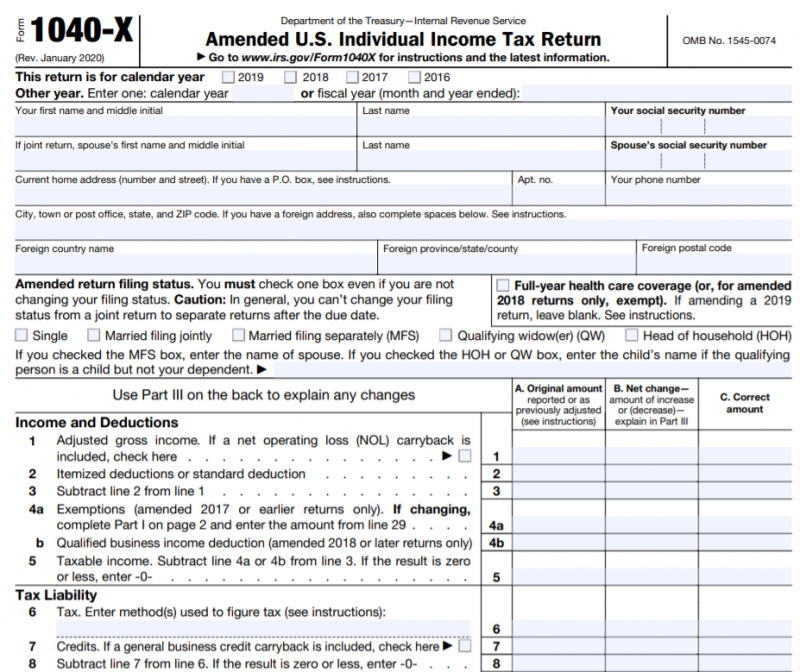

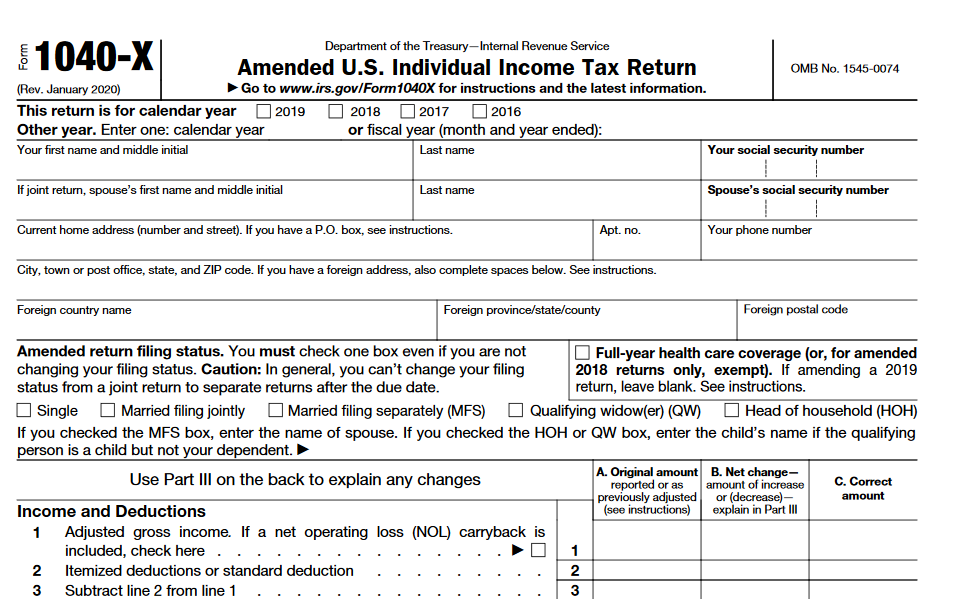

An amended return is an IRS form that can be used to fix information on an annual tax return you ve already filed You must submit your amendment either within three years from the date

The IRS rejected their e filed return They forgot to attach a copy of their Form W 2 to the return Learn the most common reasons people file amended returns when they shouldn t and exactly what to do instead or if you need to file an amended tax return

Pros And Cons Of Amending Tax Return cover a large assortment of printable, downloadable items that are available online at no cost. These resources come in many forms, including worksheets, templates, coloring pages and much more. One of the advantages of Pros And Cons Of Amending Tax Return is their versatility and accessibility.

