In the digital age, where screens dominate our lives yet the appeal of tangible printed material hasn't diminished. In the case of educational materials or creative projects, or simply adding an element of personalization to your home, printables for free can be an excellent source. Here, we'll dive into the world "R And D Tax Credits Explained," exploring the different types of printables, where to locate them, and how they can add value to various aspects of your lives.

Get Latest R And D Tax Credits Explained Below

R And D Tax Credits Explained

R And D Tax Credits Explained -

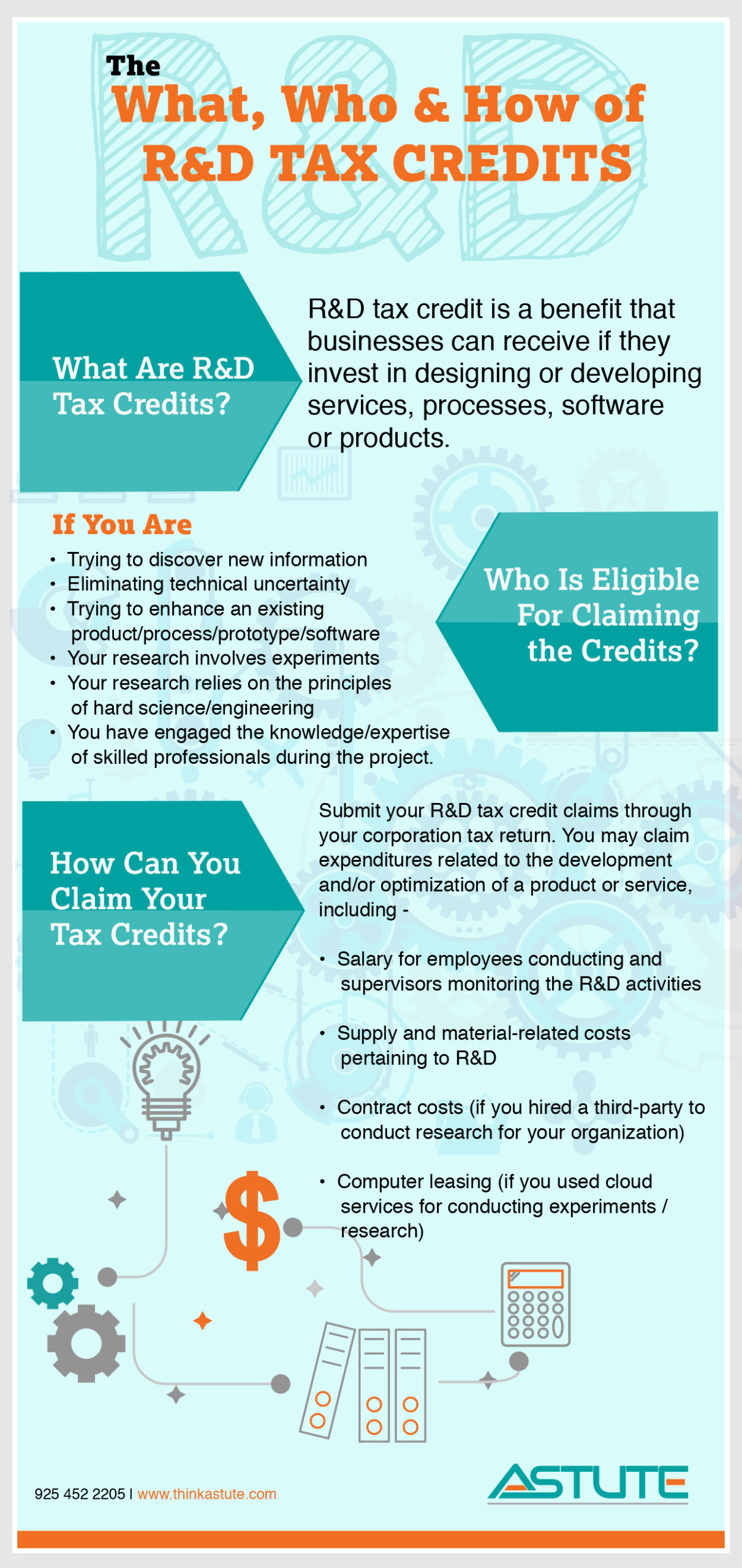

Federal and certain states tax laws permit a research and development R D tax credit to the extent that a taxpayer s current year qualified research expenses exceed a calculated base amount of research spending The federal and state credit benefits are generally greater than 10 percent of qualified spending for the year

In this paper we examine the federal tax treatment of R D investment with a focus on the R D tax credit and cost recovery for R D expenses We review the evidence for the R D tax credit s effectiveness and the credit s complexity while recommending ways to improve the credit if it is retained in the tax code

The R And D Tax Credits Explained are a huge assortment of printable items that are available online at no cost. They are available in numerous types, such as worksheets templates, coloring pages and much more. The benefit of R And D Tax Credits Explained is in their variety and accessibility.

