Today, when screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed materials hasn't faded away. In the case of educational materials as well as creative projects or simply adding a personal touch to your area, Rebate And Relief Under Income Tax Act have become an invaluable resource. This article will take a dive in the world of "Rebate And Relief Under Income Tax Act," exploring their purpose, where you can find them, and ways they can help you improve many aspects of your daily life.

Get Latest Rebate And Relief Under Income Tax Act Below

Rebate And Relief Under Income Tax Act

Rebate And Relief Under Income Tax Act -

Web An income tax rebate is a refund on taxes payable when the amount paid as income tax is less than the tax payable If you have paid more tax than you owe you will be entitled to

Web 1 Subject to the provisions of this section an assessee being an individual or a Hindu undivided family shall be entitled to a deduction from the amount of income tax as

Rebate And Relief Under Income Tax Act provide a diverse assortment of printable, downloadable material that is available online at no cost. These resources come in various types, such as worksheets coloring pages, templates and more. The beauty of Rebate And Relief Under Income Tax Act is in their versatility and accessibility.

More of Rebate And Relief Under Income Tax Act

REBATE AND RELIEFS UNDER INCOME TAX

REBATE AND RELIEFS UNDER INCOME TAX

Web REBATES AND RELIEFS Income tax Act 1961 F REVERSAL OF IGST ITC AND PAYMENT THROUGH DRC 03 F 10 37 of the Income Tax Act F Export of service F

Web 2 mai 2023 nbsp 0183 32 Rebate under Section 87A helps taxpayers reduce their income tax liability You can claim the said rebate if your total income i e after Chapter VIA deductions does not exceed Rs 5 lakh in a financial

Rebate And Relief Under Income Tax Act have gained immense popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Customization: Your HTML0 customization options allow you to customize printables to fit your particular needs whether it's making invitations making your schedule, or decorating your home.

-

Educational Value Free educational printables can be used by students of all ages. This makes them a valuable resource for educators and parents.

-

Convenience: immediate access various designs and templates cuts down on time and efforts.

