In the age of digital, where screens dominate our lives and the appeal of physical printed material hasn't diminished. Be it for educational use as well as creative projects or simply to add an extra personal touch to your area, Pros And Cons Of Earned Income Tax Credit have become an invaluable resource. In this article, we'll dive in the world of "Pros And Cons Of Earned Income Tax Credit," exploring what they are, how to get them, as well as what they can do to improve different aspects of your lives.

Get Latest Pros And Cons Of Earned Income Tax Credit Below

Pros And Cons Of Earned Income Tax Credit

Pros And Cons Of Earned Income Tax Credit -

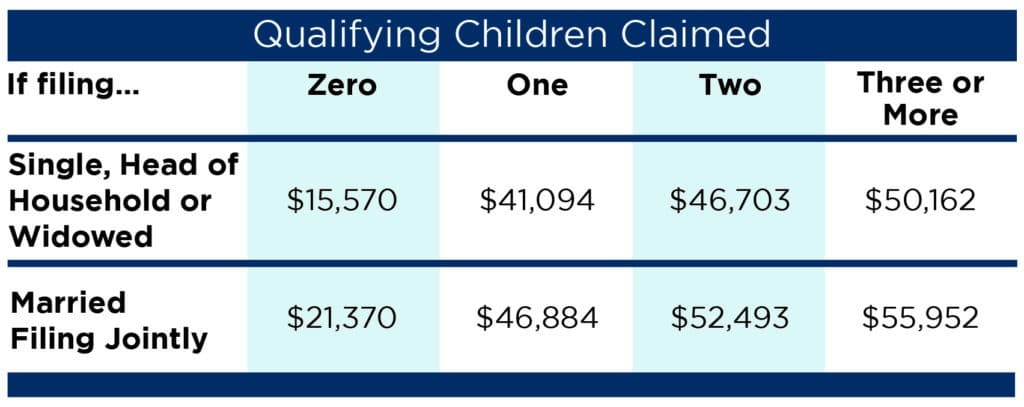

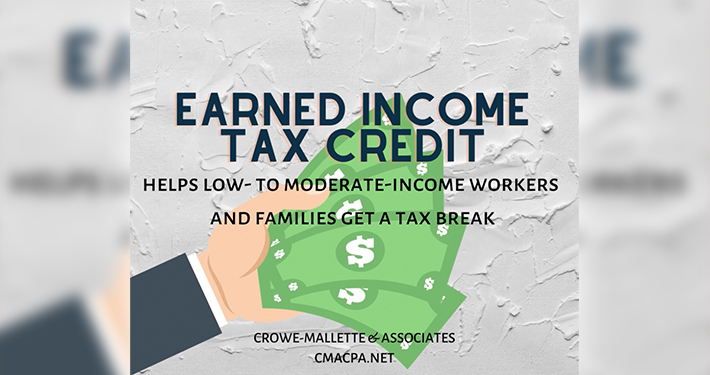

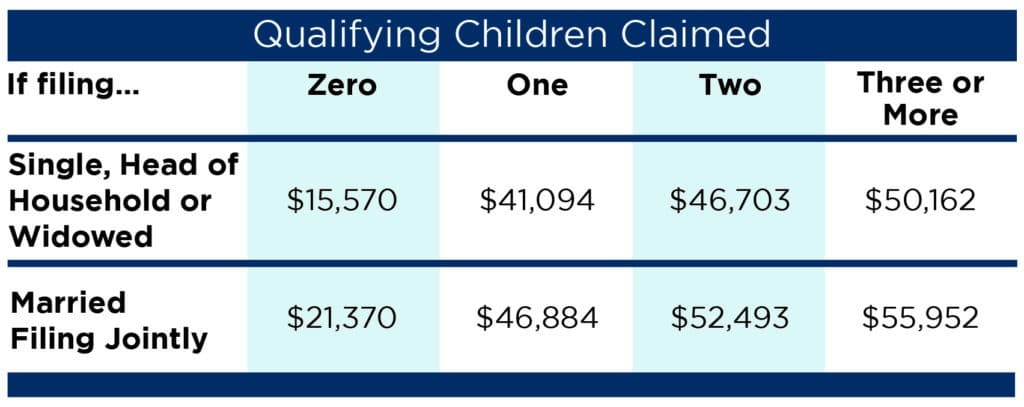

The Earned Income Tax Credit EITC helps low to moderate income workers and families get a tax break If you qualify you can use the credit to reduce the taxes you owe

The Earned Income Tax Credit EITC is a generous tax break for workers with low to moderate incomes especially those with children It s one of the few tax credits where

Pros And Cons Of Earned Income Tax Credit provide a diverse assortment of printable materials available online at no cost. They are available in a variety of kinds, including worksheets coloring pages, templates and more. The beauty of Pros And Cons Of Earned Income Tax Credit is their versatility and accessibility.