More of Pros And Cons Of Amending Tax Return

IRS Touts major Milestone As Income Tax Amending Form 1040 X Becomes

IRS Touts major Milestone As Income Tax Amending Form 1040 X Becomes

If you need to amend your Form 1040 1040 SR 1040 NR or 1040 SS PR for the current or two prior tax periods you can amend these forms electronically using available tax software products

Benefits of Amending Your Tax Return While amending your tax return might seem like an extra step it can provide significant benefits Peace of Mind Correcting errors on your tax return can prevent future IRS notices and provide peace of mind Increased Refunds Claiming additional deductions and credits can lead to higher refunds

Pros And Cons Of Amending Tax Return have garnered immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

Customization: They can make printables to fit your particular needs such as designing invitations making your schedule, or decorating your home.

-

Educational Impact: The free educational worksheets are designed to appeal to students of all ages. This makes the perfect source for educators and parents.

-

Affordability: The instant accessibility to an array of designs and templates helps save time and effort.

Where to Find more Pros And Cons Of Amending Tax Return

IRS Adds E Filing For Form 1040 X Amended Tax Returns

IRS Adds E Filing For Form 1040 X Amended Tax Returns

Each year between three and four million taxpayers file amended returns on Form 1040 X Advising a client as to whether he should avail himself of the option of amending requires careful

The IRS allows for tax return amending if you did not file correctly in your last tax submission or you made a mistake Filing your tax return is a mandatory requisite if your earnings fall under the minimum required income level

After we've peaked your interest in Pros And Cons Of Amending Tax Return Let's find out where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of Pros And Cons Of Amending Tax Return designed for a variety purposes.

- Explore categories such as decorating your home, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free including flashcards, learning tools.

- Ideal for teachers, parents, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for free.

- The blogs covered cover a wide variety of topics, all the way from DIY projects to party planning.

Maximizing Pros And Cons Of Amending Tax Return

Here are some new ways how you could make the most use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or seasonal decorations that will adorn your living spaces.

2. Education

- Use printable worksheets for free for teaching at-home as well as in the class.

3. Event Planning

- Design invitations, banners, and decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable planners for to-do list, lists of chores, and meal planners.

Conclusion

Pros And Cons Of Amending Tax Return are an abundance filled with creative and practical information that meet a variety of needs and interest. Their accessibility and flexibility make these printables a useful addition to both professional and personal lives. Explore the endless world of Pros And Cons Of Amending Tax Return now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Pros And Cons Of Amending Tax Return really are they free?

- Yes, they are! You can print and download these resources at no cost.

-

Can I utilize free templates for commercial use?

- It depends on the specific usage guidelines. Make sure you read the guidelines for the creator before utilizing their templates for commercial projects.

-

Do you have any copyright concerns when using Pros And Cons Of Amending Tax Return?

- Certain printables might have limitations regarding usage. Make sure you read the terms and conditions provided by the author.

-

How do I print printables for free?

- You can print them at home with the printer, or go to a print shop in your area for better quality prints.

-

What software do I require to open printables free of charge?

- The majority of printed documents are in the PDF format, and can be opened with free software like Adobe Reader.

