In the age of digital, where screens dominate our lives but the value of tangible printed materials hasn't faded away. In the case of educational materials as well as creative projects or just adding some personal flair to your home, printables for free are now a useful resource. With this guide, you'll take a dive deeper into "Rebate Under Provision Of Income Tax," exploring their purpose, where to find them, and the ways that they can benefit different aspects of your life.

Get Latest Rebate Under Provision Of Income Tax Below

Rebate Under Provision Of Income Tax

Rebate Under Provision Of Income Tax -

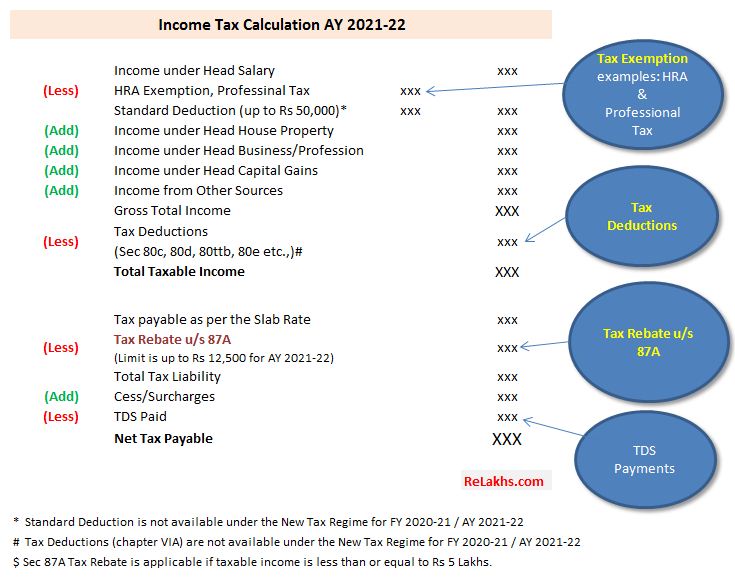

Web You can claim a maximum rebate of up to 12 500 under Section 87A of the Income Tax Act for the financial year 2022 23 The maximum amount of the 87A rebate has been

Web 1 f 233 vr 2023 nbsp 0183 32 A tax provision is the estimated amount of income tax that a company is legally expected to pay to the IRS for the current year It is just one type of provision that corporate finance departments set aside to

Printables for free cover a broad range of downloadable, printable material that is available online at no cost. These resources come in various forms, like worksheets templates, coloring pages, and much more. The beauty of Rebate Under Provision Of Income Tax lies in their versatility and accessibility.

More of Rebate Under Provision Of Income Tax

Income Tax Rebate Under Section 87A Goyal Mangal Company

Income Tax Rebate Under Section 87A Goyal Mangal Company

Web 15 mai 2022 nbsp 0183 32 Flat tax Revenu fiscal de r 233 f 233 rence Donation D 233 fiscalisation Actualit 233 s Imp 244 ts D 233 fiscalisation D 233 couvrez les dispositifs permettant de payer moins d imp 244 t sur

Web 18 juil 2023 nbsp 0183 32 Section 80C is one of the most popular and favourite sections amongst the taxpayers as it allows to reduce taxable income by making tax saving investments or

Rebate Under Provision Of Income Tax have garnered immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Individualization You can tailor printing templates to your own specific requirements for invitations, whether that's creating them making your schedule, or decorating your home.

-

Educational Impact: Printing educational materials for no cost provide for students of all ages, making these printables a powerful tool for parents and educators.

-

The convenience of You have instant access an array of designs and templates can save you time and energy.

Where to Find more Rebate Under Provision Of Income Tax

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

Web Individuals can enjoy a tax rebate under Section 87A when they earn a net taxable income within 5 00 000 in a given financial year Eligible candidates can claim a tax rebate of

Web 28 ao 251 t 2020 nbsp 0183 32 Des investissements plafonn 233 s Pour b 233 n 233 ficier du dispositif 171 IR PME 187 les particuliers doivent effectuer des souscriptions en num 233 raire au capital initial ou aux

In the event that we've stirred your curiosity about Rebate Under Provision Of Income Tax Let's take a look at where you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of Rebate Under Provision Of Income Tax to suit a variety of objectives.

- Explore categories such as design, home decor, crafting, and organization.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free or flashcards as well as learning materials.

- Ideal for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers post their original designs or templates for download.

- These blogs cover a broad array of topics, ranging including DIY projects to planning a party.

Maximizing Rebate Under Provision Of Income Tax

Here are some ways that you can make use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or seasonal decorations that will adorn your living areas.

2. Education

- Print free worksheets for teaching at-home also in the classes.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized by using printable calendars or to-do lists. meal planners.

Conclusion

Rebate Under Provision Of Income Tax are an abundance of practical and imaginative resources that cater to various needs and needs and. Their access and versatility makes these printables a useful addition to each day life. Explore the vast world of Rebate Under Provision Of Income Tax right now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Rebate Under Provision Of Income Tax really absolutely free?

- Yes you can! You can download and print these materials for free.

-

Does it allow me to use free templates for commercial use?

- It is contingent on the specific terms of use. Always verify the guidelines of the creator before using printables for commercial projects.

-

Are there any copyright problems with printables that are free?

- Some printables may contain restrictions regarding usage. Check the terms and condition of use as provided by the author.

-

How do I print Rebate Under Provision Of Income Tax?

- You can print them at home with the printer, or go to an in-store print shop to get top quality prints.

-

What software do I need to open printables that are free?

- Most printables come as PDF files, which can be opened with free software like Adobe Reader.

Comparative Provisions Of The Rebate Download Table

Decoding Section 87A Rebate Provision Under Income Tax Act

Check more sample of Rebate Under Provision Of Income Tax below

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Income Tax Rebate Under Income Tax Section 87 A For F Year 2017 18 AY 2

Section 87A Income Tax Rebate Under Section 87A For FY 2019 20

Rebate Of Income Tax Under Section 87A YouTube

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

https://tax.thomsonreuters.com/blog/tax-provi…

Web 1 f 233 vr 2023 nbsp 0183 32 A tax provision is the estimated amount of income tax that a company is legally expected to pay to the IRS for the current year It is just one type of provision that corporate finance departments set aside to

https://taxguru.in/income-tax/decoding-sectio…

Web 3 ao 251 t 2021 nbsp 0183 32 As per the existing provisions any Indian Resident individual whose income lies below Rs 5 00 000 is eligible to claim a tax amount rebate under this section The amount of tax rebate can be either 100

Web 1 f 233 vr 2023 nbsp 0183 32 A tax provision is the estimated amount of income tax that a company is legally expected to pay to the IRS for the current year It is just one type of provision that corporate finance departments set aside to

Web 3 ao 251 t 2021 nbsp 0183 32 As per the existing provisions any Indian Resident individual whose income lies below Rs 5 00 000 is eligible to claim a tax amount rebate under this section The amount of tax rebate can be either 100

Section 87A Income Tax Rebate Under Section 87A For FY 2019 20

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Rebate Of Income Tax Under Section 87A YouTube

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

Income Tax Rebate Under Section 87A

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Rebate Under Section 87A AY 2021 22 CapitalGreen