More of Pros And Cons Of Earned Income Tax Credit

Pros And Cons Of Introducing Earned Income Tax Credit EITC In Australia

Pros And Cons Of Introducing Earned Income Tax Credit EITC In Australia

The Earned Income Tax Credit EITC is a federal tax credit for working people with low and moderate incomes It boosts the incomes of workers paid low wages while offsetting federal payroll and income taxes

The Earned Income Tax Credit EITC is a refundable tax credit that boosts the income of eligible low income workers especially those with children Because the credit is

Printables that are free have gained enormous popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or expensive software.

-

Flexible: This allows you to modify printed materials to meet your requirements for invitations, whether that's creating them and schedules, or decorating your home.

-

Educational Use: These Pros And Cons Of Earned Income Tax Credit offer a wide range of educational content for learners of all ages. This makes the perfect device for teachers and parents.

-

The convenience of Instant access to an array of designs and templates is time-saving and saves effort.

Where to Find more Pros And Cons Of Earned Income Tax Credit

PESO Model PR And Marketing PowerPoint Templates In 2022 Powerpoint

PESO Model PR And Marketing PowerPoint Templates In 2022 Powerpoint

The Earned Income Tax Credit EITC How It Works and Who Receives It The Earned Income Tax Credit EITC is a refundable tax credit available to eligible workers

The EIC is a tax credit for certain people who work and have earned income under 63 398 A tax credit usually means more money in your pocket It reduces the amount of tax you owe The EIC may also give you a refund

Now that we've ignited your curiosity about Pros And Cons Of Earned Income Tax Credit we'll explore the places you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection and Pros And Cons Of Earned Income Tax Credit for a variety goals.

- Explore categories such as the home, decor, the arts, and more.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets with flashcards and other teaching tools.

- Perfect for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their imaginative designs with templates and designs for free.

- The blogs are a vast variety of topics, ranging from DIY projects to planning a party.

Maximizing Pros And Cons Of Earned Income Tax Credit

Here are some innovative ways how you could make the most use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes or other seasonal decorations to fill your living spaces.

2. Education

- Print worksheets that are free to enhance learning at home (or in the learning environment).

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Be organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Pros And Cons Of Earned Income Tax Credit are an abundance of creative and practical resources that satisfy a wide range of requirements and passions. Their access and versatility makes they a beneficial addition to both professional and personal life. Explore the many options of Pros And Cons Of Earned Income Tax Credit and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really available for download?

- Yes, they are! You can print and download these materials for free.

-

Can I use the free templates for commercial use?

- It depends on the specific usage guidelines. Be sure to read the rules of the creator before using their printables for commercial projects.

-

Do you have any copyright issues in printables that are free?

- Some printables could have limitations in their usage. Make sure you read the terms and conditions offered by the creator.

-

How do I print Pros And Cons Of Earned Income Tax Credit?

- Print them at home with an printer, or go to a print shop in your area for high-quality prints.

-

What program will I need to access printables that are free?

- Many printables are offered in the format of PDF, which is open with no cost software, such as Adobe Reader.

Earned Income Tax Credit EITC What It Is And Who Qualifies Quakerpedia

California Earned Income Tax Credit Worksheet Part Iii Line 6 Worksheet

Check more sample of Pros And Cons Of Earned Income Tax Credit below

Earned Income Credit Calculator 2021 DannielleThalia

Pros And Cons Of Earned Wage Access EWA

_fb.jpg#keepProtocol)

Earned Income Tax Credit Tax Graph Income Tax Tax Credits Income

Earned Income Credit Limitation Tax Reform Changes Ohio CPA

Tax Credit 2023 2023

Earned Income Tax Credit Crowe Mallette Associates

https://www.fidelity.com/.../earned-income-tax-credit

The Earned Income Tax Credit EITC is a generous tax break for workers with low to moderate incomes especially those with children It s one of the few tax credits where

https://www.journals.uchicago.edu/doi/full/1…

I then discuss empirical work on the effects of the EITC on poverty and income distribution and its effects on labor supply Next I discuss a few policy concerns about the EITC possible negative effects on hours of work and marriage and

The Earned Income Tax Credit EITC is a generous tax break for workers with low to moderate incomes especially those with children It s one of the few tax credits where

I then discuss empirical work on the effects of the EITC on poverty and income distribution and its effects on labor supply Next I discuss a few policy concerns about the EITC possible negative effects on hours of work and marriage and

Earned Income Credit Limitation Tax Reform Changes Ohio CPA

_fb.jpg#keepProtocol)

Pros And Cons Of Earned Wage Access EWA

Tax Credit 2023 2023

Earned Income Tax Credit Crowe Mallette Associates

What Is Earned Income Definition IRS Earned Income Credit More

Illinois Earned Income Tax Credit Do You Qualify Pasquesi Sheppard

Illinois Earned Income Tax Credit Do You Qualify Pasquesi Sheppard

The Pros And Cons Of Filing Taxes Early A Comprehensive Guide