In this day and age with screens dominating our lives and the appeal of physical printed items hasn't gone away. Whether it's for educational purposes for creative projects, just adding personal touches to your home, printables for free have become an invaluable source. The following article is a dive to the depths of "Rebate Of Tax U S 87a," exploring the different types of printables, where they are, and what they can do to improve different aspects of your life.

Get Latest Rebate Of Tax U S 87a Below

Rebate Of Tax U S 87a

Rebate Of Tax U S 87a -

What is Rebate u s 87A Back in the 1970s there were around 11 personal income tax slabs with 85 of tax in the highest bracket However over the last 50 years there has been a high reduction in the tax slab Now

Yes income tax rebate u s 87A is available on taxable income which includes agricultural incomes as well Discover the income tax rebate available under Section 87A of the Income Tax Act Learn how to claim the 87A rebate eligibility criteria and the applicable rebate amount

Rebate Of Tax U S 87a encompass a wide array of printable materials that are accessible online for free cost. They come in many designs, including worksheets coloring pages, templates and more. The beauty of Rebate Of Tax U S 87a is their flexibility and accessibility.

More of Rebate Of Tax U S 87a

Rebate U s 87A Of Income Tax Act 87A Rebate For AY 2023 24 In Hindi

Rebate U s 87A Of Income Tax Act 87A Rebate For AY 2023 24 In Hindi

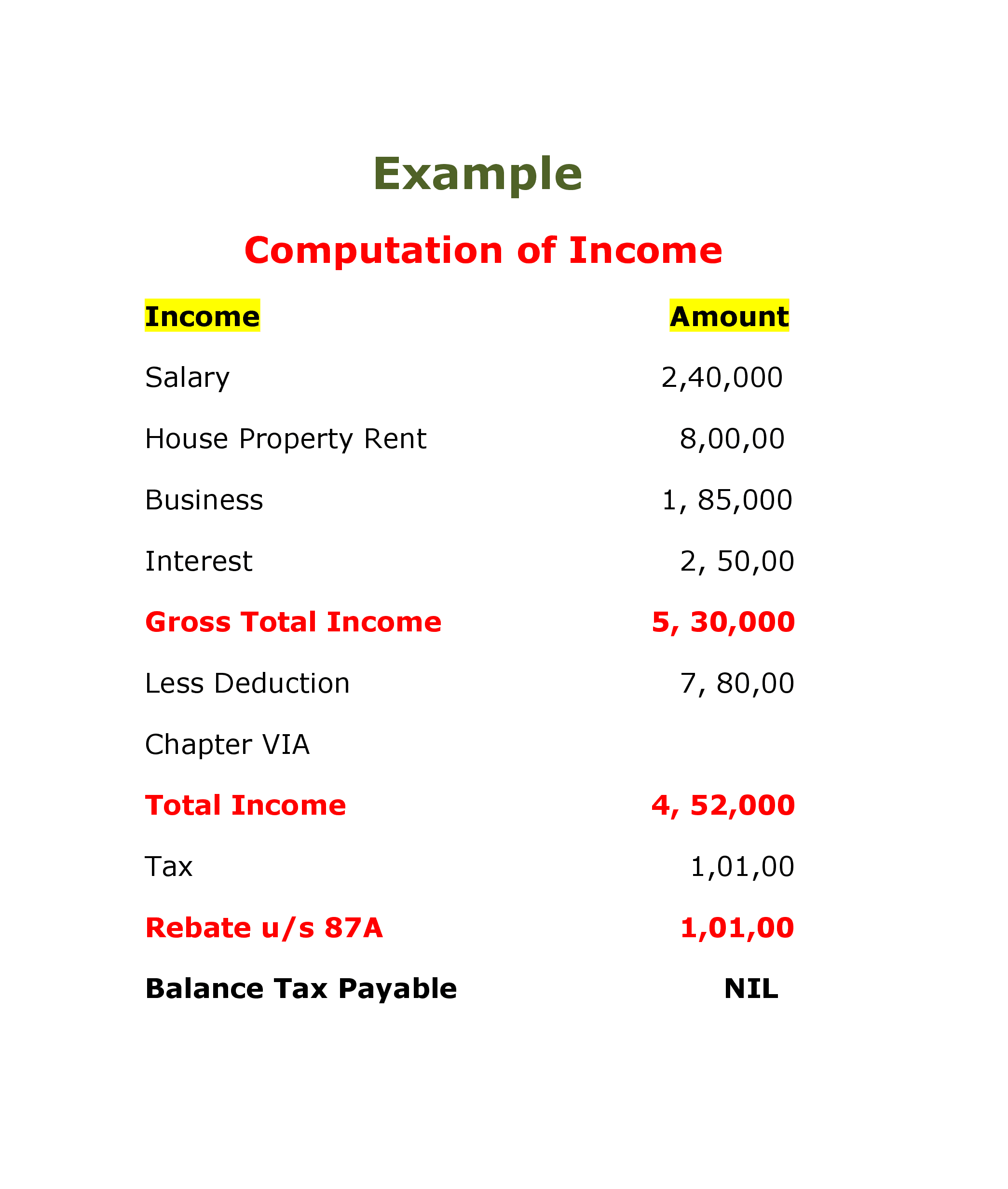

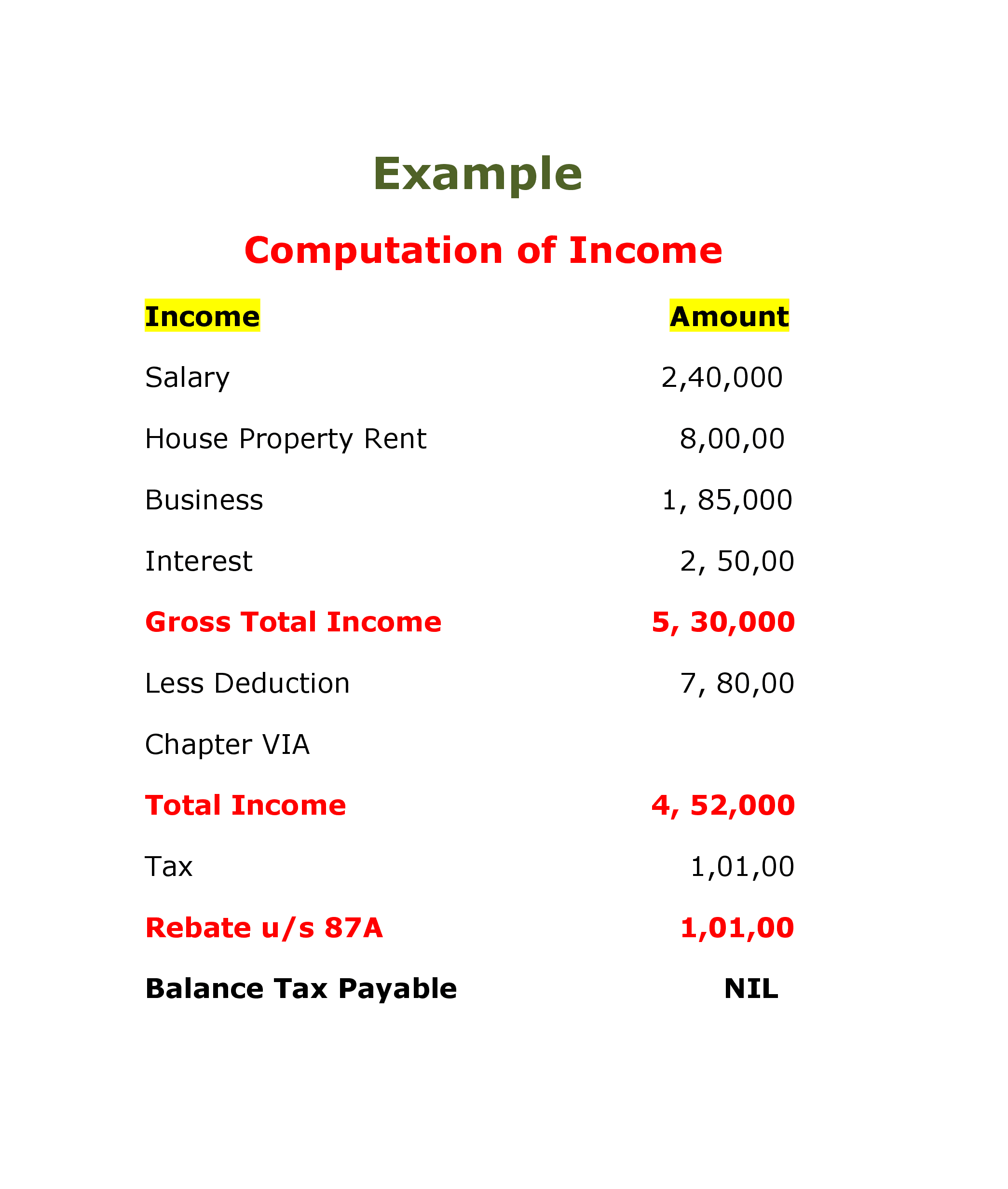

The maximum rebate under Section 87A for AY 2022 23 is Rs 12 500 Eligibility and limitations Here are some important points to remember while availing the rebate under Section 87A The rebate is applicable to individuals who are residents only This discount can be availed by old people aged sixty to eighty

Under Section 87A taxpayers are entitled to a rebate of up to Rs 12 500 effectively reducing their income tax liability This rebate is applicable to individuals whose taxable income does not exceed Rs 5 00 000 as observed in the financial year 2022 23

Printables that are free have gained enormous popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or expensive software.