More of R And D Tax Credits Explained

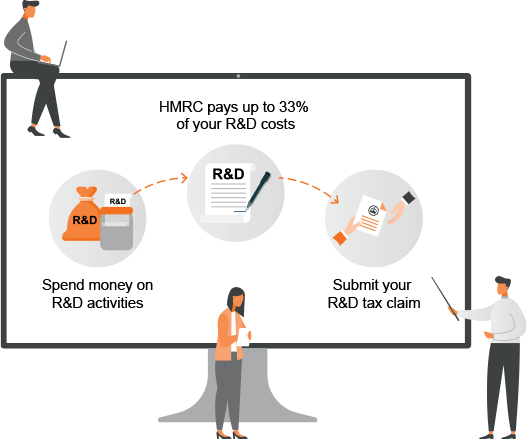

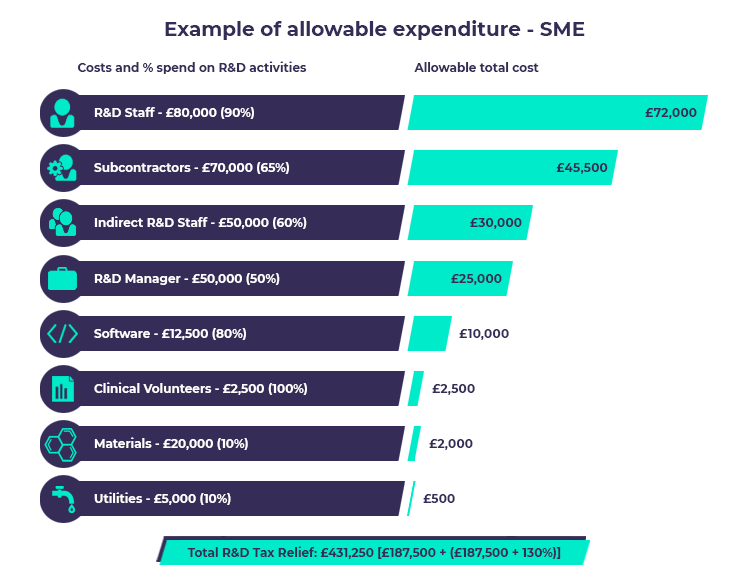

An Infographic On HMRC R D Tax Credits RDP Associates

An Infographic On HMRC R D Tax Credits RDP Associates

R D tax credits reduce a company s tax liability for certain domestic expenses Learn if you may qualify and how to claim credits

The PATH Act of 2015 made the R D Tax Credit a permanent feature of the U S tax code under Section 41 which provided long term certainty for businesses investing in R D The PATH Act also expanded the credit s applicability by allowing eligible small businesses to apply the R D credit against alternative minimum tax AMT and payroll tax

R And D Tax Credits Explained have garnered immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

customization: We can customize printed materials to meet your requirements be it designing invitations making your schedule, or even decorating your house.

-

Educational value: These R And D Tax Credits Explained provide for students of all ages, which makes them a vital tool for parents and teachers.

-

Affordability: Instant access to a variety of designs and templates is time-saving and saves effort.

Where to Find more R And D Tax Credits Explained

Are You Eligible For R D Tax Credit Find Out Using This Infographic

Are You Eligible For R D Tax Credit Find Out Using This Infographic

R D Tax Credits are a company tax relief for research and development They can either reduce a company s tax bill or for most small and medium sized companies SMEs provide a cash lump sum of up to 33 of R D expenditure

Research and Development R D tax reliefs support UK companies working on innovative projects in science and technology To claim R D tax reliefs your project must meet certain criteria and

We hope we've stimulated your interest in printables for free Let's look into where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of R And D Tax Credits Explained suitable for many motives.

- Explore categories such as interior decor, education, management, and craft.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free for flashcards, lessons, and worksheets. materials.

- Great for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs as well as templates for free.

- These blogs cover a wide variety of topics, including DIY projects to party planning.

Maximizing R And D Tax Credits Explained

Here are some innovative ways ensure you get the very most use of printables for free:

1. Home Decor

- Print and frame gorgeous art, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Use printable worksheets for free to enhance your learning at home or in the classroom.

3. Event Planning

- Make invitations, banners and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars as well as to-do lists and meal planners.

Conclusion

R And D Tax Credits Explained are an abundance of fun and practical tools which cater to a wide range of needs and pursuits. Their accessibility and flexibility make them a wonderful addition to your professional and personal life. Explore the endless world of R And D Tax Credits Explained and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really cost-free?

- Yes you can! You can download and print these tools for free.

-

Are there any free printables for commercial uses?

- It's determined by the specific rules of usage. Be sure to read the rules of the creator before utilizing printables for commercial projects.

