In this age of electronic devices, where screens rule our lives The appeal of tangible printed objects isn't diminished. No matter whether it's for educational uses and creative work, or simply adding personal touches to your home, printables for free are a great source. The following article is a dive to the depths of "Pros And Cons Of Filing Joint Tax Return," exploring what they are, how to find them, and ways they can help you improve many aspects of your lives.

Get Latest Pros And Cons Of Filing Joint Tax Return Below

Pros And Cons Of Filing Joint Tax Return

Pros And Cons Of Filing Joint Tax Return -

Whether you re newlyweds or have been married for years choosing to file taxes jointly or separately could affect the amount you owe or are refunded Here s how to decide which is right for you

Married filing jointly is a tax filing status that allows a married couple to file a single tax return that records both of their taxable income deductions credits and

Pros And Cons Of Filing Joint Tax Return offer a wide assortment of printable, downloadable material that is available online at no cost. These printables come in different types, like worksheets, templates, coloring pages and much more. One of the advantages of Pros And Cons Of Filing Joint Tax Return is their versatility and accessibility.

More of Pros And Cons Of Filing Joint Tax Return

Why Filing Joint Tax Returns Is Almost Always Better WSJ

Why Filing Joint Tax Returns Is Almost Always Better WSJ

If you re married you can choose whether you want to file a joint return or file two individual returns Filing a joint tax return means your income and your spouse s income get

Married filing jointly is a tax filing status that lets married couples report combined income credits and deductions on one tax return This filing status can offer access to more tax

Print-friendly freebies have gained tremendous recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the need to buy physical copies of the software or expensive hardware.

-

The ability to customize: Your HTML0 customization options allow you to customize the templates to meet your individual needs be it designing invitations and schedules, or decorating your home.

-

Educational Value: Printables for education that are free offer a wide range of educational content for learners from all ages, making them an essential tool for teachers and parents.

-

It's easy: instant access a plethora of designs and templates, which saves time as well as effort.

Where to Find more Pros And Cons Of Filing Joint Tax Return

The Pros And Cons Of Filing Your Own Taxes That Business Network

The Pros And Cons Of Filing Your Own Taxes That Business Network

Pros of filing married filing jointly Should I file a married filing jointly In general couples who file married filing jointly versus separately receive more tax breaks which means more money in their pockets at tax time The IRS gives couples filing jointly the largest standard deduction each year

A joint tax return is for married couples and offers some tax advantages over being married and filing separately In order to qualify for joint filing status you have to be married in

If we've already piqued your curiosity about Pros And Cons Of Filing Joint Tax Return We'll take a look around to see where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of Pros And Cons Of Filing Joint Tax Return suitable for many needs.

- Explore categories such as design, home decor, organization, and crafts.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing, flashcards, and learning tools.

- Ideal for parents, teachers or students in search of additional sources.

3. Creative Blogs

- Many bloggers post their original designs and templates for no cost.

- The blogs covered cover a wide spectrum of interests, that includes DIY projects to party planning.

Maximizing Pros And Cons Of Filing Joint Tax Return

Here are some new ways that you can make use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Print worksheets that are free for reinforcement of learning at home and in class.

3. Event Planning

- Make invitations, banners as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized by using printable calendars or to-do lists. meal planners.

Conclusion

Pros And Cons Of Filing Joint Tax Return are an abundance of innovative and useful resources that meet a variety of needs and passions. Their accessibility and versatility make them a valuable addition to the professional and personal lives of both. Explore the many options of Pros And Cons Of Filing Joint Tax Return today to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly gratis?

- Yes they are! You can print and download these materials for free.

-

Are there any free printables for commercial purposes?

- It's contingent upon the specific terms of use. Make sure you read the guidelines for the creator before utilizing their templates for commercial projects.

-

Are there any copyright violations with Pros And Cons Of Filing Joint Tax Return?