-

customization: You can tailor print-ready templates to your specific requirements when it comes to designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational Value Free educational printables are designed to appeal to students of all ages. This makes them a vital instrument for parents and teachers.

-

Convenience: Quick access to a plethora of designs and templates cuts down on time and efforts.

Where to Find more Rebate Of Tax U S 87a

Income Tax Rebate U s 87A For The Financial Year 2022 23

Income Tax Rebate U s 87A For The Financial Year 2022 23

The income tax rebate available under Section 87A can be claimed against tax liability of any nature except for long term capital gains arising on equity shares sold on stock exchange and

The available tax rebate under Section 87A of the Income Tax Act 1961 offers the benefit of nil taxation if you have a limited income However before claiming the rebate here are a few things that you should remember Resident Indian taxpayers can only avail of the rebate under Section 87A

After we've peaked your interest in printables for free we'll explore the places you can find these elusive treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection with Rebate Of Tax U S 87a for all reasons.

- Explore categories like the home, decor, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. tools.

- Great for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs with templates and designs for free.

- The blogs are a vast spectrum of interests, that includes DIY projects to planning a party.

Maximizing Rebate Of Tax U S 87a

Here are some new ways ensure you get the very most of Rebate Of Tax U S 87a:

1. Home Decor

- Print and frame beautiful artwork, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Print free worksheets for reinforcement of learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Be organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

Rebate Of Tax U S 87a are a treasure trove with useful and creative ideas that meet a variety of needs and interests. Their access and versatility makes them a wonderful addition to the professional and personal lives of both. Explore the many options of Rebate Of Tax U S 87a today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Rebate Of Tax U S 87a truly for free?

- Yes you can! You can print and download these resources at no cost.

-

Can I utilize free templates for commercial use?

- It's based on the rules of usage. Always read the guidelines of the creator before using printables for commercial projects.

-

Are there any copyright concerns with Rebate Of Tax U S 87a?

- Certain printables may be subject to restrictions on use. Be sure to read the terms and conditions provided by the designer.

-

How can I print Rebate Of Tax U S 87a?

- You can print them at home using an printer, or go to a local print shop for more high-quality prints.

-

What program must I use to open printables free of charge?

- The majority of PDF documents are provided in the format of PDF, which can be opened using free software such as Adobe Reader.

Rebate U s 87A For F Y 2018 2019 Taxable Income Not Exceed 3 5

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

Check more sample of Rebate Of Tax U S 87a below

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Rebate U s 87A

Tax Rebate U s 87A No Tax Upto 5 Lacs 5 Lacs Tax YouTube

What Is Income Tax Rebate Under Section 87A HDFC Life

87A Rebate Rebate U s 87A How To Get Income

Tax Rebate Under Section 87A Claim Income Tax Rebate For FY 2018 19

https://tax2win.in/guide/section-87a

Yes income tax rebate u s 87A is available on taxable income which includes agricultural incomes as well Discover the income tax rebate available under Section 87A of the Income Tax Act Learn how to claim the 87A rebate eligibility criteria and the applicable rebate amount

https://caclub.in/income-tax-rebate-u-s-87a-individuals

Section 87A of the Income Tax Act 1961 provides for a 100 tax rebate if the income tax liability is up to Rs 12 500 in respect of AY 2023 24 and onwards for resident individuals with taxable income up to Rs 500 000 under the existing tax regime

Yes income tax rebate u s 87A is available on taxable income which includes agricultural incomes as well Discover the income tax rebate available under Section 87A of the Income Tax Act Learn how to claim the 87A rebate eligibility criteria and the applicable rebate amount

Section 87A of the Income Tax Act 1961 provides for a 100 tax rebate if the income tax liability is up to Rs 12 500 in respect of AY 2023 24 and onwards for resident individuals with taxable income up to Rs 500 000 under the existing tax regime

What Is Income Tax Rebate Under Section 87A HDFC Life

Rebate U s 87A

87A Rebate Rebate U s 87A How To Get Income

Tax Rebate Under Section 87A Claim Income Tax Rebate For FY 2018 19

Income Tax Rebate Under Section 87A

ALL ABOUT REBATE 87A EXEMPTION OF TAX UP TO 5 LAKH SIMPLE TAX INDIA

ALL ABOUT REBATE 87A EXEMPTION OF TAX UP TO 5 LAKH SIMPLE TAX INDIA

Income Tax Rebate U s 87A For Individuals AY 2023 24 2024 25 CA Club