In the age of digital, with screens dominating our lives but the value of tangible printed objects hasn't waned. No matter whether it's for educational uses as well as creative projects or simply adding some personal flair to your home, printables for free are now an essential resource. Through this post, we'll dive to the depths of "Rebate In New Income Tax Slabs," exploring the benefits of them, where to locate them, and how they can improve various aspects of your daily life.

Get Latest Rebate In New Income Tax Slabs Below

Rebate In New Income Tax Slabs

Rebate In New Income Tax Slabs -

Find out which ITR form to use and which forms to submit for tax deduction and refund for salaried individuals in India Learn about the eligibility criteria sources of income and new tax regime for AY 2024 25

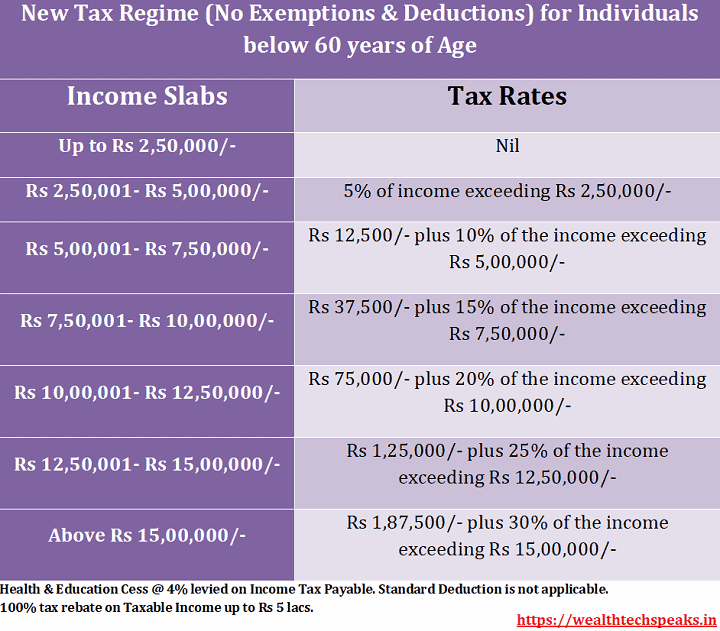

Tax rebate is a relief for individuals to avoid income tax burden if income is below a certain threshold The rebate is up to Rs 7 lakh in the new tax regime and up to Rs 5 lakh in the old regime Steps limits and calculations under Section 87A are discussed

The Rebate In New Income Tax Slabs are a huge range of downloadable, printable materials that are accessible online for free cost. These resources come in many forms, like worksheets templates, coloring pages and more. One of the advantages of Rebate In New Income Tax Slabs lies in their versatility as well as accessibility.