Where to Find more Rebate And Relief Under Income Tax Act

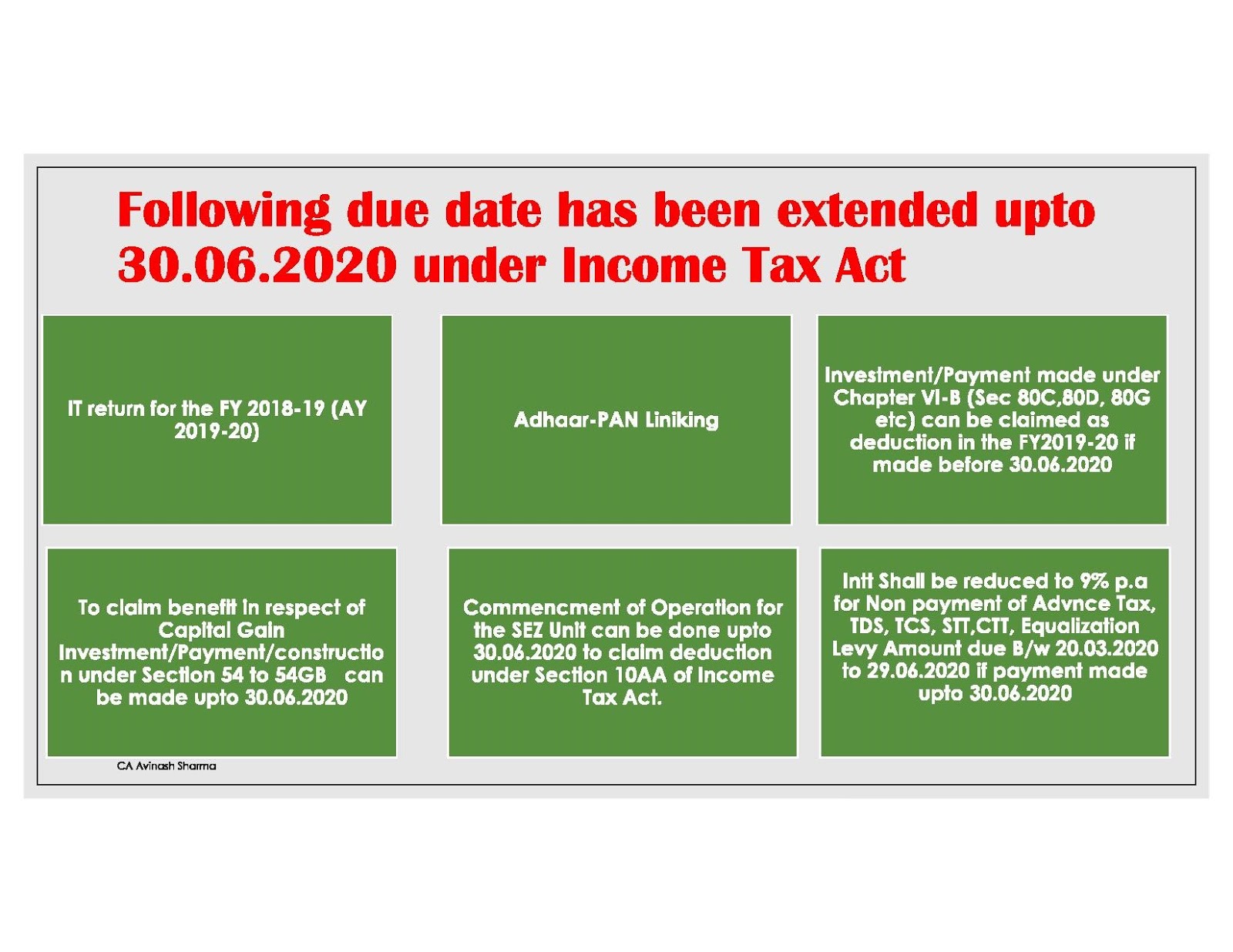

Relief Under Income Tax Act Taxation Ordinance 2020 CA Avinash

Relief Under Income Tax Act Taxation Ordinance 2020 CA Avinash

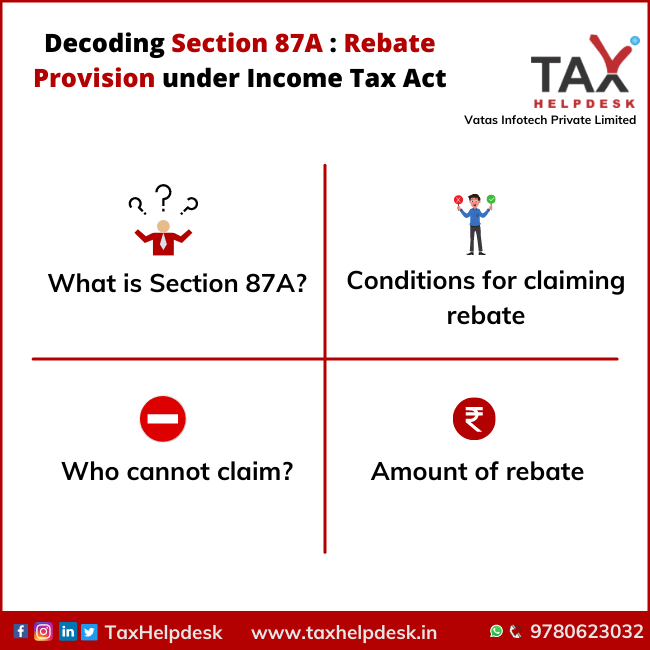

Web 18 oct 2021 nbsp 0183 32 Rebate under section 87A of Income Tax Act is a provision which helps the taxpayers to reduce the tax liability This section is available to the person whose income does not exceed Rs 5 Lakhs The tax

Web 19 oct 2021 nbsp 0183 32 Rebate under section 87A of the Income Tax Act is a provision that helps taxpayers to reduce their tax liability This section is available to the person whose

Now that we've ignited your curiosity about Rebate And Relief Under Income Tax Act we'll explore the places you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection with Rebate And Relief Under Income Tax Act for all uses.

- Explore categories like design, home decor, the arts, and more.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free along with flashcards, as well as other learning tools.

- Ideal for teachers, parents or students in search of additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs with templates and designs for free.

- The blogs covered cover a wide variety of topics, ranging from DIY projects to planning a party.

Maximizing Rebate And Relief Under Income Tax Act

Here are some creative ways in order to maximize the use of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or festive decorations to decorate your living spaces.

2. Education

- Print free worksheets for teaching at-home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Rebate And Relief Under Income Tax Act are a treasure trove of innovative and useful resources which cater to a wide range of needs and needs and. Their accessibility and flexibility make them a valuable addition to every aspect of your life, both professional and personal. Explore the endless world that is Rebate And Relief Under Income Tax Act today, and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Rebate And Relief Under Income Tax Act really available for download?

- Yes you can! You can print and download these documents for free.

-

Do I have the right to use free printouts for commercial usage?

- It depends on the specific conditions of use. Make sure you read the guidelines for the creator before using any printables on commercial projects.

-

Do you have any copyright issues when you download Rebate And Relief Under Income Tax Act?

- Some printables could have limitations on their use. Be sure to check these terms and conditions as set out by the designer.

-

How do I print printables for free?

- Print them at home using the printer, or go to a local print shop for top quality prints.

-

What software will I need to access printables that are free?

- A majority of printed materials are as PDF files, which is open with no cost software such as Adobe Reader.