What You Should Know When Amending A Federal Income Tax Return

Amending An Individual Tax Return YouTube

Check more sample of Pros And Cons Of Amending Tax Return below

Amending The Tax Return Musings And Mutterings

Chief Tax Information Officer Reveals The Top Six Things You Need To

Pros And Cons Of Clay Soil Is Clay Soil Good For Your Plants

Amending Your Income Tax Return TurboTax Tax Tips Videos

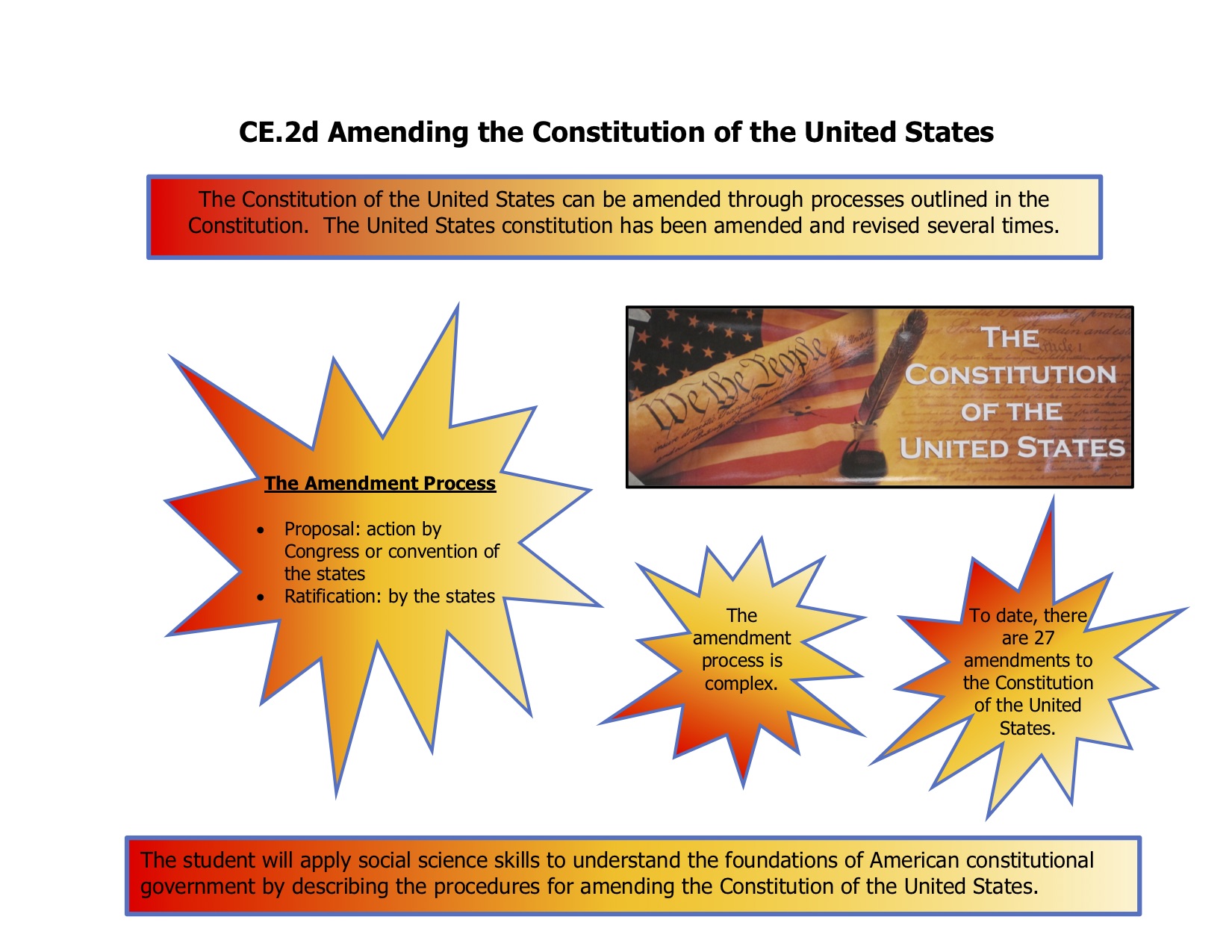

Amending The Constitution Of The United States And The Constitution Of

Optima Tax Relief Reviews Tips For Amending Tax Return Tax Return

https://www.hrblock.com/tax-center/irs/audits-and-tax-notices/top...

The IRS rejected their e filed return They forgot to attach a copy of their Form W 2 to the return Learn the most common reasons people file amended returns when they shouldn t and exactly what to do instead or if you need to file an amended tax return

https://www.forbes.com/.../13/amending-your-taxes-be-careful-with-irs

Can you amend your taxes if you forgot something or made a mistake Sure Should you It depends You must file a tax return with the IRS each year if your income is over the requisite

The IRS rejected their e filed return They forgot to attach a copy of their Form W 2 to the return Learn the most common reasons people file amended returns when they shouldn t and exactly what to do instead or if you need to file an amended tax return

Can you amend your taxes if you forgot something or made a mistake Sure Should you It depends You must file a tax return with the IRS each year if your income is over the requisite

Amending Your Income Tax Return TurboTax Tax Tips Videos

Chief Tax Information Officer Reveals The Top Six Things You Need To

Amending The Constitution Of The United States And The Constitution Of

Optima Tax Relief Reviews Tips For Amending Tax Return Tax Return

What Do You Need To Know About Amending Your Tax Return Potomac

Soverign Citizens Not Paying Tax Is Illegal The ATO Process Of

Soverign Citizens Not Paying Tax Is Illegal The ATO Process Of

11 Tips On Amending Your Tax Return Campaign For Working Families Inc