- Some printables may contain restrictions in their usage. Make sure you read the terms and conditions offered by the creator.

-

How do I print printables for free?

- Print them at home using any printer or head to a local print shop to purchase premium prints.

-

What software will I need to access printables that are free?

- Most PDF-based printables are available in PDF format, which is open with no cost software like Adobe Reader.

The Pros Cons Of Joint Filing ATC Income Tax

Filing Joint Tax Return After Divorce TAXP

Check more sample of Pros And Cons Of Filing Joint Tax Return below

Filing Tax Extensions You Need To Know The Pros Cons Before Deciding

Married But Filing Separate Tax Returns The Pros And Cons

/174524785-56a938c55f9b58b7d0f95e85.jpg)

1 The Millers A Family Of Four with Two Young Child Filing A Joint

Skyline Financial Northwest2016 Tax Table Individuals Married Filing

Filing Joint Tax Return After Divorce TAXP

Determine Whether Any Of Your Benefits and Those Of Your Spouse If You

https://www. investopedia.com /terms/m/mfj.asp

Married filing jointly is a tax filing status that allows a married couple to file a single tax return that records both of their taxable income deductions credits and

https:// money.usnews.com /money/personal-finance/...

There are many advantages to filing a joint tax return You may end up with a lower tax rate and you ll qualify for some tax breaks you can t get as separate filers Here are three

Married filing jointly is a tax filing status that allows a married couple to file a single tax return that records both of their taxable income deductions credits and

There are many advantages to filing a joint tax return You may end up with a lower tax rate and you ll qualify for some tax breaks you can t get as separate filers Here are three

Skyline Financial Northwest2016 Tax Table Individuals Married Filing

/174524785-56a938c55f9b58b7d0f95e85.jpg)

Married But Filing Separate Tax Returns The Pros And Cons

Filing Joint Tax Return After Divorce TAXP

Determine Whether Any Of Your Benefits and Those Of Your Spouse If You

The Pros And Cons Of Filing Chapter 13 Bankruptcy And How It Gives A

Pros And Cons Of Filing A Tax Extension Wheeler Accountants

Pros And Cons Of Filing A Tax Extension Wheeler Accountants

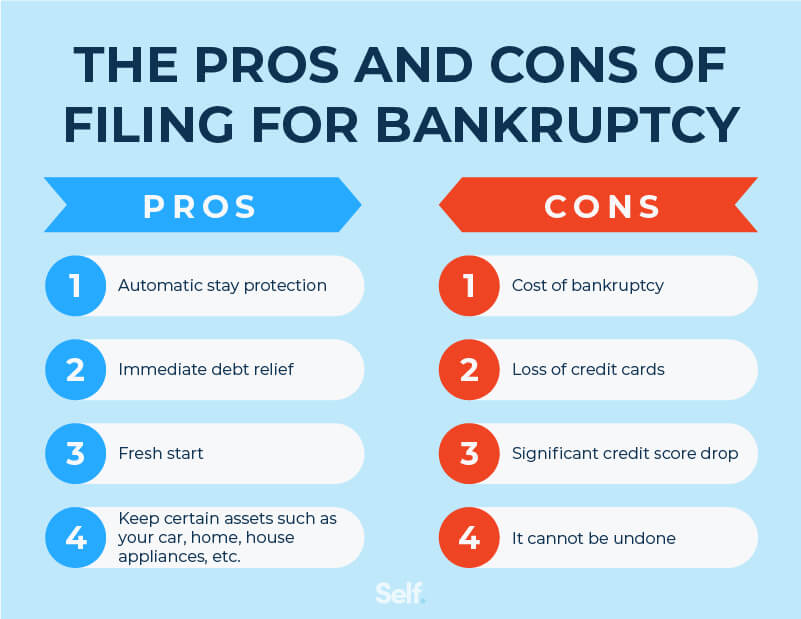

The Pros And Cons Of Filing For Bankruptcy Self Credit Builder