Income Tax Return TaxHelpdesk

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Check more sample of Rebate And Relief Under Income Tax Act below

DEDUCTION UNDER SECTION 80C TO 80U PDF

T20 0261 Additional 2020 Recovery Rebates For Individuals In The

Section 4a Income Tax Act KaydenqiLewis

Guide On Tax Reliefs For First Time Working Parents Heartland Boy

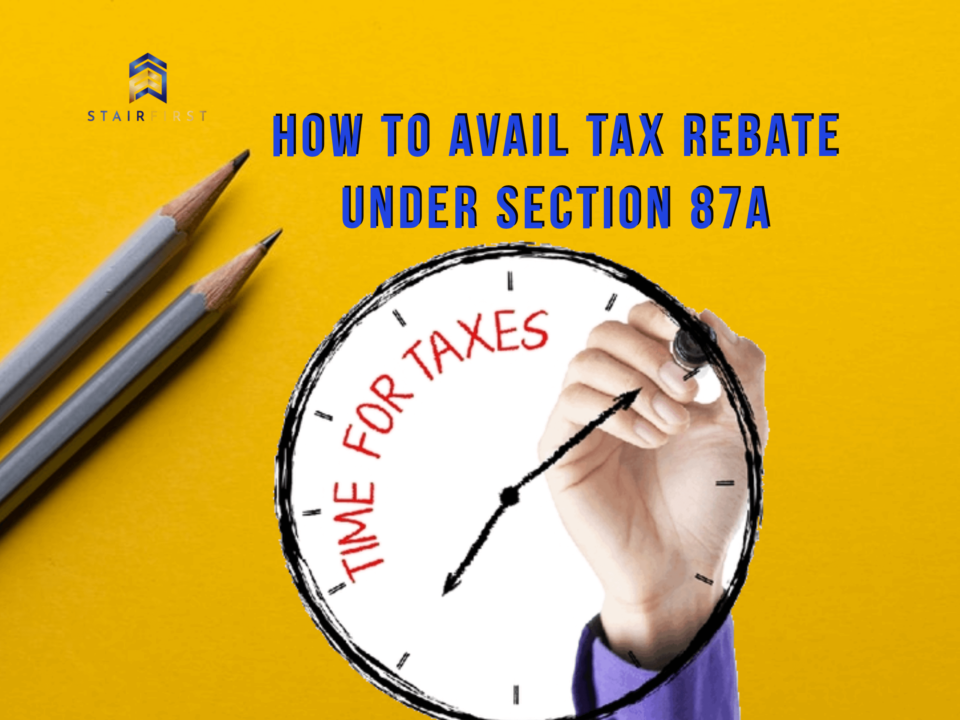

Rebate Under Section 87A Of Income Tax Act Insights From StairFirst

Section 2 41 Definition Of Relative Under Income Tax Act P R S R Co

https://taxmacs.com/.../2018/05/8.-Chapter-VIII-Rebates-an…

Web 1 Subject to the provisions of this section an assessee being an individual or a Hindu undivided family shall be entitled to a deduction from the amount of income tax as

https://wirc-icai.org/.../part3/reliefs-under-income-tax-act-1961.html

Web INCOME TAX RELIEFS SECTION 87A Persons Covered Rebate REBATE FROM INCOME TAX PAYABLE WHEN THE NET TOTAL INCOME OF THE RESIDENT

Web 1 Subject to the provisions of this section an assessee being an individual or a Hindu undivided family shall be entitled to a deduction from the amount of income tax as

Web INCOME TAX RELIEFS SECTION 87A Persons Covered Rebate REBATE FROM INCOME TAX PAYABLE WHEN THE NET TOTAL INCOME OF THE RESIDENT

Guide On Tax Reliefs For First Time Working Parents Heartland Boy

T20 0261 Additional 2020 Recovery Rebates For Individuals In The

Rebate Under Section 87A Of Income Tax Act Insights From StairFirst

Section 2 41 Definition Of Relative Under Income Tax Act P R S R Co

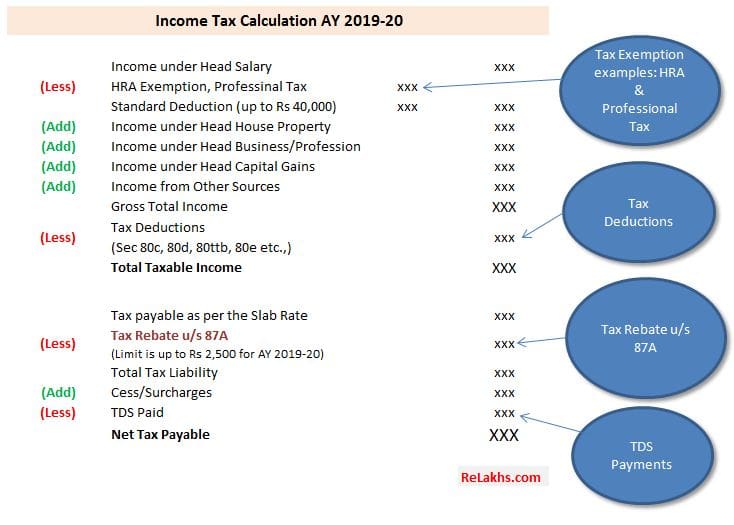

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

Relief Under Income Tax Act Taxation Ordinance 2020 CA Avinash