More of Rebate In New Income Tax Slabs

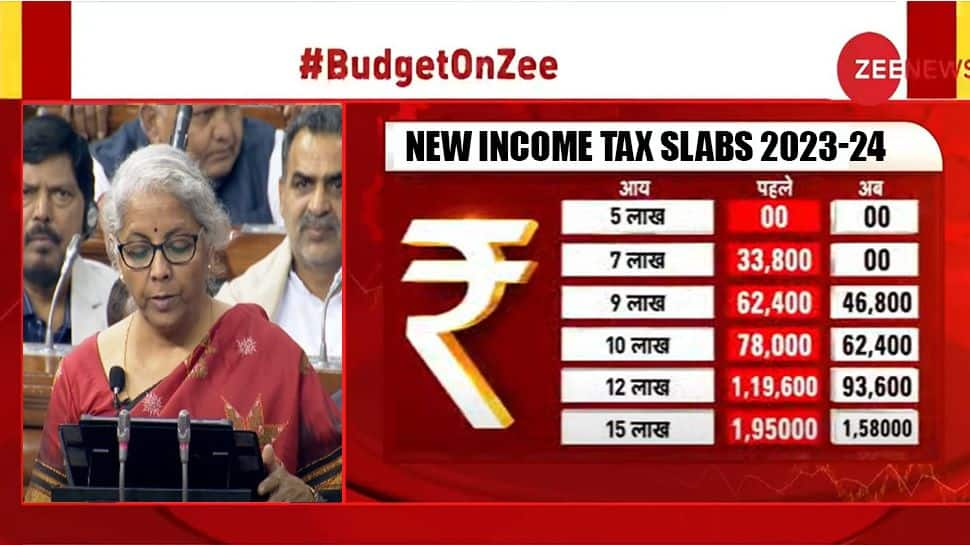

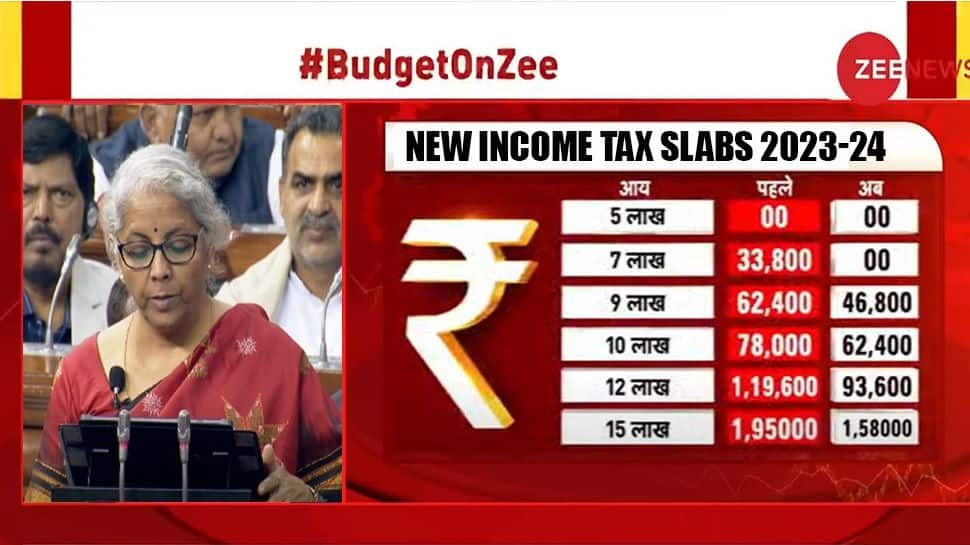

New Income Tax Slabs 2023 24 No Income Tax Till Rs 7 Lakh Check New

New Income Tax Slabs 2023 24 No Income Tax Till Rs 7 Lakh Check New

Under the new income tax regime also known as the Concessional Tax Regime for the financial year 2024 25 the eligibility limit for rebate is at Rs 7 00 000 This means that taxpayers can avail a tax rebate of up to Rs 25 000

Learn about the income tax slabs exemptions and deductions under the new tax regime for FY 2024 25 Find out how to claim tax rebate u s 87A and other benefits under the new regime

Rebate In New Income Tax Slabs have garnered immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Flexible: It is possible to tailor the design to meet your needs be it designing invitations for your guests, organizing your schedule or decorating your home.

-

Educational Use: Downloads of educational content for free provide for students of all ages. This makes them a great resource for educators and parents.

-

Convenience: The instant accessibility to many designs and templates will save you time and effort.