-

Do you have any copyright issues when you download R And D Tax Credits Explained?

- Some printables could have limitations on usage. Make sure to read the terms and conditions offered by the creator.

-

How can I print R And D Tax Credits Explained?

- Print them at home with your printer or visit the local print shops for higher quality prints.

-

What software do I need to run printables for free?

- Most PDF-based printables are available in PDF format. These can be opened with free software such as Adobe Reader.

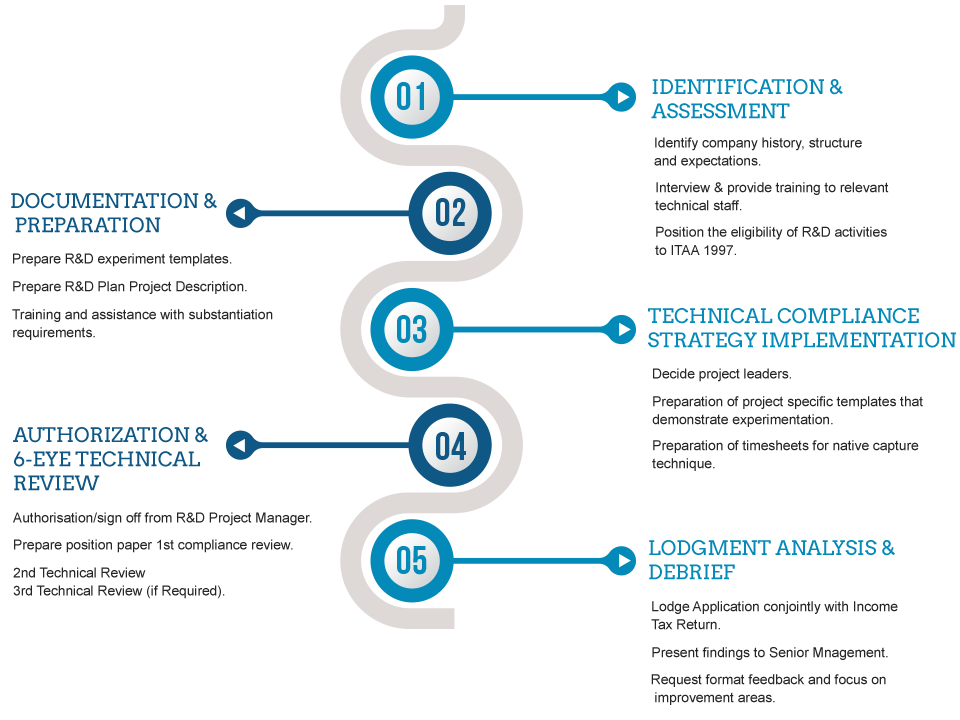

The R D Tax Credit Process 5 Easy Steps Swanson Reed UK

R D Tax Credits Explained Eligibility Definition And Calculation

.jpg)

Check more sample of R And D Tax Credits Explained below

R D Tax Credits UK What Is It How To Claim Capalona

R D Tax Credits Explained Are You Eligible What Projects Qualify

R D Tax Credits Explained In 2022 What Are R D Tax Credits Who Is

What Are R D Tax Credits YouTube

Research And Development Tax Credits Free Advice 100 Success 120m

R D Tax Credits Explained What Are They Made simplr

![]()

https://taxfoundation.org › research › all › federal › ...

In this paper we examine the federal tax treatment of R D investment with a focus on the R D tax credit and cost recovery for R D expenses We review the evidence for the R D tax credit s effectiveness and the credit s complexity while recommending ways to improve the credit if it is retained in the tax code

https://exactera.com › resources › everything-you-need...

So what do you need to know about applying for the R D tax credit This guide will walk you through it all activities expenses rules and latest developments By the end you ll be able to navigate the R D tax credit claim process with confidence and maximize the credit s potential for your company Leaving Innovation Dollars on the Table

In this paper we examine the federal tax treatment of R D investment with a focus on the R D tax credit and cost recovery for R D expenses We review the evidence for the R D tax credit s effectiveness and the credit s complexity while recommending ways to improve the credit if it is retained in the tax code

So what do you need to know about applying for the R D tax credit This guide will walk you through it all activities expenses rules and latest developments By the end you ll be able to navigate the R D tax credit claim process with confidence and maximize the credit s potential for your company Leaving Innovation Dollars on the Table

What Are R D Tax Credits YouTube

R D Tax Credits Explained Are You Eligible What Projects Qualify

Research And Development Tax Credits Free Advice 100 Success 120m

R D Tax Credits Explained What Are They Made simplr

R D Tax Credits The Essential Guide 2020

What Is A Tax Credit Tax Credits Explained

What Is A Tax Credit Tax Credits Explained

R D Tax Credits Example CBC Networking High Wycombe