Where to Find more Rebate In New Income Tax Slabs

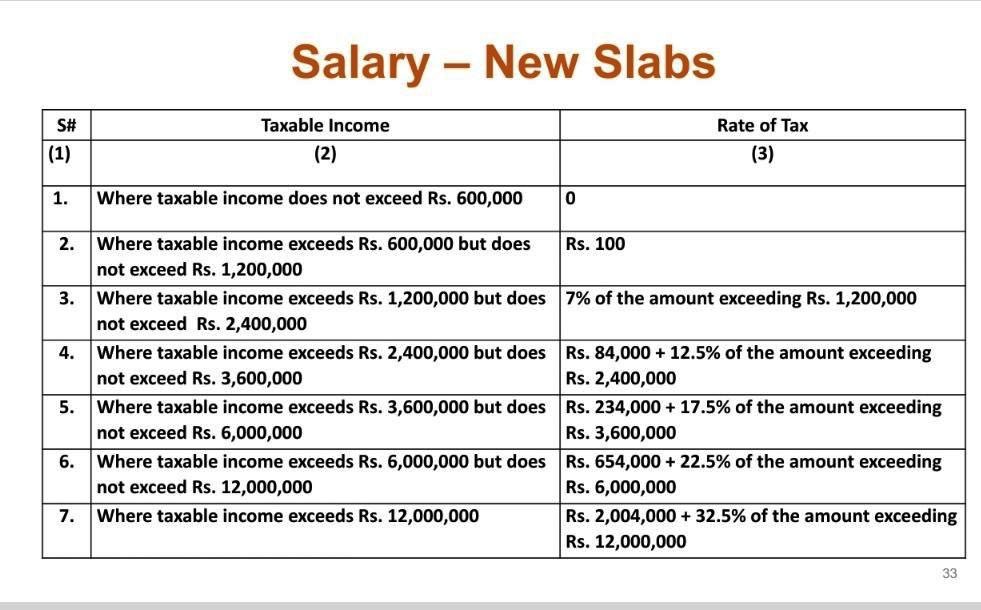

Budget 2020 New Income Tax Rates New Income Tax Slabs Income Tax

Budget 2020 New Income Tax Rates New Income Tax Slabs Income Tax

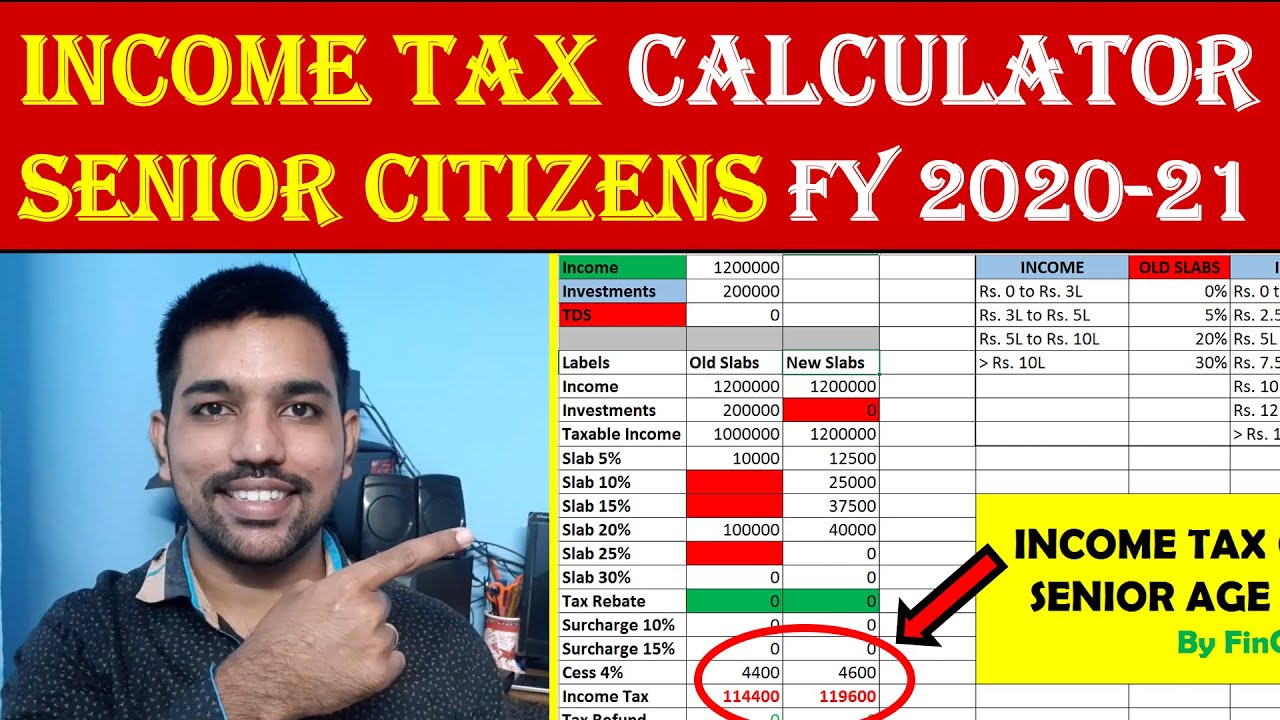

Learn about the returns and forms applicable for senior citizens and super senior citizens for AY 2024 2025 Find out the conditions for exemption from filing income tax returns the forms to declare receipts without deduction of tax and the forms to provide details of TDS

Tax Rebate Individuals with income up to Rs 7 lakhs are eligible for a complete tax rebate under the new regime effectively paying zero tax Increased Liquidity By eliminating the need for tax saving investments the new regime can

Now that we've ignited your curiosity about Rebate In New Income Tax Slabs we'll explore the places you can find these elusive treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of Rebate In New Income Tax Slabs suitable for many uses.

- Explore categories such as design, home decor, organizational, and arts and crafts.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free with flashcards and other teaching tools.

- Perfect for teachers, parents and students looking for extra sources.

3. Creative Blogs

- Many bloggers share their imaginative designs with templates and designs for free.

- The blogs are a vast variety of topics, everything from DIY projects to party planning.

Maximizing Rebate In New Income Tax Slabs

Here are some inventive ways how you could make the most use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes or seasonal decorations to adorn your living areas.

2. Education

- Utilize free printable worksheets to reinforce learning at home or in the classroom.

3. Event Planning

- Invitations, banners and decorations for special events such as weddings and birthdays.

4. Organization

- Stay organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Rebate In New Income Tax Slabs are an abundance filled with creative and practical information for a variety of needs and hobbies. Their availability and versatility make them a fantastic addition to both professional and personal lives. Explore the many options of Rebate In New Income Tax Slabs now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Rebate In New Income Tax Slabs truly free?

- Yes they are! You can print and download these files for free.

-

Do I have the right to use free printing templates for commercial purposes?

- It depends on the specific terms of use. Always verify the guidelines of the creator before using their printables for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Certain printables might have limitations in use. You should read the conditions and terms of use provided by the designer.

-

How do I print printables for free?

- Print them at home with an printer, or go to any local print store for superior prints.

-

What program do I need in order to open printables at no cost?

- The majority are printed in the PDF format, and is open with no cost software, such as Adobe Reader.

Income Tax Slabs Rates Financial Year 2022 23 WealthTech Speaks

Union Budget 2023 Centre Raises Tax Rebate Limit Reduces Slabs In Key

Check more sample of Rebate In New Income Tax Slabs below

New Income Tax Slabs Budget 2023 Highlights Big Rebate On Income Tax

Senior Citizen Income Tax Calculation 2022 23 Excel Calculator

Income Tax Slabs Year 2022 23 Info Ghar Educational News

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

New Income Tax Slab 2023 24

New Income Tax Slabs How Will It Affect The Real Estate Sector

https://cleartax.in

Tax rebate is a relief for individuals to avoid income tax burden if income is below a certain threshold The rebate is up to Rs 7 lakh in the new tax regime and up to Rs 5 lakh in the old regime Steps limits and calculations under Section 87A are discussed

https://cleartax.in › new-tax-regime-frequently-asked-questions

In Budget 2023 a tax rebate on an income up to 7 lakhs was introduced under the new tax regime This means that taxpayers with an income of up to 7 lakhs will not have to pay any tax at all if they opt for the new tax regime

Tax rebate is a relief for individuals to avoid income tax burden if income is below a certain threshold The rebate is up to Rs 7 lakh in the new tax regime and up to Rs 5 lakh in the old regime Steps limits and calculations under Section 87A are discussed

In Budget 2023 a tax rebate on an income up to 7 lakhs was introduced under the new tax regime This means that taxpayers with an income of up to 7 lakhs will not have to pay any tax at all if they opt for the new tax regime

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

Senior Citizen Income Tax Calculation 2022 23 Excel Calculator

New Income Tax Slab 2023 24

New Income Tax Slabs How Will It Affect The Real Estate Sector

Understand About Deductions Under Old And New Tax Regime TaxHelpdesk

Budget 2023 Here Are The Fresh New Income Tax Regime Slabs India Today

Budget 2023 Here Are The Fresh New Income Tax Regime Slabs India Today

Fy 2021 22 Tax Slabs Tutorial Pics